Source: Company reports/FGRT

Fiscal 2Q18 Results

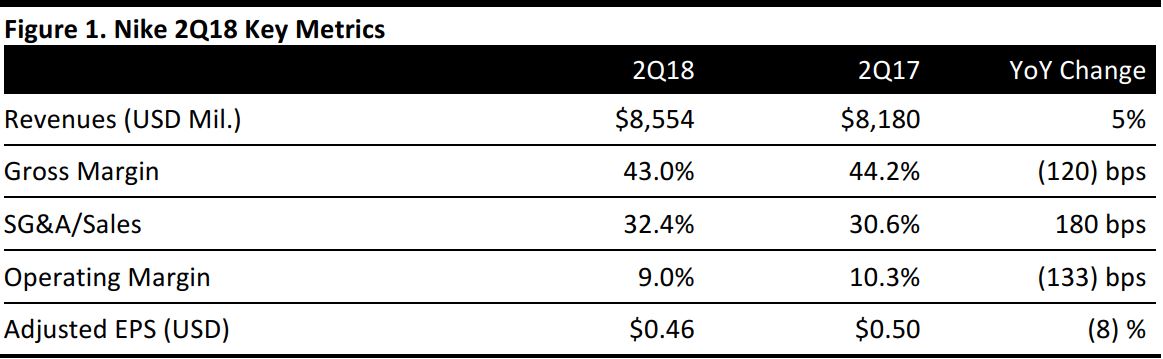

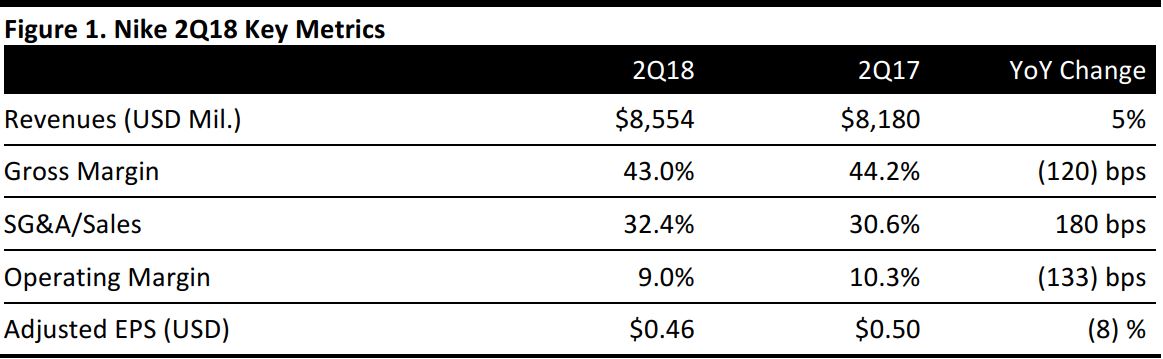

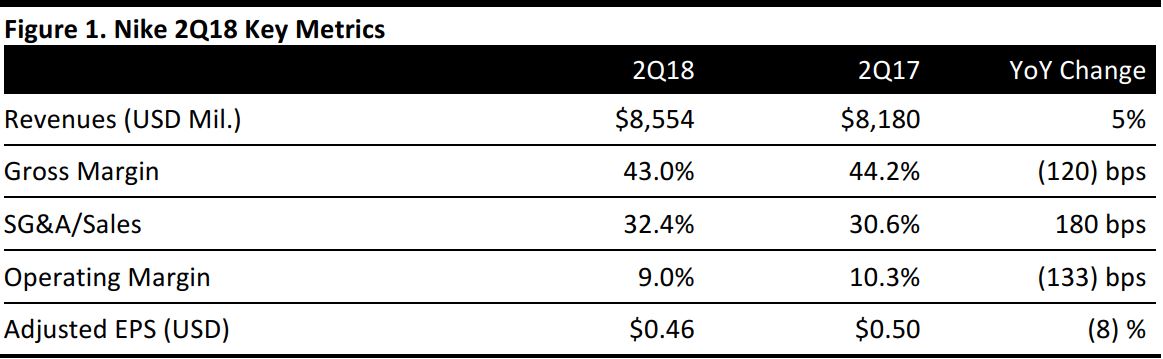

Nike reported fiscal 2Q18 revenues of $8,554 million, up 5% year over year. The increase in revenues was driven by international geographies and the strength in Nike Direct, which was partly offset by an expected decline in North America wholesale revenues due to distribution and brand exits.

Revenues for the Nike brand were $8,136 million, up 4% on a constant-currency basis, driven by EMEA, Greater China and APLA, including growth in the sportswear and Nike basketball categories. Additionally, revenues for Converse were down 4% on a currency-neutral basis to $408 million.

Mark Parker, Chairman,President and CEO, said that the quarter was led by Nike’s Consumer Direct Offense to accelerate international growth and build the domestic business. He said, “For the back half of the fiscal year, Nike’s innovation lineup is as strong as it’s ever been and we’ll continue to actively shape retail through new differentiated experiences.”

In terms of innovation, Nike reported that its cushioning platforms, ZoomX, and Nike React are going to be available for more sports in different silhouettes and price points. In March, the company will offer Air Max Day to “celebrate with consumers from around the world” with Air Max reissues and “Max mashups.”

The company reported that international business accounted for over 55% of revenues and that there are more opportunities ahead in developing markets.

Outlook

Nike provided guidance in line with 1Q guidance. The company reported a continued strong momentum in international geographies, and slightly fewer headwinds from foreign exchange, net of hedging. Nike expects short-term headwinds within the US retail landscape to dampen growth.

For 3Q, Nike expects revenue growth in the low single-digit range, with a contraction in the North America geography and Converse brand to be more than offset by strong international growth. For the full year, the company expects revenue growth in the mid single-digit range.