Nitheesh NH

Introduction: Brands and Retailers Are Adopting New Beauty Retail Models

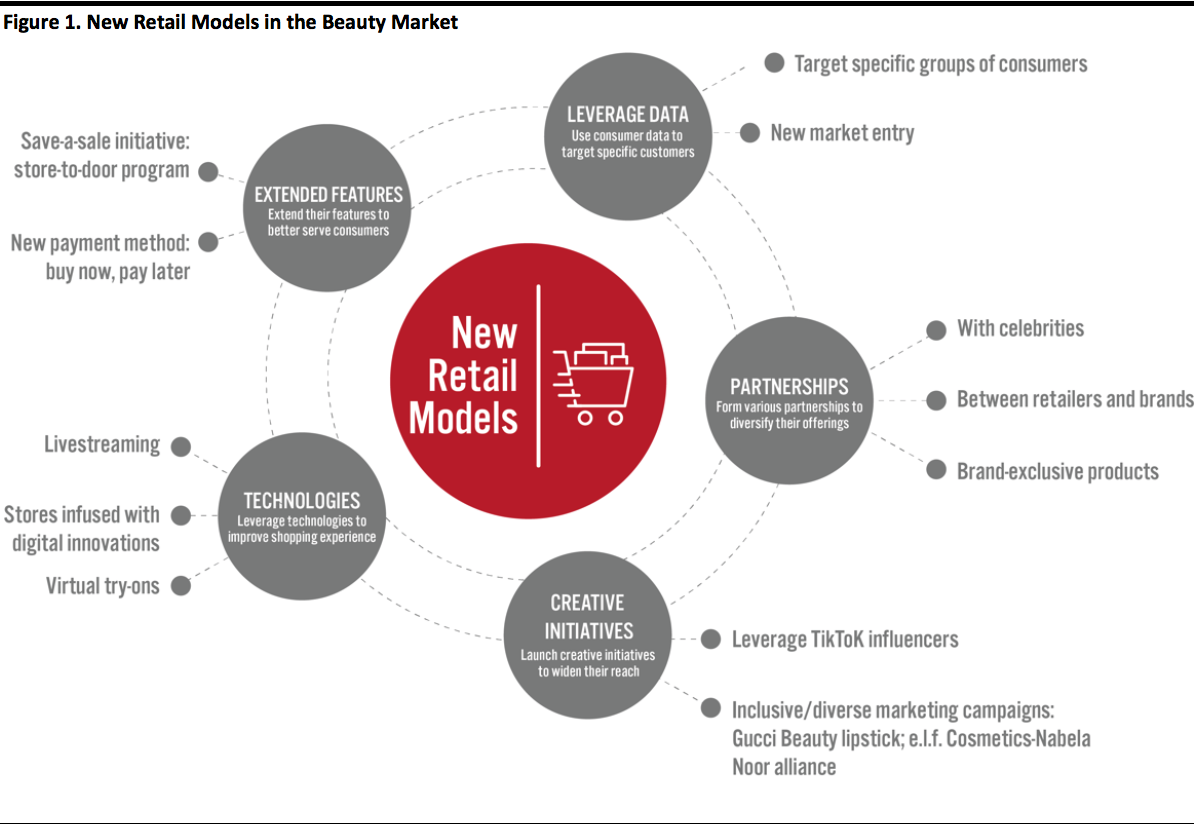

Beauty brands and retailers must constantly adapt to consumer trends and shopping habits to survive in the competitive beauty retail landscape. By adopting new retail models, companies can offer convenience and flexibility in product fulfillment. In this report, we assess how beauty brands and retailers are developing new capabilities to innovate ways of selling, and we offer a notable use case of each. Strategies include using technologies to upgrade commerce channels and strengthen current offerings, providing new features, forming partnerships, launching creative initiatives and leveraging consumer data to achieve more effective targeted marketing. [caption id="attachment_107244" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Using Technologies To Enhance the Customer Experience

