Nitheesh NH

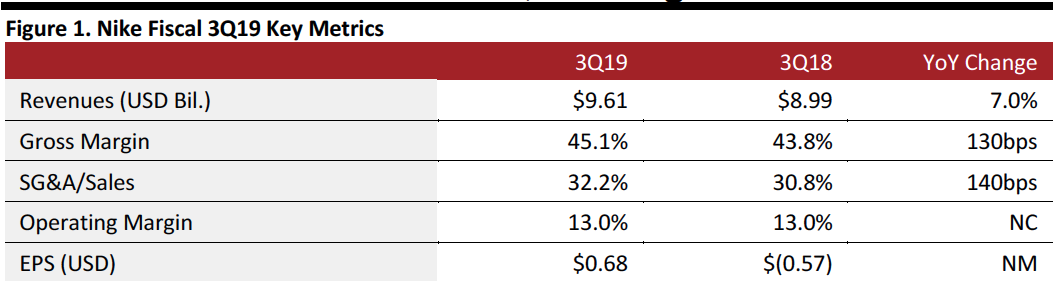

[caption id="attachment_81528" align="aligncenter" width="640"] Source: Company reports/Coresight Research; [/caption]

3Q19 Results

Nike reported 3Q19 revenues of $9.61 billion, up 7.0% year over year and in line with the consensus estimate. Foreign currency exchange rates penalized revenue growth approximately 400 bps in 3Q19. EPS of $0.68 beat the $0.65 consensus estimate and are versus a

The operating margin was flat at 13% of sales as a 130 bps gross margin expansion was offset by investment spending in Nike’s transformational initiatives. Demand creation expense was $865 million versus $862 million, while operating overhead expense increased 17% to $2.2 billion to support investments in Nike’s transformational initiatives for its Consumer Direct Offense.

Inventories rose 1% to $5.42 billion.

Details from the Quarter

3Q19 revenues rose 7%, driven by 13% growth for Nike footwear led by Greater China. Digital sales rose 36% propelled by more than 60% growth in China. 3Q19 digital sales exceeded $1 billion for the first time.

Both Nike footwear and apparel grew double-digits during the quarter on a constant-currency basis. Footwear rose 13% to $6.12 billion and apparel rose 10% to 2.71 billion. By region, China grew most rapidly, at 24% to $1.59 billion, led by 26% growth in apparel to $444 million, followed by 23% in footwear, to $1.12 billion. This was the 19th consecutive quarter of double-digit sales growth in China.

Nike considers China the best example of its outsized growth potential internationally. China is already the largest footwear and apparel market in the world, but athletic footwear and apparel represent a smaller share of the total market than in the more developed markets, such as the US. Athletic footwear and apparel are growing double digits in China and sport is increasingly becoming a larger part of life for consumers in China and Nike seeks to help catalyze the rise of sport participation and sport culture in the Chinese market. The company is focused on creating products specifically tailored to the Chinese consumers' preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem.

Sales in North America rose 7% to $3.81 billion; footwear rose 9% to $2.51 billion and apparel, up 2% to $1.17 billion. The EMEA (Europe, Middle East and Africa) region saw 12% constant currency sales growth, to $2.44 billion, and Asia Pacific and Latin America, 14% to $1.31 billion.

The innovation pipeline is full at Nike. In addition to new product during 3Q19, the company extended a new advanced algorithm in its apps that enables it to reward the most active members. Membership is important in creating a seamless physical-to-digital retail experience. In its House of Innovation stores in New York and Shanghai, over 50% of transactions are with members. Across the wider store fleet, consumers who use the Nike App at Retail averaged 40% higher sales than those who don't.

With product, Nike is bringing innovation at the core level, with new collections under the $100 price point. For women, Nike plans to launch more than 40 new styles of bras to expand inclusive sizing. The company will expand athletic yoga apparel offerings and for day-to-day life, will design for added versatility with Nike TechNet.

Outlook

The company provided guidance for the remainder of FY19 and an early read on FY20:

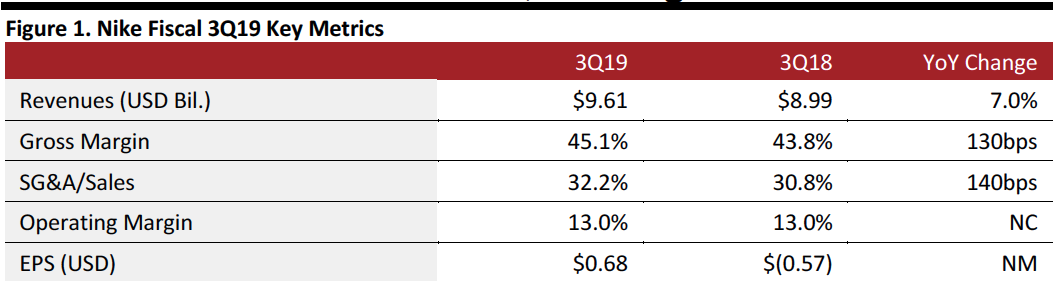

Source: Company reports/Coresight Research; [/caption]

