albert Chan

Introduction

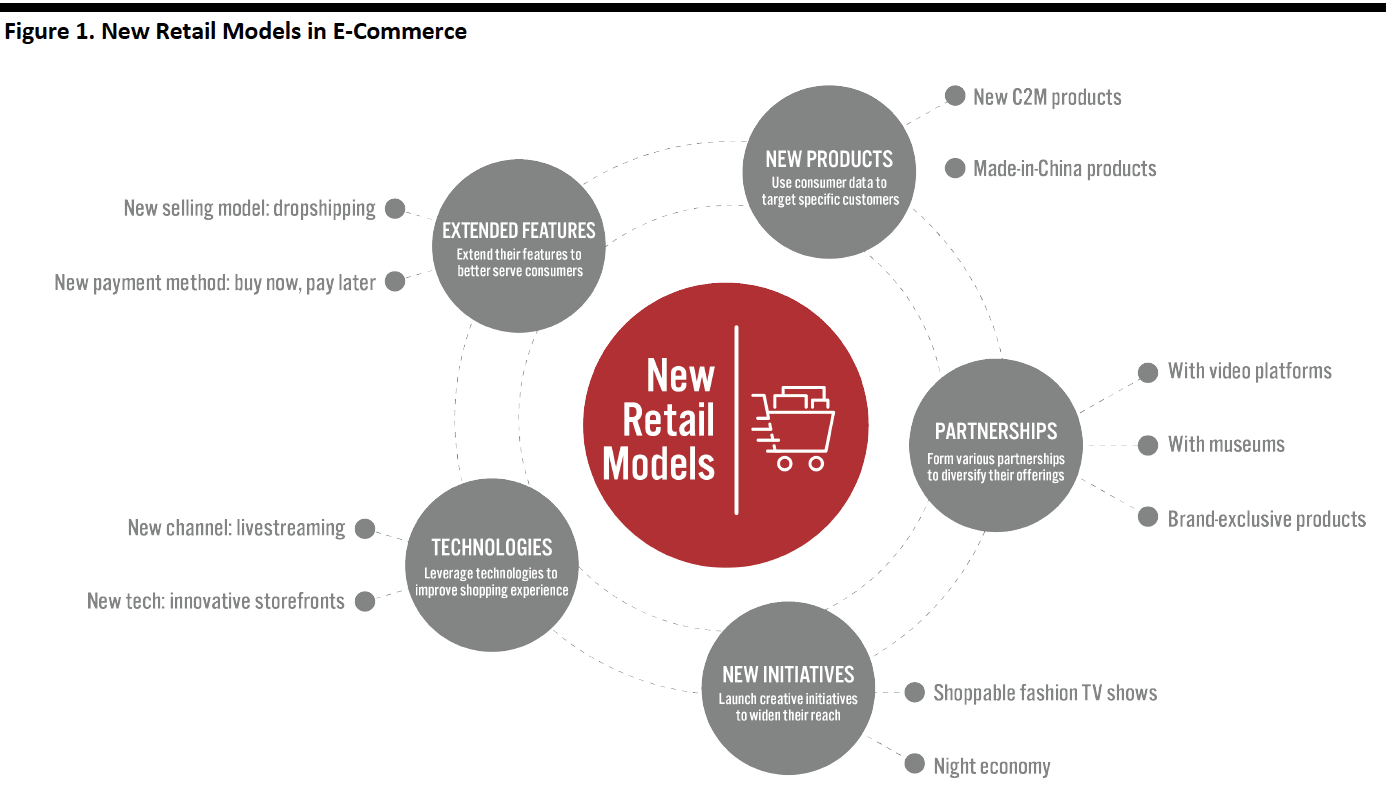

As consumers’ preferences change quickly, e-commerce companies—like their brick-and-mortar counterparts—must keep up with demand for new products and better shopping experiences. Global e-commerce platforms, specifically those based in China and the US, have been innovating to adopt new ways of retailing.

In this report, we look at how e-commerce giants are developing new capabilities to innovate ways of selling, such as using technologies to upgrade their platform and strengthen their current offerings, as well as taking advantage of consumer data to achieve more effective target marketing. We also explore how online platforms are developing new ways of selling by extending their offerings, forming partnerships and launching creative initiatives to drive sales.