In today’s digital age, beauty consumers expect to have a high level of online interaction with brands, retailers and other shoppers; they expect ease and comfort with the brands they shop. Brands and retailers are embracing new technologies to meet this demand by developing innovative ways of selling. Livestreaming Functions Help Build Transparency and Trust with Shoppers A number of beauty brands have introduced livestreaming into their marketing campaigns, and users are able to purchase items directly through embedded links in the videos. Livestream shopping is particularly popular in China, partly due to major e-commerce players such as Alibaba and JD.com integrating this functionality into their platforms. L’Oréal launched a livestreaming channel on Alibaba’s Taobao/Tmall for the pre-sale period of Singles’ Day 2019. The channel was open for 17 hours each day, and on average, more than 300,000 people watched each live session. In total, L’Oréal served more than 10.34 million orders over 392 livestreaming hours. [caption id="attachment_107222" align="aligncenter" width="520"] L’Oréal’s livestreaming channels for Singles’ Day 2019 in China

L’Oréal’s livestreaming channels for Singles’ Day 2019 in ChinaSource: Alizila[/caption] The success of this livestreaming campaign built on L’Oréal’s efforts in 2018, when it turned Cannes Film Festival into a shopping opportunity for Chinese consumers by launching a “see now, buy now” livestreaming function in a WeChat mini program. To attract viewers, the beauty brand partnered with high-profile Chinese celebrities, such as Wang Yuan and Guan Xiaotong. The celebrities livestreamed their makeup routines, enabling viewers to comment on the page and directly place orders for L’Oréal products on the app while watching the videos. During the festival, L’Oréal’s livestreaming program was viewed by nearly 3 million users. Virtual Try-Ons Beauty tech platforms and service providers are using live entertainment and mobile technology to connect to consumers through meaningful interactions and gain insights into their lifestyles and preferences. Perfect Corp, the beauty technology company that owns YouCam Makeup and the YouCam Perfect apps, added a new level of interactivity to traditional fashion shows. In February 2020, Perfect Corp partnered with PRIV, an on-demand beauty service provider, to feature PRIV’s Runway Trends Collection in an interactive beauty showcase during New York Fashion Week. The collection was designed to provide a complete beauty experience, guiding consumers through product discovery and experimentation in the app to recreation in real life. As part of the alliance, the YouCam Makeup app translated runway makeup looks into an interactive, digital try-on experience, through which beauty consumers could virtually test the makeup trends that they saw during Fashion Week, which included neon eyeliner and glitter eyeshadows. The makeup looks created by users of the app were then brought to life via a physical makeover with PRIV professionals. Perfect Corp first offered an augmented-reality fashion show at the CES BeautyTech Summit in January 2017. [caption id="attachment_107224" align="aligncenter" width="520"]

Perfect Corp’s YouCam Makeup app was integrated into a runway show at CES Beautytech 2017

Perfect Corp’s YouCam Makeup app was integrated into a runway show at CES Beautytech 2017Source: Perfect Corp[/caption] Storefronts Infused with Digital Innovation Physical stores continue to be a popular retail channel (coronavirus disruption aside), and beauty companies are employing technologies to infuse digital innovations in physical stores. SK-II, the Japanese cosmetics brand of Procter & Gamble, opened a Future X Smart Store in The Shilla Duty Free at Singapore Changi Airport in May 2019. The concept was designed to enable consumers to access to the brand’s digital storefronts and was launched in several locations in Singapore, Shanghai and Tokyo in 2018. A Future X Smart Store was also opened at the CES 2019 event. The smart stores are equipped with several cameras and features technologies such as facial recognition and artificial intelligence, which can analyze users’ skin and offer personalized recommendations of beauty products. Unlike typical skin scans, no direct facial contact is needed—instead, interactive skincare walls are installed in individual booths, which digitally scan users’ faces from a distance and provide skin analysis results. Each Future X Smart Store also features a smart beauty bar, where shoppers can browse recommended skincare products privately via responsive digital screens. If someone wishes to purchase a product, a projection mapping table that detects hand motions allows them to add products to their shopping cart in real time. Beauty consumers have autonomous control over the entire experience. Since its inception, the Future X Smart Store concept has been gaining traction among consumers and influencers. SK-II’s latest Future X Smart Store at The Shilla Duty Free is designed to cater specifically to time-pressed travelers. The store consists of a Discovery Bar, Smart Product Scan and Skincare GPS. The Discovery Bar features an interactive digital interface that provides information about SK-II’s products with a single touch. The Smart Product Scan utilizes image-recognition technology to assist shoppers in locating products from their pre-flight shopping lists. The Skincare GPS signals shelf lights to illuminate on demand, enhancing convenience by enabling shoppers to find products quickly. [caption id="attachment_107229" align="aligncenter" width="520"]