3Q19 Results

Nike reported 3Q19 revenues of $9.61 billion, up 7.0% year over year and in line with the consensus estimate. Foreign currency exchange rates penalized revenue growth approximately 400 bps in 3Q19. EPS of $0.68 beat the $0.65 consensus estimate and are versus a

The operating margin was flat at 13% of sales as a 130 bps gross margin expansion was offset by investment spending in Nike’s transformational initiatives. Demand creation expense was $865 million versus $862 million, while operating overhead expense increased 17% to $2.2 billion to support investments in Nike’s transformational initiatives for its Consumer Direct Offense.

Inventories rose 1% to $5.42 billion.

Details from the Quarter

3Q19 revenues rose 7%, driven by 13% growth for Nike footwear led by Greater China. Digital sales rose 36% propelled by more than 60% growth in China. 3Q19 digital sales exceeded $1 billion for the first time.

Both Nike footwear and apparel grew double-digits during the quarter on a constant-currency basis. Footwear rose 13% to $6.12 billion and apparel rose 10% to 2.71 billion. By region, China grew most rapidly, at 24% to $1.59 billion, led by 26% growth in apparel to $444 million, followed by 23% in footwear, to $1.12 billion. This was the 19th consecutive quarter of double-digit sales growth in China.

Nike considers China the best example of its outsized growth potential internationally. China is already the largest footwear and apparel market in the world, but athletic footwear and apparel represent a smaller share of the total market than in the more developed markets, such as the US. Athletic footwear and apparel are growing double digits in China and sport is increasingly becoming a larger part of life for consumers in China and Nike seeks to help catalyze the rise of sport participation and sport culture in the Chinese market. The company is focused on creating products specifically tailored to the Chinese consumers' preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem.

Sales in North America rose 7% to $3.81 billion; footwear rose 9% to $2.51 billion and apparel, up 2% to $1.17 billion. The EMEA (Europe, Middle East and Africa) region saw 12% constant currency sales growth, to $2.44 billion, and Asia Pacific and Latin America, 14% to $1.31 billion.

The innovation pipeline is full at Nike. In addition to new product during 3Q19, the company extended a new advanced algorithm in its apps that enables it to reward the most active members. Membership is important in creating a seamless physical-to-digital retail experience. In its House of Innovation stores in New York and Shanghai, over 50% of transactions are with members. Across the wider store fleet, consumers who use the Nike App at Retail averaged 40% higher sales than those who don't.

With product, Nike is bringing innovation at the core level, with new collections under the $100 price point. For women, Nike plans to launch more than 40 new styles of bras to expand inclusive sizing. The company will expand athletic yoga apparel offerings and for day-to-day life, will design for added versatility with Nike TechNet.

Outlook

The company provided guidance for the remainder of FY19 and an early read on FY20:

Source: Company reports/Coresight Research; [/caption]

3Q19 Results

Nike reported 3Q19 revenues of $9.61 billion, up 7.0% year over year and in line with the consensus estimate. Foreign currency exchange rates penalized revenue growth approximately 400 bps in 3Q19. EPS of $0.68 beat the $0.65 consensus estimate and are versus a

The operating margin was flat at 13% of sales as a 130 bps gross margin expansion was offset by investment spending in Nike’s transformational initiatives. Demand creation expense was $865 million versus $862 million, while operating overhead expense increased 17% to $2.2 billion to support investments in Nike’s transformational initiatives for its Consumer Direct Offense.

Inventories rose 1% to $5.42 billion.

Details from the Quarter

3Q19 revenues rose 7%, driven by 13% growth for Nike footwear led by Greater China. Digital sales rose 36% propelled by more than 60% growth in China. 3Q19 digital sales exceeded $1 billion for the first time.

Both Nike footwear and apparel grew double-digits during the quarter on a constant-currency basis. Footwear rose 13% to $6.12 billion and apparel rose 10% to 2.71 billion. By region, China grew most rapidly, at 24% to $1.59 billion, led by 26% growth in apparel to $444 million, followed by 23% in footwear, to $1.12 billion. This was the 19th consecutive quarter of double-digit sales growth in China.