[caption id="attachment_104656" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Using Technologies To Improve the Shopping Experience

Technology continues to play an important role for online retailers in developing innovative ways of selling. Notably, e-commerce platforms have introduced livestreaming functions to enable users to purchase items directly through embedded links during broadcasting. In addition, technology is being used by companies working in partnership to bridge the gap between online and offline retail, integrating digital innovation in physical stores.

Livestreaming Functions

Livestream shopping has rapidly become popular in China; it was worth ¥440 billion ($63 billion) in 2019, according to Chinese financial services firm Everbright Securities. This is partly due to major e-commerce players introducing livestreaming functions to their platforms—Taobao and JD.com launched such features in 2016 and 2018, respectively. Chinese social commerce platforms Pinduoduo, RED and WeChat also began testing the integration of livestreaming in 2019. Although this trend has slowing been taking off in the West—Amazon launched Amazon Live in February 2019, for example—the functionality is less interactive than livestreaming in China, where viewers can post live comments and ask questions to the host during the session.

Taobao reported that the number of online viewers on its livestreaming platform can reach 2 million during peak times. The company utilizes advances in technology to ensure smooth viewing and an interactive experience for consumers: In 2019, the platform established a new communications framework for audio and video on Alibaba Cloud, which reduced network latency and improved real-time interactions. Moreover, artificial intelligence (AI) identifies products being promoted by livestream hosts and displays associated embedded links that viewers can click to make purchases. AI-powered chatbots are also employed to efficiently address viewers’ questions.

Livestreaming offers brands a means to boost sales and increase brand awareness. Over 100,000 brands used Taobao livestreaming as a sales channel during Singles’ Day 2019, and Taobao Live contributed 7.5% of Alibaba’s total sales of ¥268.4 billion ($38.3 billion) on November 11. Alibaba also reported that in the quarter ended December 31, 2019, GMV generated from Taobao Live and the number of monthly active users on the livestreaming platform both grew over 100% year over year in December 2019.

[caption id="attachment_104657" align="aligncenter" width="500"] Source: Alizila[/caption]

Source: Alizila[/caption]

Innovative Storefronts

Physical stores continue to be a popular retail channel, and retailers are employing technologies to personalize in-store experiences and create a more seamless shopping journey for consumers. E-commerce companies have launched a range of services and innovations to bridge the gap between online and offline retail.

Luxury fashion e-commerce platform Farfetch partnered with French luxury house Chanel back in February 2018, and in December 2019 the two companies unveiled their “Boutique of Tomorrow” at Chanel’s flagship store in Paris. Leveraging Farfetch’s expertise in technology to provide an omnichannel concept, the boutique has an associated app through which shoppers can view products, create a wish list and book an appointment before visiting the store. Sales associates then access customer-specific information in store by scanning QR codes through the app. The digital identity of the consumer is connected to smart mirrors in the fitting rooms, which shows shoppers how their clothing choices appeared on the runway. Store associates can also send selected product images to the mirror to make suggestions based on customer preferences, the physical versions of which they can bring in from the shop floor if requested.

Furthermore, there are around 30 digital devices throughout the store, through which shoppers can take a virtual tour of Coco Chanel’s private apartment, browse exclusive content and runway images, and access podcasts. Chanel management has reported that the boutique is having a positive impact on sales and customer engagement. Farfetch CEO José Neves plans to partner with other brands such as Thom Browne to roll out similar platforms.

Implementing Extended Features To Better Serve Consumers

Many e-commerce platforms have been expanding the sales and payment options they offer to shoppers. Dropshipping capabilities are enabling Chinese e-commerce giants to position themselves as social marketplaces where users can be sellers, thus extending their reach and better serving consumers in lower-tier markets. E-commerce platforms in both China and the US are also embracing the “buy now, pay later” option, which offers more flexibility, convenience and often interest-free benefits to shoppers, encouraging consumption.

