DIpil Das

Introduction: The Apparel and Footwear Market Is Adapting to Changing Consumer Expectations

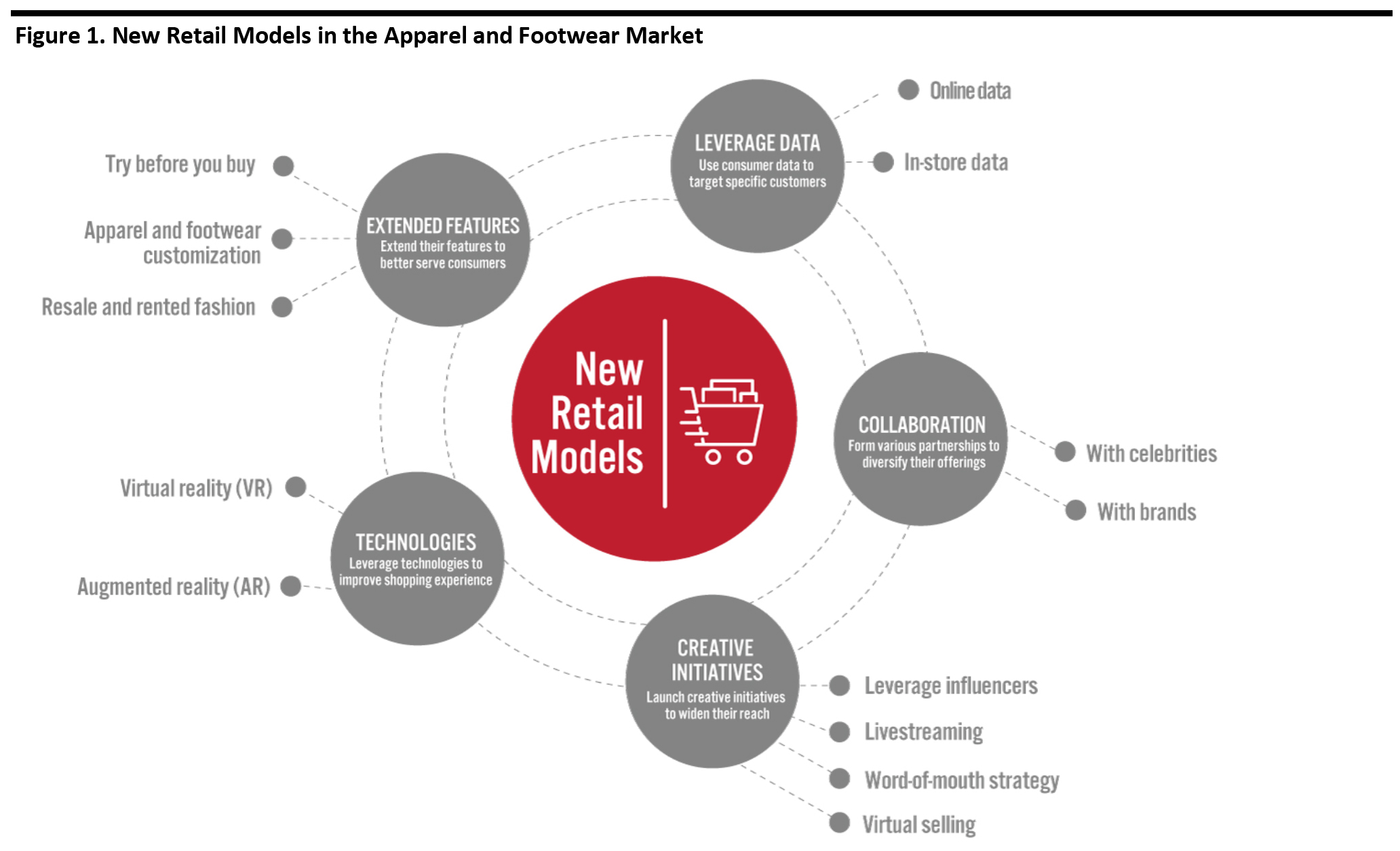

Retail is facing an increasingly complex landscape of new technologies, personalization strategies and interactions between consumers through social media. Brands and retailers are therefore adopting new retail models to meet elevated and fluctuating consumer demand, drive sales through engagement and reduce traditional pain points such as returns. In this report, we discuss how apparel and footwear brands and retailers are developing new capabilities to innovate ways of selling. Strategies include employing technologies to upgrade in-store and digital experiences, providing new features, forming collaborations, launching creative initiatives and leveraging consumer data to achieve more effective selling. [caption id="attachment_111094" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Leveraging AR and VR Technologies To Upgrade the Shopping Experience

Brands and retailers are employing new technologies to meet the shifting trends in customer behavior. Developments in AR and VR are providing opportunities to optimize consumers’ omnichannel shopping journeys and create immersive experiences for consumers—which is particularly salient in the context of recent coronavirus-led lockdowns. The global coronavirus outbreak meant that many consumers experienced a period of home quarantines, which drove housebound entertainment and shopping trends. As lockdowns ease, we expect to see VR continue to play an important role in the shopping journey, as brands look to provide new ways for consumers to engage with products before making a purchase. In the future, VR could be more broadly used in designs (enhancing CAD functionality), sales (offering more experiences for shoppers) and operations (data capture and visualization). In 2020, 46% of retailers plan to deploy AR or VR, according to Deloitte. We have already seen a number of US retailers in the apparel sector use reality technologies to provide immersive experiences for shoppers—a few examples of which we outline below.- Adidas launched a virtual try-on feature in its iOS app in 2018, helping shoppers pick out new shoe styles without needing to visit a store.

