DIpil Das

Source: Company reports/Coresight Research[/caption]

1H20 Results

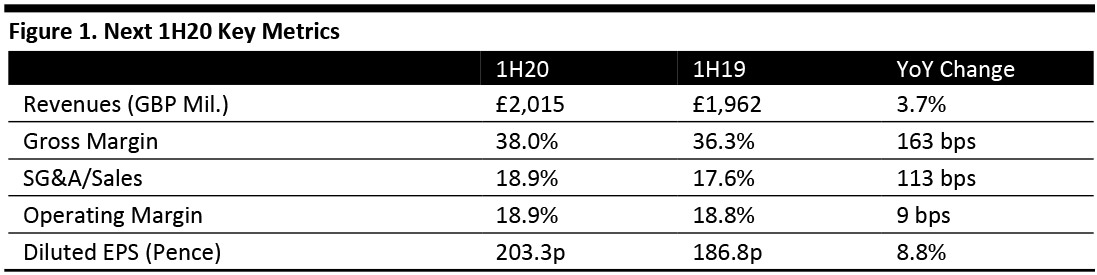

Next reported 1H20 revenues marginally lower than the consensus estimate while EPS was 3.8% higher than expectations. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1H20 Results

Next reported 1H20 revenues marginally lower than the consensus estimate while EPS was 3.8% higher than expectations. The highlights are as follows:

- Next grew revenues 3.7% year over year to £2.014 billion, with growth in the online and finance segments offset by a decline in the retail (in-store sales) segment.

- Operating profit of £380.8 million was up 15% year over year, ahead of consensus estimate of £330.9 million. Operating margin increased by 9 bps year over year to 18.9%. This growth was mainly due to strong performance by Online segment.

- Pretax profit of £319.6 million was up 0.3% year over year and ahead of consensus of £318.6 million.

- The company reported diluted EPS of 203.3p, up 8.8% year over year, and higher than the consensus estimate of 195.8 pence recorded by StreetAccount.

- Sales fell 5.5% to £874.3 million, while operating profit declined 23.5% to £56 million.

- Comparable full-price sales fell only by 4.9%, less than company’s initial expectation . The company believes better sales performance was due to improvement in stock availability in stores.

- Full-price sales were down 3.9%, better than the 8.5% decline estimated by management in March 2019. New space contributed 1.0% to full-price sales growth.

- To improve stock availability and speed delivery, Next has taken several initiatives such as increasing store deliveries from 1,350 per week to 1,850, readjusting delivery staff shift timings to coincide more closely with the arrival of new stock and stepping up management focus on reducing delivery backlogs.

- Net retail space increased 100,000 square feet (9,290 square meters) in 1H20, taking trading space to 8.4 million square feet (0.8 million square meters).

- The company continued to post robust online performance as online segment sales grew 12.6% year over year to £1,004.9 million, including markdowns.

- Full price sales grew 11.9%.

- Online operating profit grew 17.6% year over year to £177.1 million.

- Total Online UK full price sales grew 9.3% while overseas full-price online sales grew 20.7%.

- NEXT Brand UK accounted for 60% of the segment’s total operating profits and posted operating profits of £107 million, with a net margin of 19.5%.

- Label UK reported operating profit of £33.5 million, with a net margin of 14.2%.

- Operating profits from the overseas segment was £36.6 million, with a net margin of 16.7%.

- Average active customers increased 13.6% year over year to 5.9 million, led by overseas and UK cash customers.

- Finance segment revenues grew 9.9% year over year to £134 million.

- Finance segment net profit was up 24.6% year over year to £75.8 million.

Real earnings in the UK have remained positive since January 2018. Employment levels have also grown, meaning there are more people earning more money, in real terms, than last year. So, the fundamentals of the UK consumer economy are not unhealthy and aside from any potential impact from a no-deal Brexit, we can see nothing in the UK economic data to suggest that spending habits will be much different from how they were during the first half.

On Brexit, management stated:It is very hard to determine whether the uncertainty over Brexit is having any effect on consumer spending and we can find no evidence that it is affecting spending on small-ticket price items. Our view is that Brexit will only materially affect consumer spending in the event that it triggers inflationary pressure on prices or logistical problems at our ports.

Management said that a no-deal Brexit would result in a fall in tariffs on imported clothing, under the UK government’s temporary tariff regime, and this would reduce the cost of goods by around 2%; Next said it would pass these savings on to customers. Next outlined the following guidance for 2H20:- Total full-price sales including interest income to rise 3.0%.

- Full-price Retail sales including sales from new space to fall 6.2% year over year, while online sales will grow 11.8% year over year.

- Finance interest income to grow 6.5% year over year.