What’s the Story?

On February 4, 2021, the Coresight Research team attended Nordstrom’s annual Investor Day virtually. In this report, we present insights from the event, covering the company’s views of the shifting retail landscape and Nordstrom’s three initiatives under its digital-first “Closer to You” market strategy.

The Shifting Retail Landscape: Customers Are Younger; Spending Is Polarized; Digital is Driving Decisions

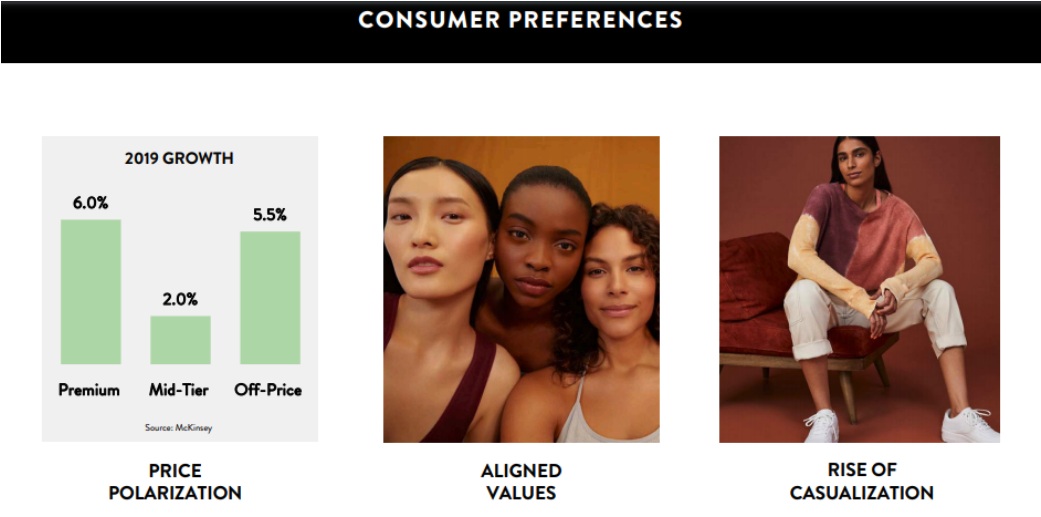

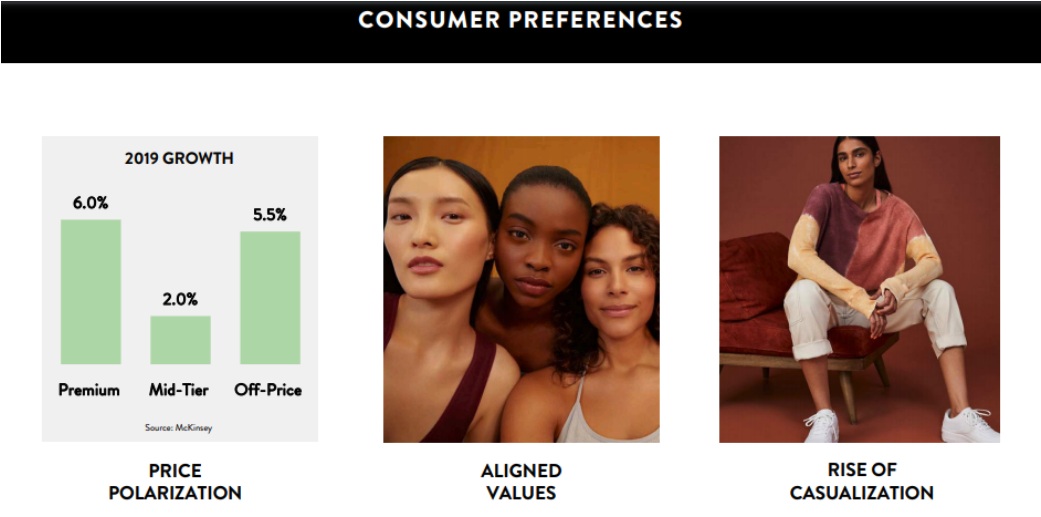

Erik Nordstrom, CEO at Nordstrom, began the day with a backdrop of the current retail landscape, focusing on how demographic shifts, consumer preferences and digital acceleration helped to inform the company’s “Closer to You” strategy and how the company is positioning its priorities and brands.

- Demographic shifts: The US population is becoming younger and more diverse—millennials are expected to make up approximately 50% of personal goods spending by 2024 as they grow into the highest earnings period of their lives.

- Consumer preferences: Consumers are migrating toward the two ends of the price spectrum: premium products and off-price products. Consumers are also focused on sustainability and the environment, so brands that are diverse and inclusive in their positioning, and give back to communities, are set to see success.

- Digital acceleration: The shopping journey, from discovery to delivery, has become increasingly digital. According to the US Census Bureau, digital commerce grew at a CAGR of 17.2% from 2015 to 2020—from 7.1% of total retail sales to 13.4%. Erik Nordstrom said that for the categories that Nordstrom sells, that number is closer to 40%. Influencers, not fashion merchants, are driving fashion trends, which further raises the importance of providing consumers with a connected and personalized digital experience.

[caption id="attachment_123124" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

“Closer to You” Strategy: Three Initiatives

These shifts in the retail landscape have set the stage for the three key initiatives under Nordstrom’s “Closer to You” strategy, which the company outlined at its Investor Day. The strategy focuses on a digital-first platform across Nordstrom and Nordstrom Rack stores, widening the aperture of the customers they serve and how they serve them.

