DIpil Das

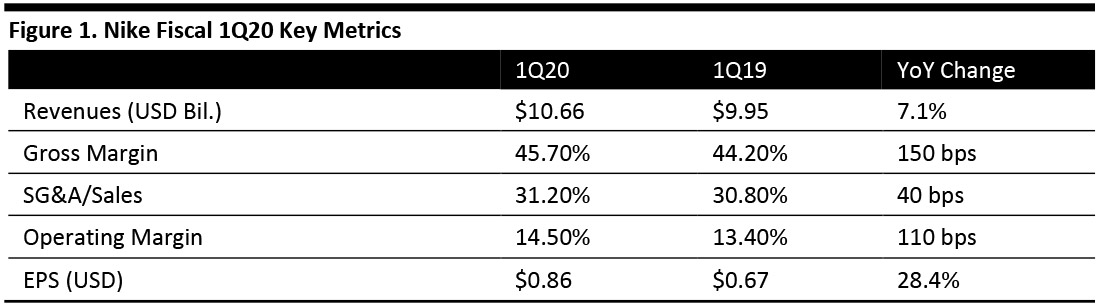

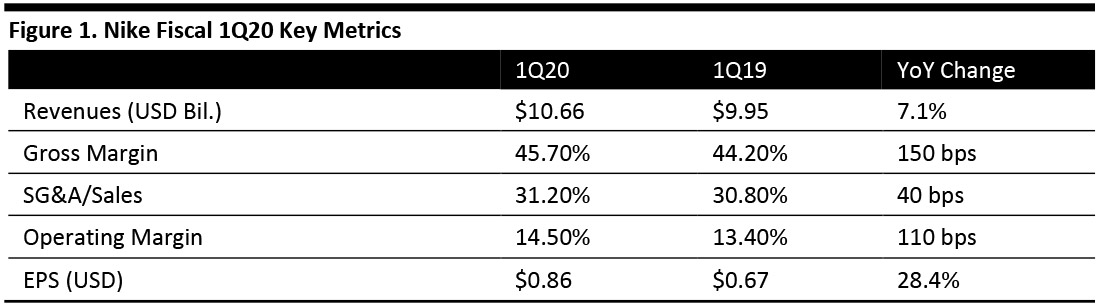

[caption id="attachment_97043" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q20 results

Nike reported 1Q20 revenues of $10.66 billion, up 7.1% year over year and beating the $10.44 consensus estimate.

Gross margin expanded by 150 bps, as average gross selling prices increased and higher margin Nike Direct growth outpaced wholesale growth.

By geography, sales in Greater China surged 22% to $1.7 billion, 27% on a currency-neutral basis. Sales in Europe, the Middle East and Africa increased 6% to $2.8 billion. Sales in Asia Pacific and Latin America grew to $1.3 billion and in North America to $4.3 billion.

By brand, revenues for the NIKE brand were $10.1 billion, up 10% on a currency-neutral basis, driven by growth across NIKE Direct and wholesale. Key categories including sportswear and the Jordan Brand performed well, with continued growth across footwear and apparel.

Revenues for Converse were $555 million, up 8% on a currency-neutral basis, mainly driven by double-digit growth in Asia and through digital globally, partially offset by declines in the US.

EPS of $0.86 beat the $0.70 consensus estimate and was ahead of $0.67 in the year ago quarter.

Inventories rose 12% to $5.8 billion, reflecting strong consumer demand globally and key consumer moments such as back-to-school.

Other details from the quarter

1Q20 digital sales rose 42%, propelled by enhanced digital services and expansion of the app ecosystem globally. The Nike App and SNKRS App are now available in over 20 countries.

China grew most rapidly, at 22% to $1.68 billion, led by equal growth in footwear, apparel and equipment. This was the 21st consecutive quarter of double-digit sales growth in China. Sport is becoming a larger part of life for consumers in China and Nike is looking to catalyze greater sport participation and foster a sports culture in the China market. The company is focused on creating products specifically tailored to Chinese consumer preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem. Nike Digital grew over 70% in Q1 in China, partly amplified by a strategic partnership with Tmall and WeChat.