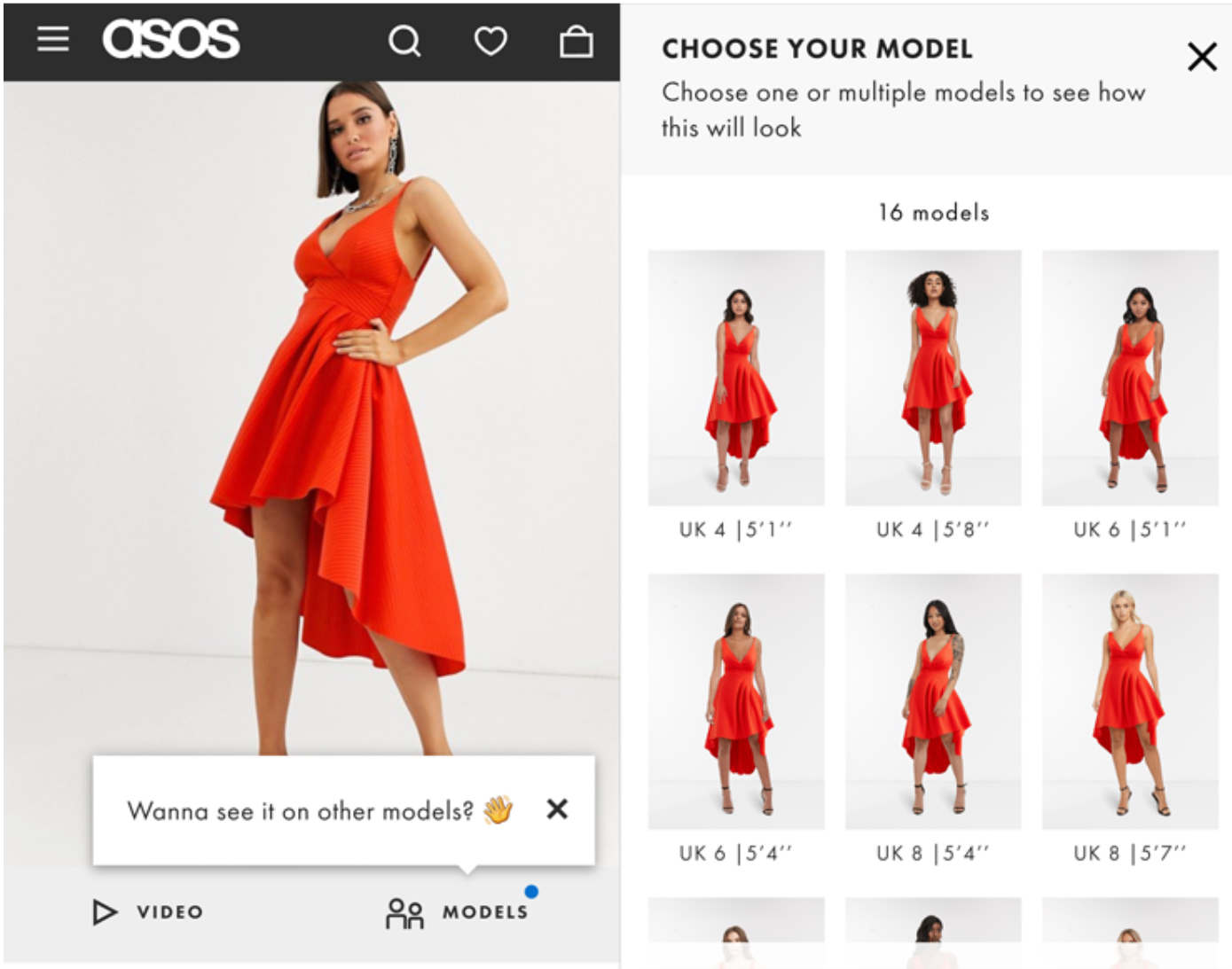

- UK-based fashion pure play ASOS scaled its size-and-fit feature “See My Fit” to offer shoppers customized views of up to 500 products each week. The tool, which was launched in collaboration with Israeli tech firm Zeekit in January 2020, allows shoppers to view the products on six real-life models to better see the cut and fit of apparel items. According to ASOS, digitally mapping products onto models provides realistic views of the clothing for consumers and removes the need for the models to come into ASOS Studios for photoshoots—supporting social distancing during the current coronavirus crisis.

ASOS’s AR tool allows shoppers to see simulated views of different models wearing the same product

ASOS’s AR tool allows shoppers to see simulated views of different models wearing the same product Source: ASOS [/caption]

- Macy’s partnered with Pinterest in May 2019 to display scannable Pincodes at gathering spots in the US, such as Central Park in New York and the Santa Monica Pier in Los Angeles. By scanning the codes, shoppers can access curated Pinterest boards that display summer fashion looks, with links to the retailer’s online store.

