Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In our New Retail in China series (formerly New Retail Briefing), we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

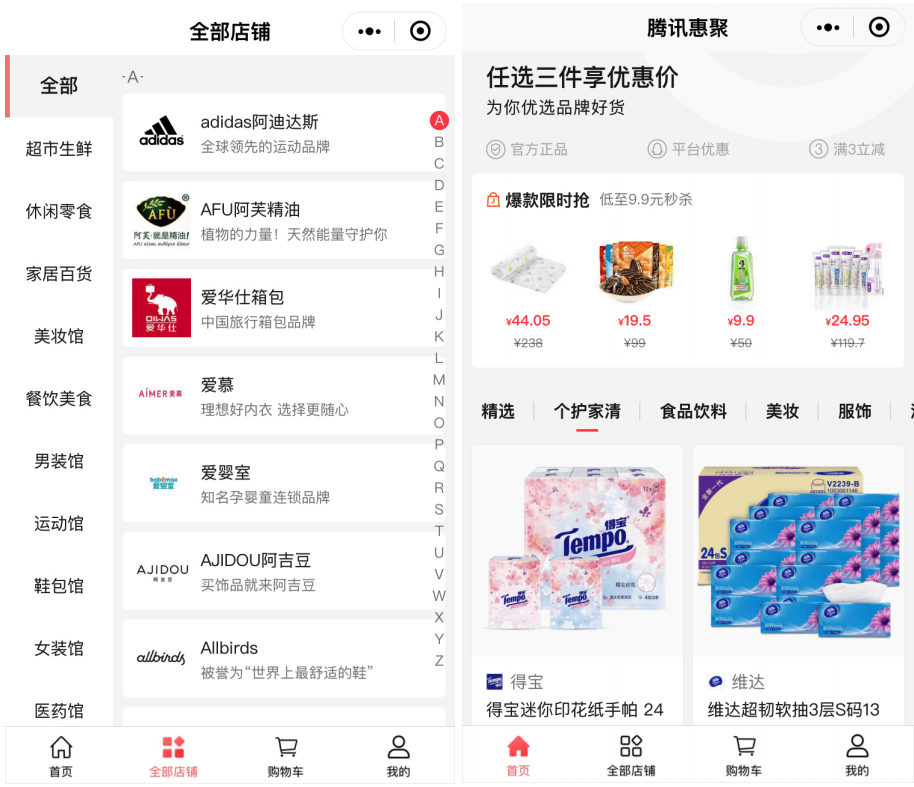

Tencent Pilots Centralized Portal for WeChat Mini-Programs On February 1, 2021, Tencent launched an early version of a centralized portal within WeChat for the mini programs built by its retailers and brands. The portal, named Tencent Huiju, is styled as a centralized e-commerce marketplace. It features an “All Shops,” section, which directs shoppers to WeChat mini programs by retailers and brands across 12 categories including beauty, fresh food, jewelry, menswear and womenswear. Hundreds of companies have a presence on the portal—including Adidas, Boy London, Dior and Walmart. The Tencent Huiju homepage features promotions, such as discounts applicable to three products from a range of selected items. Tencent Huiju has a shopping cart feature to hold products from different retailers or brands and allow consumers to complete their payment in one go. The portal offers other standard e-commerce services, such as viewing previous orders.Tencent Huiju is still relatively unknown and it is not yet clear whether Tencent will set up a large operational team to manage merchants and establish Huiju as a large marketplace similar to Tmall.

[caption id="attachment_124289" align="aligncenter" width="580"] “All Shops” section (left) and homepage (right) of Tencent Huiju WeChat mini-program