1. Winning in Its Most Important Markets

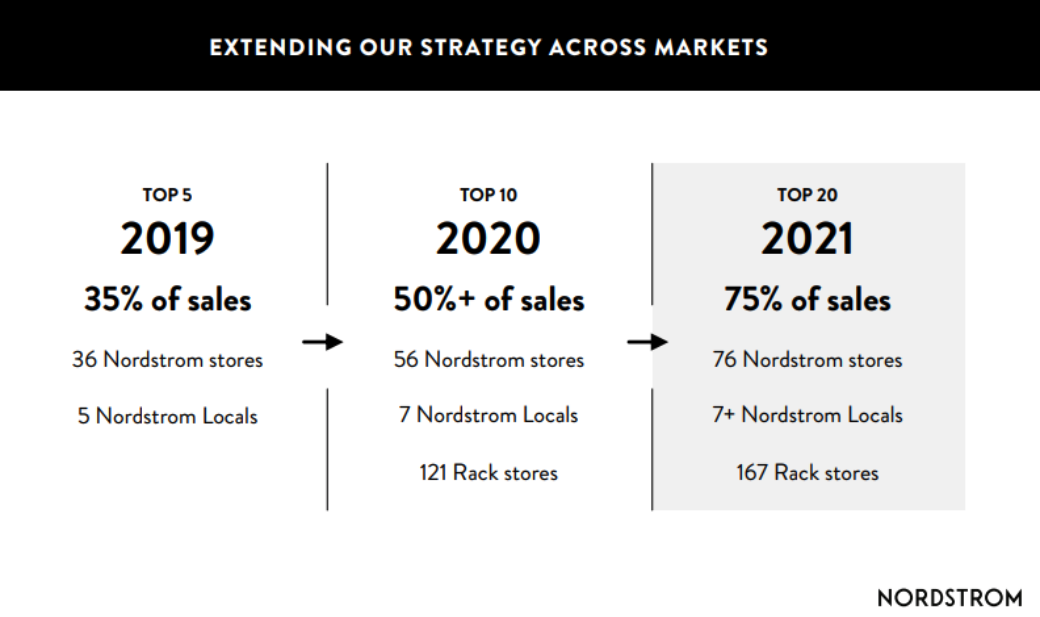

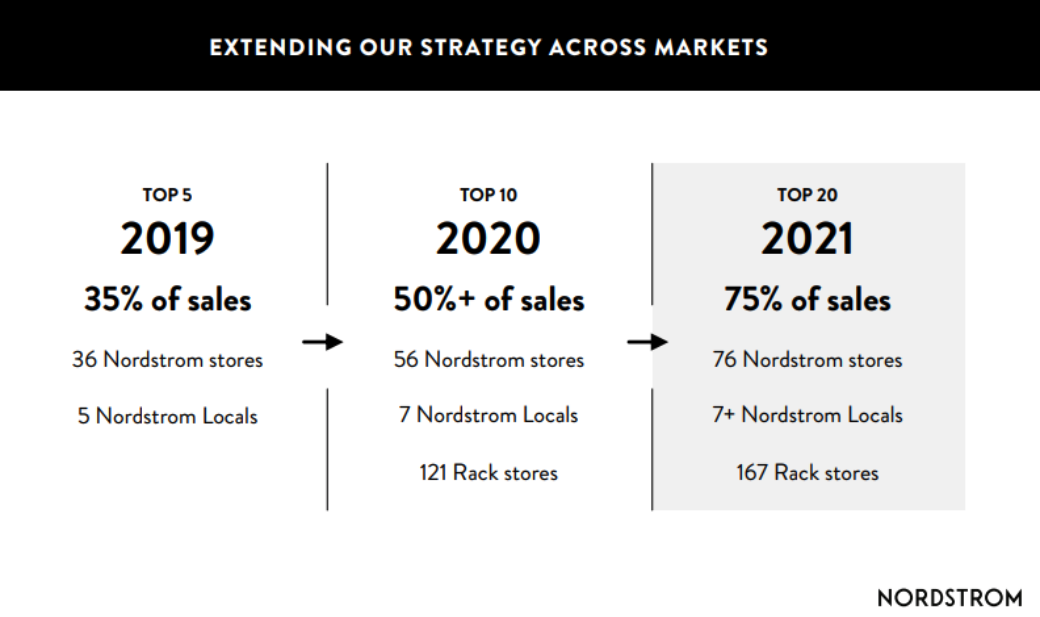

The first initiative extends the rollout of the market strategy that Nordstrom first launched in 2019, by integrating Nordstrom Rack assets and evolving the company’s distribution capabilities.

Nordstrom began its market strategy two years ago in its top five markets. The company’s goals included providing customers with greater access to services and products and combining digital capabilities with local assets (people, product and physical locations) to help reimagine the shopping experience for customers. The strategy increases customer engagement through services and provides greater access to merchandise selection with faster delivery at a lower cost to Nordstrom.

In 2020, Nordstrom doubled its market exposure, rolling out its market strategy to its top 10 markets, which represent approximately half of its total sales. The company is providing customers with four times more products available for next-day shipping and a one-day reduction in shipping speed. The sales results, consumer engagement and overall customer spend have improved in these markets since the rollout, according to Nordstrom: The company grew its customer base by 20% and sales by nearly 200 basis points higher than other markets.

Based on these positive results, Nordstrom is planning to double the exposure of its market strategy to its top 20 markets in 2021—comprising roughly 75% of the company’s total sales—which includes 76 Nordstrom stores, 167 Nordstrom Rack stores and seven Local stores (see the image below).

Nordstrom highlighted that a major component of the market strategy this year is fully integrating Nordstrom Rack—an effort that began in late 2020. This includes bringing elements of the Nordstrom service experience to Rack customers, such as “store fulfill,” ship-to-store and returns across all Nordstrom stores. Nordstrom reported that it has seen positive results since the start of the Rack integration:

- Just over 20% of nordstromrack.com orders came through store fulfill in the initial months of rollout, compared to 30% at nordstrom.com.

- Ship-to-store drove a 10% lift in new customers, and 20% of customers using this service made an incremental in-store purchase when they picked up their order.

[caption id="attachment_123125" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

2. Broadening the Reach of Nordstrom Rack

The company’s second initiative is to broaden the reach of Nordstrom Rack by better connecting physical and digital inventory and expanding its price range.