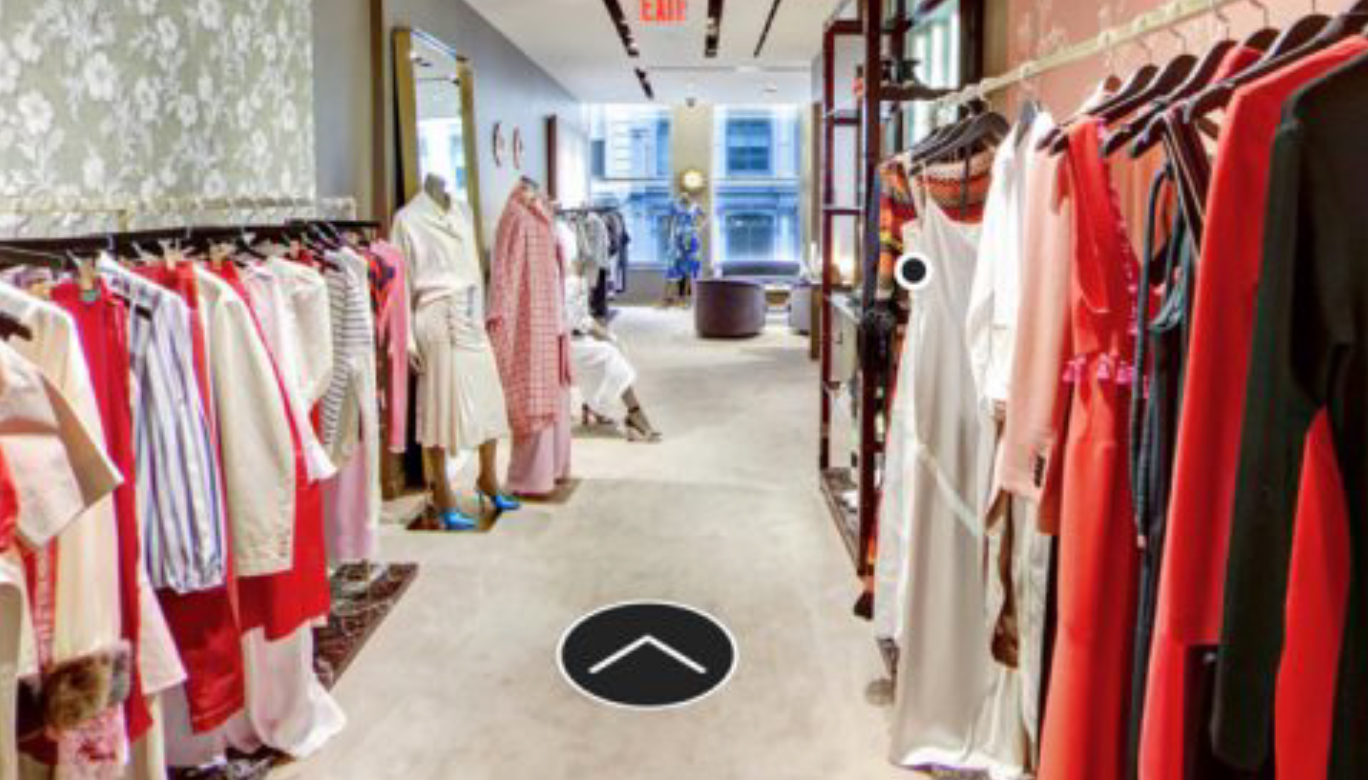

- Obsess is a shopping platform that uses AR and VR to create virtual showrooms, allowing shoppers to digitally browse the latest fashion, beauty and fitness products and view photorealistic 3D models of the items. Brands using the Obsess platform include Farfetch, Levi’s, Tommy Hilfiger and Ulta Beauty. The same technology can be used to mimic an actual physical store, offering a more authentic retail shopping experience for consumers. Obsess reported that during the coronavirus crisis, conversion rates on its virtual platforms were up to 71% higher than non-virtual stores, and product click-through rates were 20% higher.

A virtual showroom on the Obsess platform

A virtual showroom on the Obsess platform Source: Obsess [/caption]

- Austin-based activewear brand Outdoor Voices launched an AR app experience in 2018 that encouraged consumers to go outside to find virtual products in a park. Once they found the products, app users could explore 360-degree digital renderings, find out more information and purchase the products through e-commerce.

- Zara launched an AR experience in April 2018, through which users could aim their phone cameras at store display windows to see models come to life on their screens.

The Sharing Economy: Providing Extended Features or Choices To Better Serve Shoppers

Rental, subscription and resale business models have been gaining traction in the US, with more retailers offering such options and consumer acceptance increasing. We discuss three major extended options in the market that are appealing to shoppers. “Try Before You Buy” This type of product trial service allows consumers to have multiple apparel items delivered to them without incurring extra shipping costs—so that they can try on different sizes of the same item of clothing, for example. Furthermore, try-before-you-buy services incentivize more than one in three consumers (35%) to try products they had not considered before, according to the 2019 Retailer Playbook from RetailMeNot, an American coupon company. The data also showed that 63% of retailers believe that try-before-you-buy will be more popular than BOPIS (buy online, pick up in store) options within two years. Many brands and retailers—including ASOS, Stitch Fix and La Perla—have launched a try-before-you-buy feature. Given that coronavirus lockdowns are only now beginning to ease in the West, consumers may be hesitant to shop in brick-and-mortar stores and try on clothes in a fitting room. This flexible, home-delivery try-before-you-buy option could therefore appeal to shoppers in the new, low-touch retail environment. [caption id="attachment_111070" align="aligncenter" width="700"] Amazon’s Prime Wardrobe

Amazon’s Prime Wardrobe Source: Amazon [/caption] Some retailers are encouraging shoppers back to physical retail stores by implementing new measures for their fitting rooms:

- Macy’s, which is reopening stores in phases, reported that it will only open a few fitting rooms and will hold all merchandise tried on or returned for 24 hours.

- Kohl’s is keeping all fitting rooms closed until further notice and is holding returned items for 48 hours.

- Gap is not reopening its fitting rooms and is holding returned merchandise for 24 hours.