The Future X Smart Store by SK-II

The Future X Smart Store by SK-IISource: P&G[/caption]

Offering Extended Features To Better Serve Shoppers

Many beauty brands and retailers have been expanding the sales and payment options they offer to consumers. “Save-a-sale” programs are enabling beauty retailers to convert customer demand to revenue when they do not have the desired products available in store. The “buy now, pay later” payment option offers more flexibility, convenience and often interest-free benefits to shoppers, further encouraging consumption. Save-a-Sale Programs Ulta Beauty’s save-a-sale initiative is its “store-to-door” program, through which products can be shipped to shoppers free of charge when they are not available in store. According to Ulta Beauty’s CEO Mary N. Dillon, the store-to-door program is improving the consumer experience, particularly as the company expands its assortment of emerging and digitally native brands, which are generally offered in limited quantities and locations. In the first quarter of fiscal year 2019, store-to-door demand increased by nearly 20% year over year, according to the company. [caption id="attachment_107230" align="aligncenter" width="520"] Ulta Beauty operates a store-to-door program

Ulta Beauty operates a store-to-door programSource: Ulta Beauty[/caption] Similarly, Japan-based personal care company Shiseido operates a save-a-sale program through its online-to-offline (O2O) initiative in China, which was announced in March 2018. The company began installing vending machine-sized electronic terminals across its stores in the country, which are equipped with the “Shiseido Official Beauty Star Product Hall” O2O platform. The platform offers a members-only benefit that allows Shiseido shoppers to order brands and products that are not available in store. Each store receives 15% of the sales revenue generated through the initiative, as an incentive to assist shoppers with ordering products online. By mid-April 2018, the equipment was installed in four Chinese stores, which together attracted over 1,000 customers and generated ¥50,000 (roughly $7,000) in two weeks, according to Shiseido. Within two months of the platform’s launch, it was established in over 230 Shiseido stores in China. “Buy Now, Pay Later” Payment Options The digital payment option “buy now, pay later” has gained popularity around the world, particularly among young consumers. Capitalizing on this trend, beauty retailers are offering financing options to encourage consumption. For example, both Sephora and Ulta Beauty partnered with financial technology company Afterpay to provide its users an option to split payment for purchases into several installments over a pre-determined period of time, without accumulating interest. This flexibility is positively influencing consumers’ purchasing decisions, especially for big-ticket items, so could lead to sales growth for these retailers. Demonstrating this, alternative payment provider Klarna reported in November 2019 that merchants in the US offering Klarna installment financing saw an average 68% increase in average order value, a 44% rise in conversion compared to payment by card, and 21% higher purchase frequency. [caption id="attachment_107231" align="aligncenter" width="520"]

Sephora has partnered with Afterpay to provide a “buy now, pay later” payment option for both online and in-store purchases

Sephora has partnered with Afterpay to provide a “buy now, pay later” payment option for both online and in-store purchasesSource: Sephora[/caption]

