Nitheesh NH

Source: Company reports/Coresight Research[/caption]

FY19 Results

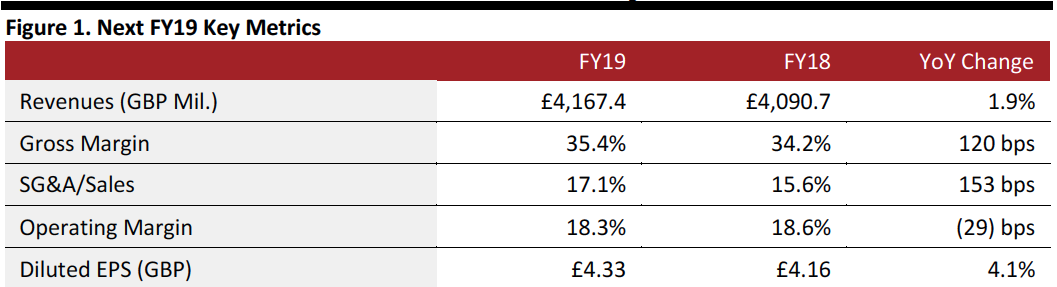

Next reported FY19 results with in-line sales while EPS slightly missed the consensus estimate. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Next reported FY19 results with in-line sales while EPS slightly missed the consensus estimate. The highlights are as follows:

- Next grew total statutory sales 1.9% year over year to £4.16 billion, while full-price sales (excluding items sold in sales and clearance) were up 3.1%.

- The gross margin expanded 120 basis points (bps) year over year to 35.4%.

- The operating margin contracted 29 bps year over year to 18.3%.

- The company reported diluted EPS of £4.33, up 4.1% year over year, but below the consensus of £4.34 by StreetAccount.

- The company invested £129 million in stores, warehousing and systems.

- Net debt increased to £1.09 billion from £1.0 billion in the previous fiscal year.

- The company’s retail segment sales, including markdown sales, fell 7.9% year over year to £1.95 billion.

- Retail operating profits fell faster than the top line, with a 21% decline to £212.3 million but ahead of the consensus of £210.3 million by StreetAccount.

- Same-store sales declined 8.5%.

- Full-price retail sales were down 7.3%.

- Net retail space increased 23,000 square feet in the reported fiscal year, taking trading space to 8.3 million square feet.

- The online business performed strongly: Next grew online revenues, including markdown sales, 14.7% year over year to £1.91 billion.

- Full-price sales grew 14.8%.

- Online operating profits grew 13.8% year over year to £352.6 million, below the consensus of £362.4 million recorded by StreetAccount.

- Total online UK full-Price sales grew 13.1% while overseas full-price online sales grew 22.1%.

- Next Brand UK, which accounted for 65% of the segment’s total operating profits, posted operating profits of £227.9 million, with a net margin of 20%.

- Label UK reported operating profits of £66.2 million, with a net margin of 16.0%.

- Operating profits from overseas operations were £58.5 million, with a net margin of 16.1%.

- Average active customers increased 8% year over year to 5.3 million, driven by the growth in overseas and UK cash customers (those who do not use a Nextpay credit account when ordering).

- The company’s finance division revenues grew 12.1% year over year to £250.3 million.

- The finance segment’s operating profits grew 8.4% year over year to £121.2 million, roughly in line with the consensus of £121.4 million recorded by StreetAccount.

Whilst our relationship with the EU remains uncertain, other economic indicators for the consumer look less worrying than at this point last year. Real earnings in the UK have remained positive since January 2018 and look like they are still gaining strength as we move into 2019. Employment rates are also continuing to increase; people in work are earning more and more people are in work. Whilst these increases remain modest, there is nothing to suggest that consumers will feel the need to retrench in the year ahead, the prolonged period of real income squeeze appears to be coming to an end.

On Brexit, management stated:We can see no evidence that [the current] uncertainty is affecting consumer behavior in our sector. It appears to us that consumer behaviour (in our sector) will only be materially changed if the UK’s departure from the EU (or continued uncertainty around this subject) begins to affect employment, prices or earnings.

Next outlined the following guidance for FY20:- Total full-price sales to increase 1.7% year over year.

- Full-price retail sales (including sales from new space) to fall 8.5% year over year, while full-price online sales grow 11% year over year.

- Finance interest income to grow 9.9% year over year.

- EPS to grow 3.6% year over year to £4.49.