Connecting Inventory

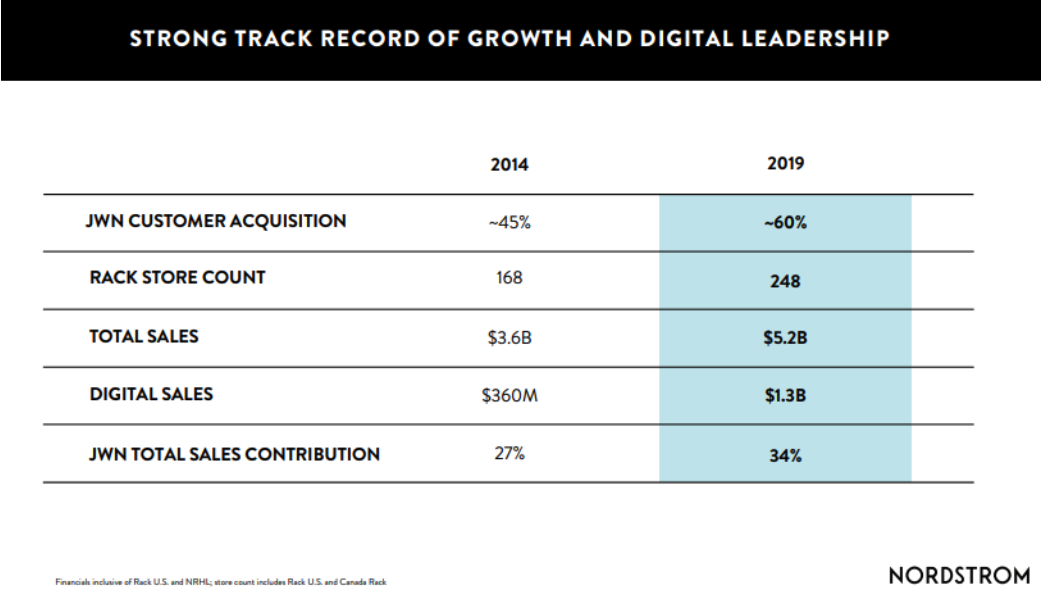

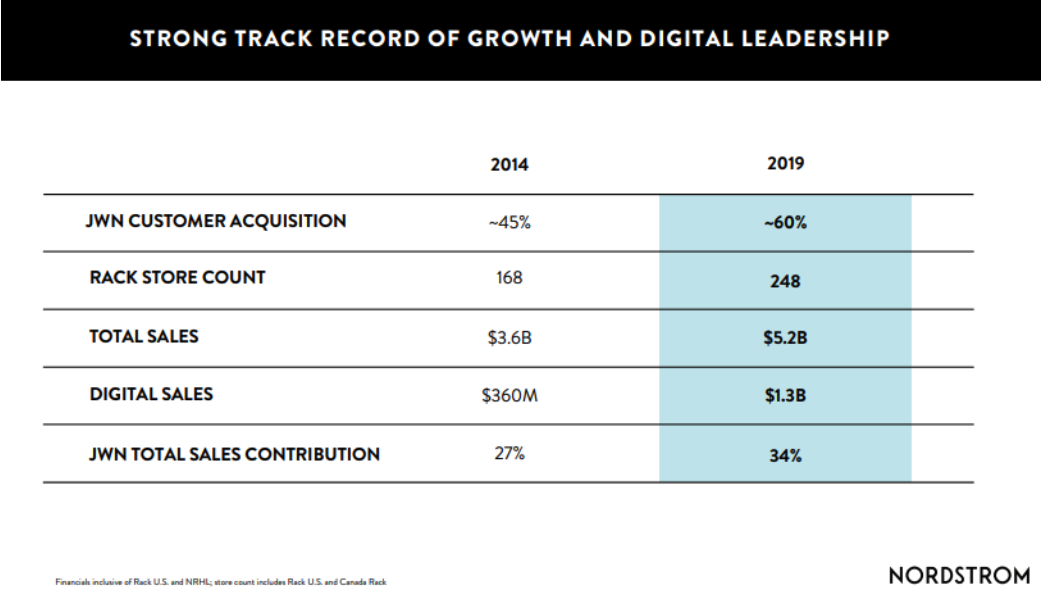

Geevy Thomas, President of Nordstrom Rack, presented an overview of Nordstrom Rack’s growth over the past five years, highlighting that it is Nordstrom’s number-one source of customer acquisition. The company has been investing in its Rack online presence: Nordstrom Rack’s digital penetration was 25% in 2019, accelerating to 38% of total sales in the most recently completed quarter, according to the company. The company expects to grow Nordstrom Rack’s digital penetration to 45% over time. The company sees an opportunity to improve efficiency and bring digital margins more in line with brick-and-mortar margins over time, similar to its Nordstrom business.

In October 2020, Nordstrom created a shared view of its inventory across its physical and digital assets in Nordstrom Rack. By enabling this capability, product selections grew by 20% without purchasing any additional inventory. When the company launched shared inventory at Nordstrom full-line stores, the company saw a 10% lift in spend, reduced inventory by 5% and improved inventory turns by over 10%. Through reduced markdown activity and enhanced fulfillment efficiency, the company sees further opportunities to increase profitability.

[caption id="attachment_123126" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

Expanding Customer Base Through Lower Price Points

The company is aiming to expand its customer base. Nordstrom Rack has historically focused on “trendy fashion lovers” who are looking for great value with a high brand focus; these shoppers comprise 26% of Nordstrom Rack’s customer base, according to the company. Nordstrom Rack sees an opportunity to gain a foothold among price-conscious consumers—which represent only 13% of Norstrom Rack’s customer base today—and so intends to focus on these shoppers moving forward.

Nordstrom repositioned its Nordstrom Rack portfolio into three groups in the fall of 2020, in order to focus on customers that are prioritizing price:

- Price stores—Assortment with lower average price points; a price-driven merchandising approach

- Brand stores—Largely unchanged from the traditional Nordstrom Rack store offering

- Hybrid stores—A mix of brand- and price-focused product offerings

Currently, approximately one-third of Nordstrom’s North America stores are now positioned as “price stores.” The company expects this strategy to drive revenue growth, new customer acquisition and incremental traffic trips that will increase transactions. Nordstrom reported that it is encouraged by early indicators from its repositioned stores. The company sees the potential to expand price stores in new markets. Erik Nordstrom said that Nordstrom Rack stores are on a short lead to make decisions and to build out the stores, and he sees an opportunity for potential store growth in Nordstrom Rack, particularly in its price stores.