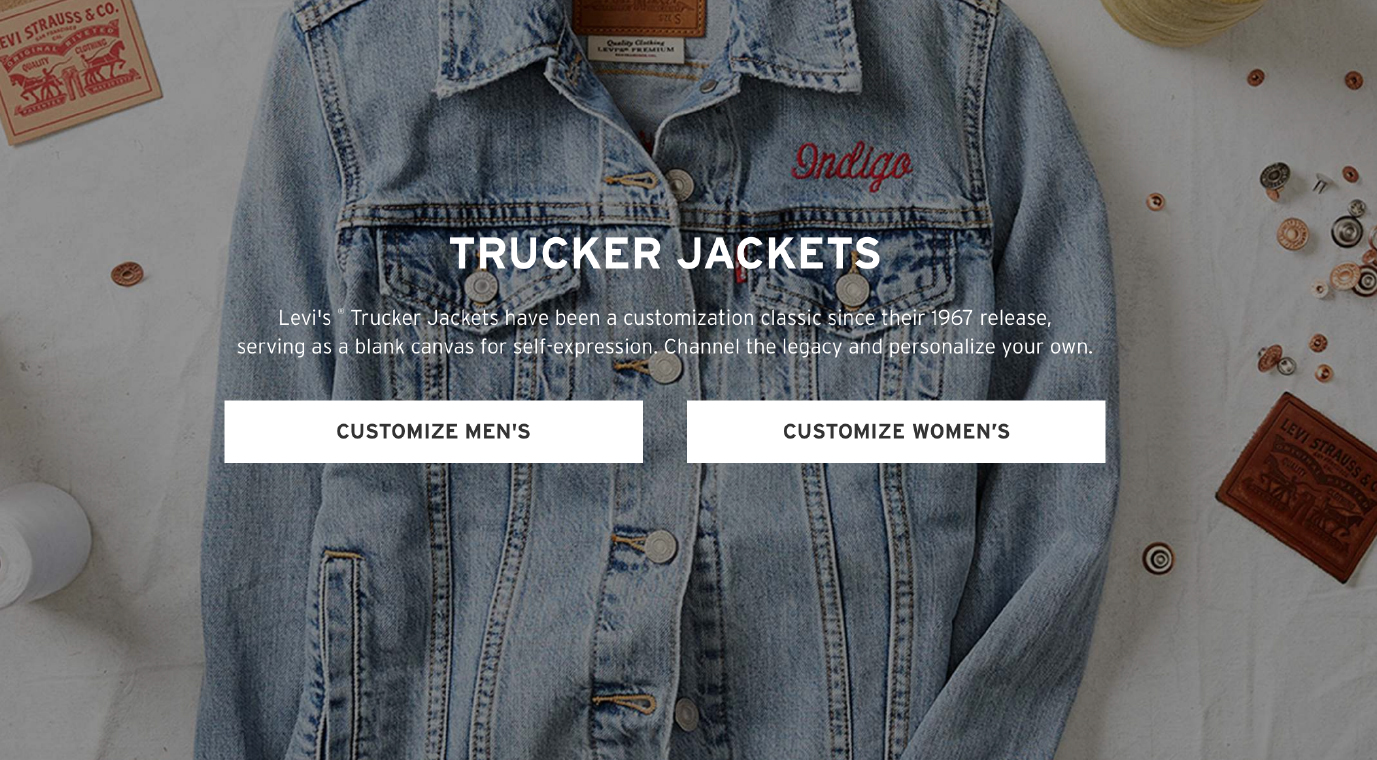

- Levi Strauss & Co. has been offering customized jeans since fall 2019. Shoppers can start by picking a base pair of unfinished jeans from one of the brand’s seven most popular fits and then choosing a light or dark denim wash. They can then customize different design features of their jeans, choosing from more than 1,000 possible design combinations.

