On July 10, Nordstrom hosted an Investor Day in Los Angeles, California, reportedly choosing LA because it is the company’s largest market, accounting for $1 billion in sales in 2017.

The day consisted of management presentations from Co-Presidents Blake, Peter and Erik Nordstrom, CFO Anne Bramman and Chief Digital Officer/President of Nordstrom.com Ken Worzel.

Nordstrom Plans to Grow Revenues by $3 Billion Over Five Years

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

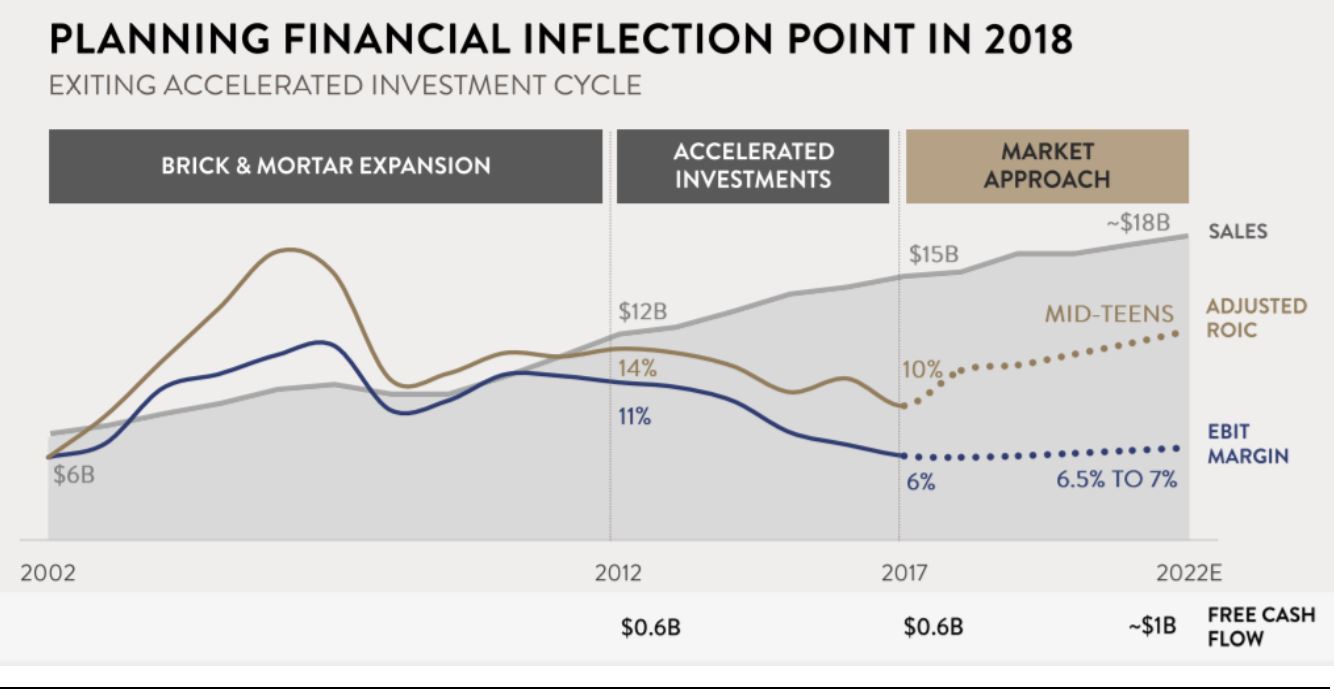

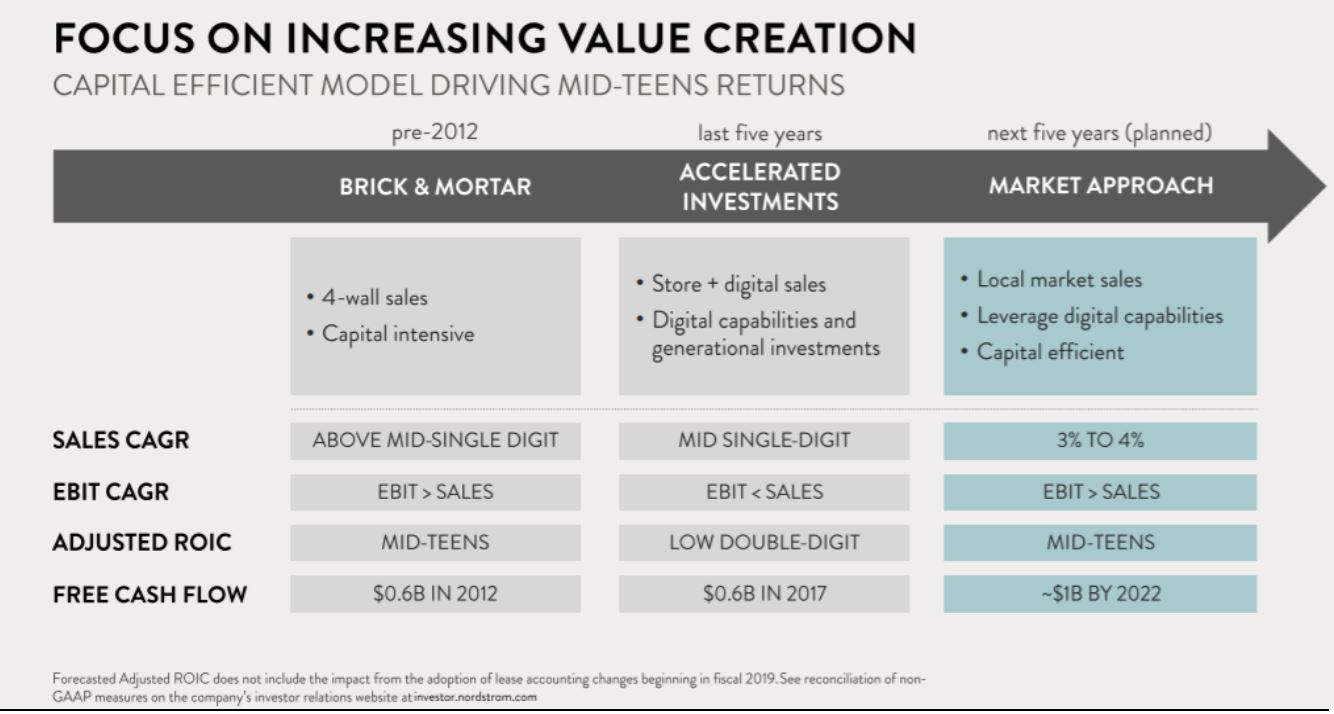

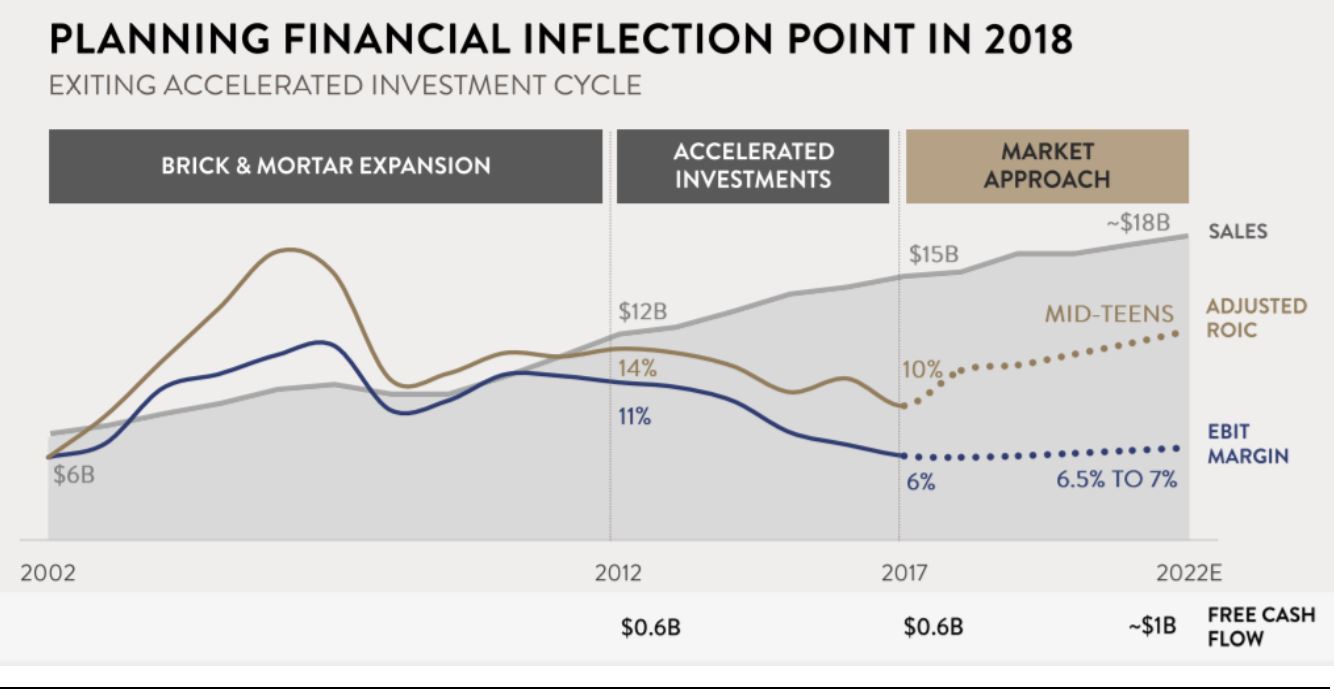

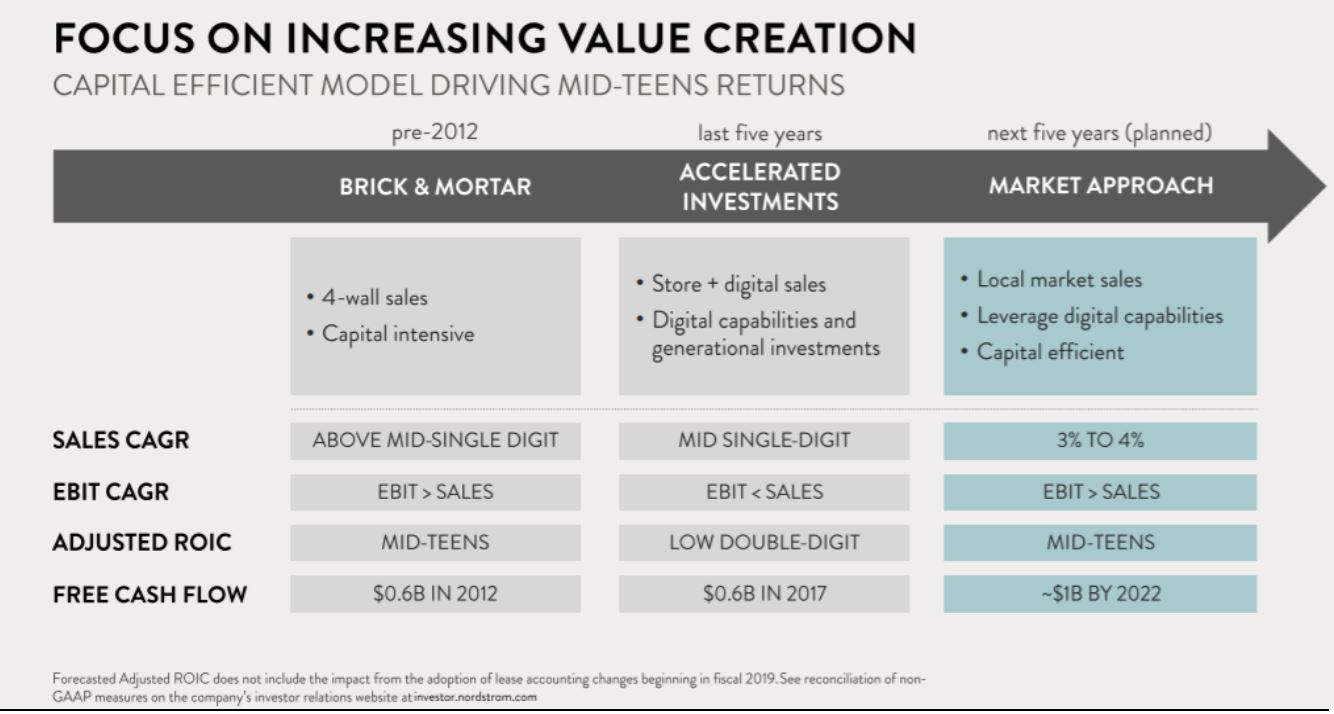

Nordstrom reiterated its fiscal year 2019 guidance and outlined a five-year plan to grow revenues 20% to $18 million by 2022 from $15 billion in 2017, and to grow sales at a compound annual rate (CAGR) of 3% to 4% from 2017 to 2022. Over the past five years, the company has focused on accelerated investments of approximately $1.5 billion.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Two key expected outcomes from the company’s sales plan are higher digital sales penetration and increased market share. The company anticipates that digital sales penetration will grow to 40% in 2022 from 26% in 2017.