Embracing Cross-Channel Retail To Drive Shopper Engagement

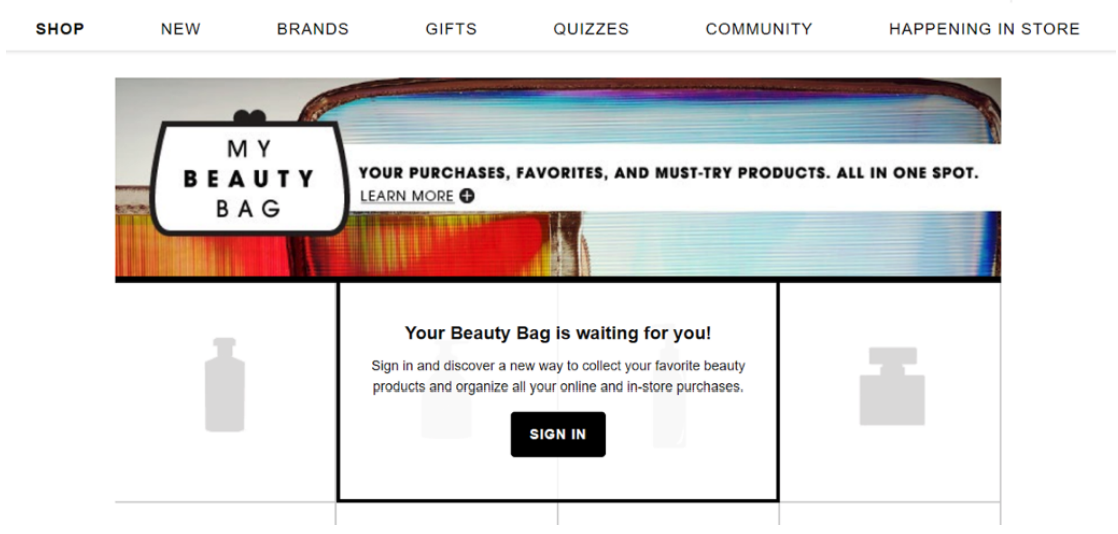

Beauty retailers are investing in cross-channel strategies to keep up with consumer demand for convenience and flexibility in product fulfillment. Sephora merged its digital and in-store merchandising teams in September 2017, which it calls “omnitude,” approaching everything from an omnichannel perspective. According to Mary Beth Laughton, EVP of Omni Retail at Sephora, cross-channel shoppers at Sephora are over three times more invested than a single-channel shopper. In January 2018, the company debuted its Store Companion app, which serves as a customer’s in-store shopping companion, storing their purchasing history and providing personalized product recommendations. As part of its Beauty Insider membership program, Sephora has also implemented a “My Beauty Bag” feature, which allows online shoppers to look up products, virtually try them on using digital software and add them to a wish list. Consumers can then access their wish lists from their mobile devices when visiting a physical Sephora store, thus driving cross-channel conversion for the retailer. [caption id="attachment_107233" align="aligncenter" width="520"] Sephora’s “My Beauty Bag” online shopping feature

