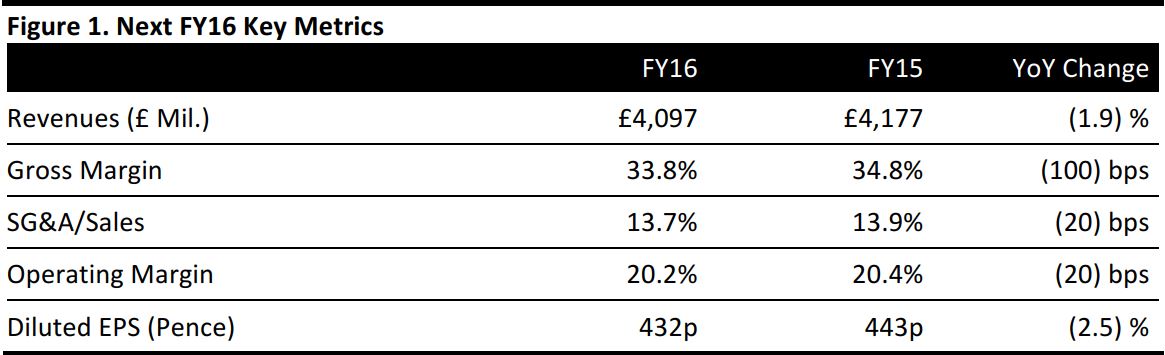

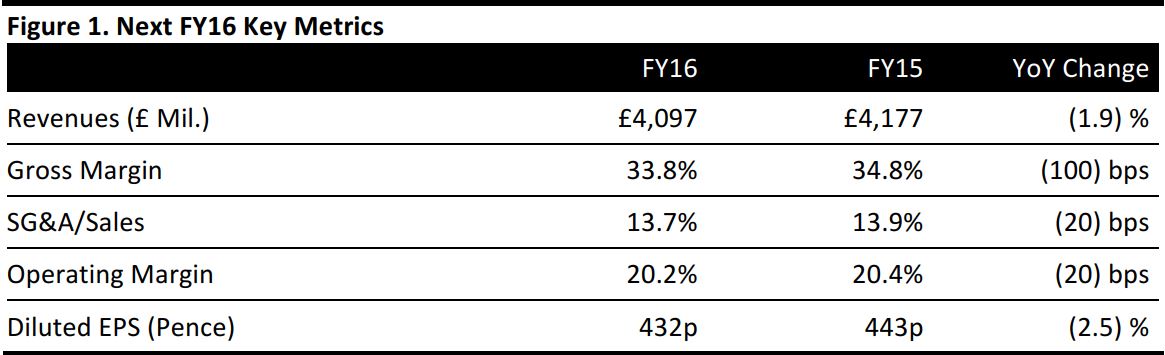

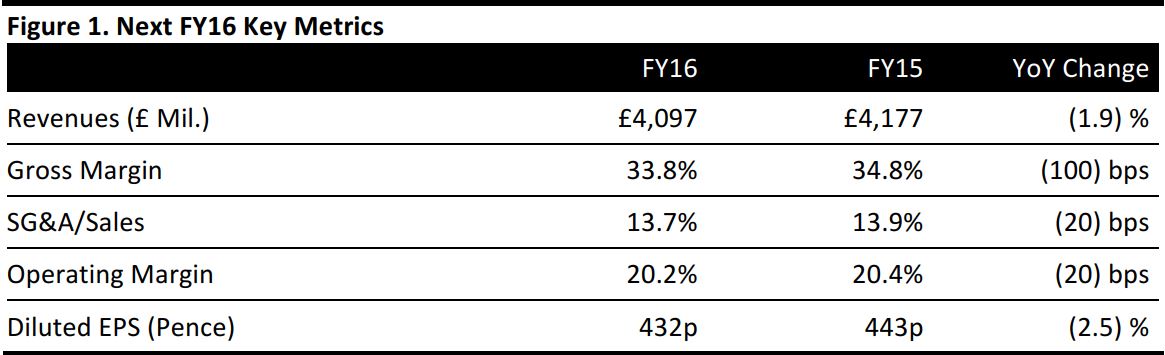

Years ended January 28, 2017, and January 30, 2016. FY15 was 53 weeks.

Source: Company reports/Fung Global Retail & Technology

FY16 Results

For the year ended January 28, 2017, British fashion retailer Next reported £4,097 million in group revenues, down 1.9% year over year and below the consensus estimate of £4,157 million.Retail store comparable sales declined 5.4% year over year, reflecting meaningful sales erosion.

FY15 was 53 weeks. On a 52-week basis, group revenues were down 0.3% fin FY16.

The FY16 gross margin contracted 100 bps year over year to 33.8%. The SG&A margin contracted by 20 bps to 13.7% in FY16. Diluted EPS was 432 pence for FY16, down 2.5% year over year and below the consensus estimate of 433 pence.

Segmental Sales Breakdown

The figures below are on a 52-week basis.

In FY16, Next Retail segment sales declined 2.9% to £2,305 million, with space growth contributing 2.5%, pointing to a retail store comparable sales decline of 5.4%. Retail operating profit margin contracted by 220 bps to 14.7% year over year. The Retail segment includes store-based sales only.

Next Directory sales increased 4.2% to £1,729 million for the year, with full-price sales growth of 3.6%. Directory operating profit margin expanded 130 bps year over year to 25.7%. Directory includes online and catalog sales.

Overall growth of the Retail and Directory segments, which the company terms as the Next Brand, was flat year over year, at £4,033 million in FY16.

Guidance

Next remains very cautious about the outlook for the year ahead, citing a sector-wide trend of consumers shifting spending away from clothing, price inflation and weaker real incomes.

In FY17, the company expects total full-price, constant-currency sales growth of the Next Brand in the range of (4.5)% to +1.5%. The company guides for FY17 profit before tax (PBT) of £680–£780 million, equating to a fall of between 1.3% and 13.9%. EPS growth for FY17 is expected at between (12.4)% and +0.5%.

FY17 revenue consensus estimates stand at £4,123 million, implying annual year-over-year growth of 0.6%. Consensus expects PBT at £728 million, implying a year-over-year decline of 7.9%. The FY17 consensus EPS estimate stands at 406 pence, implying a year-over-year decline of 6.0%.