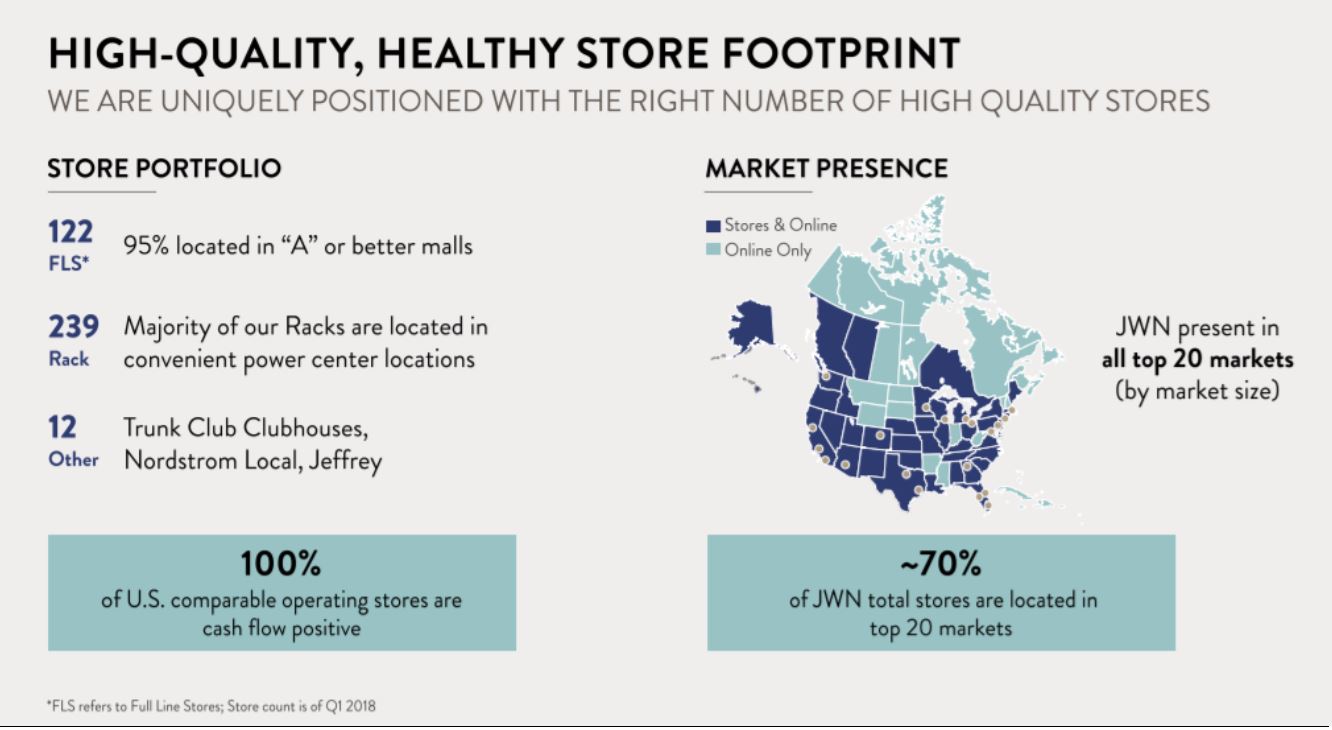

Nordstrom’s Store Footprint Is 100% Cash-Flow Positive

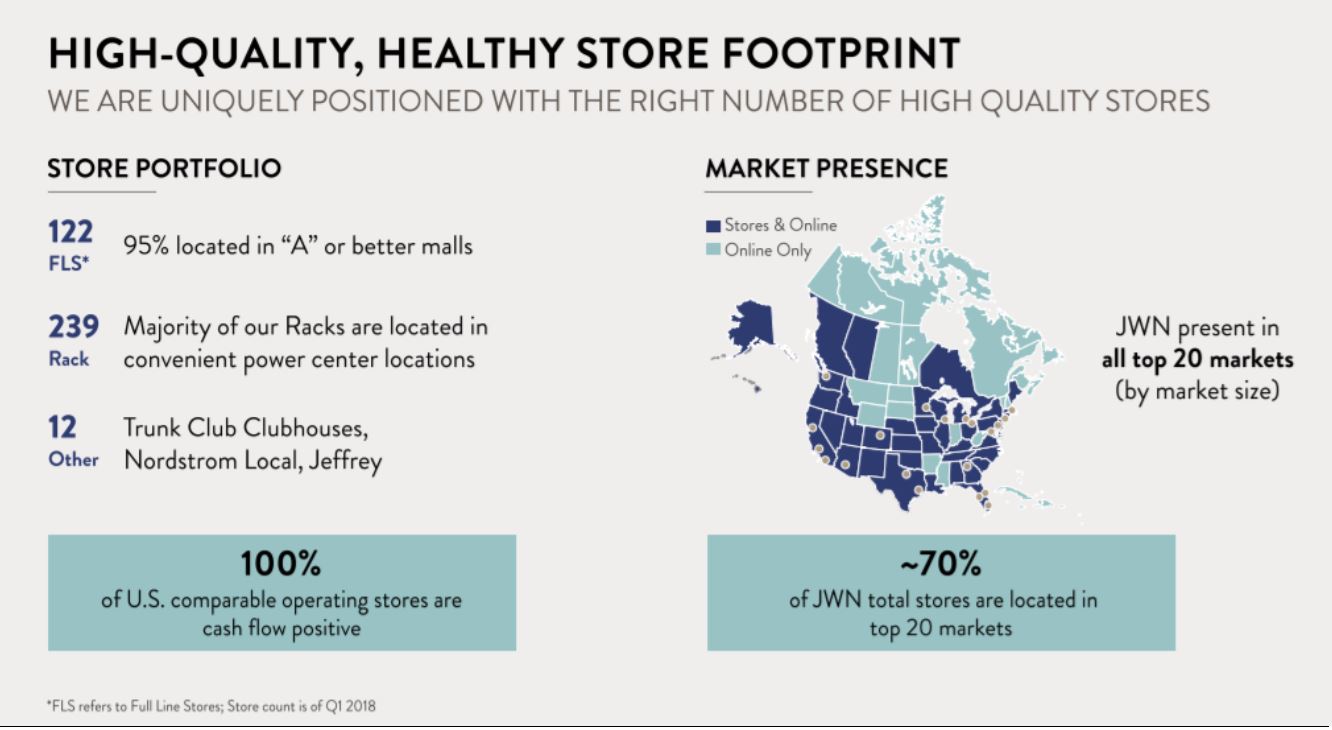

Erik Nordstrom, one of the company’s Co-Presidents, provided a macro overview and the customer strategy. The company has 122 full-line stores, with over 95% of stores located in Type “A” malls. There are 239 Nordstrom Rack stores that are located mainly in power centers and 12 “other” stores that include Trunk Club Clubhouses, Nordstrom Local stores and Jeffrey Boutiques. All of Nordstrom’s stores are cash-flow positive, and the company reported that it has no plans to close any of its stores.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