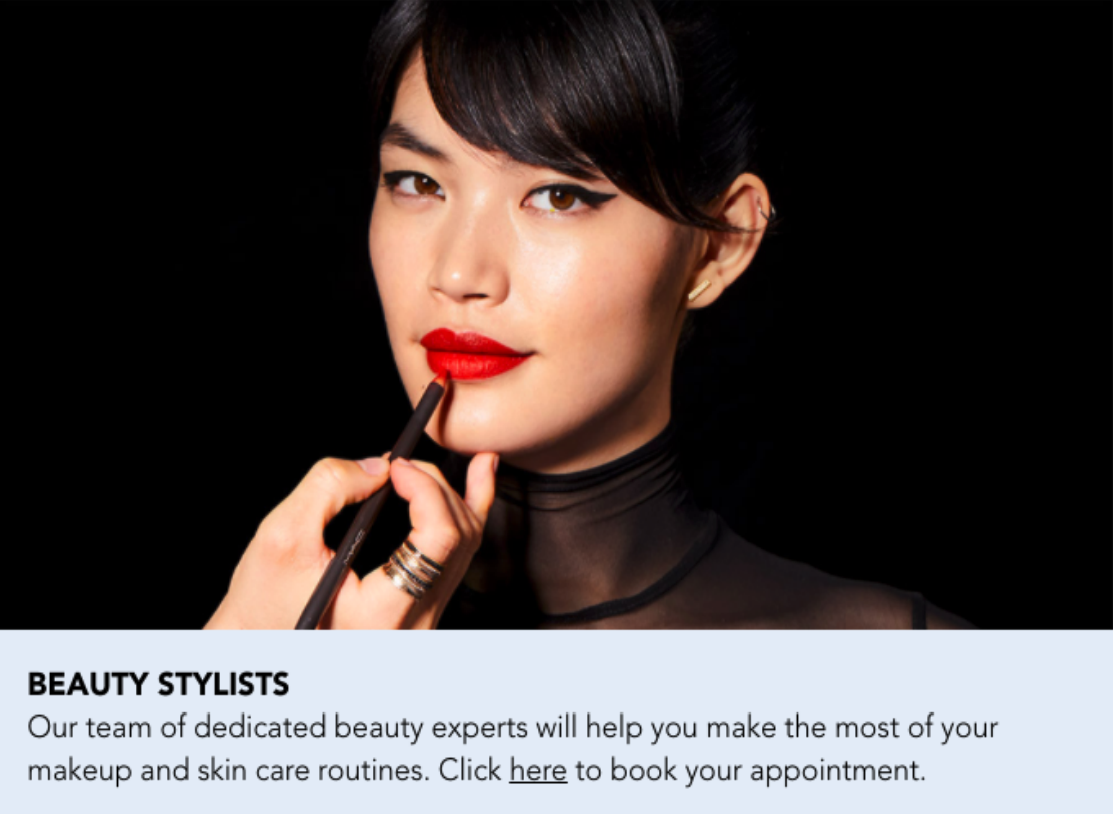

Sephora’s “My Beauty Bag” online shopping featureSource: Sephora[/caption] Ulta Beauty reported in its results for the fourth quarter of fiscal year 2019, ended February 1, 2020, “Our omnichannel guests are extremely valuable, spending nearly three times more than retail-only guests.” The company had enhanced its cross-channel capabilities with the rollout of a “buy online, pick up in store” service across all stores during the second quarter of fiscal year 2019. Dillon stated that pilot program was offered in 47 stores in late 2018, and the initial response from customers exceeded the company’s expectations. Ulta Beauty had also enhanced its mobile app and website to offer a better cross-channel shopping journey, such as by introducing a “Store Availability” function that offers visibility of in-store inventory. Bloomingdale’s—a subsidiary of Macy’s—upped its cross-channel game in January 2019 with the launch of the Beauty Stylists program, which allows consumers to make online bookings for in-store beauty consultations. Previously, shoppers had to make separate appointments for a consultation with each beauty brand, but the new program enables them to book a single slot to discover new beauty brands and receive product recommendations across all brands that the store features. The beauty assistants are brand-agonistic experts and trained makeup artists who help consumers navigate through the available products, offer makeup tutorials and provide tips on improving beauty and skincare routines. [caption id="attachment_107234" align="aligncenter" width="520"]

Bloomingdale’s Beauty Stylists program

Bloomingdale’s Beauty Stylists programSource: Bloomingdale’s[/caption]

Using Consumer Data To Target Consumers and Enter New Markets

Retailers and e-commerce platforms have a huge amount of consumer data that offers insights into purchasing behaviors and preferences. Beauty brands are leveraging this data to create customer profiles, analyze consumption characteristics and inform production plans. L’Oréal collaborated with Alibaba’s Tmall Innovation Centre (TMIC) in September 2018 as part of the brand’s consumer-to-business approach in developing a male beauty line specifically for the China market. Launched in 2017, TMIC offers guidance to brands, from discovery to design to development. Under the alliance with L’Oréal, TMIC generated data insights and an analysis of consumer trends from Alibaba’s 600 million+ customer base, which enabled the beauty brand to tailor its marketing strategies and product development to Chinese consumers, as well as form new value chains to connect products, consumers and channels. Asian retail conglomerate A.S. Watson holds data about 4 billion customers, which it uses to launch effective marketing campaigns for both small and big brands. For example, the retailer launched Unilever’s TRESemmé hair care in China in 2018 using a strategic plan informed by this data. A.S. Watson targeted its 300,000 loyalty members to announce the arrival of TRESemmé through SMS, while an additional 5 million shoppers were reached through a social media campaign on Dianping—a Chinese review and rating app. A.S. Watson said that this joint approach helped contribute to a 128% uplift in sales compared to an average week.Forming Partnerships To Diversify Offerings and Expand Operations

Beauty brands and retailers are forming partnerships to expand their offerings, unlock potential markets and enter broader retail distribution. Ulta Beauty’s Strategic Alliances with Emerging and Digitally Native Brands Ulta Beauty has built a strategy around exclusive brand collaborations and product launches, particularly with digitally native brands. Under the partnerships, brands launch products that sell exclusively on their own websites and through Ulta Beauty, with the beauty retailer providing marketing support and promotional priority in search results for brands. In turn, Ulta Beauty receives sales commission as well as potential increased traffic from an extended customer base, due to product diversity and exclusivity. The retailer’s partnerships—such as with Kylie Cosmetics, which was forged in late 2018, and with social media influencer brand Morphe before that—continue to drive store traffic and boost customer acquisitions, particularly among younger shoppers, according to Ulta Beauty’s CEO Mary Dillon. In April 2019, Ulta Beauty expanded its exclusive partnership with direct-to-consumer (DTC) hair-color company Madison Reed. Under the alliance, Ulta Beauty carries all of Madison Reed’s products—including hair-color kits, color-protecting shampoos and conditioners and hair-color primers—in 1,200 Ulta Beauty stores and online at Ulta.com. The partnership also includes Madi, a chatbot that gives customers hair-color recommendations based on computer vision technology. [caption id="attachment_107235" align="aligncenter" width="520"] Madison Reed’s products are sold on Ulta.com

