Source: Company reports/FGRT

1H17 Results

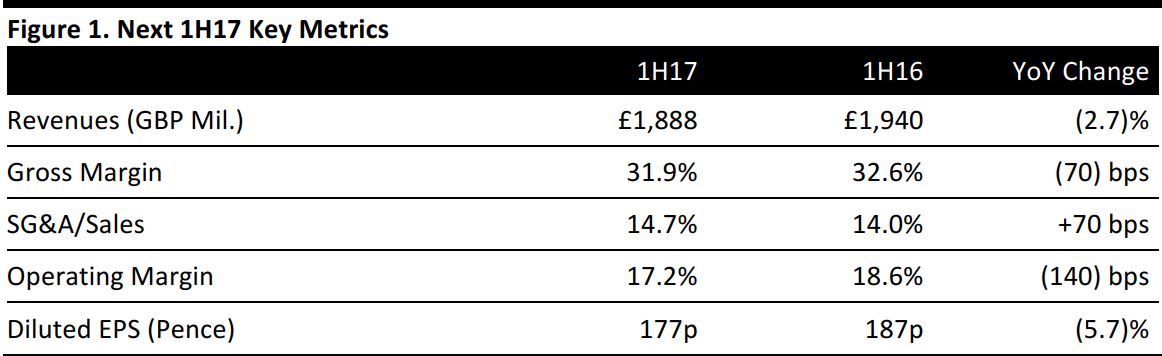

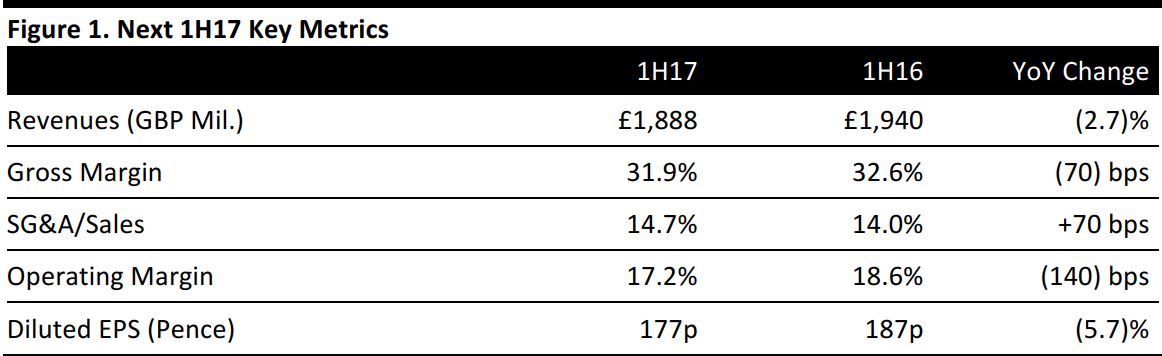

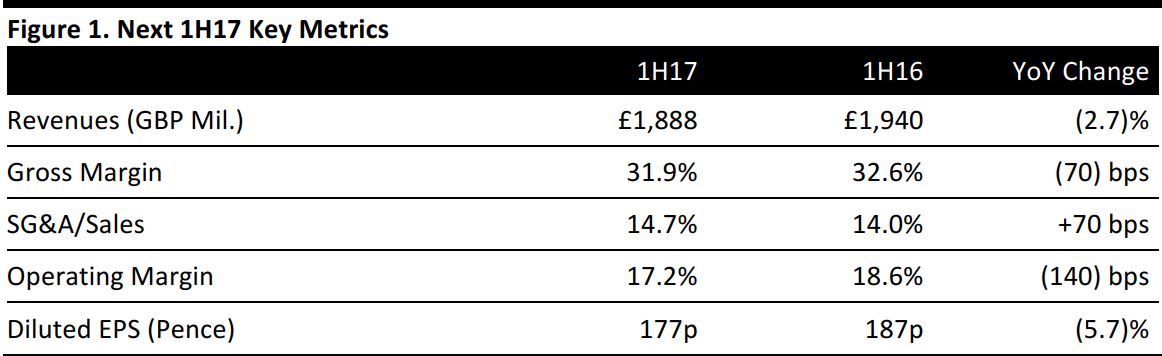

British fashion retailer Next reported £1,888 million in group revenues in 1H17, down 2.7% year over year and above the consensus estimate. Retail store sales declined 8.3% year over year, reflecting meaningful sales erosion.

1H17 gross margin contracted 70 bps year over year to 31.9%, while the SG&A margin expanded 70 bps to 14.7%. Diluted EPS for the first half was 177 pence, down 5.7% year over year and above the consensus estimate of 165 pence.

Segmental Sales Breakdown

Next Retail: In 1H17, Next Retail segment sales declined 8.3% to £2,305 million, with space growth contributing 2.5%, pointing to a retail store comparable sales decline of 10.8%. Retail operating profit margin contracted by 340 bps to 9.0% year over year. The Retail segment reflects in-store sales.

Next Directory: Sales for Next Directory increased 5.7% to £868 million in 1H17, with full-price sales growth of 7.4%. Directory operating profit margin expanded 10 bps year over year to 25.0%. Directory includes online and catalog sales.

Next Brand: The overall growth of the Retail and Directory segments, which the company terms as the Next Brand, declined 2.3% year over year to £1,862 million in 1H17.

Guidance

The company commented on the challenging environment facing the industry: inflation, declining real incomes and a sectorial trend of consumers shifting spending away from clothing to experience-based spending.

In FY17, Next expects total full-price sales growth to be between (2.0)% and +1.5%. The company expects FY17 PBT in the range of £687–£747 million, for year-over-growth of between (13.1)% and (5.5)%. EPS growth for FY17 is expected to fall between (10.9)% and (3.1)%.

The FY17 revenue consensus estimate stands at £4,096 million, implying an annual year-over-year decline of 1.0%. Consensus expects PBT of £717 million, implying a year-over-year decline of 9.3%. The consensus EPS estimate for FY17 stands at 402 pence, implying a year-over-year decline of 7.0%.