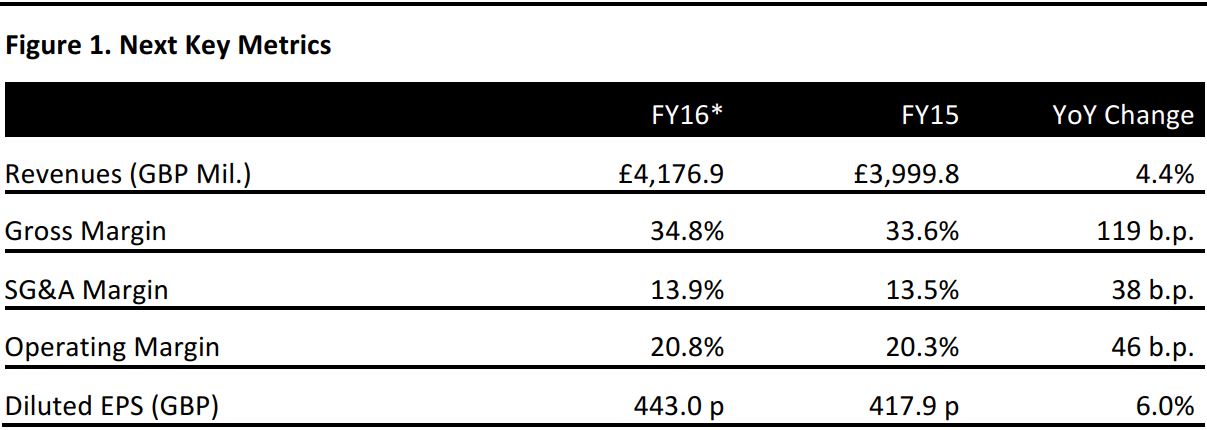

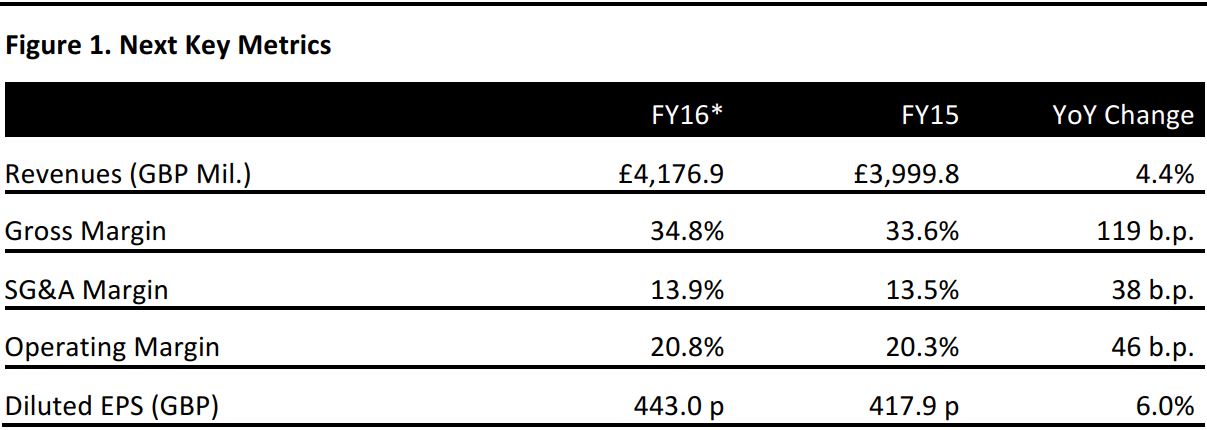

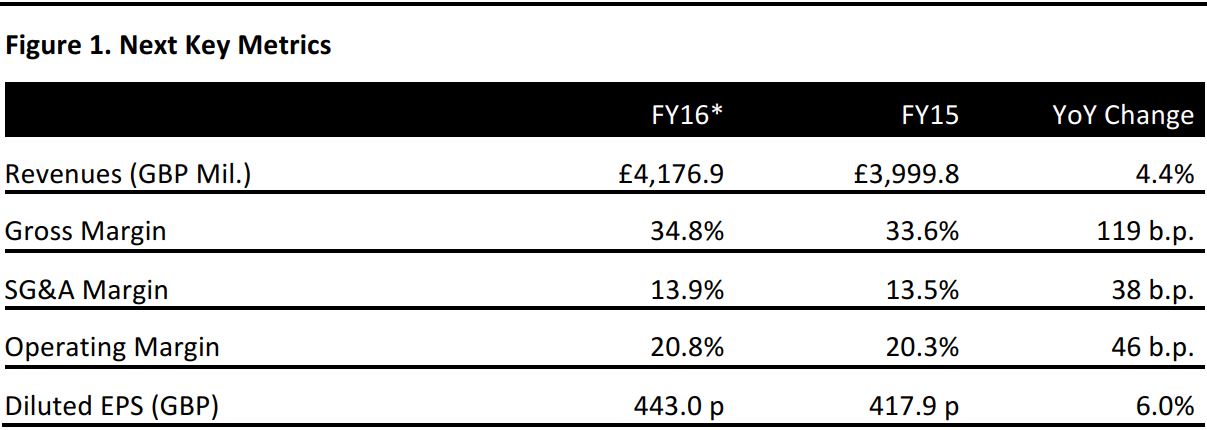

*53 weeks to January 30, 2016 vs. 52 weeks to January 24, 2015.

Source: Company reports

FY16 RESULTS

British fashion retailer Next reported £4,176.9 million in group revenues, in the 53 weeks ending January 30, 2016, beating the consensus estimate of £4,141.6 million and up 4.4% from £3,999.8 million in the 52 weeks to January 24, 2015.

The SG&A margin increased by 40 basis points, from 13.5% in FY15 to 13.9% in FY16. The operating margin improved by 50 basis points from 20.3% in FY15 to 20.8% in FY16. Diluted EPS was 443 pence for FY16, up 6.0% from 417.9 pence in FY15 and beating the consensus estimate of 431 pence.

SEGMENTAL SALES BREAKDOWN

In the comparable 52 weeks of both years, the Next Retail segment sales grew 1.1% from £2,348.2 million to £2,373.5 million. Next Directory sales exhibited a stronger growth of 7.7%, from £1,540.6 million inFY15 to £1,658.7 million in FY16, driven mainly by the 21.2% full price sales growth of Next’s Label brand in the UK. The overall growth of the Retail and Directory segments, which the company terms as the NextBrand, was 3.7% from £3,888.8 in FY15 to £4,032.2 million.

The company noted that its buying teams overachieved their target margins in the spring and summer seasons, which led to the improvement in the Next Retail segment sales. The company added that it is doing a great deal to improve technology for customers buying through its Directory channel. It stated that the share of orders by value, placed from desktops, fell from 95% in 2010 to 37% in 2015, with the majority of the orders last year placed through tablets and phones. It has introduced a mobile version of its website, for customers who access it through their phones.