Driving Social Commerce through Dropshipping

With the rise of social commerce in China’s digital retail landscape, major e-commerce companies such as Alibaba and JD.com have introduced a new peer-to-peer dropshipping function into their core platforms, enabling them to compete with social commerce players Pinduoduo and RED. This unconventional selling model allows everyone to become an entrepreneur while lowering front-end operational costs for suppliers. Dropshipping helps to attract new shoppers to e-commerce platforms from existing users’ network.

Alibaba’s Taoxiaopu allows Taobao’s 693 million annual active users to sell products through social media that are held and shipped by third-party brands. The platform first began testing the function in April 2019 before opening to all users at the end of the year. Any Taobao user can now register to become dropshippers, without paying a fee. Once set up, new sellers can select from 30 stock-keeping units (SKUs) to start with; if they secure five transactions, they gain access to more than 10,000 SKUs. Sellers can earn commission from transactions through the links they share with social contacts on Alipay, WeChat, Weibo and DingTalk (Alibaba’s enterprise communication app). Alibaba sources products directly from brands, which are responsible for shipping and customer service. According to Taobao data released on February 14, the number of Taoxiaopu sellers increased by more than 300% from February 3, 2020. Previous data also revealed that over half of the registered sellers on the platform are from lower-tier cities.

JD.com started testing a similar function called Dongxiaodian as a WeChat mini program in November 2019. Currently, users need to have an invitation code to become a seller. The company claims to offer more products and higher commission than other platforms. In the future, JD.com plans to incorporate livestreaming, short videos and more personalized features in Dongxiaodian.

[caption id="attachment_104658" align="aligncenter" width="500"] Alibaba’s Taoxiaopu (left); JD.com’s Dongxiaodian (right)

Alibaba’s Taoxiaopu (left); JD.com’s Dongxiaodian (right)Source: Taobao app/Dongxiaodian WeChat mini program[/caption]

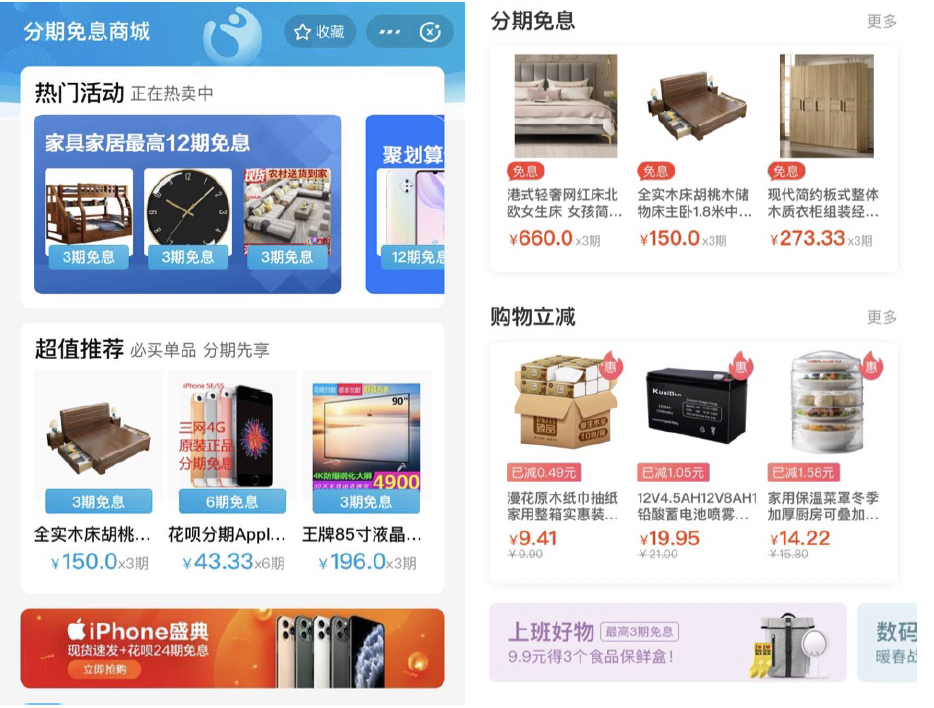

Buy Now, Pay Later

The alternative digital payment option “buy now, pay later” has become popular around the globe and is particularly well established in China and the US. The option allows shoppers to split payment for a purchase into several installments over a pre-determined period of time. This flexibility is positively influencing consumers’ purchasing decisions, especially for big-ticket products, so could lead to sales growth for e-commerce platforms. Demonstrating this, merchants using services from alternative payment provider Klarna have reported a 68% increase in average order value for shoppers that choose to pay in installments.

