albert Chan

NIKE, Inc.

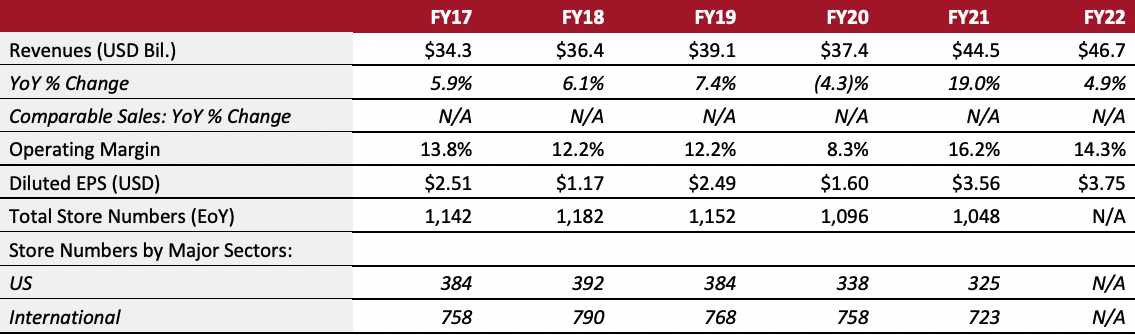

Sector: Apparel and footwear Countries of operation: Australia, China, Japan, the UK, the US and 165 other countries. Key product categories: Athletic accessories, apparel, equipment and footwear Annual Metrics [caption id="attachment_151913" align="aligncenter" width="700"] Fiscal year ends on May 31 of the same calendar year

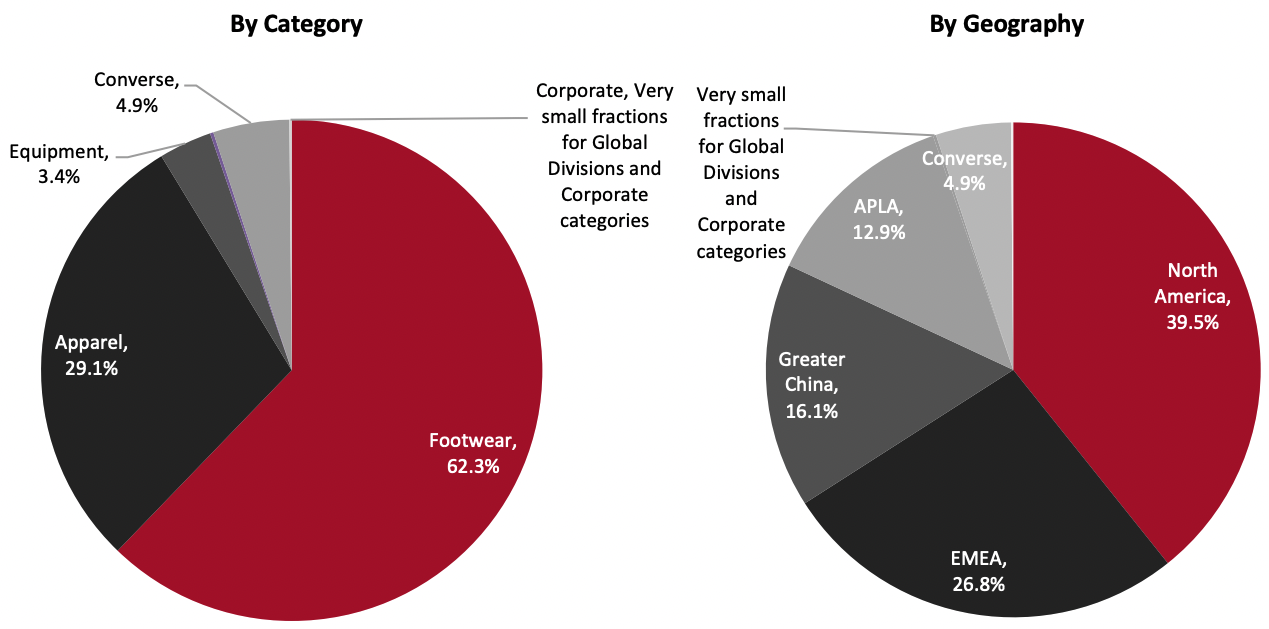

Fiscal year ends on May 31 of the same calendar yearSource: Company reports[/caption] Summary Founded in 1964 and headquartered in Beaverton, Oregon, NIKE is the world’s largest brand of athletic apparel, footwear and accessories. Its NIKE brand focuses on six key categories: Running, NIKE Basketball, the Jordan Brand, Football (Soccer), Training and Sportswear (which comprises sports-inspired lifestyle products). The company also markets products for children as well as for other athletic and recreational uses, including American football, baseball, cricket, golf and lacrosse. Additionally, the company owns Converse and the Jordan Brand, which design, distribute and license athletic and casual accessories, apparel and footwear. As of May 31, 2021,NIKE is supplied by 191 footwear factories located in 14 countries and 344 apparel factories located in 33 countries, mostly outside the US. The company employs 73,300 people worldwide, including part-time employees. It operates 325 stores in the US and 723 stores in international markets. Company Analysis Coresight Research insight: NIKE fuels its long-term growth by successfully leveraging the growing popularity of sports and active lifestyle products—as well as effectively keeping pace with increasingly online consumers with a thirst for innovative products. The company’s global consumer base and scale offer significant opportunities for the company to expand. Over the next three to five years, we anticipate that NIKE will retain its status as the largest global sportswear company, driven by the company’s strong digital capabilities and top-tier brand collaboration.

| Tailwinds | Headwinds |

|

|

- Focus on designing innovative products incorporating new technologies across categories and consumer applications. Examples of these technologies include Adaptive, Dri-Fit, FlyEase, Flyknit, Flyweave, Flywire, NIKE Air, React and ZoomX.

