albert Chan

Next Plc

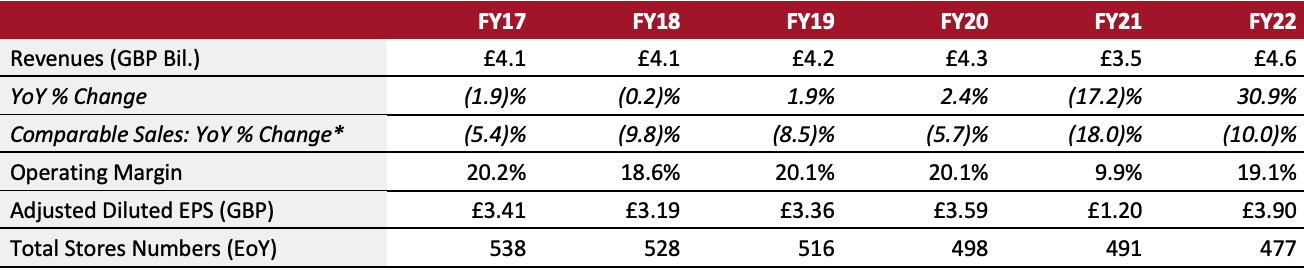

Sector: Apparel specialty retail Countries of operation: 36 countries, with its main operations in the UK Key product categories: Apparel, beauty, footwear and home goods Annual Metrics [caption id="attachment_148000" align="aligncenter" width="700"] Fiscal year ends on January 30 of the same calendar year

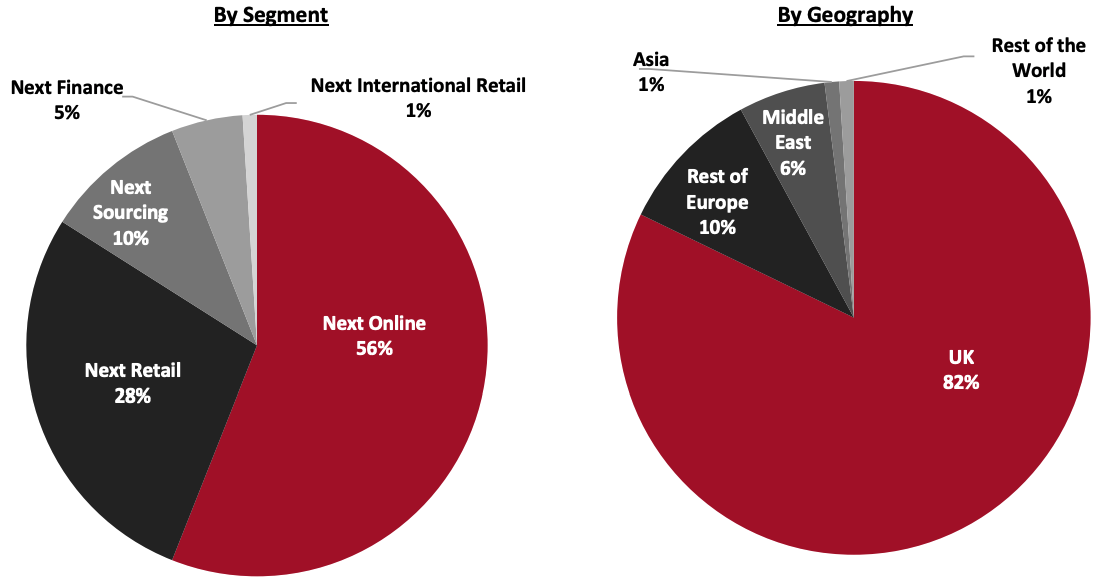

Fiscal year ends on January 30 of the same calendar year*For Next Retail[/caption] Summary Next is a UK-based retailer that offers accessories, clothing, home products and shoes through its worldwide fleet of stores. It was founded in 1864 and is headquartered in Leicester. The company comprises five operating segments: Next Finance, which provides consumer credit services and enables customers to buy products online and in store; Next International Retail, which includes 190 franchised stores in 36 countries; Next Online, an e-commerce business with over 8 million active customers across more than 70 countries; Next Retail, a chain of 477 stores in the UK and Ireland; and Next Sourcing, a Hong Kong-based internal sourcing agent that designs and sources Next-branded products. Company Analysis Coresight Research insight: Next holds a dominant position in the UK apparel market, particularly among consumers aged 20–40. Driven by a combination of scale and warehouse investment, including in automation, Next has become one of the UK’s lowest cost fulfillment platforms. Next has also been improving and investing in its e-commerce business over the last decade—the retailer now generates more than 60% of its sales via online channels. Furthermore, the company continues to ramp up its warehouse spend, from 40% of its total capital expenditure in fiscal 2020 to 67% in fiscal 2022, ended January 30, 2022—with investment mainly directed toward its new, highly automated, boxed warehouse, which is set to open by the end of 2023. We believe that the company’s “Total Platform” has the potential to become a long-term revenue driver. Total Platform is an end-to-end, fully integrated e-commerce platform for third-party brands, offering click and collect and returns from Next stores services. As traditional routes to market are increasingly challenged, such as in department stores and in standalone retail, Total Platform offers a rapidly scalable and cost-effective solution without major investment hurdles. Brands including Adidas, FatFace and Victoria’s Secret are already using the platform, indicating that the strategy is gaining traction. Additionally, recently acquired fashion brand and retail chain Reiss (Next bought a 25% stake in Reiss in March 2021) went live on Next’s Total Platform in February 2022, which substantially expanded Total Platform’s capabilities, offering services such as delivery to wholesale customers, overseas retail stores and concession partners. This also brought a suite of import and tax functionality, such as the provision of bonded UK warehousing. Apparel brand Gap will go live on Next’s Total Platform in August 2022. The company’s beauty segment has strong scope for growth. In its fiscal 2022 earnings call held in March 2022, Next stated that it has entered into a long-term agreement with US-based beauty retailer Bath & Body Works (BBW) on selling the latter’s product ranges on the Next website and hosting the BBW website in the UK. We believe this partnership will help Next to expand its beauty offerings. Additionally, Next’s August 2020 purchase of Debenham’s former beauty store in Milton Keynes extended the company’s fast-growing premium beauty offerings from online-only into brick-and-mortar retail.