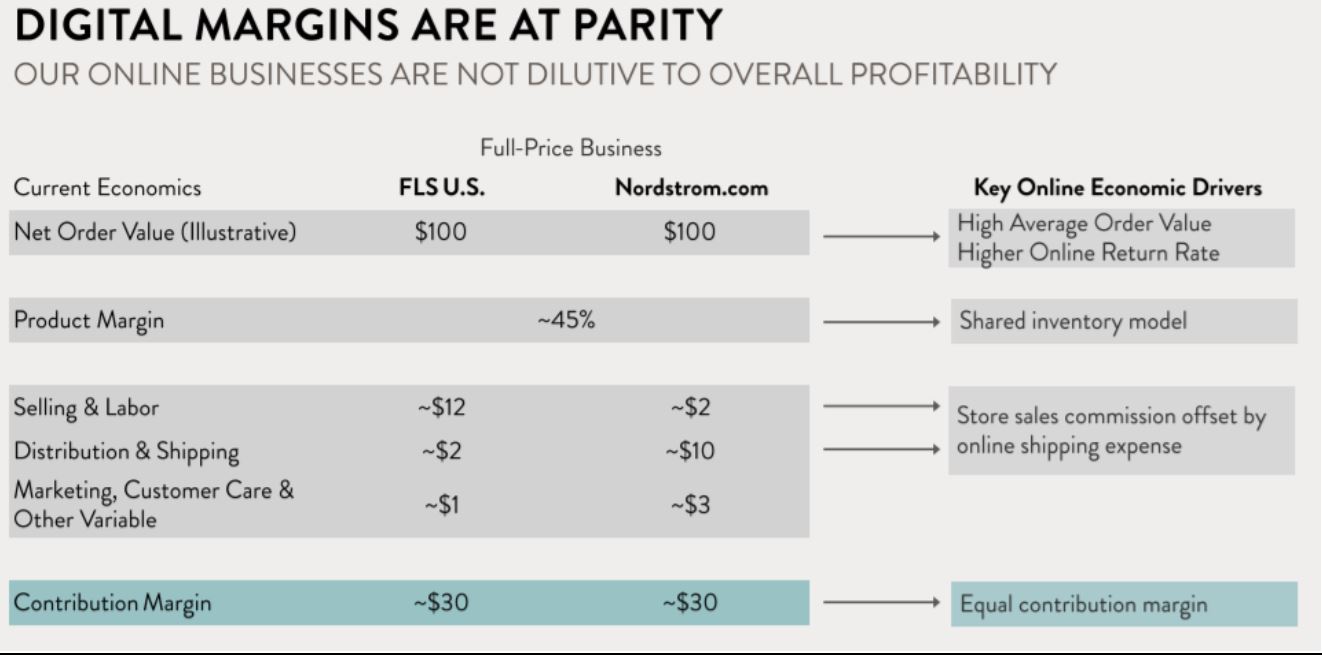

Nordstrom’s E-Commerce Business Is Not Diluting the Company’s Profitability

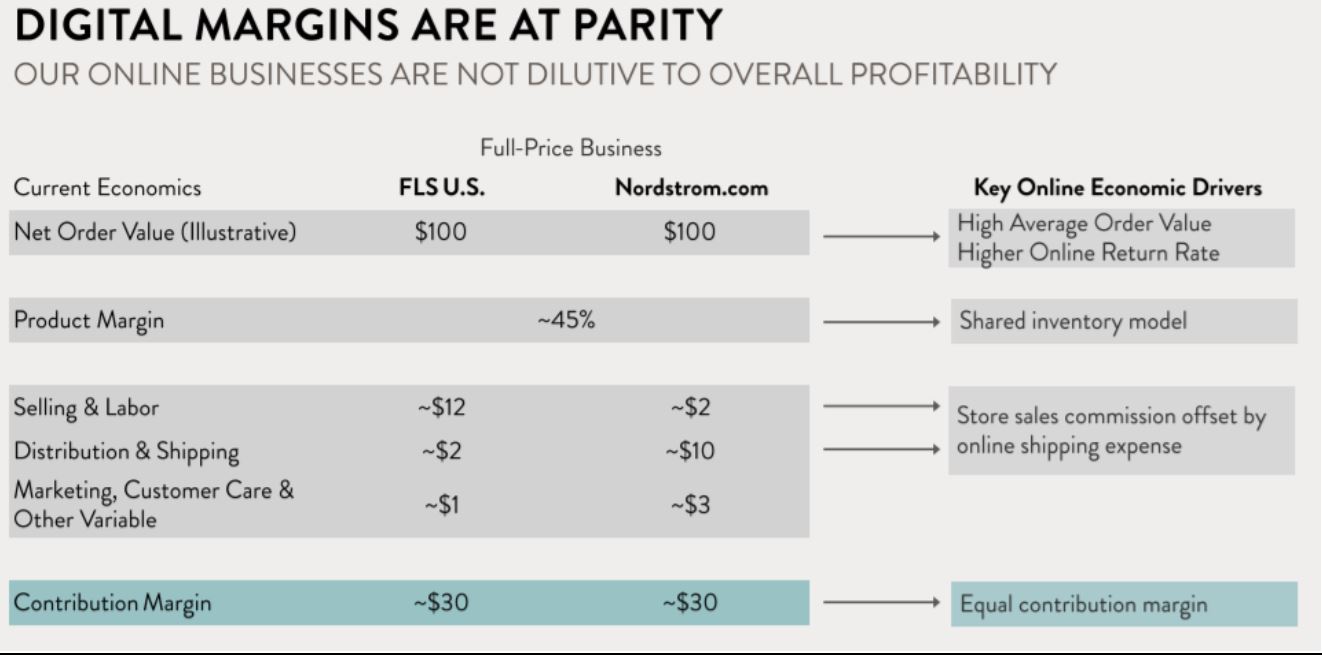

Erik Nordstrom presented insight into the company’s e-commerce business, and addressed the question of whether e-commerce is unprofitable. He highlighted that the costs of selling in the company’s full-line stores is the same as selling online.

He presented a hypothetical chart representing the economic breakdown of its full-line store compared to Nordstrom.com. The product margin is 45% and the contribution margin is the same for both the full-line store and Nordstrom.com. The only difference is the breakdown in the costs; in the full-line store, the costs are mainly attributed to selling and labor, whereas online, the costs are attributed to distribution and shipping.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Erik Nordstrom reported that the product overlap between items sold at Nordstrom and those same items also sold on Amazon is narrow. Specifically, 15% of the company’s customer choices are also on Amazon, and of that 15%, only 16% of those choices are in the top-100 brands. Nordstrom’s best items and best brands are not found on Amazon, and he highlighted that differentiation is important for the company.

Blake Nordstrom addressed the issue of customer returns. He pointed out that 80% of customer returns are made in-store, no matter where the original purchase was made, and customers spend 55%–70% more during the return process.

Nordstrom Positioning Itself as a Retailer of Newness and Brand Assortment

The company aspires to be the best fashion retailer in the world with the “one Nordstrom model” focused on customers through three pillars: fashion authority, service and experience, and brands.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