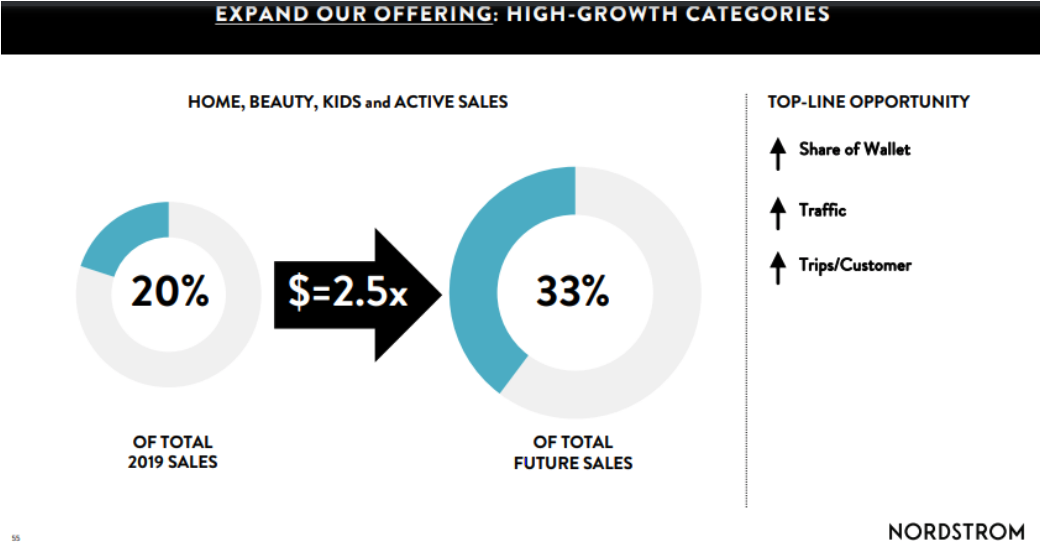

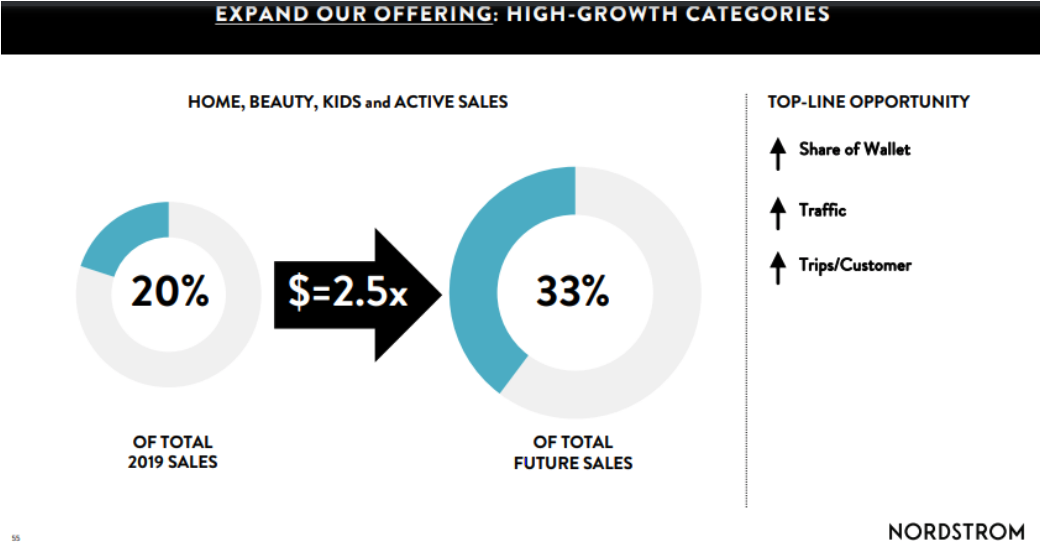

Furthermore, Nordstrom sees an opportunity to expand its assortment in the high-growth categories of beauty, home, kids and active, which together comprised 20% of Nordstrom Rack sales in 2019. Over time, the company expects its sales to more than double in these categories and take a higher share of overall sales (see image below). Nordstrom believes that leaning into high-growth categories will further help the company to increase store traffic, its share of wallet and the number of shopping trips made by customers.

[caption id="attachment_123127" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

3. Increasing Digital Velocity

Nordstrom’s third initiative is to increase the digital velocity of the business, by growing its assortment, delivering personalization at scale and increasing the linkages between digital and physical retail.

