Source: Company reports/Fung Global Retail & Technology

1Q17 Results

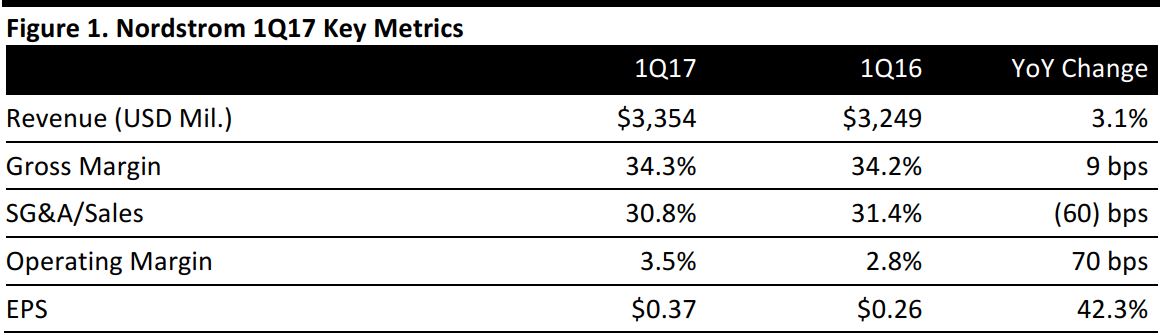

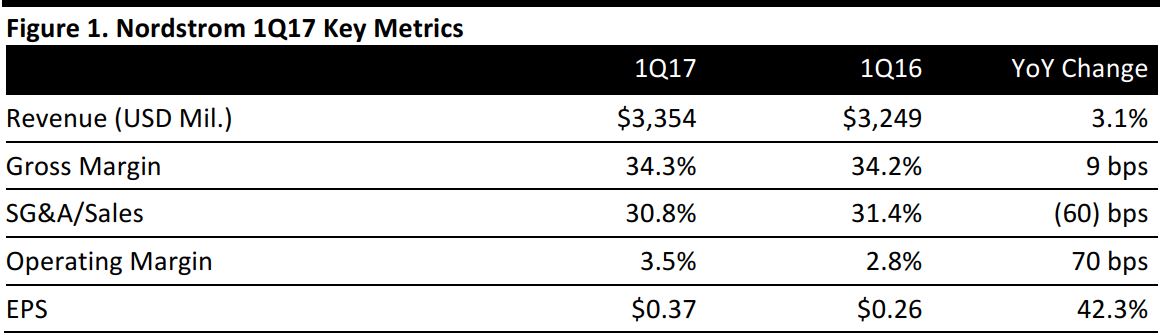

Nordstrom reported 1Q17 total revenues of $3.35 billion, slightly above the $3.34 billion consensus estimate, and net sales of $3.28 billion, up 2.7% year over year.

The company reported EPS of $0.37, up 42.3% from $0.26 in the year-ago period. This included an interest expense charge of $18 million, or $0.06 per share, related to a $650 million debt refinancing that was completed in the quarter but was not included in the company’s outlook.

The company indicated that there was an overall increase in customer count in the quarter. Comp sales decreased by 0.8% year over year, missing the consensus estimate of a 0.1% decrease. Online sales were up 11% at Nordstrom.com and up 19% at Nordstrom Rack.com/Haute Look.com.

Performance by Business Segment

Sales at the Nordstrom brand—which includes full-line stores, Nordstrom.com and Trunk Club—decreased by 1.7% and comps decreased by 2.8%. Top-performing categories were men’s and women’s apparel.

The Nordstrom Rack brand, which includes Nordstrom Rack stores and Nordstrom Rack.com/HauteLook.com, saw sales increase by 8.7% and comps increase by 2.3%.

The West was the top-performing region for both segments.

At the end of the quarter, Nordstrom Rewards had more than 8.6 million active members in North America, up 70% from 5 million in the year-ago quarter. The company ended the quarter with 353 stores, up from 329 stores in the year-ago period.

Outlook

The company maintained its FY17 outlook for EPS of $2.75–$3.00. The company expects total sales to be up 3%–4% and comps to be flat.

Management reiterated FY17 guidance based on the following assumptions:

- The 53rd week is expected to add another $200 million in total sales.

Two anniversary sales events will take place in the second and third quarters, consistent with the timing in 2016.