Source: Company reports

1Q16 RESULTS

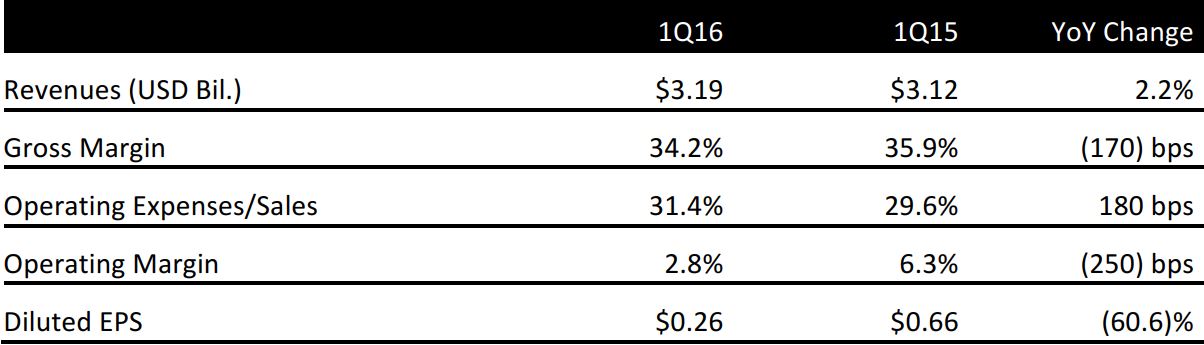

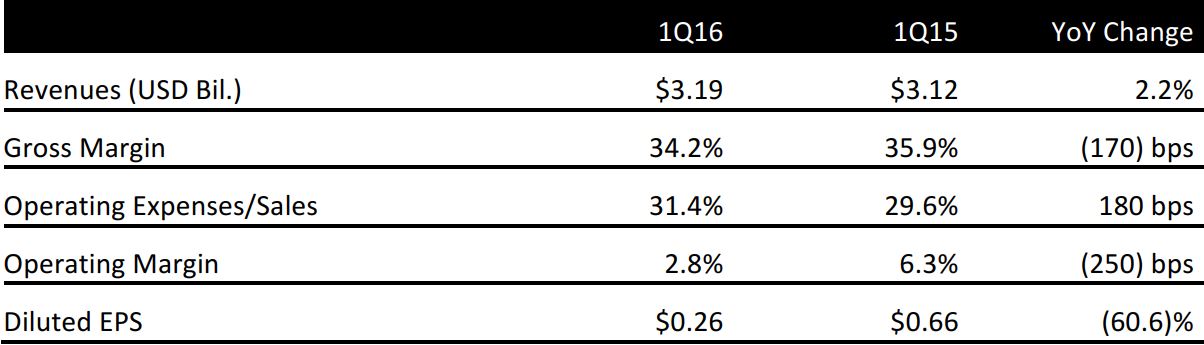

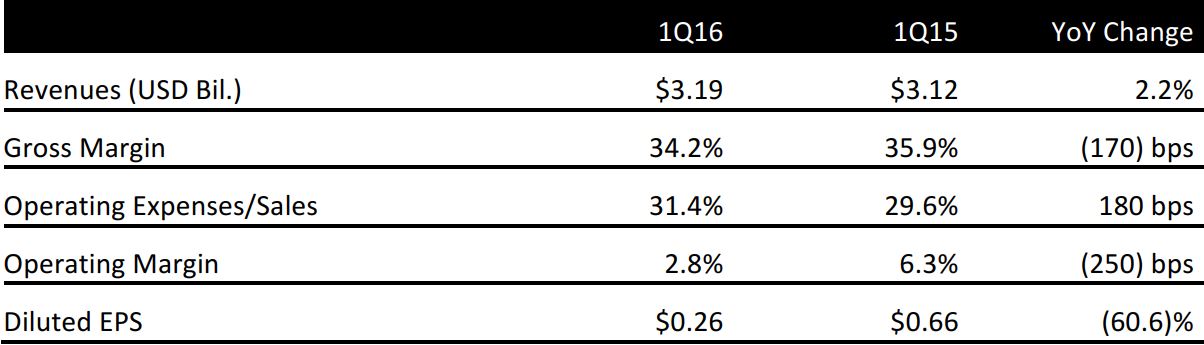

Nordstrom announced 1Q16 diluted EPS of $0.26, far below the consensus estimate of $0.45, and well below the year-ago figure. The disappointing results were driven by sales that were lower than planned and by higher markdowns intended to better align inventories with softening industry trends. Results were well below the company’s internal expectations as well.

Total net sales were up 2.5%, to $3.2 billion, from $3.1 billion during the same period last year. Comps declined by1.7%. Retail EBIT fell by $107 million, to $90 million, reflecting increased markdowns and higher credit chargeback expenses in addition to planned fulfillment and technology costs supporting the company’s growth initiatives. Credit EBIT was$32 million lower than in the year-ago quarter, a function of an expected reduction in net revenue from a revenue-sharing program agreement with TD Bank.

Segment results reflected softening economic and industry trends, with full-price sales falling while off-price sales gained traction. Across Nordstrom’s US full-line stores and Nordstrom.com, the top-performing merchandise category was beauty. Off-price net sales, which consist of Nordstrom Rack and Nordstromrack.com/HauteLook sales, increased by 11.8%, while same-store sales increased by 4.6%.

FY16 OUTLOOK

Company management outlined its lowered expectations for the remainder of the year. Net sales guidance was reduced from 3.5%–5.5% growth to 2.5%–4.5% growth. Same-store sales guidance was similarly cut, from 0%–2%to (1)%–1%. The company also lowered its FY16 EPS guidance, from $3.10–$3.35 to $2.50–$2.70.