On a comparable 52-week basis, sales in the Next International segment fell 13.4% from £86.2 million in FY15 to £74.7 million in FY16. The company noted that it was unable to find profitable advertising methods for its international customers until recently. Since it has now found some success with online advertising in certain countries, it intends to invest £3 million in its online marketing efforts overseas.

Also on a 52-week basis, Lipsy’s sales grew by 1.7% from £73 million in FY15 to £74.3 million in FY16, despite the loss of a big wholesale customer that went into administration, as noted by the company.

SOURCING CHANGES

Two sourcing changes were noted by Next. First, it is placing an emphasis on the development and direct sourcing of better fabric, yarn, trims, and embellishment for long lead time products; this will involve buying fabrics and yarns before the company knows exactly what garments they will be used for. Second, Next is accelerating the decision-making process for short lead time products that are sourced closer to home; this involves encouraging buying and merchandizing teams to make decisions outside formal selection meetings.

GUIDANCE

Lord Wolfson, the Chief Executive, noted that the year ahead may be the toughest that Next has faced since 2008. Keeping in mind the recent patterns in consumer spending, the company noted that “growth in experience related expenditure such as eating out, travel and recreation was much stronger” than growth in spending on clothing according to national statistics data for the third quarter of 2015.

To this effect, the company expects total full price sales growth of the NextBrand to be in the range of -1.0% to +4.0% in FY17. At the mid-point of 1.5% of the guidance range, Next Brand sales are expected to be £4,092.7 million, lower than the current consensus estimate of £4,297.9 million.

Lord Wolfson added that “it may well feel like walking up the down escalator,” considering the economic challenges in the year ahead, but the company is clear and determined about its goals for the coming year. Next’s first quarter trading update is scheduled for May 4, 2016.