DIpil Das

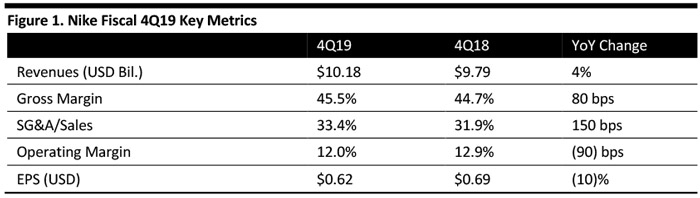

[caption id="attachment_91965" align="aligncenter" width="700"] Source: Company reports/Coresight Research; [/caption]

4Q19 Results

Nike reported 4Q19 revenues of $10.18 billion, up 4% (10% currency neutral) year over year, and ahead of the $10.16 billion consensus estimate. EPS of $0.62 missed the $0.66 consensus estimate and declined 10% from the year ago quarter.

Inventories rose 7% to $5.6 billion.

Details from the Quarter

Sales for Nike brand rose 10% at constant exchange rates to $9.7 billion, driven by growth across Nike Direct and wholesale. Revenues for Converse were $491 million, flat currency neutral. Double-digit growth in Asia and digital was offset by declines in the US and Europe.

Gross margin expanded 80 bps to 45.5%, driven by higher selling prices, currency exchange rates and growth in Nike Direct, offsetting the negative impact from higher product costs and supply chain investments.

SG&A expense rose 9% to $3.4 billion. Demand creation expense was up 3% to $1.0 billion, due to global brand campaigns and key sports moments. Wage-related and administrative expenses increased operating overhead expense 12% to $2.4 billion.

Nike footwear sales rose 6% (12% currency neutral) to $6.50 billion and apparel rose 3% (8% currency neutral) to $2.85 billion. By region, greater China grew most rapidly, at 16% (22% currency neutral) to $1.70 billion, led by 16% (23% currency neutral) growth in footwear to $1.17 billion, followed by 14% (21% currency neutral) in apparel, to $494 million. This was the 20th consecutive quarter of double-digit sales growth in greater China. Digital sales rose 37% in greater China. Broad-based category strength drove results in China and Nike continues to see strong momentum as the company enters FY20. Innovation and messaging of and for China has kept the Nike brand immune to any Chinese consumer turning from US brands as the trade discussions continue.

Sales in North America rose 8% to $4.17 billion. Footwear rose 9% to $2.74 billion and apparel grew 6% to $1.28 billion, at constant exchange rates. Nike is gaining market share in its largest wholesale accounts with double digit 4Q sales growth at Foot Locker, Dicks and Nordstrom.

The Europe, Middle East and Africa (EMEA) region saw 9% constant currency sales growth, to $2.46 billion, and Nike has the leading market share in the region’s key five cities. Nike’s women business grew 45% in the region. In Asia Pacific and Latin America, sales rose 9% on a currency neutral basis to $1.38 billion.

Nike’s strategy to merge physical and digital is exceeding expectations, and London, New York and Shanghai are where Nike is furthest along. Digital connections through the Nike App at retail is increasing customer engagement significantly and spend per consumer is increasing dramatically, lifting customer lifetime value. During FY19, Nike increased its digital advantage with its 2X Direct strategy. Mobile and Nike’s apps are central to the strategy and building membership, which stands at 170 million in the Nike+ ecosystem. The SNKRS App has acquired more new members than any other digital channel for Nike and in FY19, SNKRS more than doubled its business, doubled its number of monthly active users and now accounts for roughly 20% of Nike’s digital business.

Outlook

The company reiterated guidance for FY20:

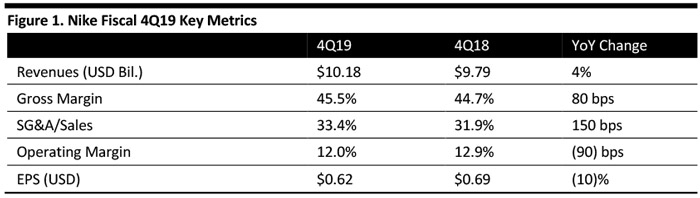

Source: Company reports/Coresight Research; [/caption]

4Q19 Results

Nike reported 4Q19 revenues of $10.18 billion, up 4% (10% currency neutral) year over year, and ahead of the $10.16 billion consensus estimate. EPS of $0.62 missed the $0.66 consensus estimate and declined 10% from the year ago quarter.

Inventories rose 7% to $5.6 billion.

