Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

FY18 Results

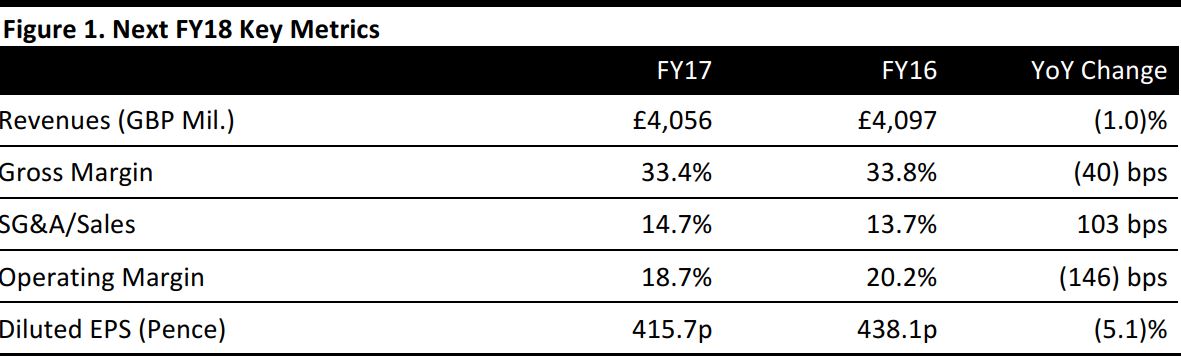

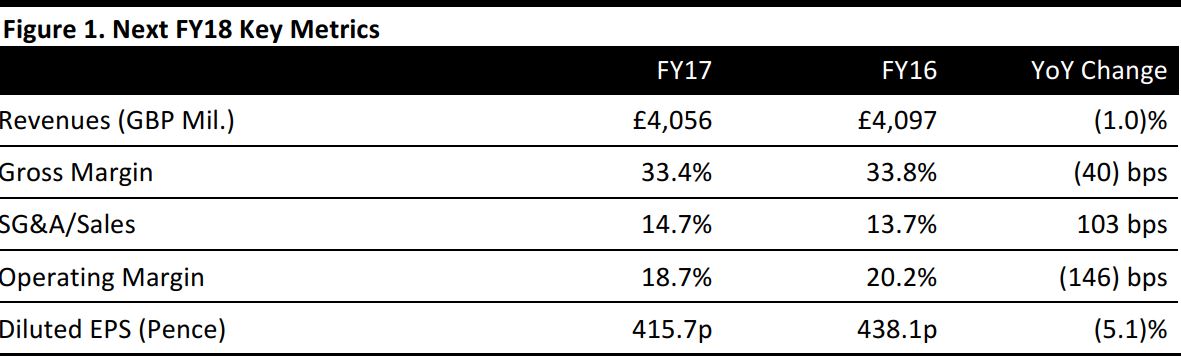

Next reported a weak set of results for FY18 and its CEO Simon Wolfson noted that, “in many ways, 2017 was the most challenging year we have faced for 25 years.”Wolfson pointed to British shoppers prioritizing leisure services over apparel and stated that, “we are not anticipating any easing of this headwind in the year ahead.”

Heavy declines in store-based comparable sales were a particular drag on profits in the year ended January 2018. However, top- and bottom-line figures were broadly in line with consensus expectations.

- Statutory revenues were down 1.0% in total, as shown in the table above.

- Revenues at Next Retail, which represents in-store sales, were down 7.9% to £2.1 billion. Net new space contributed 2.0% to total Next Retail sales, implying that store-based comparable sales were down by a hefty 9.9%. Retail’s full-price comparable sales were down 9.1%.

- Next Retail operating profit fell 24.0%, yielding a segment operating margin of 12.7%, down sharply from 15.3% in the prior year. The deleveraging of fixed store costs impacted meaningfully on margins.

- Revenues at Next Online (formerly Directory) were up 9.2% to £1.9 billion. Segment operating profit climbed by 7.4%, yielding a margin of 24.4% versus 24.8% one year earlier.

- At the group level, key metrics were in line with consensus. Total nonstatutory Next Group sales came in at £4.12 billion, down 0.5% year over. EBIT of £759.9 was down 8.2% and pretax profit of £726.1 was down 8.1% year over year.

Label, Overseas and Cash Customers Drive Online Growth

Online, Next’s multi brand Label business and overseas shoppers were the drivers of sales growth: Label sales were up 42.7% and overseas sales were up 25.5%. Next Brand UK online sales, by contrast, were up only 1.6%.

Active online customer growth was skewed toward customers paying cash as opposed to buying on credit. Cash shopper numbers were up 8% and Credit shopper numbers were flat. Overseas shopper numbers were up 10%.

The company changed its cost allocation for online orders fulfilled in-store. The cost per parcel was increased from 57 pence to 89 pence, and this contributed a small uplift to Retail margins and exerted minor downward pressure on Online margins.

The company closed a net 10 stores in the year, taking its portfolio to 528 stores at January 2018.

Outlook

Management stated that it is in discussions with a travel operator, branded footwear concession and cosmetics concession to bring these services into its stores. It plans to open 98 concessions in its stores in FY19, yielding annualized income of around£5 million.

Management issued the following guidance for FY19:

- Total group full-price sales growth of 1.0%, split total Retail full-price sales growth of (7.4)% and Online full-price sales growth of 10.3%.

- Retail full-price comparable sales growth of (8.5)%.

- Pretax profit of £705 million, down 2.9% year over year, as operational costs grow faster than sales.

- EPS growth of 1.4% year over year, which includes a 4.3% enhancement as a result of share buybacks.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research