Madison Reed’s products are sold on Ulta.comSource: Ulta Beauty[/caption] Shiseido’s Strategic Partnership with A.S. Watson Shiseido entered into a three-year partnership with A.S. Watson in June 2019, under which the two companies are co-developing exclusive products of brands Senka and Za, among others. In addition, A.S. Watson is helping Shiseido to expand its presence in China and other potential markets, such as Indonesia and the Philippines. According to Shiseido, the partnership also involves the companies co-developing innovations to contribute to sustainable beauty. [caption id="attachment_107236" align="aligncenter" width="520"]

Shiseido and A.S. Watson announce a three-year plan to strengthen their strategic partnership

Shiseido and A.S. Watson announce a three-year plan to strengthen their strategic partnershipSource: A.S. Watson[/caption] Clean Beauty Retailer Follain Achieves Broader Retail Distribution through Collaborations Follain, which specializes in luxury, clean beauty, entered into partnerships with Ulta Beauty and clothing retailer Anthropologie for the launch of its private-label skincare brand on March 2, 2020. Through these collaborations, Follain products were made available in 395 Ulta Beauty stores and 33 Anthropologie stores. We believe these partnerships will enable Follain to extend its reach to new customers. [caption id="attachment_107237" align="aligncenter" width="520"]

Follain’s private-label skincare products are available on Ulta.com

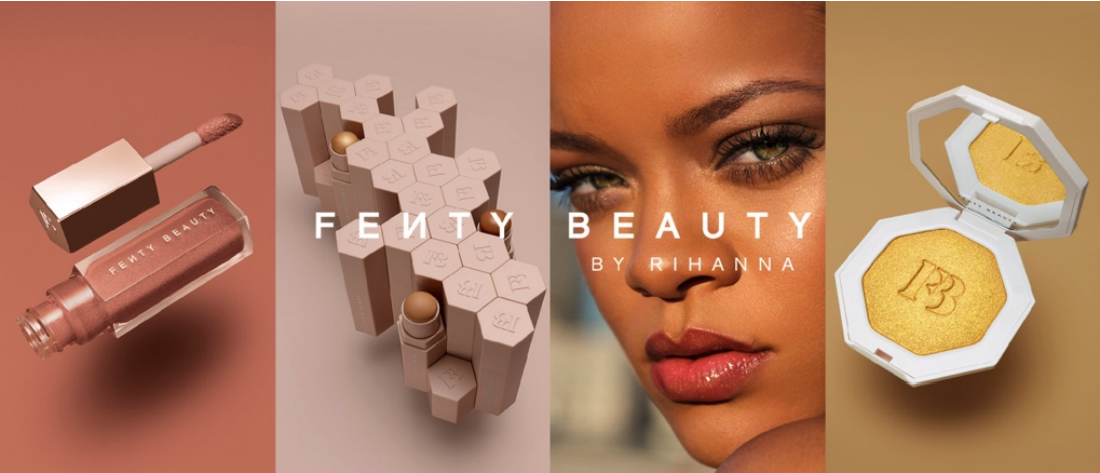

Follain’s private-label skincare products are available on Ulta.comSource: Ulta Beauty[/caption] Rihanna Partners with LVMH To Launch Fenty Beauty on a Large Scale In 2017, pop icon and fashion and beauty entrepreneur Rihanna created makeup brand Fenty Beauty in partnership with LVMH’s Kendo, the group’s incubator for beauty brands. Fenty Beauty by Rihanna unveiled 91 products exclusive to LVMH’s Sephora. LVMH provided Fenty Beauty the logistical infrastructure to launch on a global basis instantly—the brand was launched in 1,600 stores in 17 countries. Furthermore, Sephora provided Fenty Beauty with product placement and merchandising online and in store. Partnering with LVMH may have also given Rihanna access to Sephora’s sales data, which could inform key decisions regarding the launch of new product lines. By entering into a lucrative partnership with LVMH to launch her beauty brand, Rihanna took a different approach to Kylie Jenner, who launched Kylie Cosmetics online. Fenty Beauty’s revenues in the first month of operation were five times those of Kylie Cosmetics, and then 34% higher in the following month, according to online research firm Slice Intelligence. [caption id="attachment_107238" align="aligncenter" width="520"]

