Source: Company reports/FGRT

2Q17 Results

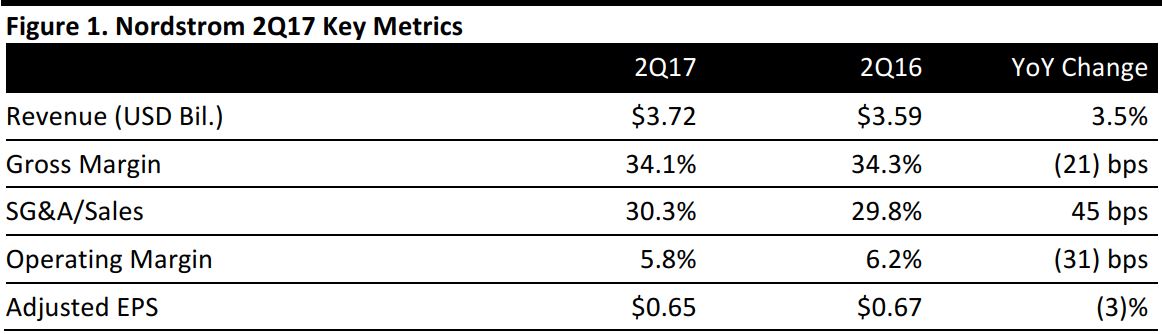

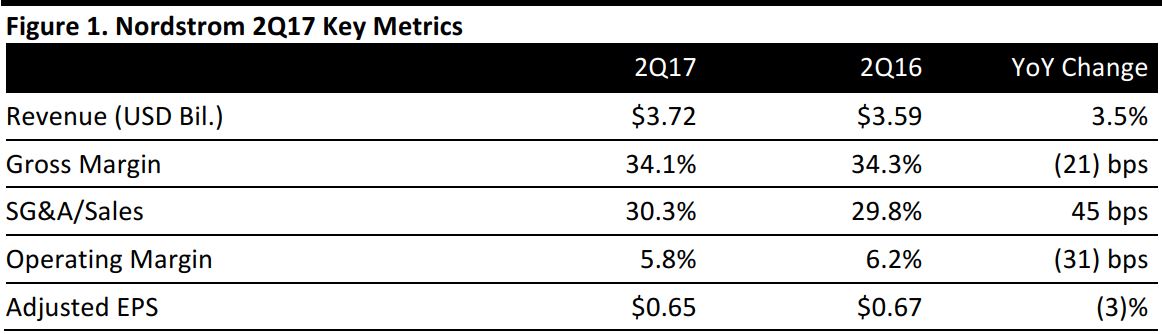

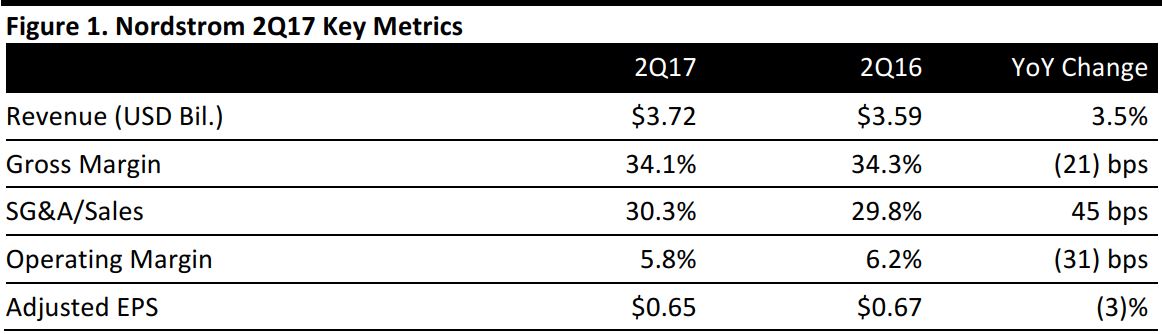

Nordstrom reported 2Q17 total revenues of $3.72 billion, below the $3.75 billion consensus estimate but up 3.5% year over year.

The company reported adjusted EPS of $0.65, down 3% from $0.67 in the year-ago period but above the consensus estimate of $0.64.

Comparable sales increased by 1.7% year over year. Nordstrom reported that its Anniversary Sale, historically its largest event of the year, generated better results than in recent years. Three of the five top-selling brands during the sale were Nordstrom proprietary labels.

Performance by Business Segment

Sales at the Nordstrom brand—which includes full-line stores, Nordstrom.com and Trunk Club—increased by 2.4% and comps increased by 1.4%. The top-performing categories were beauty and women’s apparel. The East was the best-performing US geographic region.

The Nordstrom Rack brand, which includes Nordstrom Rack stores and Nordstrom Rack.com/HauteLook.com, saw sales increase by 9.8% and comps increase by 3.1%. The East was the best-performing geographic region.

The company reported that its Nordstrom Rewards loyalty program continues to be important in reaching customers. During the second quarter, sales from Nordstrom Rewards customers represented 56% of total sales, compared with 48% in the year-ago period. At the end of the quarter, Nordstrom Rewards had more than 9.4 million active members in North America and Canada, up 50% from 6 million in the year-ago quarter.

The company ended the quarter with 354 stores, up from 329 stores in the year-ago period.

Outlook

The company raised its FY17 EPS guidance from $2.75–$3.00 to $2.85–$3.00, which is in line with the consensus estimate of $2.98.

The company also raised its sales growth expectation to 4%, up from prior guidance of 3%-4%, for total revenues of $15.35 billion. The consensus estimate calls for full-year revenues of $15.28 billion.