Source: Company reports/ Coresight Research

Source: Company reports/ Coresight Research

1Q18 Results

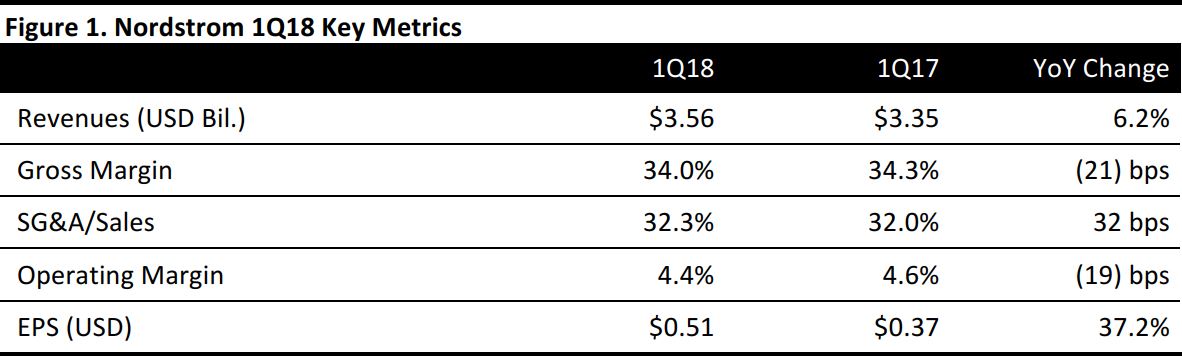

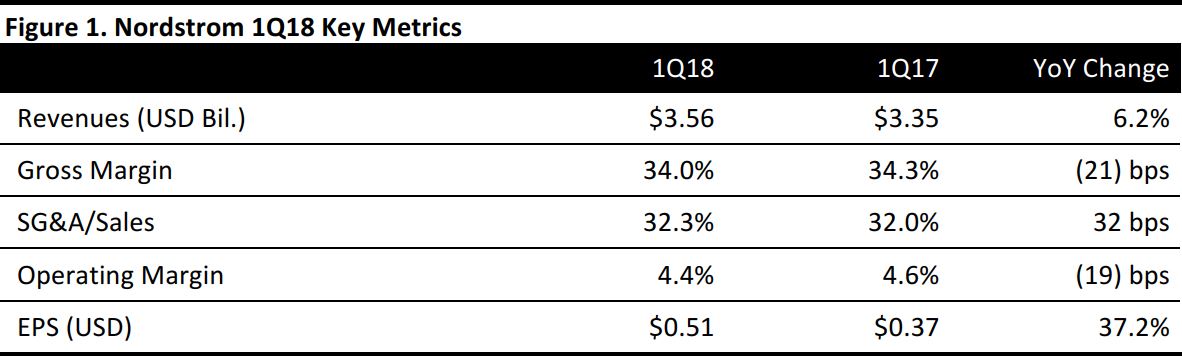

Nordstrom reported 1Q18 revenues of $3.56 billion, up 6.2% year over year and beating the $3.45 billion consensus estimate. EPS was $0.51, up 37.2% year over year and beating the $0.43 consensus estimate.

Comparable sales were up 0.6%, below the 1.1% consensus estimate but above the 0.8% decline reported in the year-ago quarter.

Details from the Quarter

Nordstrom’s gross margin decreased by 21 basis points in the quarter, due to higher occupancy expenses related to US and Canada Nordstrom Rack openings and planned preopening expenses associated with the Nordstrom Men’s Store NYC.

SG&A expense as a percentage of sales increased by 32 basis points, primarily due to preopening expenses associated with the Nordstrom Men’s Store NYC, which offset an improvement driven by productivity gains in technology, supply chain and marketing.

Management commented that the company ended the first quarter in a good inventory position, with net sales growth exceeding a decline in inventory.

To date in fiscal 2018, Nordstrom has opened eight stores and closed one store, for a total of 373 stores, compared with 353 stores a year ago. Total gross square footage was 30.4 million square feet at the end of the quarter, up from 29.8 million square feet a year ago.

Other details:

- The company opened the Nordstrom Men’s Store in New York City during the quarter.

- Nordstrom expanded in Canada with the introduction of Nordstrom Rack, opening three stores in the Toronto and Calgary markets.

- Online sales represented 29% of total sales, up from 25% percent in the year-ago quarter, an increase of 18% year over year.

- Sales from Nordstrom Rewards customers represented 53% of sales, compared with 47% a year ago.

Results by Category

Full Price

- Full-price sales were $2.2 billion, up 3.9% from a year ago.

- Full-price comps were up 0.7%, compared with (2.9)% a year ago.

- The company ended the quarter with 135 full-price stores, up from 131 a year ago.

Off Price

- Off-price sales were $1.2 billion, up 6.7% from a year ago.

- Off-price comps were up 0.4%, versus 2.3% in the year-ago quarter.

- The company ended the quarter with 238 off-price stores, up from 222 a year ago.

Outlook

The company’s FY18 guidance was as follows

- Net sales: $15.2–$15.4 billion (unchanged)

- Comps: 0.5%–1.5% (unchanged)

- Operating profit (EBIT): $895–$940 million (up from $885–$940 million previously)

- EPS: $3.35–$3.55 (up from $3.30–$3.55 previously)

Source: Company reports/ Coresight Research

Source: Company reports/ Coresight Research