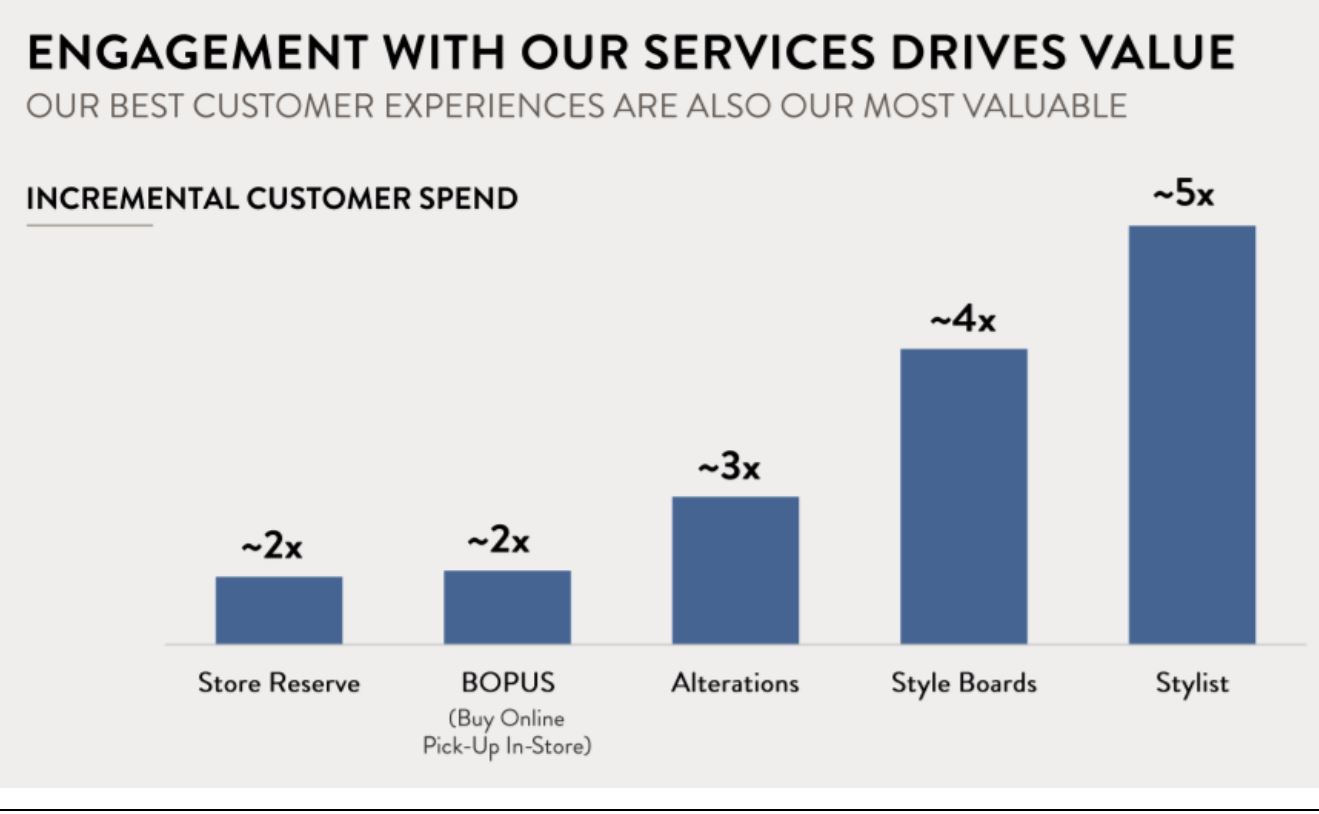

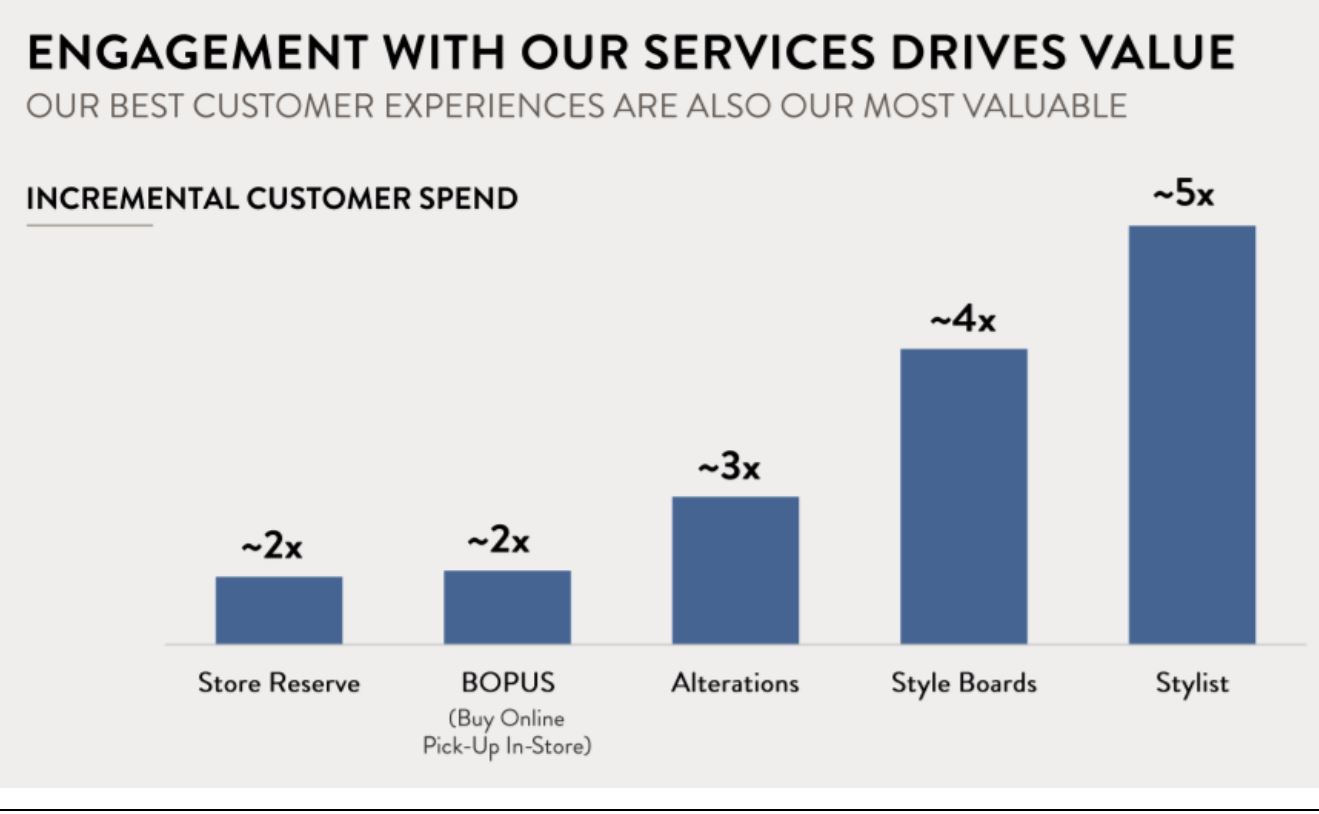

Nordstrom Service Drives Customer Value

As its foundation, Nordstrom invests in customer service. Erik Nordstrom emphasized that the investment in service drives customer value. The figure below was presented and shows the incremental spend of Nordstrom customers across the company’s services.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Erik Nordstrom provided