The innovation pipeline is full at Nike. On August 6, Nike acquired artificial intelligence platform Celect, hoping to better predict shopper behavior. With Celect technology integrated into Nike’s mobile apps and website, Nike is now testing if it can better predict what sneaker and apparel products consumers want, when and where - and meet them there. Nike continues to offer new products with innovative designs or partnership with NBA stars.

Outlook

The company provided guidance for 2Q20 and FY20:

Source: Company reports/Coresight Research[/caption]

1Q20 results

Nike reported 1Q20 revenues of $10.66 billion, up 7.1% year over year and beating the $10.44 consensus estimate.

Gross margin expanded by 150 bps, as average gross selling prices increased and higher margin Nike Direct growth outpaced wholesale growth.

By geography, sales in Greater China surged 22% to $1.7 billion, 27% on a currency-neutral basis. Sales in Europe, the Middle East and Africa increased 6% to $2.8 billion. Sales in Asia Pacific and Latin America grew to $1.3 billion and in North America to $4.3 billion.

By brand, revenues for the NIKE brand were $10.1 billion, up 10% on a currency-neutral basis, driven by growth across NIKE Direct and wholesale. Key categories including sportswear and the Jordan Brand performed well, with continued growth across footwear and apparel.

Revenues for Converse were $555 million, up 8% on a currency-neutral basis, mainly driven by double-digit growth in Asia and through digital globally, partially offset by declines in the US.

EPS of $0.86 beat the $0.70 consensus estimate and was ahead of $0.67 in the year ago quarter.

Inventories rose 12% to $5.8 billion, reflecting strong consumer demand globally and key consumer moments such as back-to-school.

Other details from the quarter

1Q20 digital sales rose 42%, propelled by enhanced digital services and expansion of the app ecosystem globally. The Nike App and SNKRS App are now available in over 20 countries.

China grew most rapidly, at 22% to $1.68 billion, led by equal growth in footwear, apparel and equipment. This was the 21st consecutive quarter of double-digit sales growth in China. Sport is becoming a larger part of life for consumers in China and Nike is looking to catalyze greater sport participation and foster a sports culture in the China market. The company is focused on creating products specifically tailored to Chinese consumer preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem. Nike Digital grew over 70% in Q1 in China, partly amplified by a strategic partnership with Tmall and WeChat.

The innovation pipeline is full at Nike. On August 6, Nike acquired artificial intelligence platform Celect, hoping to better predict shopper behavior. With Celect technology integrated into Nike’s mobile apps and website, Nike is now testing if it can better predict what sneaker and apparel products consumers want, when and where - and meet them there. Nike continues to offer new products with innovative designs or partnership with NBA stars.

Outlook

The company provided guidance for 2Q20 and FY20:

Source: Company reports/Coresight Research[/caption]

1Q20 results

Nike reported 1Q20 revenues of $10.66 billion, up 7.1% year over year and beating the $10.44 consensus estimate.

Gross margin expanded by 150 bps, as average gross selling prices increased and higher margin Nike Direct growth outpaced wholesale growth.

By geography, sales in Greater China surged 22% to $1.7 billion, 27% on a currency-neutral basis. Sales in Europe, the Middle East and Africa increased 6% to $2.8 billion. Sales in Asia Pacific and Latin America grew to $1.3 billion and in North America to $4.3 billion.

By brand, revenues for the NIKE brand were $10.1 billion, up 10% on a currency-neutral basis, driven by growth across NIKE Direct and wholesale. Key categories including sportswear and the Jordan Brand performed well, with continued growth across footwear and apparel.

Revenues for Converse were $555 million, up 8% on a currency-neutral basis, mainly driven by double-digit growth in Asia and through digital globally, partially offset by declines in the US.

EPS of $0.86 beat the $0.70 consensus estimate and was ahead of $0.67 in the year ago quarter.