Details from the Quarter

Sales for Nike brand rose 10% at constant exchange rates to $9.7 billion, driven by growth across Nike Direct and wholesale. Revenues for Converse were $491 million, flat currency neutral. Double-digit growth in Asia and digital was offset by declines in the US and Europe.

Gross margin expanded 80 bps to 45.5%, driven by higher selling prices, currency exchange rates and growth in Nike Direct, offsetting the negative impact from higher product costs and supply chain investments.

SG&A expense rose 9% to $3.4 billion. Demand creation expense was up 3% to $1.0 billion, due to global brand campaigns and key sports moments. Wage-related and administrative expenses increased operating overhead expense 12% to $2.4 billion.

Nike footwear sales rose 6% (12% currency neutral) to $6.50 billion and apparel rose 3% (8% currency neutral) to $2.85 billion. By region, greater China grew most rapidly, at 16% (22% currency neutral) to $1.70 billion, led by 16% (23% currency neutral) growth in footwear to $1.17 billion, followed by 14% (21% currency neutral) in apparel, to $494 million. This was the 20th consecutive quarter of double-digit sales growth in greater China. Digital sales rose 37% in greater China. Broad-based category strength drove results in China and Nike continues to see strong momentum as the company enters FY20. Innovation and messaging of and for China has kept the Nike brand immune to any Chinese consumer turning from US brands as the trade discussions continue.

Sales in North America rose 8% to $4.17 billion. Footwear rose 9% to $2.74 billion and apparel grew 6% to $1.28 billion, at constant exchange rates. Nike is gaining market share in its largest wholesale accounts with double digit 4Q sales growth at Foot Locker, Dicks and Nordstrom.

The Europe, Middle East and Africa (EMEA) region saw 9% constant currency sales growth, to $2.46 billion, and Nike has the leading market share in the region’s key five cities. Nike’s women business grew 45% in the region. In Asia Pacific and Latin America, sales rose 9% on a currency neutral basis to $1.38 billion.

Nike’s strategy to merge physical and digital is exceeding expectations, and London, New York and Shanghai are where Nike is furthest along. Digital connections through the Nike App at retail is increasing customer engagement significantly and spend per consumer is increasing dramatically, lifting customer lifetime value. During FY19, Nike increased its digital advantage with its 2X Direct strategy. Mobile and Nike’s apps are central to the strategy and building membership, which stands at 170 million in the Nike+ ecosystem. The SNKRS App has acquired more new members than any other digital channel for Nike and in FY19, SNKRS more than doubled its business, doubled its number of monthly active users and now accounts for roughly 20% of Nike’s digital business.

Outlook

The company reiterated guidance for FY20:

Source: Company reports/Coresight Research; [/caption]

4Q19 Results

Nike reported 4Q19 revenues of $10.18 billion, up 4% (10% currency neutral) year over year, and ahead of the $10.16 billion consensus estimate. EPS of $0.62 missed the $0.66 consensus estimate and declined 10% from the year ago quarter.

Inventories rose 7% to $5.6 billion.

Details from the Quarter

Sales for Nike brand rose 10% at constant exchange rates to $9.7 billion, driven by growth across Nike Direct and wholesale. Revenues for Converse were $491 million, flat currency neutral. Double-digit growth in Asia and digital was offset by declines in the US and Europe.

Gross margin expanded 80 bps to 45.5%, driven by higher selling prices, currency exchange rates and growth in Nike Direct, offsetting the negative impact from higher product costs and supply chain investments.

SG&A expense rose 9% to $3.4 billion. Demand creation expense was up 3% to $1.0 billion, due to global brand campaigns and key sports moments. Wage-related and administrative expenses increased operating overhead expense 12% to $2.4 billion.

Nike footwear sales rose 6% (12% currency neutral) to $6.50 billion and apparel rose 3% (8% currency neutral) to $2.85 billion. By region, greater China grew most rapidly, at 16% (22% currency neutral) to $1.70 billion, led by 16% (23% currency neutral) growth in footwear to $1.17 billion, followed by 14% (21% currency neutral) in apparel, to $494 million. This was the 20th consecutive quarter of double-digit sales growth in greater China. Digital sales rose 37% in greater China. Broad-based category strength drove results in China and Nike continues to see strong momentum as the company enters FY20. Innovation and messaging of and for China has kept the Nike brand immune to any Chinese consumer turning from US brands as the trade discussions continue.

Sales in North America rose 8% to $4.17 billion. Footwear rose 9% to $2.74 billion and apparel grew 6% to $1.28 billion, at constant exchange rates. Nike is gaining market share in its largest wholesale accounts with double digit 4Q sales growth at Foot Locker, Dicks and Nordstrom.