Increasing Assortment by 5X

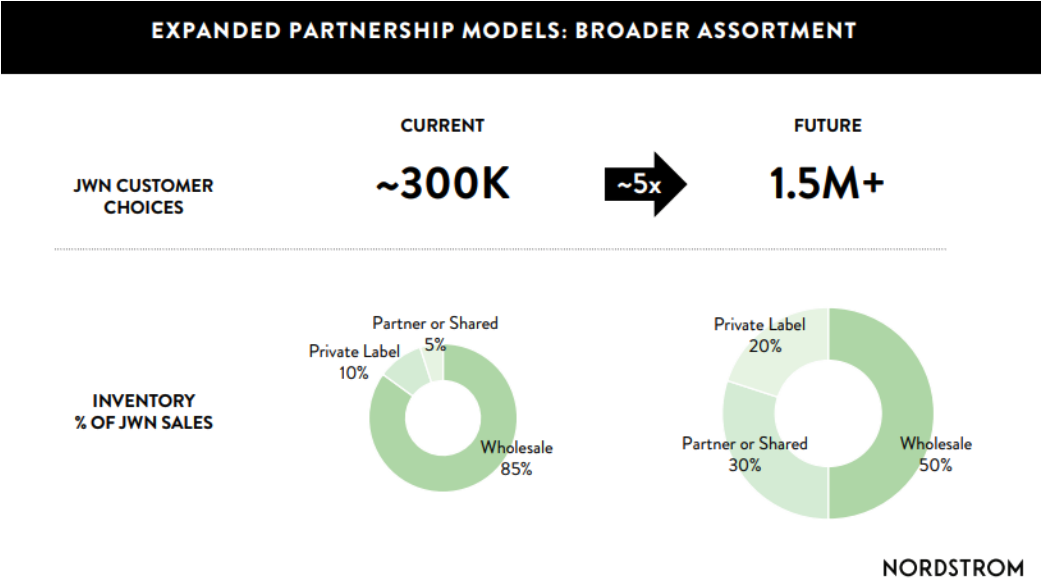

Nordstrom plans to significantly expand the assortments that it offers its customers, from approximately 300,000 choices today, to more than 1.5 million over the next three to five years. This will mean a transition from a store-based model to a digital-first merchandising model. Nordstrom generates more than 50% of its sales digitally and is focusing on building out is product catalog online. The company said that today, its total Nordstrom online business is three times what is offered in its physical stores; in the future, it sees potential for its online assortment to be 20 times what is offered in stores.

The company used the example of the trending home category, in which Nordstrom is taking a digital-first approach to grow business by 5X within the next three to five years by tripling its selections in bedding, office and even pet products.

[caption id="attachment_123128" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

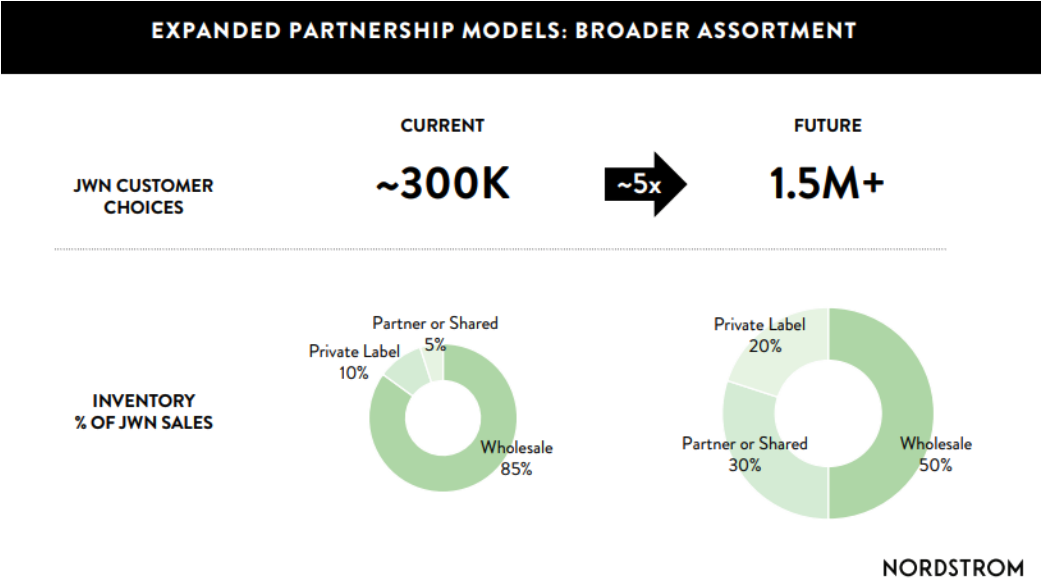

Expanding Partnerships

Nordstrom employs five primary partnership models: private label and traditional wholesale, where it owns the inventory; drop ship and concession, where the vendor owns the inventory; and revenue share, where the ownership of the inventory is shared. The company is expanding its ability to offer inventory that it does not own using dropshipping, concession and revenue-sharing models with its brand partners.

Over time, Nordstrom expects traditional wholesale to comprise 50% of total sales, down from 85% today. Extending beyond the traditional wholesale model will allow Nordstrom to increase product selection and share risk and benefits with partners. It also gives the company flexibility to adapt to emerging preferences and trends. Nordstrom reported that over 25% of sales during its Anniversary Sale in August 2020 were fulfilled by dropshipping.

Nordstrom reported that it sees an opportunity to increase its private-label penetration from 10% of sales to 20% by 2025. Customers who purchase Nordstrom-made products spend five times more than the average Nordstrom customer, make three times more trips per year and make significantly fewer merchandise returns, according to the company. In 2019, the gross margin rates of Nordstrom-made brands were 500 basis points higher than third-party brand products.