Fenty Beauty by Rihanna

Fenty Beauty by RihannaSource: LVMH[/caption]

Launching Social Media Video Marketing Strategies and Making Inclusive Ad Campaigns To Expand Customer Bases

Beauty brands and retailers are launching creative initiatives to introduce more innovative ways of selling, with the goal of increasing and maintaining traffic and sales growth. Examples include the use of TikTok influencers and bringing greater inclusivity and diversity in their advertising campaigns Beauty Brands are Tapping TikTok Influencers Many beauty brands, such as e.l.f Cosmetics, Estée Lauder-owned MAC Cosmetics and Nars Cosmetics, are tapping Chinese short-video app TikTok (launched in 2018 in the US) for their marketing campaigns. Beauty companies can advertise on the app through “hashtag challenges,” whereby high-profile influencers launch video trends. In October 2019, e.l.f Cosmetics launched its most influential campaign on TikTok, #EyesLipsFace, which garnered more than 4.7 billion views. [caption id="attachment_107239" align="aligncenter" width="520"] e.l.f Cosmetics’ #EyesLipsFace campaign on TikTok in October 2019

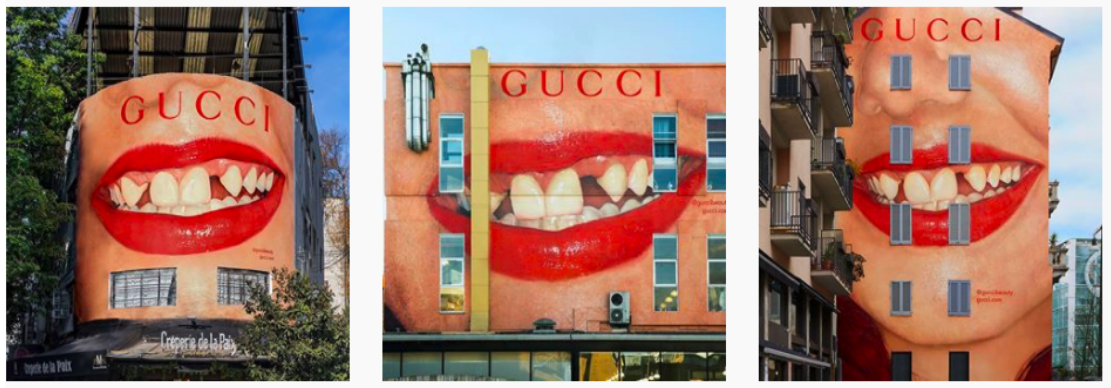

e.l.f Cosmetics’ #EyesLipsFace campaign on TikTok in October 2019Source: TikTok[/caption] Leveraging TikTok is a cost-effective way for brands to generate awareness among younger audiences. The platform is also testing new e-commerce features, including shoppable product links within videos, which will further benefit brands. In March 2020, Rihanna’s Fenty Beauty opened a “TikTok House” for beauty influencers and content creators. The house provides TikTok influencers with a location to shoot video content while trying out Fenty Beauty’s latest products. Fenty Beauty has already partnered with several influencers, such as Emmy Combs, Makayla and Savannah Palacio, who have begun creating beauty content for the brand. Making Marketing Campaigns More Inclusive and Diverse Beauty brands are bringing greater inclusivity and diversity into their advertising campaigns, in order to connect with wider audiences. Gucci Beauty’s unconventional lipstick campaign in May 2019 challenged almost every beauty standard that had previously been seen in beauty ads. The campaign promoted the brand’s line of 58 lipsticks and featured a close-up of model and singer Dani Miller’s smile, showing teeth that were neither perfectly straight nor sparkling white and had large gaps. Through this image, Gucci Beauty conveyed its message that authentic beauty lies in imperfection. The brand used this image across its social media pages and website, as well as on billboards. [caption id="attachment_107240" align="aligncenter" width="520"]

Gucci Beauty’s May 2019 lipstick campaign featured an image of an imperfect smile