The Europe, Middle East and Africa (EMEA) region saw 9% constant currency sales growth, to $2.46 billion, and Nike has the leading market share in the region’s key five cities. Nike’s women business grew 45% in the region. In Asia Pacific and Latin America, sales rose 9% on a currency neutral basis to $1.38 billion.

Nike’s strategy to merge physical and digital is exceeding expectations, and London, New York and Shanghai are where Nike is furthest along. Digital connections through the Nike App at retail is increasing customer engagement significantly and spend per consumer is increasing dramatically, lifting customer lifetime value. During FY19, Nike increased its digital advantage with its 2X Direct strategy. Mobile and Nike’s apps are central to the strategy and building membership, which stands at 170 million in the Nike+ ecosystem. The SNKRS App has acquired more new members than any other digital channel for Nike and in FY19, SNKRS more than doubled its business, doubled its number of monthly active users and now accounts for roughly 20% of Nike’s digital business.

Outlook

The company reiterated guidance for FY20:

Source: Company reports/Coresight Research; [/caption]

4Q19 Results

Nike reported 4Q19 revenues of $10.18 billion, up 4% (10% currency neutral) year over year, and ahead of the $10.16 billion consensus estimate. EPS of $0.62 missed the $0.66 consensus estimate and declined 10% from the year ago quarter.

Inventories rose 7% to $5.6 billion.

Details from the Quarter

Sales for Nike brand rose 10% at constant exchange rates to $9.7 billion, driven by growth across Nike Direct and wholesale. Revenues for Converse were $491 million, flat currency neutral. Double-digit growth in Asia and digital was offset by declines in the US and Europe.

Gross margin expanded 80 bps to 45.5%, driven by higher selling prices, currency exchange rates and growth in Nike Direct, offsetting the negative impact from higher product costs and supply chain investments.

SG&A expense rose 9% to $3.4 billion. Demand creation expense was up 3% to $1.0 billion, due to global brand campaigns and key sports moments. Wage-related and administrative expenses increased operating overhead expense 12% to $2.4 billion.

Nike footwear sales rose 6% (12% currency neutral) to $6.50 billion and apparel rose 3% (8% currency neutral) to $2.85 billion. By region, greater China grew most rapidly, at 16% (22% currency neutral) to $1.70 billion, led by 16% (23% currency neutral) growth in footwear to $1.17 billion, followed by 14% (21% currency neutral) in apparel, to $494 million. This was the 20th consecutive quarter of double-digit sales growth in greater China. Digital sales rose 37% in greater China. Broad-based category strength drove results in China and Nike continues to see strong momentum as the company enters FY20. Innovation and messaging of and for China has kept the Nike brand immune to any Chinese consumer turning from US brands as the trade discussions continue.

Sales in North America rose 8% to $4.17 billion. Footwear rose 9% to $2.74 billion and apparel grew 6% to $1.28 billion, at constant exchange rates. Nike is gaining market share in its largest wholesale accounts with double digit 4Q sales growth at Foot Locker, Dicks and Nordstrom.

The Europe, Middle East and Africa (EMEA) region saw 9% constant currency sales growth, to $2.46 billion, and Nike has the leading market share in the region’s key five cities. Nike’s women business grew 45% in the region. In Asia Pacific and Latin America, sales rose 9% on a currency neutral basis to $1.38 billion.

Nike’s strategy to merge physical and digital is exceeding expectations, and London, New York and Shanghai are where Nike is furthest along. Digital connections through the Nike App at retail is increasing customer engagement significantly and spend per consumer is increasing dramatically, lifting customer lifetime value. During FY19, Nike increased its digital advantage with its 2X Direct strategy. Mobile and Nike’s apps are central to the strategy and building membership, which stands at 170 million in the Nike+ ecosystem. The SNKRS App has acquired more new members than any other digital channel for Nike and in FY19, SNKRS more than doubled its business, doubled its number of monthly active users and now accounts for roughly 20% of Nike’s digital business.

Outlook

The company reiterated guidance for FY20:

- Revenue growth in the high-single-digit range, slightly higher than FY19’s 7%, with foreign exchange impacting 1Q20 results but abating in 2Q20.

- Gross margin expansion up to 50 bps, which includes 50 bps headwind from foreign exchange and strategic supply chain investments.

- SG&A growth in the high-single-digit range, in line with revenue growth.

- For 1Q20, revenue growth of 4% or slightly more and up to 25 basis points of gross margin expansion.