Levi’s jeans-customization website page

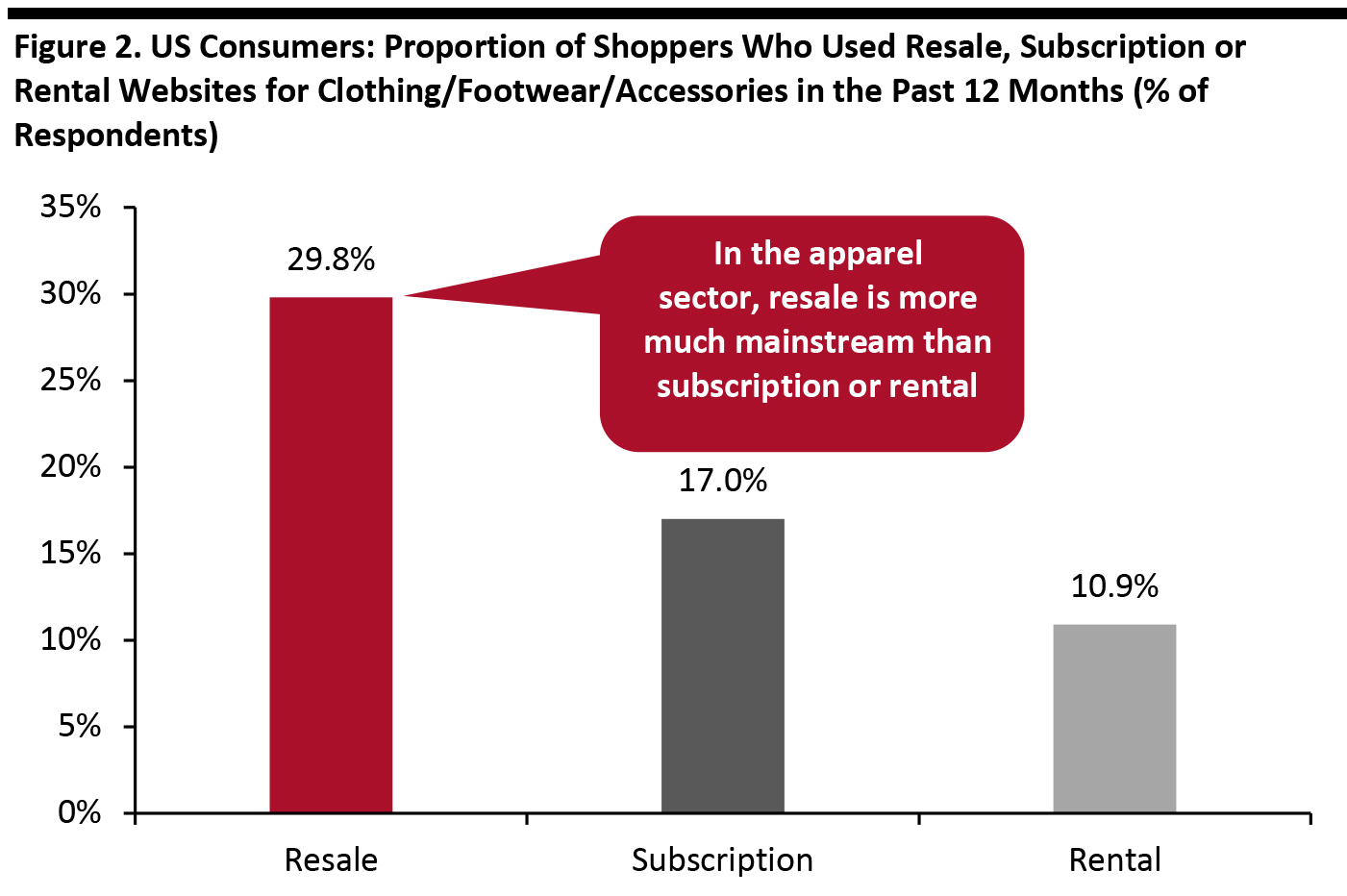

Levi’s jeans-customization website page Source: Levi’s [/caption] Resale and Rented Fashion Resale and rented fashion is disrupting the traditional retail model by making apparel a reusable and leasable product with a just-in-time element. A recent Coresight Research proprietary survey found that resale is more mainstream than subscription or rental in the US, with 29.8% of shoppers using resale websites to buy clothing, footwear or accessories in 2019—almost triple the proportion of respondents who used rental websites (as shown in Figure 2). [caption id="attachment_111072" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months

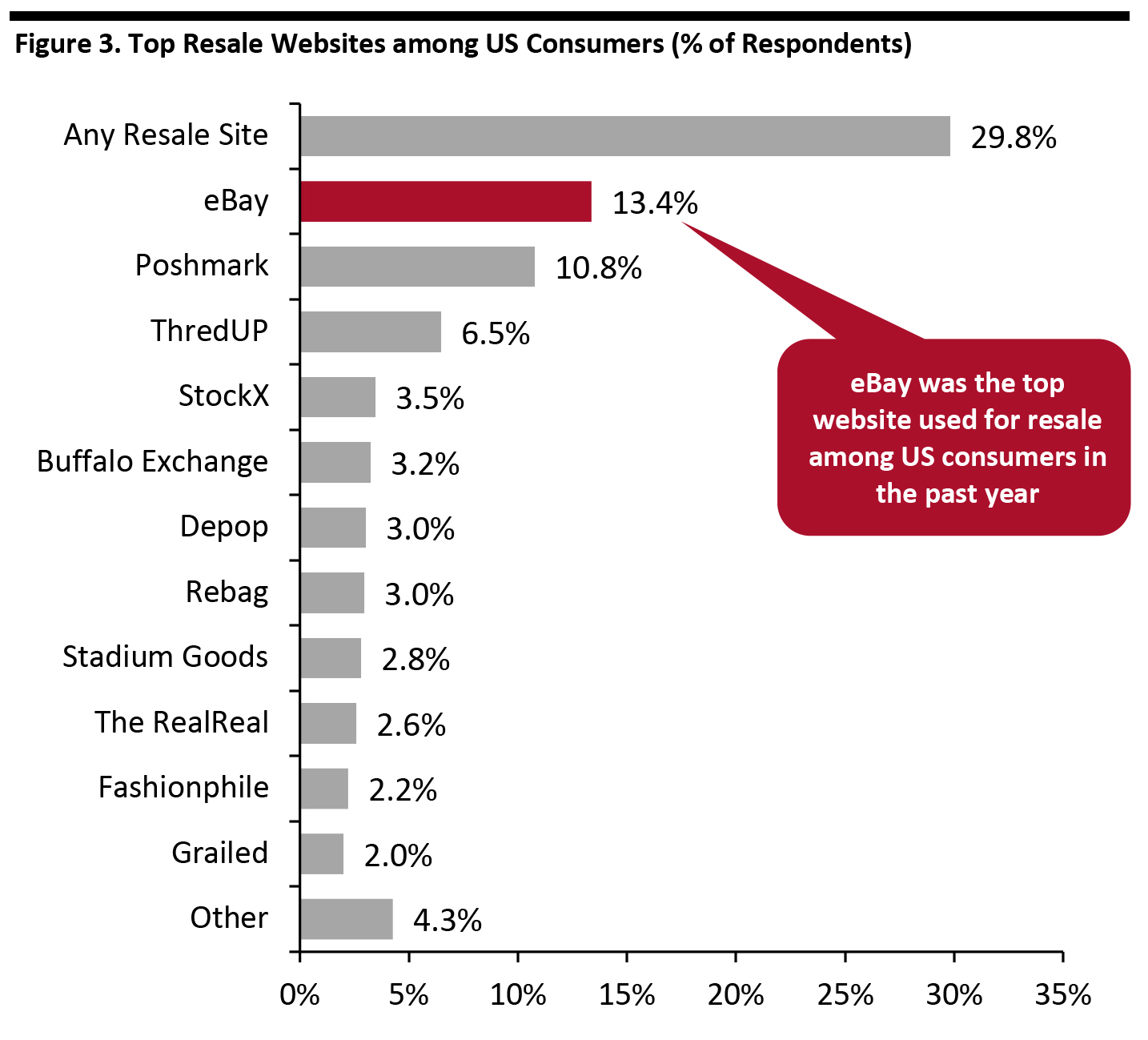

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months Source: Coresight Research[/caption] Further data from our survey suggest that the specialized resale, rental and subscription segments remain highly niche and fragmented. For resale, mainstream platform eBay (used by 13.4% of survey respondents) is the most-used site, followed by specialized sites Poshmark (10.8%) and ThredUP (6.5%). [caption id="attachment_111734" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months

