FIRST-HALF 2016 HEADLINES: GROWTH STRENGTHENS

- In the six months ending August 31, Boohoo.com grew revenue by 35% in British pound terms (39% at constant exchange rates), to £90.8 million (US$139.3 million).

- UK sales were up 30%, sales in the rest of Europe were up 19% (34% at constant exchange rates) and sales in the rest of the world were up 65% (75% at constant exchange rates)

- Gross profit rose by 30%, while gross margin fell back slightly, to 60.1%, from 62.3% in the first half of FY 2015.

- Operating profit climbed 38%, yielding a first-half margin of 6.6%, up from 6.4% in the first half of FY 2015. The EBITDA margin was 8.4%.

- EPS jumped 55%, to 0.45p.

- com increased its number of active customers by 32%, to 3.5 million. The stronger sales growth reported by the company suggests it is encouraging its existing shoppers to spend more.

Boohoo.com reported some investments in its first-half results that will help support further growth. These included completion of a warehouse extension that increased space by 33% and the launch of both a new transactional app for the UK and mobile-responsive sites for Europe.

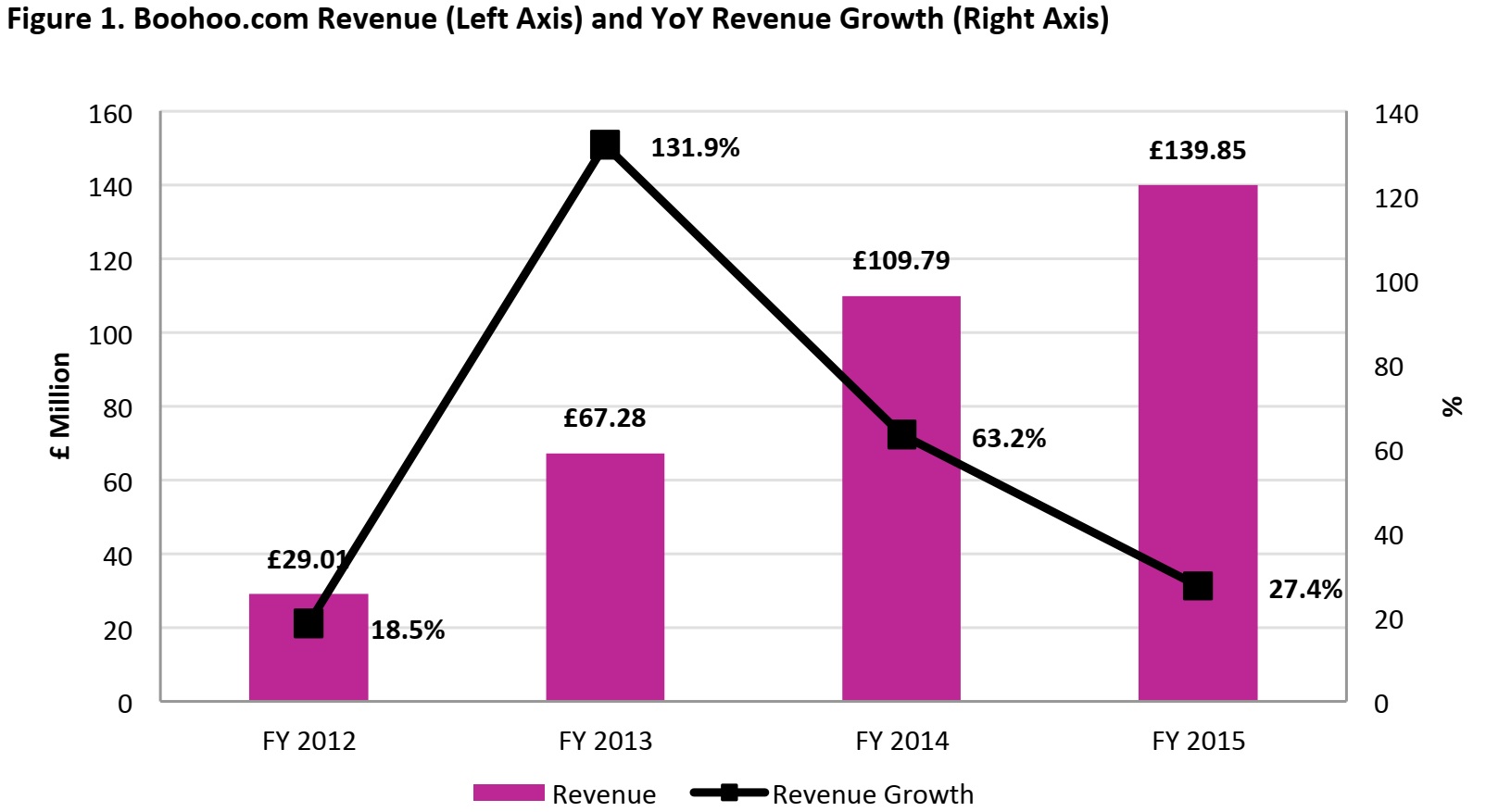

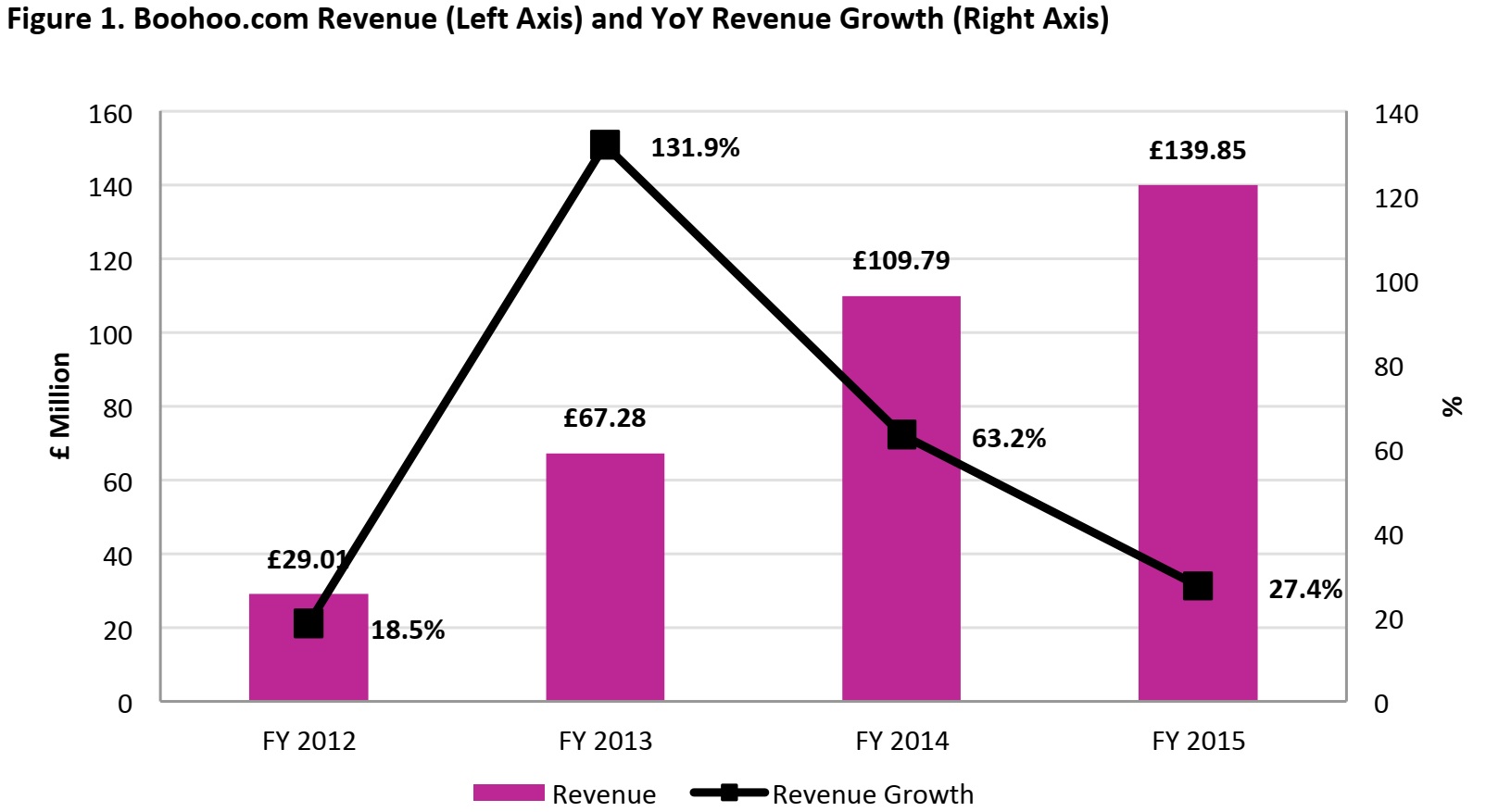

The 35% jump in revenue was an improvement over fiscal year 2015, when revenue grew by “just” 27%, or 31% at constant exchange rates.

Boohoo.com is growing fast, but this is partially because it is still at an early stage of growth. In fiscal year 2015, the company had just a 0.2% share of UK clothing, footwear and accessories spend, we calculate.

Source: S&P Capital IQ/FBIC Global Retail & Technology

OPENING UP THE WHOLESALE CHANNEL