In the US, leading companies offering installment payment plans include Affirm, Afterpay and QuadPay, all of which have seen robust growth, driven by young consumers. There are typically two types of buy now, pay later services: Shoppers can select the financing payment option on verified merchants’ checkout page—for example, luxury e-commerce retailer Luisa Via Roma accepts Affirm financing support; or consumers can apply for a visa card issued by financing platforms and use this to directly pay on any website.

Retailers in China have also been increasingly implementing buy now, pay later options to align with changing consumer preferences, particularly among young people. JD offers its Baitiao service, while Tencent-backed WeBank offers an online consumer loan product called Weilidai. Ant Financial, an affiliate company of Alibaba, offers its Huabei consumer credit product, which provides users with a revolving line of credit or installment purchase plans that do not incur interest if payments are made on time. The Wall Street Journal reported in December 2019 that more than half of Alipay’s 900 million users in China have Huabei accounts, and almost half of Huabei users are under the age of 30. During Singles’ Day 2019, Huabei temporarily increased its credit line and offered zero interest on 8 million products in order to boost sales. The company reported that products that supported Huabei during the shopping festival saw GMV increase by more than 90%.

[caption id="attachment_104659" align="aligncenter" width="500"] Products that offer interest-free installment plan on Huabei

Products that offer interest-free installment plan on HuabeiSource: Alipay[/caption]

Using Consumer Data To Target Shoppers Effectively

E-commerce platforms gather a huge amount of consumer data, giving them insights into consumer purchasing behaviors. They can therefore advise brands and retailers on how to effectively target customers by adopting new ways of selling, such as through a C2M model, or by identifying shopping trends that can influence the launch of relevant marketing campaigns.

Helping Brands To Adopt a C2M Model

Brands can leverage consumer data gathered by e-commerce platforms by adopting a C2M model, through which they can create customer profiles, forecast consumption and plan production. This helps brands to better meet customer demand and manufacture consumer-centric products, as well as to achieve sales growth and reduce inventory waste.

Chinese tissue-paper brand Haojili analyzed consumer data provided by Taobao to identify what kind of tissue paper shoppers preferred, taking into account factors such as price, paper size and texture. Haojili then developed its C2M product, 14-roll tissue paper made from bamboo and priced at ¥9.90 (around $1.40), which saw sales of 240,000 units on the one-day 6.18 Mid-Year Shopping Festival in 2019.

[caption id="attachment_104660" align="aligncenter" width="250"] Haojili’s 14-roll tissue paper

Haojili’s 14-roll tissue paperSource: Taobao[/caption]

Gaming hardware brand Republic of Gamers (ROG) leveraged JD.com’s consumer data in the development of its gaming phone “ROG Phone II,” which was launched on July 24, 2019. In under 24 hours, the company received over 2 million pre-orders for the product.

[caption id="attachment_104661" align="aligncenter" width="350"] ROG Phone II

ROG Phone IISource: Republic of Gamers[/caption]

Forming Partnerships To Diversify Offerings

To further push the development of new retail models, e-commerce platforms are forming cross-industry partnerships, such as with as video-streaming platforms, museums and different brands.