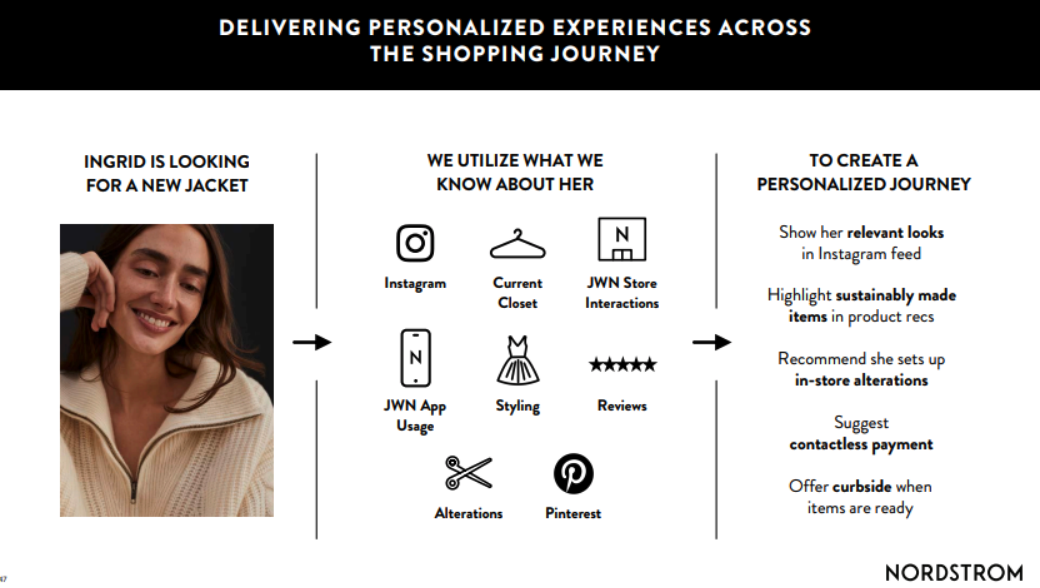

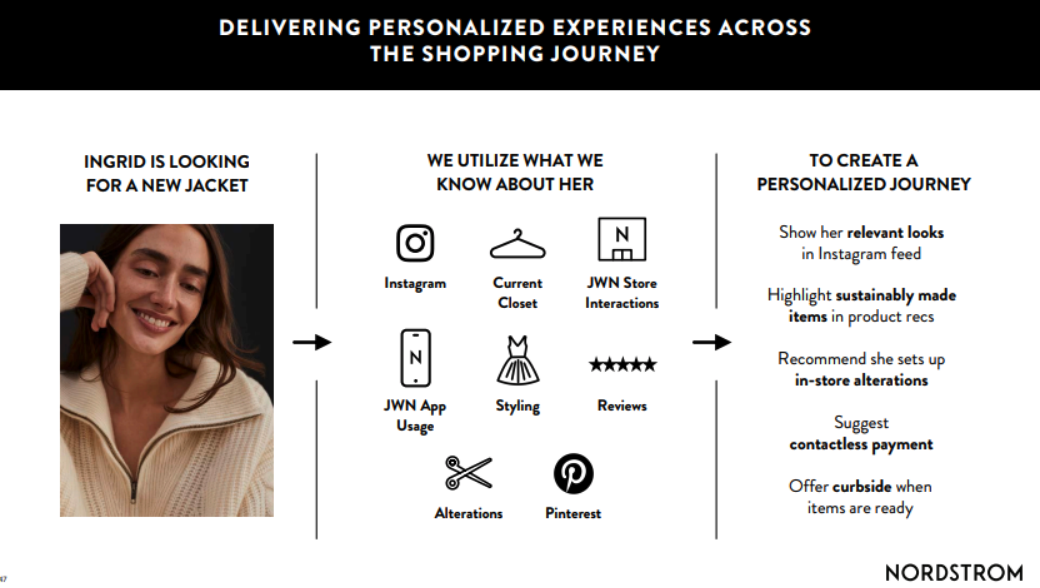

Increasing Personalization at Scale

Kenneth Worzel, Chief Operating Officer at Nordstrom, said that 2020 was a milestone year, with more than half of sales coming through digital channels. Worzel said that the company expects the majority of sales to be digital moving forward, even as store revenues recover.

Nordstrom is adding digital capabilities to personalize the online experience, which aim to replicate in-store services and the physical shopping experience. Worzel said that personalization addresses and anticipates how customers prefer to shop and offers them the most relevant product and services for them.

- Nordstrom offers “Looks,” a tool that gives customers outfit recommendations based on their search history and past purchases. The company stated that customers have responded positively to this feature, with a customer satisfaction score of 90 and attributed sales growing by triple digits year over year.

- Nordstrom salespeople host videos to provide styling and product advice to shoppers. The company produced over 40,000 videos in 2020, which saw engagement from nearly 25% of its customers. According to Nordstrom, conversion rates were nearly 2X versus customers who did not engage with salesperson videos, with higher spend, more trips and lower returns rates.

- Nordstrom is engaging with customers on Instagram. Nordstrom stylists and independent influencers can add a clickable link to a post featuring shoppable Nordstrom products, through which customers can add the items to their digital cart on nordstrom.com. More than 80,000 links have been created since this was rolled out.

[caption id="attachment_123129" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

