Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

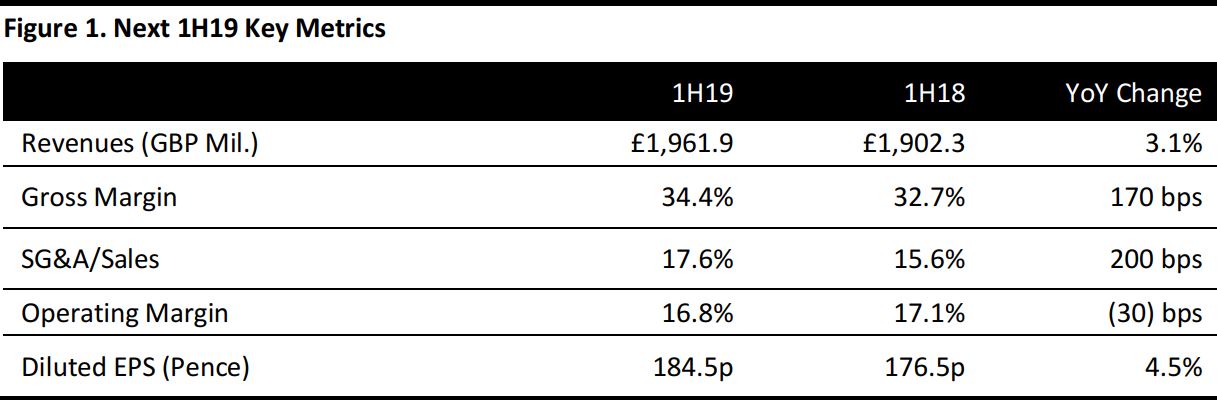

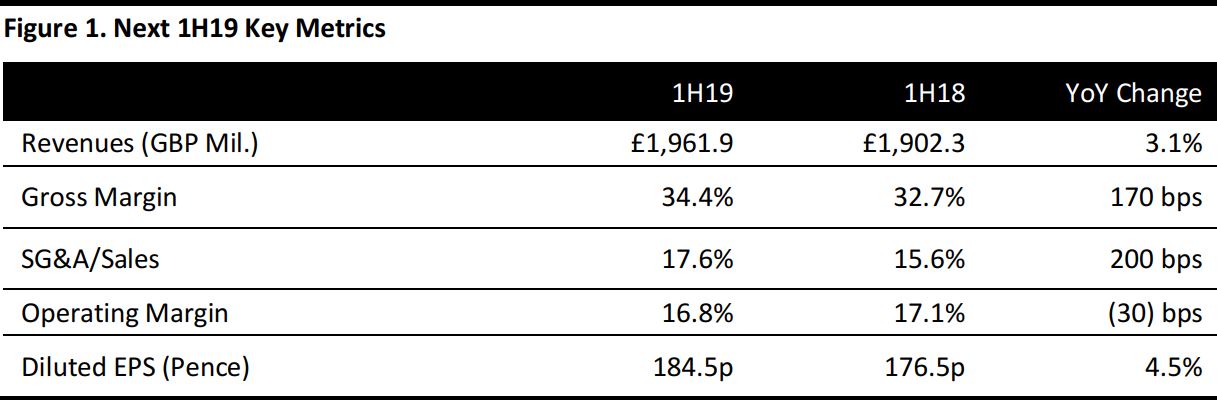

1H19 Results

Next announced absolute sales and profit data for 1H19 on September 27. The company had already announced 2Q19 and 1H19 revenue growth

on August 1.

From 1H19, Next will be breaking out its reporting into three segments—Retail, Online and Finance (Next’s line of business which provides credit of £1.1 billion to its customers for purchases made online and in-store). Previously, the company had consolidated its Finance and Online businesses for reporting purposes. Next said that it is splitting these out to provide greater clarity on the underlying performance of both the Finance and Online (product) businesses.

The latest announcement provided the following additional details about performance in 1H19:

- The company grew revenues by 3.1% year over year to £1,961.9 million, led by double-digit growth in the Online and Finance segments, offset by a decline in Next Retail sales.

- Gross margin expanded 170 basis points year over year to 34.4%. Improved underlying bought-in margins helped gross margin growth in Retail and Online by 0.2%. Better clearance rates and greater participation of full price sales expanded Retail gross margin by 1.1% and Online gross margin by 0.9%.

- Operating profits grew by 1.6% year over year to £330.5 million and the operating margin contracted 30 basis points year over year to 16.8%, owing to an increase in selling, general, and administrative costs. Increased rates of pay and incentives for store staff and falling like-for-like sales amplifying store occupancy costs weighed on Retail margins. Growth in overseas sales (which cost more to distribute) and third-party branded sales (which have a lower bought-in gross margin) eroded Online margins and offset growth prompted from other areas such as improved clearance rates, increased full price sales and producing fewer catalogs.

- Diluted EPS was 184.5 pence, up 4.5% year over year and broadly in line with the consensus estimates of 184.7 pence.

Segmental Sales Breakdown

Retail: Retail, which is Next’s in-store sales segment, showed a sluggish performance as sales fell 6.9% year over year to £925 million, while operating profits fell 23% year over year to £73.2 million. Next reported a full-price Retail sales decline of 5.3% and said that it was 1.7% ahead of the company’s initial expectations for 1H19. Sales from net new space contributed 0.7% of growth.

Online: The company continued to post robust online performance as online sales surged 16.8% year over year to £892.3 million, representing 46% of total sales, while segment operating profits grew 21.2% year over year to £163.3 million. Next grew full-price Online sales by 16.0%.

Within the Online segment, Next Brand UK’s full-price sales grew by 11.5%, while Label UK’s sales grew 24.2%. Overseas sales surged 22%, as the company increased the breadth of its offers available to customers shopping online.

Outlook

Next guided for FY19 full price sales to grow 3% year over year. Among the segments, the company expects to grow Online sales by 13.2% and Finance revenues by 12.8%. Next expects Retail sales, including sales from new space, to drop by 6%.

The company expects its retail space to increase by 0.5% year over year to 8.3 million square feet. Because of poor in-store sales, Next plans to close seven of its clearance stores and 15 mainline stores in the current year.

Next upgraded its full year EPS growth guidance to 5% from the 3.7% guidance given in May. The company also raised its central guidance for full year pre-tax profits by £10 million to £727 million, almost in line with last year’s £726.1 million.

As part of its four-year £200 million capex program to improve warehousing and infrastructure, the company will launch a £30 million automated storage-and-retrieval-system project to process returns from customers and a £15 million project to expand forward picking areas for boxed stock.

Analysts expect full year revenues to grow by 1.7% and adjusted EPS to increase by 3.1%.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research