Nike considers China the best example of its outsized growth potential internationally. China is already the largest footwear and apparel market in the world, but athletic footwear and apparel represent a smaller share of the total market than in the more developed markets, such as the US. Athletic footwear and apparel are growing double digits in China and sport is increasingly becoming a larger part of life for consumers in China and Nike seeks to help catalyze the rise of sport participation and sport culture in the Chinese market. The company is focused on creating products specifically tailored to the Chinese consumers' preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem.

Sales in North America rose 7% to $3.81 billion; footwear rose 9% to $2.51 billion and apparel, up 2% to $1.17 billion. The EMEA (Europe, Middle East and Africa) region saw 12% constant currency sales growth, to $2.44 billion, and Asia Pacific and Latin America, 14% to $1.31 billion.

The innovation pipeline is full at Nike. In addition to new product during 3Q19, the company extended a new advanced algorithm in its apps that enables it to reward the most active members. Membership is important in creating a seamless physical-to-digital retail experience. In its House of Innovation stores in New York and Shanghai, over 50% of transactions are with members. Across the wider store fleet, consumers who use the Nike App at Retail averaged 40% higher sales than those who don't.

With product, Nike is bringing innovation at the core level, with new collections under the $100 price point. For women, Nike plans to launch more than 40 new styles of bras to expand inclusive sizing. The company will expand athletic yoga apparel offerings and for day-to-day life, will design for added versatility with Nike TechNet.

Outlook

The company provided guidance for the remainder of FY19 and an early read on FY20:

Source: Company reports/Coresight Research; [/caption]

3Q19 Results

Nike reported 3Q19 revenues of $9.61 billion, up 7.0% year over year and in line with the consensus estimate. Foreign currency exchange rates penalized revenue growth approximately 400 bps in 3Q19. EPS of $0.68 beat the $0.65 consensus estimate and are versus a

The operating margin was flat at 13% of sales as a 130 bps gross margin expansion was offset by investment spending in Nike’s transformational initiatives. Demand creation expense was $865 million versus $862 million, while operating overhead expense increased 17% to $2.2 billion to support investments in Nike’s transformational initiatives for its Consumer Direct Offense.

Inventories rose 1% to $5.42 billion.

Details from the Quarter

3Q19 revenues rose 7%, driven by 13% growth for Nike footwear led by Greater China. Digital sales rose 36% propelled by more than 60% growth in China. 3Q19 digital sales exceeded $1 billion for the first time.

Both Nike footwear and apparel grew double-digits during the quarter on a constant-currency basis. Footwear rose 13% to $6.12 billion and apparel rose 10% to 2.71 billion. By region, China grew most rapidly, at 24% to $1.59 billion, led by 26% growth in apparel to $444 million, followed by 23% in footwear, to $1.12 billion. This was the 19th consecutive quarter of double-digit sales growth in China.

Nike considers China the best example of its outsized growth potential internationally. China is already the largest footwear and apparel market in the world, but athletic footwear and apparel represent a smaller share of the total market than in the more developed markets, such as the US. Athletic footwear and apparel are growing double digits in China and sport is increasingly becoming a larger part of life for consumers in China and Nike seeks to help catalyze the rise of sport participation and sport culture in the Chinese market. The company is focused on creating products specifically tailored to the Chinese consumers' preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem.

Sales in North America rose 7% to $3.81 billion; footwear rose 9% to $2.51 billion and apparel, up 2% to $1.17 billion. The EMEA (Europe, Middle East and Africa) region saw 12% constant currency sales growth, to $2.44 billion, and Asia Pacific and Latin America, 14% to $1.31 billion.

The innovation pipeline is full at Nike. In addition to new product during 3Q19, the company extended a new advanced algorithm in its apps that enables it to reward the most active members. Membership is important in creating a seamless physical-to-digital retail experience. In its House of Innovation stores in New York and Shanghai, over 50% of transactions are with members. Across the wider store fleet, consumers who use the Nike App at Retail averaged 40% higher sales than those who don't.

With product, Nike is bringing innovation at the core level, with new collections under the $100 price point. For women, Nike plans to launch more than 40 new styles of bras to expand inclusive sizing. The company will expand athletic yoga apparel offerings and for day-to-day life, will design for added versatility with Nike TechNet.

Outlook

The company provided guidance for the remainder of FY19 and an early read on FY20:

- For Q419 Nike expects high single-digit constant-currency revenue growth, with roughly 600 bps of currency exchange headwinds, which would result in low single-digit reported revenue growth.

- The company projects about 75 bps gross-margin expansion and high-single-digit growth in SG&A expenses.

- The preliminary outlook for FY20 is high single-digit revenue growth along with gross margin expansion.

- The company currently expects the currency headwind on reported revenue to largely dissipate into FY20.