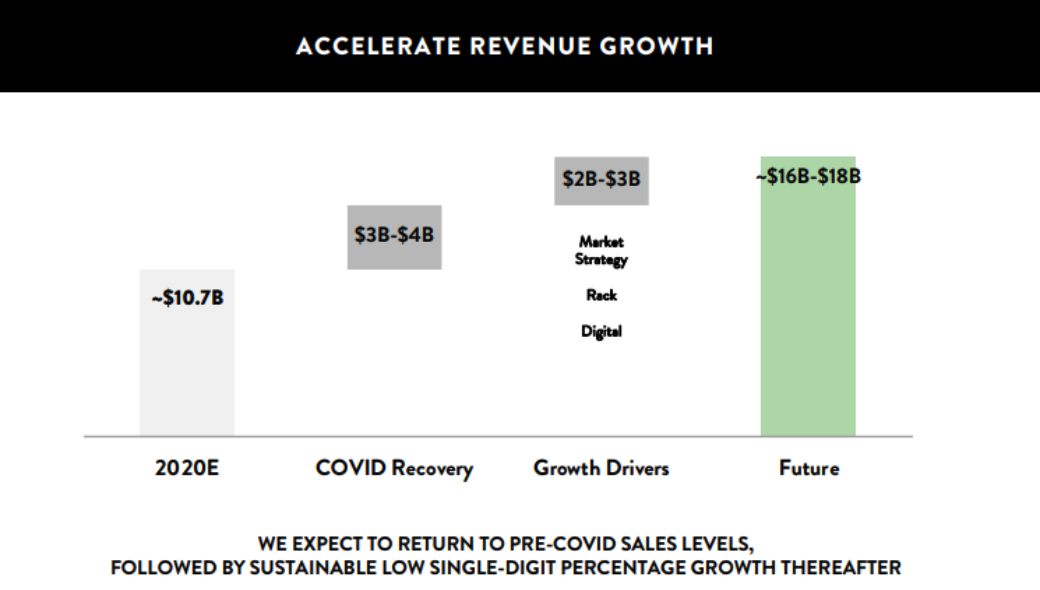

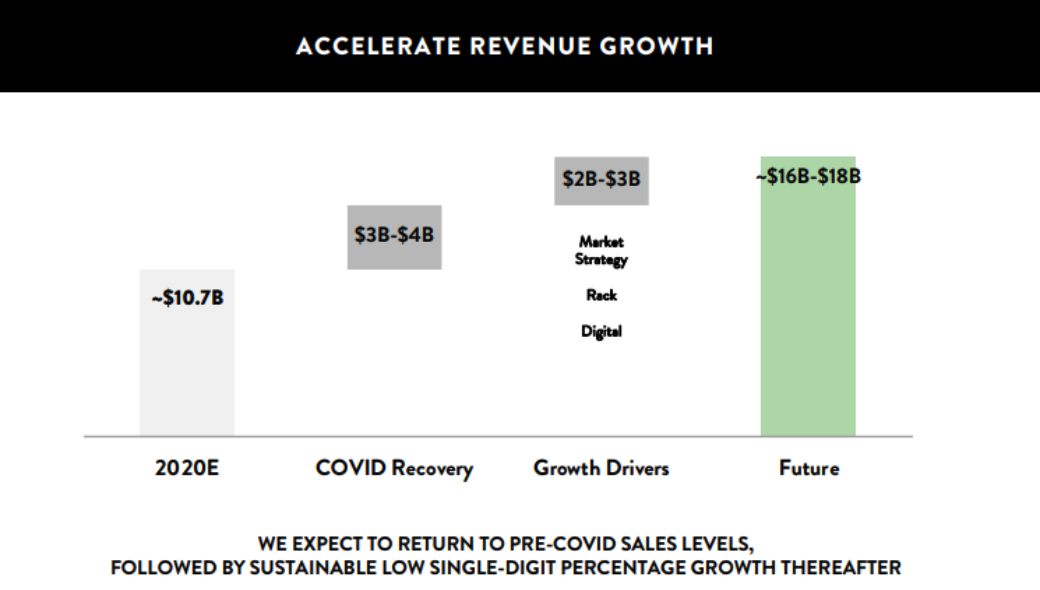

Financial Outlook

Nordstrom reported that it is increasingly optimistic about its recovery from the Covid-19 pandemic as vaccine rollouts continue. The company has seen its revenues improve sequentially each quarter since the reopening of its stores in the second quarter.

Nordstrom detailed three expected revenue drivers going forward:

- The company expects $3–4 billion in incremental revenue from 2020 levels—revenue lost to Covid-19—with roughly two-thirds of that coming in 2021, assuming stores remain open.

- The execution of the three growth priorities will support an additional $2–3 billion of annual revenue in the medium term.

- There will be sustainable low, single-digit-percentage growth as Nordstrom leverages and scales its “Closer to You” strategy, according to the company.

Nordstrom expects 25% revenue growth in 2021, assuming that stores will be open for the entire year and the company executes its three initiatives. Nordstrom predicts that digital will comprising approximately 50% of sales through the year. It has rebaselined its cost structure and expects to achieve positive EBIT. The company reported that it expects improved EBIT margins, of 6% of more, over the long term.

[caption id="attachment_123130" align="aligncenter" width="725"]

Source: Nordstrom

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]

2. Broadening the Reach of Nordstrom Rack

The company’s second initiative is to broaden the reach of Nordstrom Rack by better connecting physical and digital inventory and expanding its price range.

Connecting Inventory

Geevy Thomas, President of Nordstrom Rack, presented an overview of Nordstrom Rack’s growth over the past five years, highlighting that it is Nordstrom’s number-one source of customer acquisition. The company has been investing in its Rack online presence: Nordstrom Rack’s digital penetration was 25% in 2019, accelerating to 38% of total sales in the most recently completed quarter, according to the company. The company expects to grow Nordstrom Rack’s digital penetration to 45% over time. The company sees an opportunity to improve efficiency and bring digital margins more in line with brick-and-mortar margins over time, similar to its Nordstrom business.

In October 2020, Nordstrom created a shared view of its inventory across its physical and digital assets in Nordstrom Rack. By enabling this capability, product selections grew by 20% without purchasing any additional inventory. When the company launched shared inventory at Nordstrom full-line stores, the company saw a 10% lift in spend, reduced inventory by 5% and improved inventory turns by over 10%. Through reduced markdown activity and enhanced fulfillment efficiency, the company sees further opportunities to increase profitability.

[caption id="attachment_123126" align="aligncenter" width="725"]

Source: Nordstrom[/caption]

2. Broadening the Reach of Nordstrom Rack

The company’s second initiative is to broaden the reach of Nordstrom Rack by better connecting physical and digital inventory and expanding its price range.

Connecting Inventory

Geevy Thomas, President of Nordstrom Rack, presented an overview of Nordstrom Rack’s growth over the past five years, highlighting that it is Nordstrom’s number-one source of customer acquisition. The company has been investing in its Rack online presence: Nordstrom Rack’s digital penetration was 25% in 2019, accelerating to 38% of total sales in the most recently completed quarter, according to the company. The company expects to grow Nordstrom Rack’s digital penetration to 45% over time. The company sees an opportunity to improve efficiency and bring digital margins more in line with brick-and-mortar margins over time, similar to its Nordstrom business.

In October 2020, Nordstrom created a shared view of its inventory across its physical and digital assets in Nordstrom Rack. By enabling this capability, product selections grew by 20% without purchasing any additional inventory. When the company launched shared inventory at Nordstrom full-line stores, the company saw a 10% lift in spend, reduced inventory by 5% and improved inventory turns by over 10%. Through reduced markdown activity and enhanced fulfillment efficiency, the company sees further opportunities to increase profitability.

[caption id="attachment_123126" align="aligncenter" width="725"] Source: Nordstrom[/caption]

Expanding Customer Base Through Lower Price Points

The company is aiming to expand its customer base. Nordstrom Rack has historically focused on “trendy fashion lovers” who are looking for great value with a high brand focus; these shoppers comprise 26% of Nordstrom Rack’s customer base, according to the company. Nordstrom Rack sees an opportunity to gain a foothold among price-conscious consumers—which represent only 13% of Norstrom Rack’s customer base today—and so intends to focus on these shoppers moving forward.