- Continue to supply materials via wholly owned subsidiaries. Its Air Manufacturing Innovation, which has facilities near Beaverton, Oregon, supplies materials and cushioning components used in footwear. The principal materials used in the products are natural and synthetic fabrics (both virgin and recycled), and specialized performance fabrics designed to efficiently wick moisture away from the body, retain heat and repel rain and snow.

- Continue to innovate features, such as incorporating injury prevention functions into footwear. For example, the Zoom 10 Invincible Run, launched in 2021, increases foam in the midsole.

- Set ambitious goals around the use of sustainable materials throughout its product line. For example, in February 2021 NIKE launched Cosmic Unity, its first performance shoe under its “Move to Zero” initiative (aiming for zero waste and zero carbon).

- Continue to optimize supply and demand with speed and agility, and maintain healthy inventory levels. Initiatives such as Express Lane, now operationalized in all geographies, enable increased flexibility and responsiveness in serving consumer demand while driving higher profitability.

- Maintain a heavily digitalized supply chain. NIKE is dependent on IT systems and networks, including the Internet and third-party services across its logistic network, including product design, production, forecasting, ordering, manufacturing, transportation, sales and distribution.

- Continue to scale radio-frequency identification (RFID) capabilities across stores in Europe, the Middle East and Africa (EMEA), enable better product allocation and replenishment, and begin testing consumer-facing RFID capabilities, included self-checkout in stores in Korea.

- Invest significantly in digital technologies and information systems for the digital aspect of NIKE Direct operations.

- Focus on engaging and serving members across multiple platforms, including livestreams and social media.

- Continue to innovate services for NIKE members. For example, NIKE now allows its customers to connect their NIKE Membership accounts and DICK'S Scorecard through the DICK'S mobile app, aiming to help both companies reach more customers and provide them with access to exclusive products, experiences and offers.

Company Developments

Company Developments

| Date | Development |

| May 30, 2022 | NIKE launches Re-Creation program, which collects vintage and deadstock products from customers and create new locally designed and manufactured products. |

| April 29, 2022 | NIKE partners with the Bryant family to honor Kobe’s legacy. The first new Kobe release, the Kobe 6 Protro “Mambacita Sweet 16," honors Gigi Bryant. |

| February 25, 2022 | NIKE moves away from Foot Locker wholesale in its shift to direct-to-consumer (DTC) retail. |

| December 13, 2021 | NIKE acquires RTFKT, a virtual shoe brand that delivers next generation collectibles, merging culture and gaming. |

| November 18, 2021 | NIKE teams up with Roblox to create a virtual world called NIKELAND on the Roblox online gaming platform. The virtual world includes NIKE buildings, fields and arenas for players to compete in various minigames. |

| August 25, 2021 | NIKE launches a collection of accessories, apparel and sneakers in collaboration with Nordstrom. |

| August 18, 2021 | NIKE collaborates with American tennis player Serena Williams to launch a limited-edition line of products including women’s athleisure, shoes and accessories. |

| June 24, 2021 | NIKE collaborates with Louis Vuitton to release Air Force 1 sneakers. |

| June 21, 2021 | NIKE launches a new line of vegan sneakers made from pineapple leather. |

| April 13, 2021 | NIKE launches a refurbished sneaker program, which takes returns for gently worn, like-new or imperfect footwear and refurnish them to be resold at NIKE stores at a discount. |

| March 11, 2021 | NIKE sets diversity targets for 2025 and ties executive compensation to hitting them. |

| February 1, 2021 | NIKE launches Go FlyEase, a no-lace slip-on sneaker. |

| September 2, 2020 | NIKE launches a maternity clothing line. |

| July 31, 2020 | NIKE opens its third House of Innovation in Paris. |

| May 9, 2020 | NIKE launches a Spanish-language option in the US on NIKE.com and the NIKE App. |

| April 2, 2020 | NIKE launches a new yoga collection that features NIKE’s latest performance fabric innovation, Nike Infinalon. |

| December 6, 2019 | NIKE completes the sale of Hurley International LLC to Bluestar Alliance LLC. |

| November 14, 2019 | NIKE appoints Thasunda Brown Duckett to its Board of Directors. |

| October 22, 2019 | NIKE announces that Mark Parker will step down as CEO. |

- John Donahoe—President and CEO

- Andy Campion—Chief Operating Officer

- Thomas Clarke—President of Innovation

- Matthew Friend—EVP & Chief Financial Officer

Source: Company reports