a specific example about alterations, and said that Nordstrom is the biggest employer of tailors in North America, and that customers who are using alteration services are spending three times the average. He said that it is a value-driving service that the company can leverage.

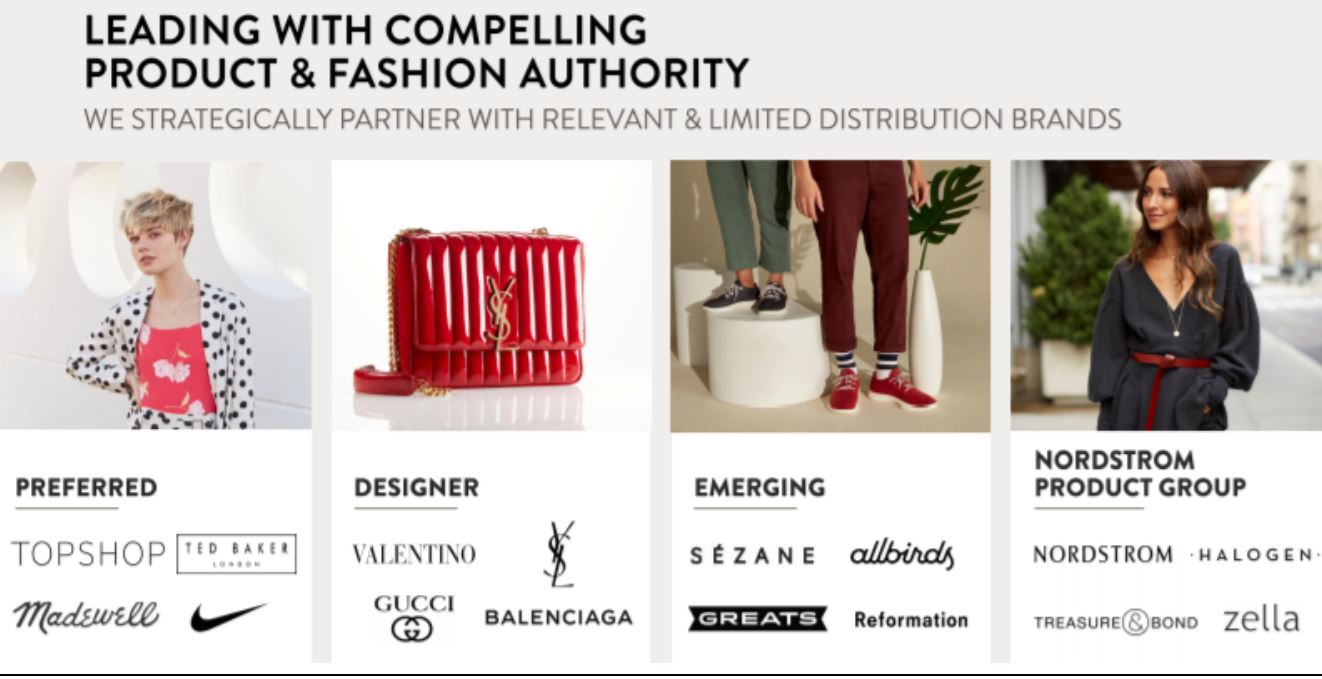

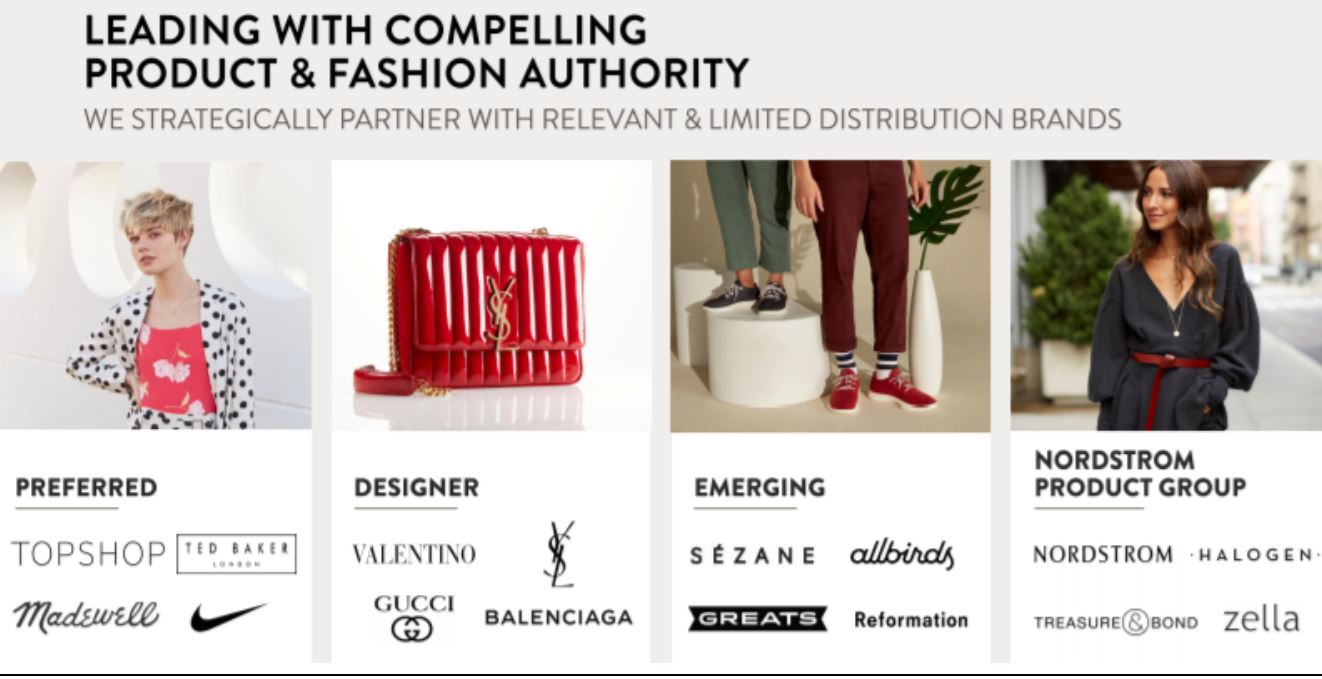

Nordstrom Is Positioning Itself as a Fashion Authority with a High-Low Assortment