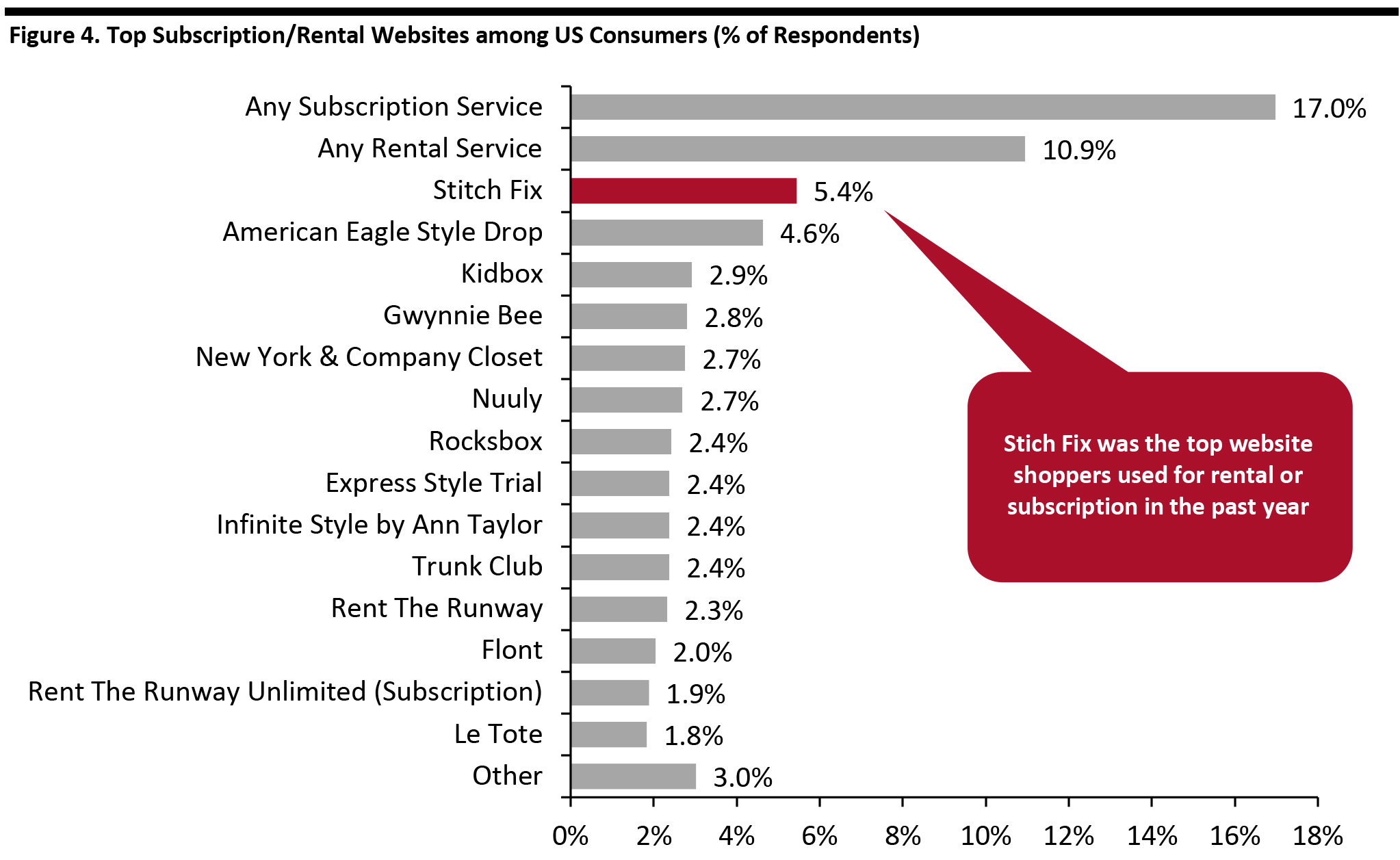

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months Source: Coresight Research [/caption] Apparel rental and subscription services are much less popular than resale, possibly because there has been no longstanding mainstream platform like eBay in this space. Stitch Fix (5.4%), American Eagle Style Drop (4.6%) and Kidbox (2.9%) are the top three websites, by number of users. [caption id="attachment_111735" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months Source: Coresight Research [/caption] Although rental or subscription services have not yet become mainstream in the industry, we expect more shoppers to use these services to expand their closets at low costs and with low commitment. According to 2019 Future of Fashion and Retail Consumer Survey launched by CGS, a New York-based software and consulting firm, 72% of consumers are willing to pay $50 or more per month to rent three fashion items. This presents an opportunity for brands and retailers to capture consumer desire for fast fashion, value, easy access and low commitment. During the coronavirus pandemic, we have seen consumers’ interest peak in resale and consignment. Pre-loved fashion titan Vestiaire Collective noted a 44% increase in new listings on their site in April. For The RealReal, traffic trends increased modestly in April year over year, despite a reduction of approximately two-thirds in the company’s advertising spend. Resale platforms have also launched new initiatives during this uncertain time: The RealReal launched virtual appointments to continue delivering personalized consignment consultations and enable people to monetize the assets in their homes; ThredUp collaborated with Reebok to offer customer loyalty points in exchange for old clothes.