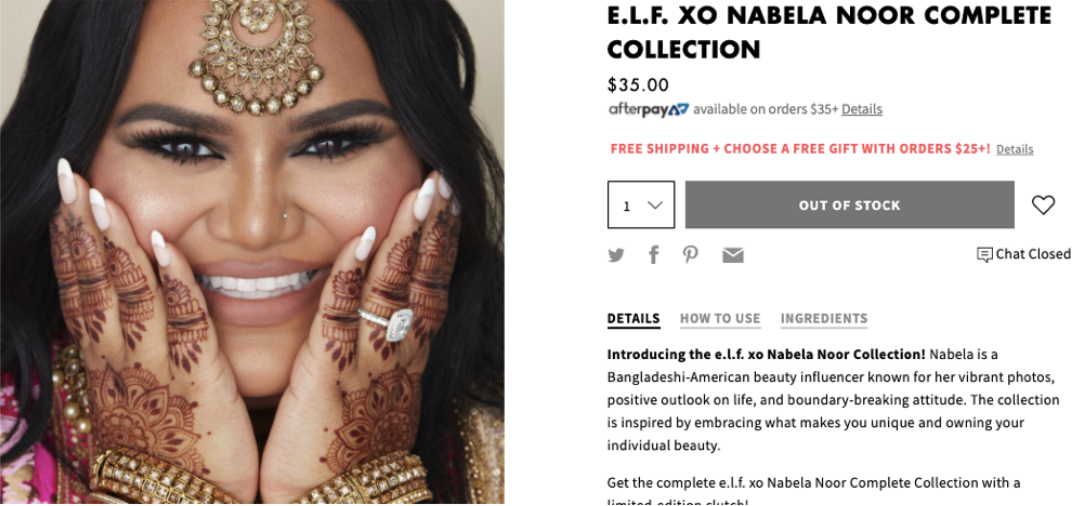

Gucci Beauty’s May 2019 lipstick campaign featured an image of an imperfect smileSource: Gucci Beauty/Instagram[/caption] e.l.f. Cosmetics has welcomed diversity in its choice of social media influencers to represent the brand’s products. In October 2019, the beauty brand partnered with Nabela Noor, a Bangladeshi-American, plus-sized influencer on YouTube who actively supports cultural inclusivity in beauty. The collaboration saw the launch of a makeup collection that celebrates Noor’s South Asian heritage, through which e.l.f. Cosmetics promoted a message of self-love and positivity to its customers. [caption id="attachment_107241" align="aligncenter" width="520"]

e.l.f. xo Nabela Noor Collection on e.l.f. Cosmetics’ website

e.l.f. xo Nabela Noor Collection on e.l.f. Cosmetics’ websiteSource: e.l.f. Cosmetics[/caption]

Adopting Social Commerce To Increase Awareness, Drive Transactions and Provide Customer Services

Social commerce has now gained true traction in beauty retail, driven by the rise in Gen-Z shoppers and developments in mobile and social technology. According to a recent Coresight Research survey on social media shopping, beauty is one of the most popular categories among US social media shoppers, with 51.5% stating that they use social media to discover beauty products or research purchases, and 41.3% using social media platforms to purchase beauty products. Through social commerce, beauty brands and retailers are personalizing the shopping experience to drive transactions and provide customer services. Social media encompasses a significant part of online beauty brand Glossier’s strategy. Its Instagram channel, which has 2.7 million followers, and its beauty blog “Into The Gloss” provide makeup tutorials, product reviews and techniques from industry leaders worldwide. The beauty brand’s Instagram channel directly connects with its DTC website, providing a frictionless shopping experience for consumers. Furthermore, Glossier leverages its beauty blog to track and analyze customers’ behavioral data using machine learning and other tools. The brand compiles and assesses queries and comments to ensure that new products are developed with shoppers’ feedback in mind. The brand is also focused on building a stronger connection with its blog readers, because consumers who read “Into The Gloss” are 40% more likely to buy products than consumers who only visit the Glossier website, according to Bryan Mahoney, the company’s Chief Technology Officer. [caption id="attachment_107242" align="aligncenter" width="520"] Glossier’s Instagram account

Glossier’s Instagram accountSource: Instagram[/caption] Sephora launched its mini program on WeChat in 2018 to boost its social commerce presence in China. Through the WeChat social retail channel, the retailer is able to communicate directly with consumers and offer product recommendations and other information to encourage purchasing. For example, through WeChat, Sephora shoppers can find out store information, book appointments and share their purchases and reviews with their social circle. When customers step into a Sephora store, they can scan a QR code using their mobile devices to access relevant information on WeChat. According to Sephora, the mini program has helped the retailer to embrace social culture in China and thus offer its Chinese customers a full social shopping experience.