The modern customer shops a lot of different brands in a high-low assortment. Customers today are shopping mixed brands including exclusive and limited-edition collections such as Zella, Nike, Reformation and Gucci. Nordstrom highlighted that the modern customer puts brands together and does not settle on just one brand, but they enjoy being exposed to a variety of different brands. The company highlighted that it is building strategic relationships with brands, and is a full-price retailer, not a promotional one, which is important for many customers.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Nordstrom Is Building Strategic Brand Partnerships Centered Around “Brand Newness”

The company is focusing on driving newness by offering four pillars of strategic brands and cross-brand discovery: preferred, designer, emerging and Nordstrom Product Group. The company acknowledged that brands and companies are selling direct to consumers and offered that Nordstrom can be a place for customers to discover new brands, and that the company can be a platform for emerging brands.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Preferred: The preferred brands are those that represent more established brands and are brands that appeal to a lot of different demographics including Nike, Madewell, Levi’s and Topshop.

Designer: This pillar includes styles that one may find at boutiques. This is the company’s fastest-growing business and is growing at double-digit rates across all categories and classifications: apparel, accessories and shoes.

Emerging brands: This includes some previously digitally native brands including Allbirds, Reformation and Greats. The company said that the goal is to leverage these brands and to ultimately try to see if they “take hold” within the Nordstrom ecosystem, and then move onto other brands.

Nordstrom Product Group (NPG): NPG is a $1 billion business accounting for 11% of the company’s sales. NPG is part of every category except designer and beauty. The company reported that NPG products drive high gross margins and provide good value for consumers.

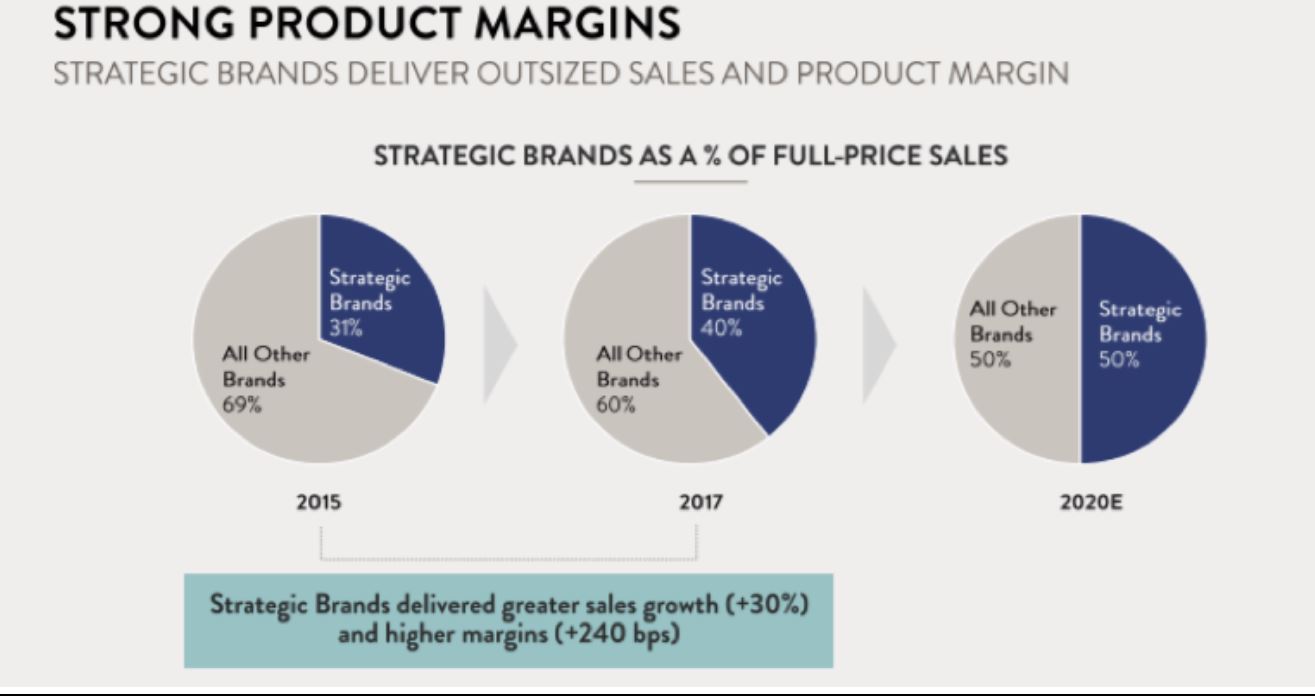

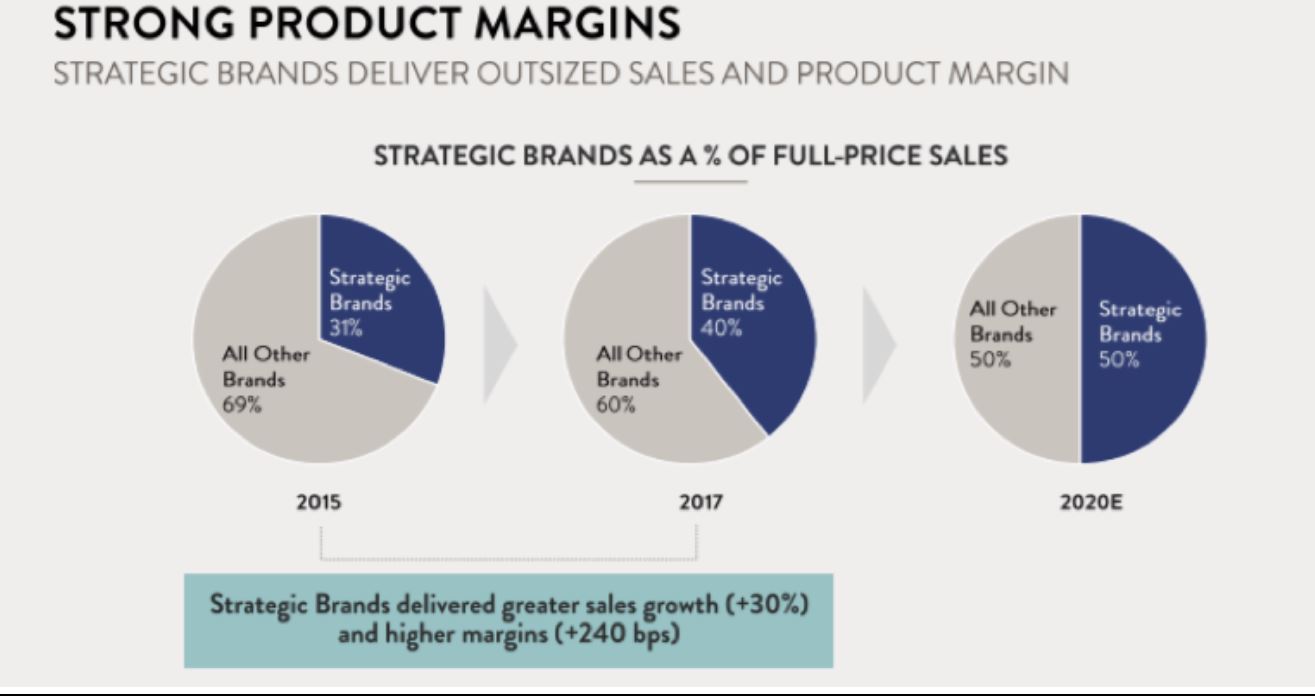

Strategic Brands Growing 30% Faster than Nonstrategic Brands

Strategic brands are growing 30% faster than nonstrategic brands and are delivering margins that are 240 basis points higher. Nordstrom reported that it has been purposeful in expanding the proportion of its mix of strategic brands; from 2015 to 2017, the proportion went from 31% to 40%. The company targets that by 2022, half of the business will be comprised of strategic brands.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