Nordstrom repositioned its Nordstrom Rack portfolio into three groups in the fall of 2020, in order to focus on customers that are prioritizing price:

Source: Nordstrom[/caption]

Expanding Customer Base Through Lower Price Points

The company is aiming to expand its customer base. Nordstrom Rack has historically focused on “trendy fashion lovers” who are looking for great value with a high brand focus; these shoppers comprise 26% of Nordstrom Rack’s customer base, according to the company. Nordstrom Rack sees an opportunity to gain a foothold among price-conscious consumers—which represent only 13% of Norstrom Rack’s customer base today—and so intends to focus on these shoppers moving forward.

Nordstrom repositioned its Nordstrom Rack portfolio into three groups in the fall of 2020, in order to focus on customers that are prioritizing price:

Source: Nordstrom[/caption]

3. Increasing Digital Velocity

Nordstrom’s third initiative is to increase the digital velocity of the business, by growing its assortment, delivering personalization at scale and increasing the linkages between digital and physical retail.

Increasing Assortment by 5X

Nordstrom plans to significantly expand the assortments that it offers its customers, from approximately 300,000 choices today, to more than 1.5 million over the next three to five years. This will mean a transition from a store-based model to a digital-first merchandising model. Nordstrom generates more than 50% of its sales digitally and is focusing on building out is product catalog online. The company said that today, its total Nordstrom online business is three times what is offered in its physical stores; in the future, it sees potential for its online assortment to be 20 times what is offered in stores.

The company used the example of the trending home category, in which Nordstrom is taking a digital-first approach to grow business by 5X within the next three to five years by tripling its selections in bedding, office and even pet products.

[caption id="attachment_123128" align="aligncenter" width="725"]

Source: Nordstrom[/caption]

3. Increasing Digital Velocity

Nordstrom’s third initiative is to increase the digital velocity of the business, by growing its assortment, delivering personalization at scale and increasing the linkages between digital and physical retail.

Increasing Assortment by 5X

Nordstrom plans to significantly expand the assortments that it offers its customers, from approximately 300,000 choices today, to more than 1.5 million over the next three to five years. This will mean a transition from a store-based model to a digital-first merchandising model. Nordstrom generates more than 50% of its sales digitally and is focusing on building out is product catalog online. The company said that today, its total Nordstrom online business is three times what is offered in its physical stores; in the future, it sees potential for its online assortment to be 20 times what is offered in stores.

The company used the example of the trending home category, in which Nordstrom is taking a digital-first approach to grow business by 5X within the next three to five years by tripling its selections in bedding, office and even pet products.

[caption id="attachment_123128" align="aligncenter" width="725"] Source: Nordstrom[/caption]

Expanding Partnerships

Nordstrom employs five primary partnership models: private label and traditional wholesale, where it owns the inventory; drop ship and concession, where the vendor owns the inventory; and revenue share, where the ownership of the inventory is shared. The company is expanding its ability to offer inventory that it does not own using dropshipping, concession and revenue-sharing models with its brand partners.

Over time, Nordstrom expects traditional wholesale to comprise 50% of total sales, down from 85% today. Extending beyond the traditional wholesale model will allow Nordstrom to increase product selection and share risk and benefits with partners. It also gives the company flexibility to adapt to emerging preferences and trends. Nordstrom reported that over 25% of sales during its Anniversary Sale in August 2020 were fulfilled by dropshipping.

Nordstrom reported that it sees an opportunity to increase its private-label penetration from 10% of sales to 20% by 2025. Customers who purchase Nordstrom-made products spend five times more than the average Nordstrom customer, make three times more trips per year and make significantly fewer merchandise returns, according to the company. In 2019, the gross margin rates of Nordstrom-made brands were 500 basis points higher than third-party brand products.

Increasing Personalization at Scale

Kenneth Worzel, Chief Operating Officer at Nordstrom, said that 2020 was a milestone year, with more than half of sales coming through digital channels. Worzel said that the company expects the majority of sales to be digital moving forward, even as store revenues recover.

Nordstrom is adding digital capabilities to personalize the online experience, which aim to replicate in-store services and the physical shopping experience. Worzel said that personalization addresses and anticipates how customers prefer to shop and offers them the most relevant product and services for them.

Source: Nordstrom[/caption]

Expanding Partnerships

Nordstrom employs five primary partnership models: private label and traditional wholesale, where it owns the inventory; drop ship and concession, where the vendor owns the inventory; and revenue share, where the ownership of the inventory is shared. The company is expanding its ability to offer inventory that it does not own using dropshipping, concession and revenue-sharing models with its brand partners.

Over time, Nordstrom expects traditional wholesale to comprise 50% of total sales, down from 85% today. Extending beyond the traditional wholesale model will allow Nordstrom to increase product selection and share risk and benefits with partners. It also gives the company flexibility to adapt to emerging preferences and trends. Nordstrom reported that over 25% of sales during its Anniversary Sale in August 2020 were fulfilled by dropshipping.

Nordstrom reported that it sees an opportunity to increase its private-label penetration from 10% of sales to 20% by 2025. Customers who purchase Nordstrom-made products spend five times more than the average Nordstrom customer, make three times more trips per year and make significantly fewer merchandise returns, according to the company. In 2019, the gross margin rates of Nordstrom-made brands were 500 basis points higher than third-party brand products.

Increasing Personalization at Scale

Kenneth Worzel, Chief Operating Officer at Nordstrom, said that 2020 was a milestone year, with more than half of sales coming through digital channels. Worzel said that the company expects the majority of sales to be digital moving forward, even as store revenues recover.

Nordstrom is adding digital capabilities to personalize the online experience, which aim to replicate in-store services and the physical shopping experience. Worzel said that personalization addresses and anticipates how customers prefer to shop and offers them the most relevant product and services for them.

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]

Source: Nordstrom[/caption]