Source: Company reports/Fung Global Retail & Technology

1Q17 RESULTS

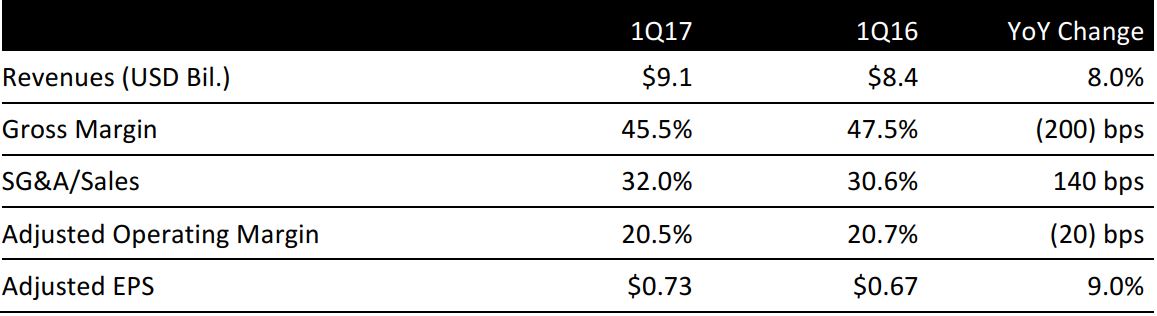

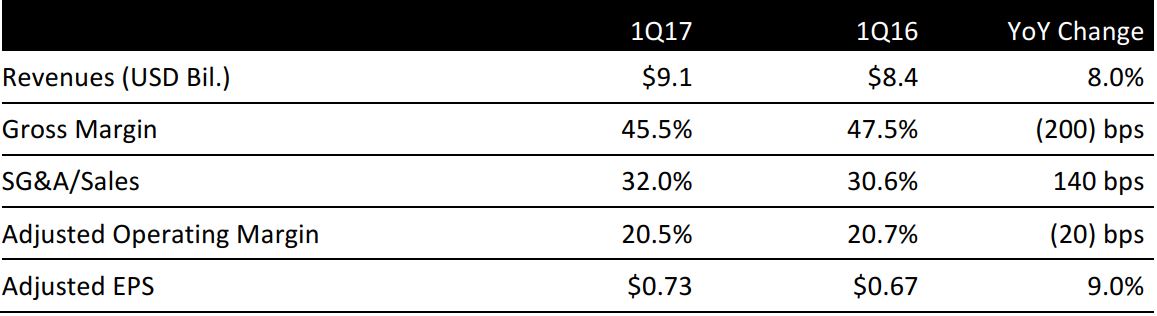

Nike reported fiscal 1Q17 revenues of $9.1 billion, up 8.0% year over year and above the consensus estimate. Revenues increased by 10% excluding currency effects. Sales increased in all regions and segments except emerging markets, the global brand divisions and the licensing businesses.

Adjusted EPS was $0.73, ahead of the $0.56 consensus estimate and up 9.0% year over year, driven by strong revenue growth, operating overhead leverage, a lower effective tax rate and a lower average share count, which were partially offset by a gross margin decline and high demand creation expense in an Olympic quarter.

By Product Category

Globally, footwear sales increased by 10% excluding currency effects. Apparel sales increased by 12% in constant currency and equipment sales increased by 6%. The company’s global brand divisions decreased by 30%.

- Footwear—Sales of footwear increased by 7%, or 10% excluding currency effects. The strongest footwear sales came from Greater China, with growth of 25% excluding currency effects, followed by central and Eastern Europe at 19% and Japan at 17%.

- Apparel—Sales increased by 9%, or 12% excluding currency changes, globally. The strongest regions for apparel growth included Western Europe, with 26% growth excluding currency effects and Japan, with 21% growth.

- Equipment—Equipment is the company’s smallest segment and had slower growth than apparel and footwear. The strongest region for equipment growth was Japan, where sales were up 12% excluding currency effects.

By Geographic Region

In the quarter, revenues increased by 6% in North America, by 7% in Western Europe, by 10% in Central and Eastern Europe, by 15% in Greater China, and by 37% in Japan. Revenues declined by 2% in emerging markets.

- North America—Other than the decline in emerging markets, North America posted the company’s slowest growth, at 6%. Footwear, apparel, and equipment all posted growth in the mid-single digits.

- Greater China and Japan—The company’s Asia business reported the strongest growth, with sales in Japan up 37%, or 18% excluding currency effects, and sales in China up 15%, or 21% excluding currency effects.

OUTLOOK

Future orders scheduled for delivery from September 2016 through January 2017 totaled $12.3 billion, 5% higher year over year, and 7% higher on a currency-neutral basis. The most significant growth in future orders came from Japan, at 26%, and Greater China, at 15%.

Consensus estimates for 2Q17 call for EPS of $0.51 and revenues of $8.3 billion. For the full 2017 fiscal year, consensus estimates are for EPS of $2.60 and revenues of $33.6 billion.