“All Shops” section (left) and homepage (right) of Tencent Huiju WeChat mini-programSource: WeChat[/caption] Coresight Research insight: Tencent used to run its own e-commerce platforms, QQ Wanggou and Paipai, but sold them to JD.com in 2014. In recent years, Tencent has been investing in other e-commerce and retail companies, including JD.com, Pinduoduo and supermarket chain Yonghui, rather than committing resources to its own e-commerce business. However, Tencent officially launched its own social e-commerce mini program, Xiao’e Pinpin, in November 2020. With more than one billion consumers in China using WeChat, we believe that Tencent will want to capitalize on such a significant consumer base. JD.com’s Logistics Unit To Go Public in Hong Kong On February 16, 2021, JD Logistics filed its IPO prospectus with the Hong Kong Stock Exchange, following the listing by online pharmaceutical and healthcare spinoff JD Health two months ago. JD Logistics will remain a subsidiary of JD.com after it goes pubic—JD.com will still indirectly hold a shareholder stake of more than 50% in the logistics arm. In 2017, JD Logistics was spun off into a standalone entity and began to open up its solutions and services to external customers. JD Logistics operates a network of over 800 warehouses covering approximately 215 million square feet, as of January 2021. This extensive infrastructure will enable JD.com to serve more external customers. According to the IPO prospectus, JD Logistics’ revenue rose by 43.2% to ¥49.5 billion ($7.6 billion) for the nine months ended September 30, 2020, from ¥34.6 billion ($5.3 billion) for the same period in 2019. Technology is at the core of JD Logistics’ development. As of December 31, 2020, JD Logistics has more than 4,400 patents and computer software copyrights, of which more than 2,500 relate to automation technologies. A pioneer in integrating robotics in logistics networks, JD Logistics has deployed over 5,000 robots across 100 of its warehouses. The company will continue to invest in technology to drive long-term innovation, according to its prospectus. [caption id="attachment_124290" align="aligncenter" width="720"]

JD Logistics’ delivery vehicles

JD Logistics’ delivery vehiclesSource: JD.com[/caption] Coresight Research insight: The booming global e-commerce logistics market—which includes spending on transportation services, warehousing and distribution services by businesses—is estimated to grow at a CAGR of 20.5% from 2020 to 2027, according to research firm Global Industry Analysts. The market growth is primarily driven by the upsurge in online shopping and increasing cross-border e-commerce activities. With logistics services witnessing an uptake amidst the Covid-19 pandemic, SF REIT—which is owned by the parent company of one of China’s largest couriers, SF Express—is also set to go public in Hong Kong. Santoni Launches in China with Direct-to-Consumer (DTC) Strategy On February 1, 2021, Italian high-end shoe brand Santoni unveiled its store on Tmall Luxury Pavilion. The online debut in China was accompanied by a Chinese New Year capsule collection containing a selection of backpacks, leather goods and sneakers in honor of the Year of Ox. The Italian brand already serves Chinese consumers through luxury department store Lane Crawford, which sells in Mainland China and Hong Kong, but is now expanding its reach with a DTC strategy. The company has announced plans to open physical stores in China in the next six to 12 months, depending on developments related to the pandemic. The company expects its first store openings to be in Beijing, Chengdu and Shanghai. Santoni currently operates physical flagship stores in major international cities, including London, Milan, New York and Paris. The company’s revenue dropped by 20% year over year to €65 million ($78.9 million) amid the pandemic in 2020. The retailer hopes that its efforts to expand in China will improve its business performance. [caption id="attachment_124291" align="aligncenter" width="320"]

Santoni’s Tmall flagship store

Santoni’s Tmall flagship storeSource: Tmall[/caption] Coresight Research insight: China’s luxury e-commerce market will grow from ¥93 billion ($14 billion) in 2020 to ¥147 billion ($22 billion) in 2025, representing a CAGR of 9.6%, according to an estimate made by consulting firm McKinsey prior to the Covid-19 outbreak. Nevertheless, the market is becoming increasingly competitive as many luxury brands have accelerated their digital transitions. Alongside the surge in e-commerce, many consumers are looking to DTC brands for personalized and engaging experiences. We expect to see more companies reduce their exposure to wholesale and transition to DTC online in 2021. Appendix: New Retail Developments New Retail developments in China are listed in Appendix Figure 1. Appendix Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=788]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies, and even brick-and-mortar stores. See selected transactions in the following tables. Appendix Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=789]Source: Company reports/Coresight Research

Appendix Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=790]Source: Company reports/Coresight Research

Appendix Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=791]Source: Company reports/Coresight Research