Exploring Consumer Data To Achieve More Efficient Selling

Consumer data can help brands and retailers to gain a deeper understanding of the market, which may guide their operational decision-making. According to a survey published in May 2020 by Ascend2, a B2B marketing solution provider, almost half of 277 surveyed brands are budgeting more on data than they have previously. We expect that more apparel and footwear brands will focus on data around consumers’ e-commerce purchase decisions—such as webpage click rates, time spent on pages or products, conversion rates, customer lifetime value and customer retention. Online Data- Superdry works with Funnel, an automated data-collection platform, to gain actionable insights and obtain a complete overview of marketing channels to optimize its business strategy. Funnel combines customer and conversion data from over 400 third-party platforms including social media, tourist websites and game sites to identify the conversion rates of marketing campaigns so that brands can re-allocate their budget accordingly.

- In May 2020, Julie Bornstein, former COO of Stitch Fix, launched an AI-powered shopping platform, The Yes, to craft a customized store for consumers. The app asks consumers style-related questions and lets them vote yes or no on items to generate a curated feed of brand preferences. The platform includes both premium and economy brands—such as Gucci and Everlane, respectively—and integrates one-tap purchasing and price-matching functions. Shoppers can find each brand’s full online collection and receive free shipping as well as returns services.

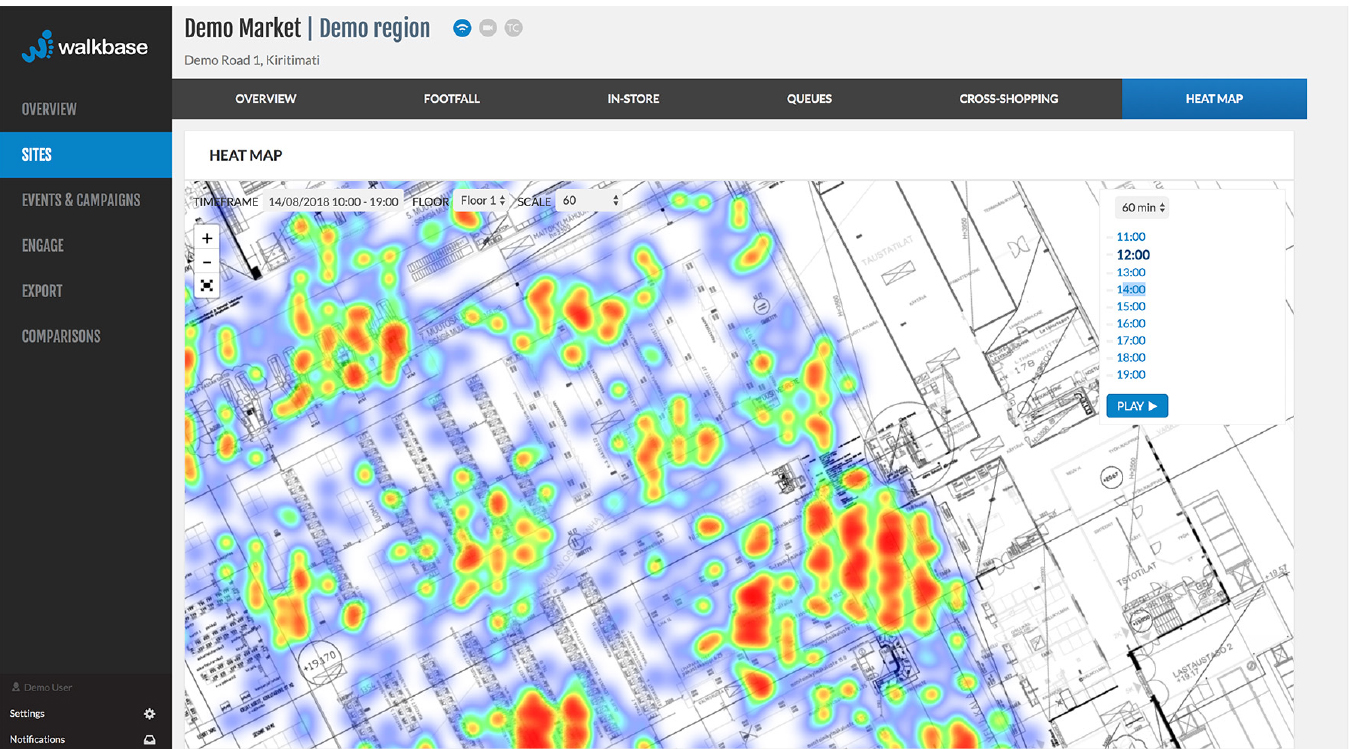

- Topshop partnered with Walkbase in 2019 to optimize the shopping experience in its flagship stores. Walkbase used sensors to gather real-time data on customers’ in-store behavior, including footfall, conversion, dwell times and routes around the store, which enabled the retailer to accurately see the pathways from fitting rooms to checkout. Acting on the insights that the data provided, Topshop invested in new fitting-room technology and increased its staffing.

Walkbase’s sensors collect in-store data for retailers to analyze shopper behaviors

Walkbase’s sensors collect in-store data for retailers to analyze shopper behaviors Source: Walkbase [/caption]

Forming Collaborations To Expand Offerings and Strengthen Reputation

Apparel and footwear brands and retailers are forming surprising partnerships to expand their offerings, unlock potential markets and strengthen their reputation. With Celebrities For the last two decades, apparel brand collaborations have been limited. For example, NIKE focused on sports-celebrity endorsements for 36 years to maintain its reputation as an iconic sneaker brand—such as Kobe Bryant, Kevin Durant, Maria Sharapova and Roger Federer. Now, we are seeing more apparel brands promote new products by partnering with different types of celebrities, including singers, artists, actors, models and sports figures.- In May 2020, Levi’s teamed up with Tyler Gregory Okonma, an American rapper, to release a limited-edition capsule collection.