To reach more shoppers, Boohoo.com has begun a trial of selling its apparel through third-party e-commerce players in the UK and abroad. The company said it plans to grow the number of retailers it sells through and that it sees wholesaling as “an effective strategy to build [its] brand internationally and broaden [its] customer reach.”

We think other big-name, mono-brand retailers should consider selling through third-party retailers to bring their product to a broader audience. This model would suit those names trying to capture shoppers who do not currently visit their site or walk through their doors, such as younger consumers.

OUTLOOK

- com expects full-year revenue growth to be between 30% and 35%, and it looks to have strong medium-term growth prospects.

- The company says it is trading in line with market expectations for EBITDA. According to S&P Capital IQ, consensus estimates are for EBITDA of £18.3 million for fiscal year 2016, suggesting a full-year EBITDA margin of 10.2%.

- In the second half, the company will “look at opportunities to invest in building customer lifetime value and market reach,” and it warned that this may impact margins in the near term.

- With just 35% of Boohoo.com’s sales coming from outside the UK, there is considerable scope for the company to grow international revenue. And with its tiny UK market share of 0.2% in fiscal year 2015, there is likely to be strong domestic growth ahead. That means competition will intensify for brick-and-mortar fashion retailers in the UK and overseas.

- With a P/E ratio of 46.67 as of September 29, Boohoo.com has already seen the market factor in its opportunities to expand. That ratio is still lower than ASOS’s, though, which has a P/E of 59.38.

For more on this sector, keep an eye out for our forthcoming report entitled

Online Fashion Retailing.