| Tailwinds | Headwinds |

|

|

- Expand ranges from existing brand partners and continue to add new third-party brands to its site.

- Extend the Platform Plus service to additional brand partners.

- Expand and develop its own licensing business.

- Invest in warehousing, distribution, returns processing and call centers.

- Invest in automation and data security.

- Develop the next-day Platform Plus service that enables 24-hour delivery—from the current two-day delivery service.

- Launch an online marketing system to target customers with brands and products.

- Modernize its software infrastructure to replace and update existing legacy systems.

- Enhance the performance, resilience and speed of its website.

- Enter into new partnerships with international brands and expand existing collaborations.

- Increase investment in its overseas digital marketing.

- Expand ranges available on its overseas website, including its private-label brands.

- Add third-party and in-house split payment methods for overseas customers.

- Reduce carbon emissions by 55% by 2030, compared to its 2017 baseline.

- Eliminate avoidable plastics in product packaging by 2025.

- Procure 100% of cotton from sustainable sources by 2025.

- Install collection points in all its stores for shoppers to return their plastic packaging for recycling by the end of 2022.

Company Developments

Company Developments

| Date | Development |

| April 19, 2022 | Next partners with a group of investors led by Davidson Kempner to acquire a 44% stake in UK-based maternity wear and kids clothing retailer JoJo Maman Bébé. The financial terms of the transactions were not disclosed. |

| March 24, 2022 | Next revises its fiscal 2023 revenue and net profit guidance downward as the company expects substantial product price inflation. For fiscal 2023, the company cut its revenue forecast by 2% and net profit forecast by 1%. |

| March 7, 2022 | Next closes its Russian operations amid Russia-Ukraine war conflict. |

| February 17, 2022 | Next announces that fashion brand and retail chain Reiss went live on Next’s Total Platform. |

| January 7, 2022 | Next announces that it will increase the prices of its spring and summer ranges and homeware collections by 3.7%, and raise the prices of its autumn and winter season collections by 6.0% as the company witnessed a surge in costs for manufacturing, transportation and wages. |

| September 17, 2021 | Next enters into a joint venture agreement with Gap Inc. to operate Gap’s e-commerce business across the Next’s Total Platform, host Gap-branded shop-in-shops at selected retail locations and provide buy online, pick up in store (BOPIS) options for online shoppers starting from 2022. Under the terms of the alliance, Next owns a 51% stake in the joint venture, while Gap owns 49%. |

| September 14, 2021 | Next plans to invest £50 million ($70 million) to expand its warehouse in Rotherham to meet growing online sales demand. |

| July 21, 2021 | Next agrees to repay £29 million ($41 million) of business rates (taxes on commercial property) it saved during the government emergency economic measures brought in amid lockdowns as the first quarter of fiscal 2022 (ended April 30, 2021) substantially beat the company’s expectations. |

| April 1, 2021 | Next rules out further store closures for the remainder of 2021 amid the expansion of the Covid-19 vaccine rollout. However, the company expects comparable sales to be down 20% year over year in fiscal 2022 as the pandemic has accelerated the consumer shift to online shopping. |

| March 10, 2021 | Next enters into an agreement to acquire a 25% stake in UK-based fashion brand Reiss. Upon completion of the deal, Next will make an equity investment of £33 million ($46 million) and a debt investment of £10 million ($14 million). Under the terms of the deal, Next has an option to purchase an additional 26% at pre-agreed terms, which will take Next’s holding in Reiss to 51%. |

| January 22, 2021 | Next announces its withdrawal from the bidding process to acquire bankrupt apparel retailer Arcadia Group from its administrators. |

| September 23, 2020 | Next announces plans to open a huge store in Liverpool city center, in the building of a former Forever 21 store. The building is split across multiple floors and is bigger than Next’s current site in the city. |

| September 14, 2020 | Next announces a partnership with L Brands to form a joint venture to acquire a majority stake in L Brands’ Victoria’s Secret UK business. Next will own a 51% stake in the joint venture, while L Brands will own 49%. |

| August 24, 2020 | Next signs a deal to take over Debenhams’ former store in Milton Keynes. The new store will sell beauty, home products and women’s fashion. The new store extends the company’s fast-growing premium beauty offerings from online-only into brick and mortar. |

- Simon Wolfson—CEO

- Michael Roney—Chairman

- Amanda James—Group Finance Director

- Jane Shields—Group Sales and Marketing Director

- Richard Papp—Group Merchandise and Operations Director

Source: Company reports/S&P Capital IQ