- In February 2019, NIKE teamed up with two artists for its running collection, with Los Angeles-based artist Nathan Bell working on his first collaboration with Nike Running and the brand calling on Atlanta-based artist Eva Magill-Oliver for a new range of women's apparel and accessories.

Eva Magill-Oliver’s collaboration with Nike

Eva Magill-Oliver’s collaboration with Nike Source: Nike [/caption] Collaborations between Brands When brands collaborate with each other to launch new projects and products—known as brand mashups—synergies are created that effectively leverage the unique strengths of each brand. Brands launch exclusive products through these partnerships, which creates excitement for shoppers. Some collaborations are surprising, which boosts buzz around a brand on social media—particularly for large collaborations, such as Off-White x RIMOWA, Uniqlo x KAWS and Reformation x New Balance.

- Streetwear brand Supreme and The North Facelaunched a collaboration in 2019, which features products such as insulated Baltoro jacket, lightweight mountain jacket and hoodies with prints of New York City’s Statue of Liberty. The North Face’s Baltoro down jacket was made exclusively for Supreme; it features an insulated packable hood and is made from water-resistant nylon. Furthermore, in March 2020, Supreme released a line of the North Face’s Remote Terrain Gear.

North Face X Supreme 2019

North Face X Supreme 2019 Source: Supreme [/caption] Retailers can also work with subsidiary brands.

- Moosejaw, in collaboration with Walmart, introduced two gear and apparel lines, Lithic and Allforth, in May 2020. The brands mark the first product collaboration between the two companies since Walmart acquired Moosejaw in 2017.

Launching Creative Initiatives To Expand Customer Bases

Apparel and footwear brands and retailers are launching creative initiatives to introduce more innovative ways of selling, with the goal of increasing brand awareness and driving sales. Examples include the use of influencers, livestreaming and world-of-mouth strategies. Leverage Influencers Influencers can increase brand exposure through their huge followings on social media. When an influencer recommends or endorses a brand, their followers are likely to take notice. Facebook is the most widely used social media platform for shopping among US social media users, but Instagram is the most popular among respondents aged 18–24, according to Coresight Research’s Social Commerce survey of US consumers in late 2019. Our proprietary survey showed that apparel and beauty are the top categories that shoppers research, discover or purchase on social media—reflecting these categories’ image-driven nature.- Chiara Ferragni is an Italian-born, New York-based blogger and fashion designer. She has worked for Guess as a model and spokesperson. She also promotes her own brand. A number of leading fashion designers have invited her for marketing, including Chanel, Christian Dior, Louis Vuitton, Max Mara, Seven for All Mankind, Steve Madden and Tommy Hilfiger.

Chiara Ferragni promotes her own brand and works with other brands

Chiara Ferragni promotes her own brand and works with other brands Source: Instagram [/caption]

- American fashion brand Rebecca Minkoff began hosting a program on its Instagram account called “Happiest Hour” in April 2020. Every weekday at 5:00 p.m., influencers, models, stylists, celebrities and other friends of the company discuss how they are staying positive during the coronavirus pandemic.

- At the start of April 2020, Tory Burch hosted a chat with model Halima Aden on Instagram. Using #ToryStories, the brand has also been conducting Instagram takeovers centered around cooking, table settings, crafts, health and wellness.

Shoppers are motivated to promote DVF on RED by posting pictures; viewers can buy products directly from the platform

Shoppers are motivated to promote DVF on RED by posting pictures; viewers can buy products directly from the platform Source: RED [/caption] Livestreaming A number of apparel brands have introduced livestreaming into their marketing campaigns, and users are able to purchase items directly through embedded links in the videos. Livestream shopping is particularly popular in China, partly due to major e-commerce players such as Alibaba and JD.com integrating this functionality into their platforms. For different categories, brands and retailers can choose the most appropriate livestreaming platform. For instance, TikTok (Douyin in China) is the most suitable for specifically targeting beauty and apparel consumers, whereas Alibaba’s Taobao Live offers greater category range, including apparel, grocery and parent-and-baby products.

- Uniqlo launched a livestreaming campaign on Taobao Live during the coronavirus pandemic. To attract viewers and boost sales of its products, the brand worked with a key opinion leader for the livestream sessions, who wore Uniqlo apparel and talked about the benefits of the products—comfortable fabrics, cheap pricing and chic style. Viewers could comment on the page and directly place orders on the app while watching the livestreams.

Uniqlo’s livestreaming campaign

Uniqlo’s livestreaming campaign Source: Alibaba [/caption] Virtual Selling Retailers have tapped into virtual selling in recent years, but this focus intensified amid Covid-19 retail shutdowns. Virtual selling includes chatting with customers through emails, phone calls, social media platforms and even one-to-one text messages and video chats. Some companies, such as Zalando and Levi’s, were using virtual stylists before the pandemic, while other retailers and brands are only launched virtual stylist services online to helping keep the business steady during lockdowns.

- In April 2020, John Lewislaunched a number of virtual services, including a virtual styling assistant that allows customers to book free one-to-one video appointments with personal stylists. At the end of April, the retailer expanded the services to include “inspirational talks” and learning sessions.

- David’s Bridal and Indochinoannounced the launch of their virtual stylist appointment services in April and May 2020 respectively.