For example, Nordstrom reported that it is partnering with social influencers who have helped the company to launch several brands including Something Navy and Gal Meets Glam—two of its biggest launches. Something Navy recorded sales of $1.8 million during the first week and Gal Meets Glam reported $1.6 million.

Some 55% of Sales Are Through the Nordstrom Loyalty Program

The Nordstrom loyalty program has over 10 million active members and accounts for $9 billion in sales.The company reported that five years ago, 35% of its business was through the loyalty program, and today,the loyalty program accounts for 55% of sales. In terms of engagement, loyalty card customers make three times the number of trips and spend four times the average.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

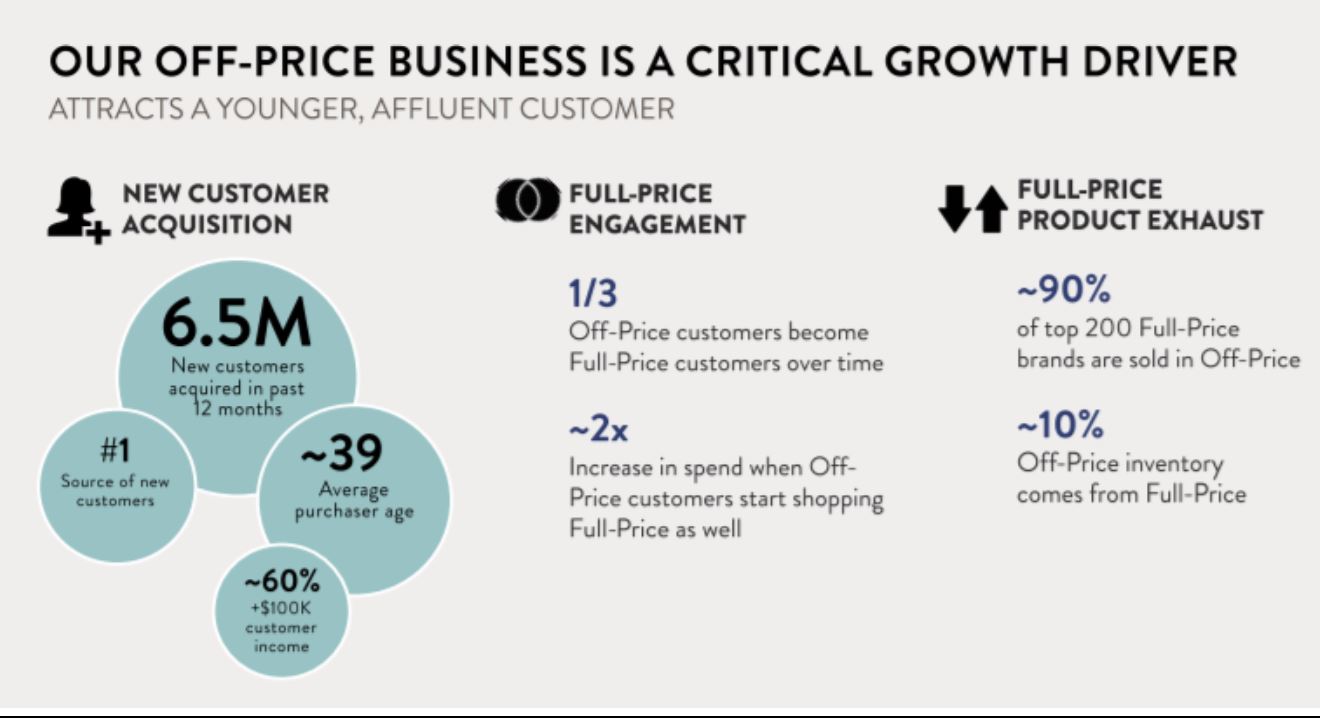

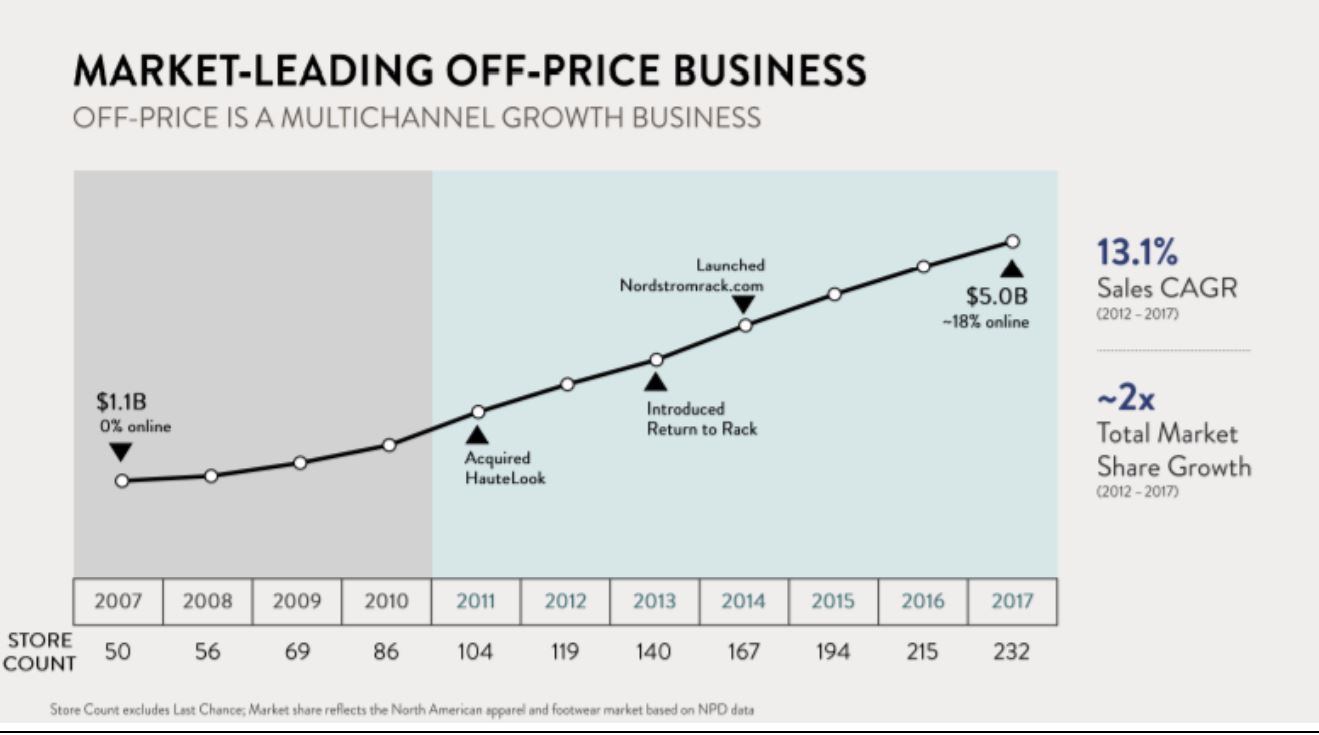

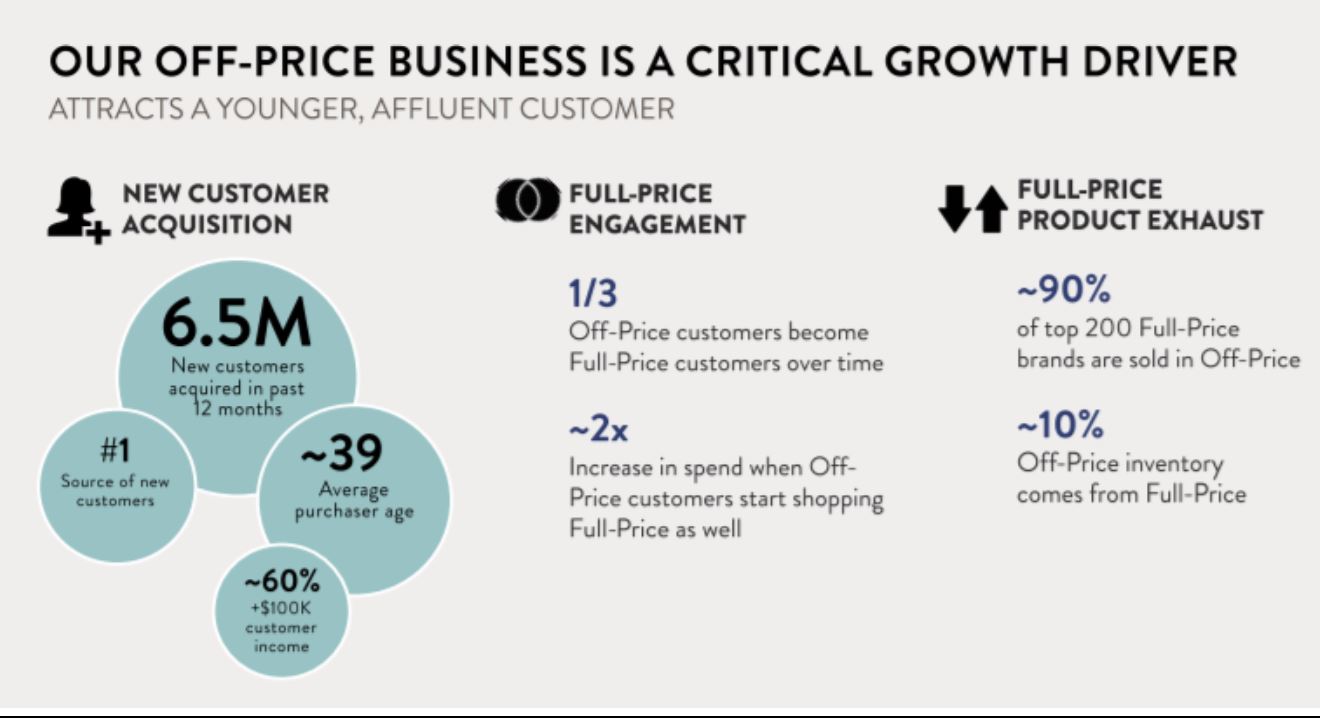

Off-Price Business Driving New Customers

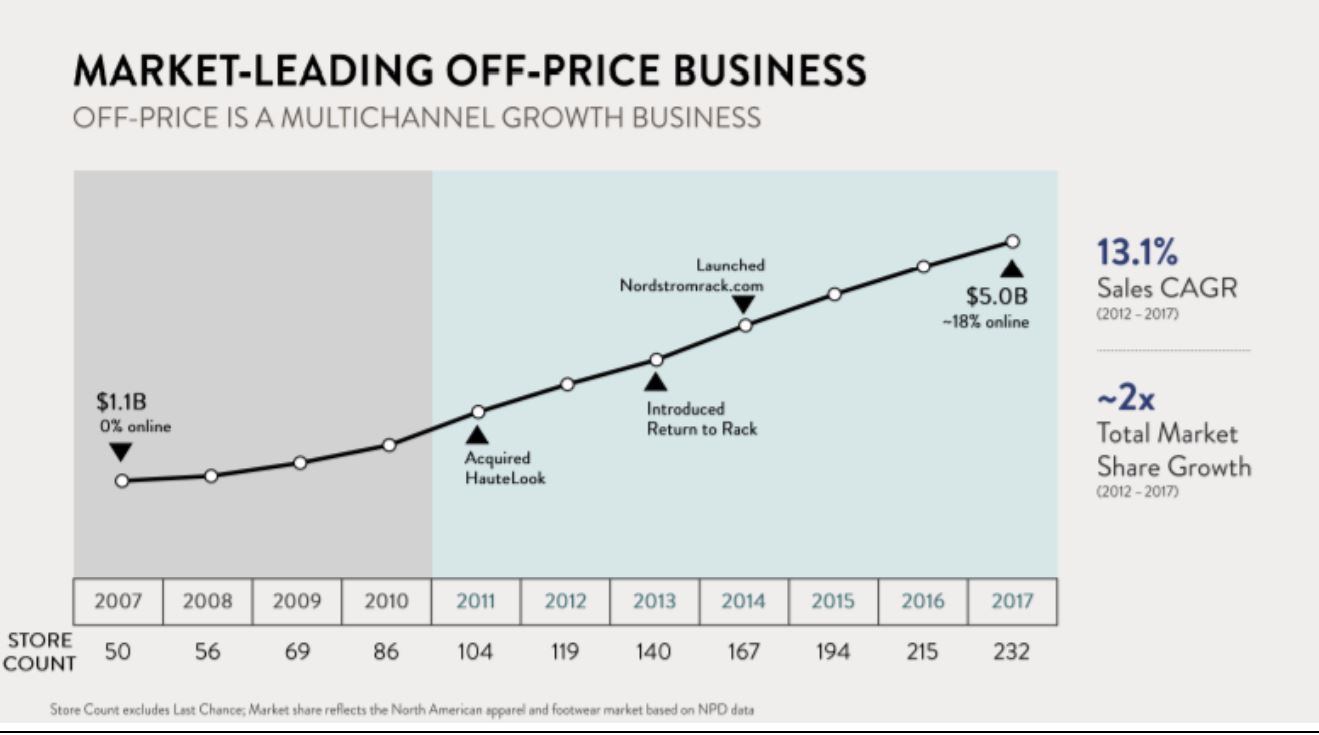

Nordstrom ended 2017 with approximately $5 billion in off-price revenues, accounting for one-third of the company’s total revenues. From 2012 to 2017, Nordstrom doubled its market share in off-price.

The company had 50 off-price stores in 2007, and in 2017, it had 232 stores (which includes Nordstrom Rack and Haute Look). Today, the company has a total of 239 stores. Nordstrom highlighted that for the next five years, off-price stores are a key component to growth. The company emphasized that off-price is its number-one source of new customers and vendor partnerships, and is also a source of talent for the company. For example, many Nordstrom managers and full-line employees were once Nordstrom Rack employees.

According to the company, the average age of the Nordstrom customer is 42, and the average age at its off-price brands is 39, and is a more affluent customer.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides

Nordstrom Is Focusing On its Top Local Markets, with 25% of Its Full-Price Business in LA and NYC

The company reported that it is focusing on a “local market strategy,” focusing its efforts on its largest markets, Los Angeles and New York City. Its LA store is its largest market and generates over $1 billion in sales. In 2018, The combination of LA and NYC—with the opening of the tower in NYC—will represent over 25% of the company’s full-price business.

Nordstrom opened its men’s store in NYC in 2018, and the women’s store will open in the fall of 2019. The company reported that its top-10 markets represent over 60% of its business.

The local market strategy focuses on bringing “the best of Nordstrom” to these customers. The company reported that when it is able to get customers to engage beyond one channel, spending increases; the result is that customers spend five times the amount of customers shopping both stores and online versus those shopping just one channel.

Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides Source: Nordstrom Investor Day Slides

Source: Nordstrom Investor Day Slides