Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

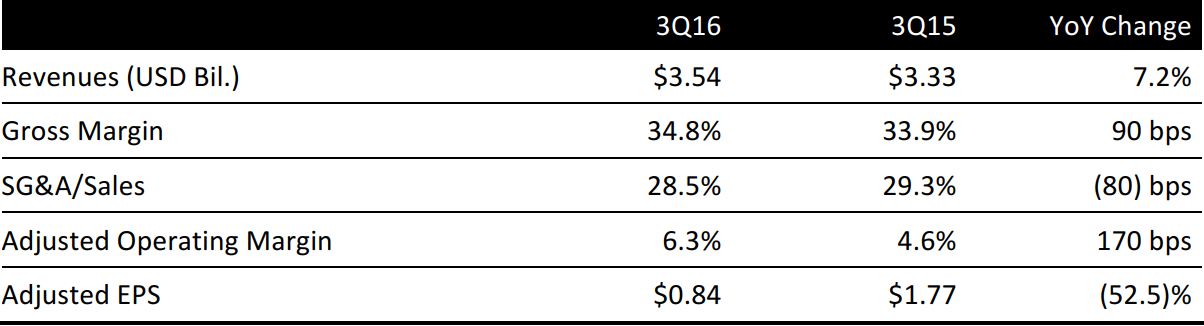

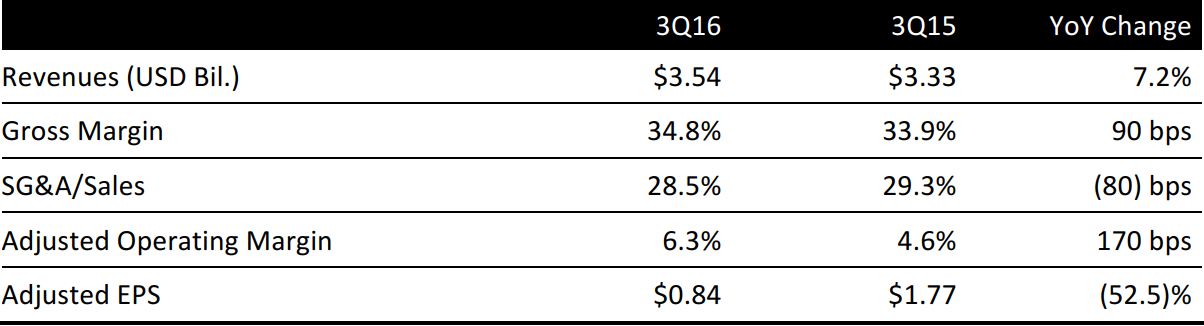

Nordstrom reported 3Q16 revenues of $3.54 billion, up 7.2% year over year and above the consensus estimate, reflecting continued strength in inventory and expense execution. Total comps increased by 2.4% in the quarter.

Adjusted EPS was $0.84, above the consensus estimate of $0.52, though down 52.5% year over year. The company reported a net loss of $10 million for the quarter, partially due to a noncash goodwill impairment of $197 million related to Trunk Club, which the company acquired in 2014.

The company said the Trunk Club business continues to deliver outsized top-line growth, though current expectations for future growth and profitability are lower than initial estimates.

BY PRODUCT CATEGORY

- Nordstrom brand: Including US and Canada full-line stores and Nordstrom.com, net sales, when combined with trunk Club, increased by 2.4% and comparable sales increased by 0.9%.

- Women’s apparel: The younger-customer-focused departments in women’s apparel continued to outperform, reflecting strength in denim and collaborations with new and emerging limited-distribution brands.

- Nordstrom Rack brand: In the Nordstrom Rack brand, which consists of Nordstrom Rack stores and Nordstromrack.com/HauteLook.com, net sales increased by 10.1% and comparable sales increased by 3.9%.

OUTLOOK

Nordstrom updated its fiscal year 2016 outlook to include its third-quarter results, which exceeded company expectations primarily due to the company’s efforts to align inventory and improve operational efficiencies.

For fiscal 2016, the company now expects:

- Net sales growth of 3.5%, versus 2.5%–4.5% previously.

- Diluted EPS of $1.70–$1.80, down from $2.60–$2.75 previously. Excluding the impairment charge to Trunk Club, the company’s EPS outlook is $2.85–$2.95.