Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

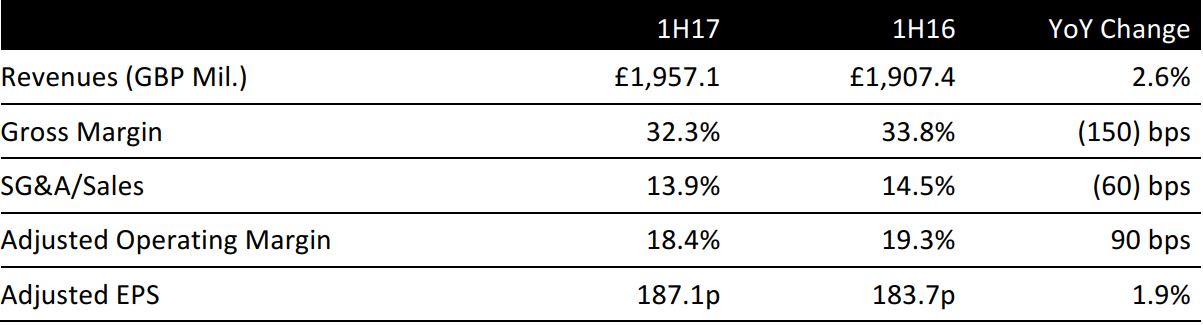

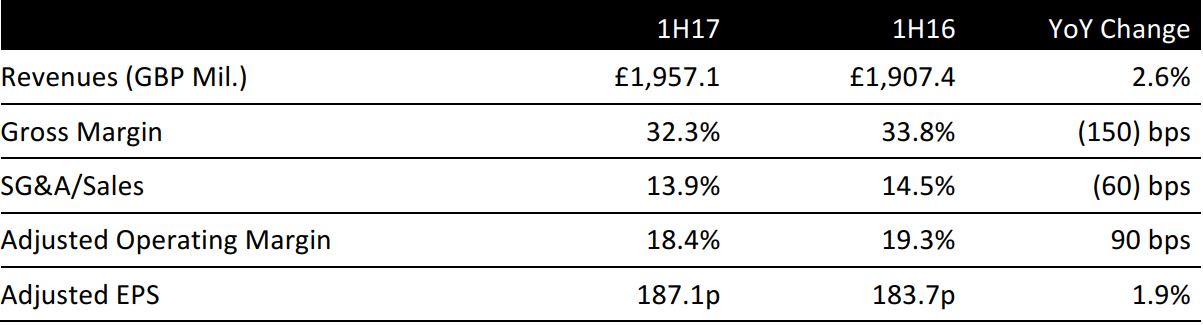

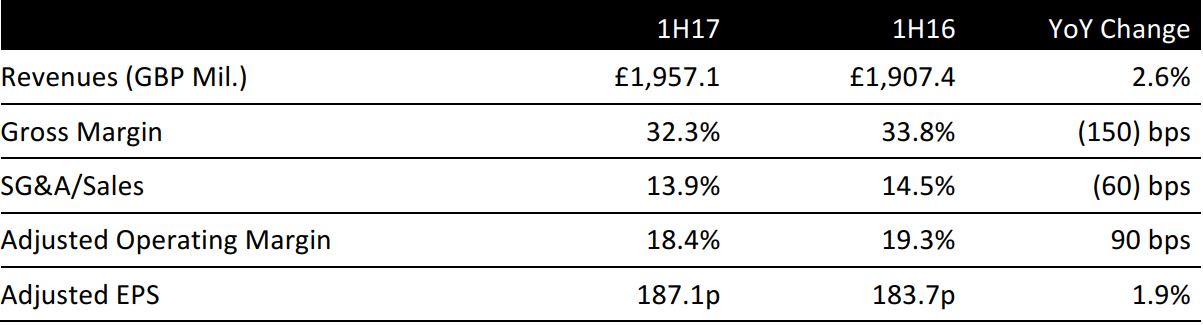

British fashion retailer Next reported £1,957.1 million in group revenues in the 26 weeks that ended July 30, 2016, and beat the consensus estimate of £1,924.9 million. Revenues were up 2.6% from £1,907.4 million in the 26 weeks that ended July 25, 2015.

The selling and general administrative expense (SG&A) margin increased by 60 basis points, from 14.5% in 1H16 to 13.9% in 1H17. The operating margin contracted by 90 basis points from 19.3% in 1H16 to 18.4% in 1H17. Diluted EPS was 187.1 pence for 1H17, up 2.6% from 183.7 pence in FY15 and beat the consensus estimate of 188 pence.

SEGMENTAL SALES BREAKDOWN

In 1H17, the Next Retail segment sales grew 0.1% to £1,083.6 million, with space growth contributing +2.8%. Next Directory sales exhibited a stronger growth of 7.1%to £821.2 million in 1H17, driven mainly by 5.5% growth in full-price sales. The overall growth of the Retail and Directory segments, which the company terms as the Next Brand, was 3% to £1,904.8 million in 1H17.

In 1H17, the Next Retail segment comparable sales declined 0.7% and full-price sales declined 4%. The Retail operating margin declined by 16.8% year over year. Next Directory comparable sales exhibited stronger growth of 5.4%, driven mainly by 4.9% full-price sales growth. The overseas Directory business grew +20.7% year over year in 1H17.

GUIDANCE

The company noted full-price sales in July remained subdued and trading since July remained challenging and volatile. The company maintained its full-year guidance and will have a clearer picture of trading conditions at the beginning of November when 3Q17 sales are announced.

The company expects total full-price sales growth of the Next Brand to be in the range of (2.5)% to +2.5% in FY17. Furthermore, the company expects FY17 profit before tax (PBT) in the range of €775 million and €845 million, to fall in the range of (5.6)% and +2.9% year-over-year PBT growth. FY17 growth in earnings per share is expected to fall between (2.5)% and +6.3%.

Consensus estimates for FY17 revenue stand at £4,189.7 million and implies annual year-over-year growth of 0.3%. Consensus expects profit before tax at £805.1 million, which suggests a year-over-year decline of 2%. The FY17 consensus EPS estimate is 440 pence, equating to a year-over-year increase of 1.2%.