Inventories rose 12% to $5.8 billion, reflecting strong consumer demand globally and key consumer moments such as back-to-school.

Other details from the quarter

1Q20 digital sales rose 42%, propelled by enhanced digital services and expansion of the app ecosystem globally. The Nike App and SNKRS App are now available in over 20 countries.

China grew most rapidly, at 22% to $1.68 billion, led by equal growth in footwear, apparel and equipment. This was the 21st consecutive quarter of double-digit sales growth in China. Sport is becoming a larger part of life for consumers in China and Nike is looking to catalyze greater sport participation and foster a sports culture in the China market. The company is focused on creating products specifically tailored to Chinese consumer preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem. Nike Digital grew over 70% in Q1 in China, partly amplified by a strategic partnership with Tmall and WeChat.

The innovation pipeline is full at Nike. On August 6, Nike acquired artificial intelligence platform Celect, hoping to better predict shopper behavior. With Celect technology integrated into Nike’s mobile apps and website, Nike is now testing if it can better predict what sneaker and apparel products consumers want, when and where - and meet them there. Nike continues to offer new products with innovative designs or partnership with NBA stars.

Outlook

The company provided guidance for 2Q20 and FY20:

Source: Company reports/Coresight Research[/caption]

1Q20 results

Nike reported 1Q20 revenues of $10.66 billion, up 7.1% year over year and beating the $10.44 consensus estimate.

Gross margin expanded by 150 bps, as average gross selling prices increased and higher margin Nike Direct growth outpaced wholesale growth.

By geography, sales in Greater China surged 22% to $1.7 billion, 27% on a currency-neutral basis. Sales in Europe, the Middle East and Africa increased 6% to $2.8 billion. Sales in Asia Pacific and Latin America grew to $1.3 billion and in North America to $4.3 billion.

By brand, revenues for the NIKE brand were $10.1 billion, up 10% on a currency-neutral basis, driven by growth across NIKE Direct and wholesale. Key categories including sportswear and the Jordan Brand performed well, with continued growth across footwear and apparel.

Revenues for Converse were $555 million, up 8% on a currency-neutral basis, mainly driven by double-digit growth in Asia and through digital globally, partially offset by declines in the US.

EPS of $0.86 beat the $0.70 consensus estimate and was ahead of $0.67 in the year ago quarter.

Inventories rose 12% to $5.8 billion, reflecting strong consumer demand globally and key consumer moments such as back-to-school.

Other details from the quarter

1Q20 digital sales rose 42%, propelled by enhanced digital services and expansion of the app ecosystem globally. The Nike App and SNKRS App are now available in over 20 countries.

China grew most rapidly, at 22% to $1.68 billion, led by equal growth in footwear, apparel and equipment. This was the 21st consecutive quarter of double-digit sales growth in China. Sport is becoming a larger part of life for consumers in China and Nike is looking to catalyze greater sport participation and foster a sports culture in the China market. The company is focused on creating products specifically tailored to Chinese consumer preferences and fit, and creating digital experiences that connect the brand more deeply to consumers through China's unique digital ecosystem. Nike Digital grew over 70% in Q1 in China, partly amplified by a strategic partnership with Tmall and WeChat.

The innovation pipeline is full at Nike. On August 6, Nike acquired artificial intelligence platform Celect, hoping to better predict shopper behavior. With Celect technology integrated into Nike’s mobile apps and website, Nike is now testing if it can better predict what sneaker and apparel products consumers want, when and where - and meet them there. Nike continues to offer new products with innovative designs or partnership with NBA stars.

Outlook

The company provided guidance for 2Q20 and FY20:

- For 2Q20, Nike expects 7% revenue growth, in line with Q1 reported revenue growth, and 25-bps growth in gross margin.

- The company projects about 50-75 bps gross-margin expansion.

- For FY20, Nike expects high single-digit constant-currency revenue growth.

- The company projects about 50-75 bps gross-margin expansion and in-line growth in SG&A expenses.