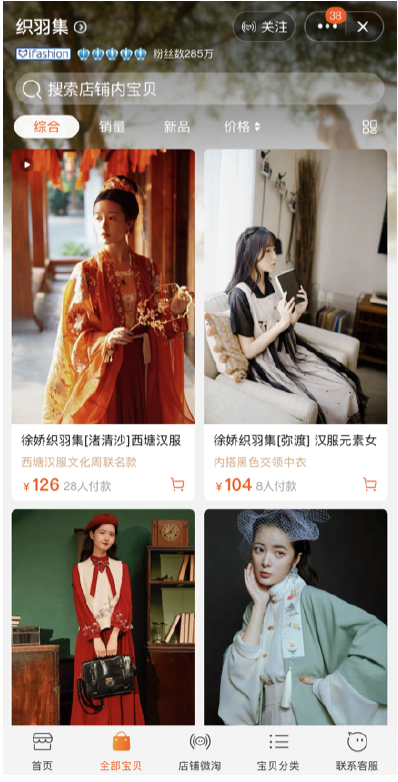

Alibaba Partners with Bilibili To Sell ACG-Related Products

Alibaba partnered with Bilibili—a video-sharing platform that is focused on anime, comics and gaming (ACG)—to tap into its extensive user base and drive traffic to Alibaba’s e-commerce sites. The average number of monthly active users on Bilibili reached 127.9 million for the quarter ended September 30, 2019, representing a 38% year-over-year increase.

Content creators on Bilibili are increasing their presence on Taobao by opening stores. Content creator Xu Jiao opened a store on Taobao to sell clothes; the store has so far attracted 2.85 million fans as of February 18, 2020. Taobao will provide opportunities for these content creators to launch their own products on the platform as well as co-branded products.

[caption id="attachment_104662" align="aligncenter" width="250"] Bilibili’s content creator Xu Jiao opened a store on Taobao

Bilibili’s content creator Xu Jiao opened a store on TaobaoSource: Taobao[/caption]

JD.com Works with Museums To Target Art Consumers

JD.com partnered with four high-profile museums to launch products that incorporate artwork from their collections. JD.com’s exclusive channel JD Art sees high volumes of art purchases—for example, reprints of Yingri by artist Wu Guanzhong saw a 171% year-over-year increase in sales on June 18, 2019.

Under the collaboration, hygiene brand Tempo worked with the Metropolitan Museum of Art to release new packaging for its tissues using Van Gogh’s artwork—Irises, Landscape with Sky and Wheat Field with Cypresses.

[caption id="attachment_104663" align="aligncenter" width="250"] Tempo’s tissue product packaging incorporates designs using Van Gogh’s artwork

Tempo’s tissue product packaging incorporates designs using Van Gogh’s artworkSource: Tempo[/caption]

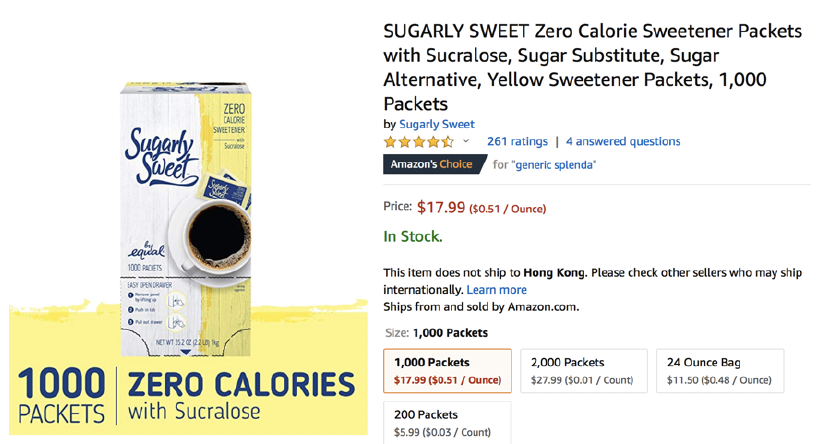

Amazon Launches Brand-Exclusive Products

Amazon has partnered with a number of brands to launch exclusive products on the platform targeted at different consumers. Under the partnership, brands launch products that sell only on their own website and through Amazon, where the e-commerce giant provides marketing support and promotional priority in search results for brands. In turn, Amazon receives sales commission as well as potential increased traffic from an extended customer base, due to product diversity and exclusivity.

An example of such a partnership is with sweetener brand Equal, which launched its exclusive Sugarly Sweet product line on Amazon in 2019. The product range comprises four zero-calorie sweetener variants that are intended to appeal to young, calorie-conscious consumers. Equal stated that working with Amazon could help it to reach consumers who do most of their shopping online.

