Source: Company reports/Fung Global Retail & Technology

Fiscal 3Q17 Results

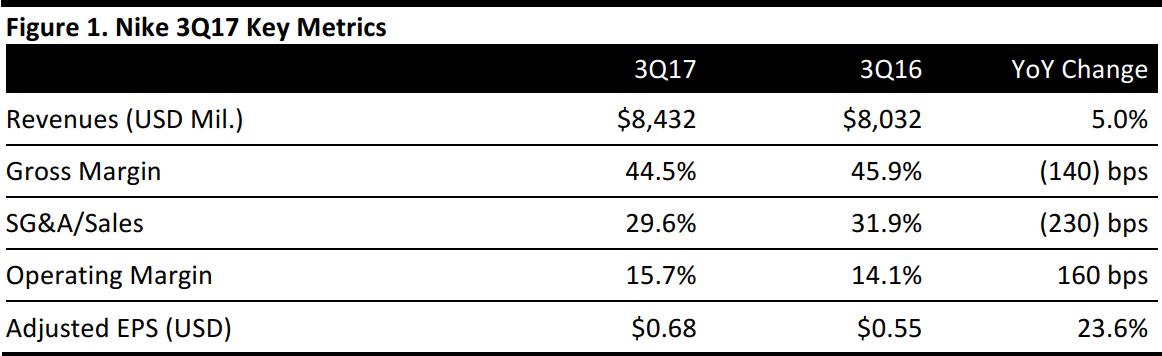

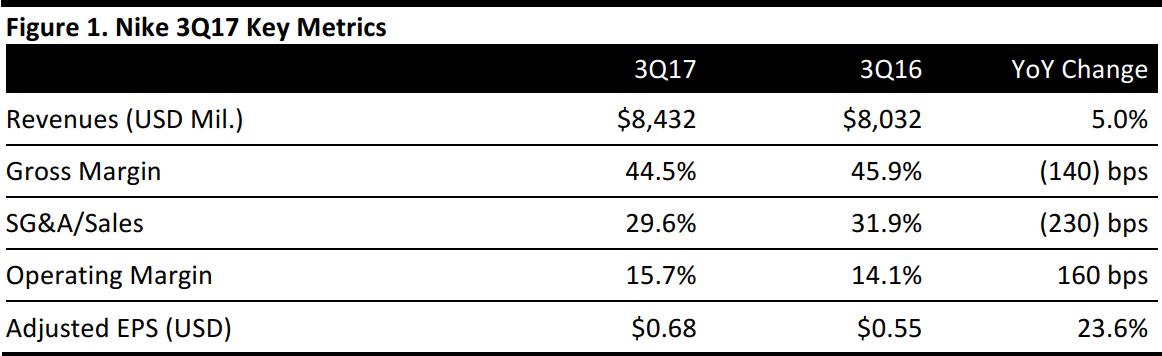

Nike reported fiscal 3Q17 adjusted EPS of $0.68, ahead of the $0.53 consensus estimate and up 23.6% year over year, driven by SG&A expense leverage as well as by higher other income, a lower tax rate and a lower share count.

Revenues of $8.4 billion were up 5.0% year over year, or up 7.0% on a currency-neutral basis. Revenues for the Nike brand were $7.9 billion, up 7.0% in currency-neutral terms, driven by double-digit growth in the Western Europe, Greater China and Emerging Markets regions as well as the sportswear and Jordan brand categories.

Revenues for Converse were $498 million, up 3.0% on a currency-neutral basis, driven by growth in North America.

By Product Category

Globally, footwear sales for the Nike brand increased by 7% excluding currency effects. Apparel sales increased by 9% in constant currency and equipment sales decreased by 7%. The company’s global brand division’s sales decreased by 17%.

- Footwear: Sales of footwear increased by 5%, or by 7% excluding currency effects. The strongest footwear sales came from the Emerging Markets region, which saw sales growth of 17% excluding currency effects, followed by Greater China at 14% and Japan at 8%.

- Apparel: Global apparel sales increased by 7%, or by 9% excluding currency changes. The strongest regions for apparel growth were Greater China, where sales increased by 22% excluding currency effects, and Western Europe and Japan, each with 21% growth.

- Equipment: Equipment is the company’s smallest segment, and sales declined in the quarter. The strongest region for equipment sales growth was Greater China, where sales were up 7% excluding currency effects. Sales in the category also increased in the Western Europe and Emerging Markets regions, while they declined in North America and Japan and were flat in Central and Eastern Europe.

By Geographic Region

In the quarter, revenues increased by 3% in North America, by 10% in Western Europe, by 3% in Central and Eastern Europe, by 15% in Greater China, by 8% in Japan and by 13% in the Emerging Markets region.