[caption id="attachment_104664" align="aligncenter" width="500"] Equal’s Sugarly Sweet product line is sold exclusively on Amazon

Equal’s Sugarly Sweet product line is sold exclusively on AmazonSource: Amazon[/caption]

Launching Creative Initiatives To Extend Reach to Customers

E-commerce platforms are launching creative initiatives to introduce more innovate ways of selling, with the goal of increasing and maintaining traffic and sales growth.

Amazon Releases Shoppable Fashion Competition TV Series

Amazon is in the process of launching a shoppable fashion design competition show on its video-on-demand platform Amazon Prime Video. The first episode of the reality show, entitled “Making the Cut,” will be available to view on the platform from March 27, 2020. The show’s format sees 12 fashion designers compete against each other, with winning design from each episode being released as a shoppable product—priced at $100 or lower—that consumers can buy through Amazon immediately after the episode is released. Amazon Prime Video will air two episodes per week for five weeks; the finale is scheduled on April 24.

The shoppable reality show could attract more affluent fashion shoppers to make purchases through Amazon by raising the profile of the site’s high-fashion offerings. Coresight Research’s analysis of Amazon apparel listings found that, currently, generic (nonbranded) products dominate Amazon Fashion.

This initiative could also drive more fashion consumers to subscribe as Amazon Prime members, as this show is exclusive to members only. With other Prime benefits including faster delivery options, fashion followers could then be prompted to shop more across different Amazon categories to make full use of the membership.

[caption id="attachment_104665" align="aligncenter" width="500"] “Making the Cut” episodes will be made available on Amazon Prime Video

“Making the Cut” episodes will be made available on Amazon Prime VideoSource: Amazon[/caption]

Alibaba Taps Into Flourishing Night Economy

One consumption trend that is booming in China is the occurrence of commerce activities between the hours of 6pm and 6am—known as the night economy. With 60% of consumption taking place overnight, according to the Chinese Ministry of Commerce, Alibaba is leveraging this trend to draw more traffic to its platforms.

China’s State Council formally introduced the concept of the night economy in late August 2019 using the description “lively night-time businesses and markets.” Many cities have since unveiled plans to stimulate night-time consumption, including Beijing, Shanghai, Tianjin and Xian. Shopping malls, restaurants, supermarkets and tourist spots have extended their operating hours to target late-night shoppers.

E-commerce platforms such as Alibaba’s Taobao are benefiting from this boom. Around 36% of daily online purchases occur between 9:00 p.m. and 10:00 p.m. on Taobao, according to Alibaba’s Night Economy Report, which was released on July 24, 2019. Alibaba’s ecosystem—including local service and food-ordering platform Ele.me and online ticketing platform Taopiaopiao—enables the company to offer products and experiences that appeal to consumers participating in the night economy, such as dining, trips and recreational activities.

[caption id="attachment_104666" align="aligncenter" width="250"] Theater ticket promotions for plays and musicals on Taopiaopiao

Theater ticket promotions for plays and musicals on TaopiaopiaoSource: Taopiaopiao[/caption]

Offline retailers that operate their own e-commerce app are also seeing sales growth during the night. For shopping mall operator Intime, the number of orders placed through its app overnight—for products ranging from cosmetics to apparel—saw a 600% year-over-year increase during China’s Golden Week (October 1–7, 2019), according to the company.

Key Insights

E-commerce platforms have been developing new capabilities and adopting new ways of retailing to meet evolving consumer demands and extend their reach to different customers. These companies are employing innovative technologies to upgrade their platforms, such as by adding livestreaming functions and launching new storefronts. The addition of dropshipping capabilities is allowing users to become entrepreneurs and make use of their social contact network. Furthermore, e-commerce players are looking to drive sales by offering flexibility in payment options.

To extend their reach to consumers, e-commerce platforms are taking advantage of large amounts of consumer data—helping brands to adopt consumer-to-manufacturer business models, for example. Partnerships are also being formed to mutually benefit from extended customer bases: Alibaba is working with ACG-focused video-sharing platform Bilibili; and Amazon is launching brand-exclusive products.

New initiatives, such as Amazon’s shoppable fashion design competition show, also present opportunities for e-commerce platforms to further stimulate consumption. Major players have already witnessed positive results from these initiatives and we expect to see more innovative ways of retailing appear in the e-commerce sector in the future.