DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In our New Retail in China series (formerly New Retail Briefing), we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

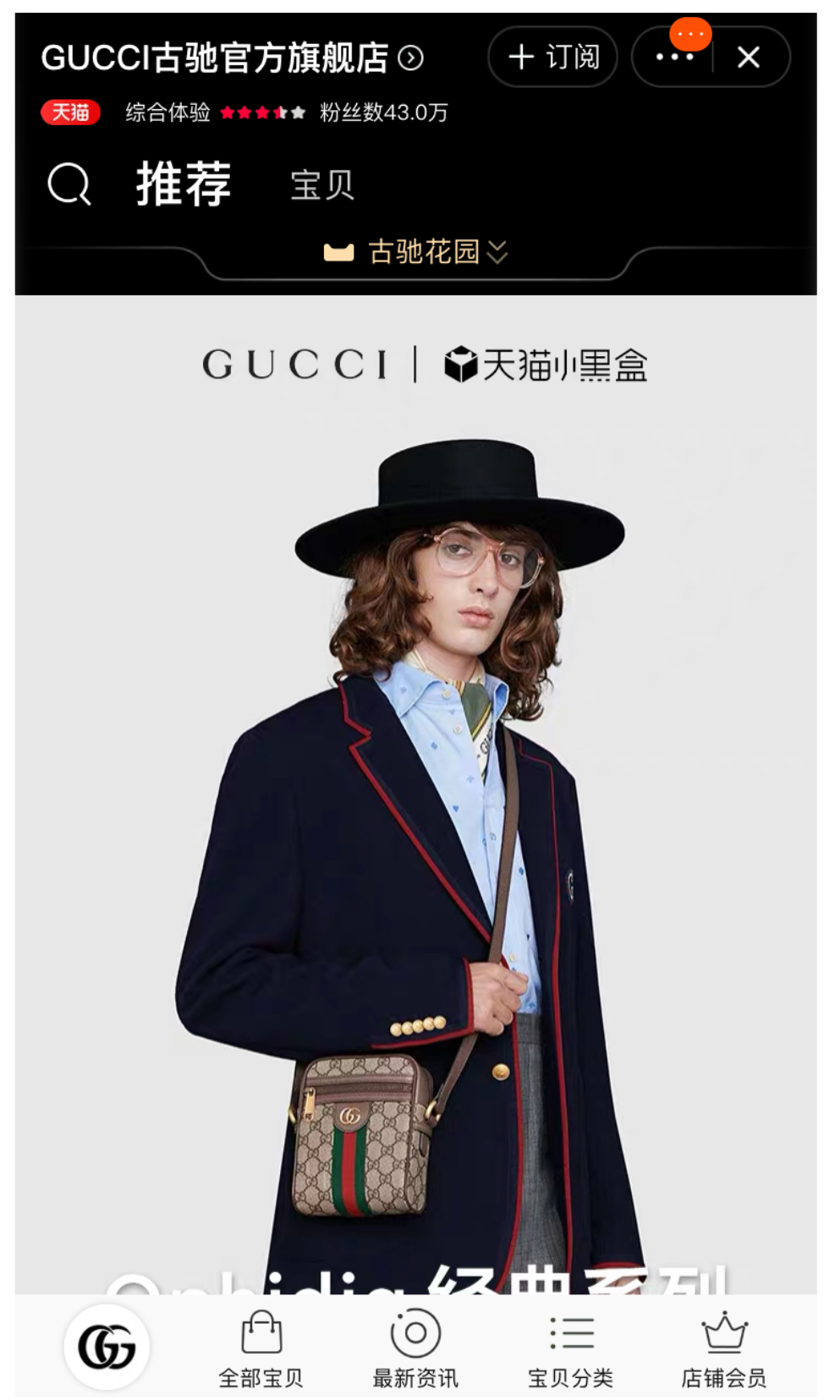

Gucci Launches a Flagship Store on Tmall On December 21, 2020, Gucci opened its first flagship store on Tmall Luxury Pavilion, offering accessories, jewelry, leather goods, ready-to-wear and watches. The Italian fashion house has announced plans to open another flagship store in February this year, which will offer its beauty and fragrances products. Gucci is among the last of the big names in luxury to join Tmall Luxury Pavilion—Alibaba’s dedicated site for luxury and premium brands features more than 200 luxury and designer brands as of September 2020. This increased from around 150 in December 2020, prior to the widespread Covid-19 outbreak. Gucci entered China’s digital ecosystem quite early, launching its Chinese website in 2017. In the same year, it started to operate its WeChat mini program, where the brand initially sold limited collections and gradually expanded to all categories. The brand has been reluctant to partner with China’s e-commerce platforms until now due to concerns over counterfeit products. For instance, in July 2014, Gucci’s parent company Kering filed a lawsuit accusing Alibaba of being complicit in the sale of counterfeit Kering items on its marketplaces. In August 2017, Alibaba and Kering agreed on a task force to protect Kering’s brands as well as leverage Alibaba’s technology to eliminate counterfeit products. As part of the agreement, Kering agreed to withdraw the lawsuit against Alibaba. [caption id="attachment_122518" align="aligncenter" width="435"] Gucci’s flagship store on Tmall Luxury Pavilion

Gucci’s flagship store on Tmall Luxury Pavilion Source: Tmall [/caption] Coresight Research insight: China’s luxury e-commerce market will grow from ¥93 billion ($14 billion) in 2020 to ¥147 billion ($22 billion) in 2025, representing a CAGR of 9.6%, according to an estimate made by consulting firm McKinsey prior to the Covid-19 outbreak. We expect to see greater demand for luxury goods through online channels in 2021, partly due to luxury brands’ ongoing expansion into e-commerce in China, as well as depressed rates of international travel, which look set to redirect some shopping from overseas to domestic markets. Forays into China’s Growing Domestic Duty-Free Market: JD.com Opens First Duty-Free Store On December 30, JD Worldwide, JD.com’s cross-border e-commerce platform, opened its first duty-free store in the city of Sanya, in Hainan province. Focused on electronics and household appliances, the duty-free store leverages JD.com’s AI-enhanced technology to provide an upgraded shopping experience for customers. The store features digital devices that consumers can use to look for recommendations—JD.com has not yet specified the type of device, but did report that the store has smart shelves that enable consumers to scan product QR codes to purchase them online. JD Worldwide also plans to open an online duty-free store to facilitate an omnichannel shopping experience for consumers in China. [caption id="attachment_122519" align="aligncenter" width="725"]

The opening of JD Worldwide’s duty-free store in Sanya, Hainan province

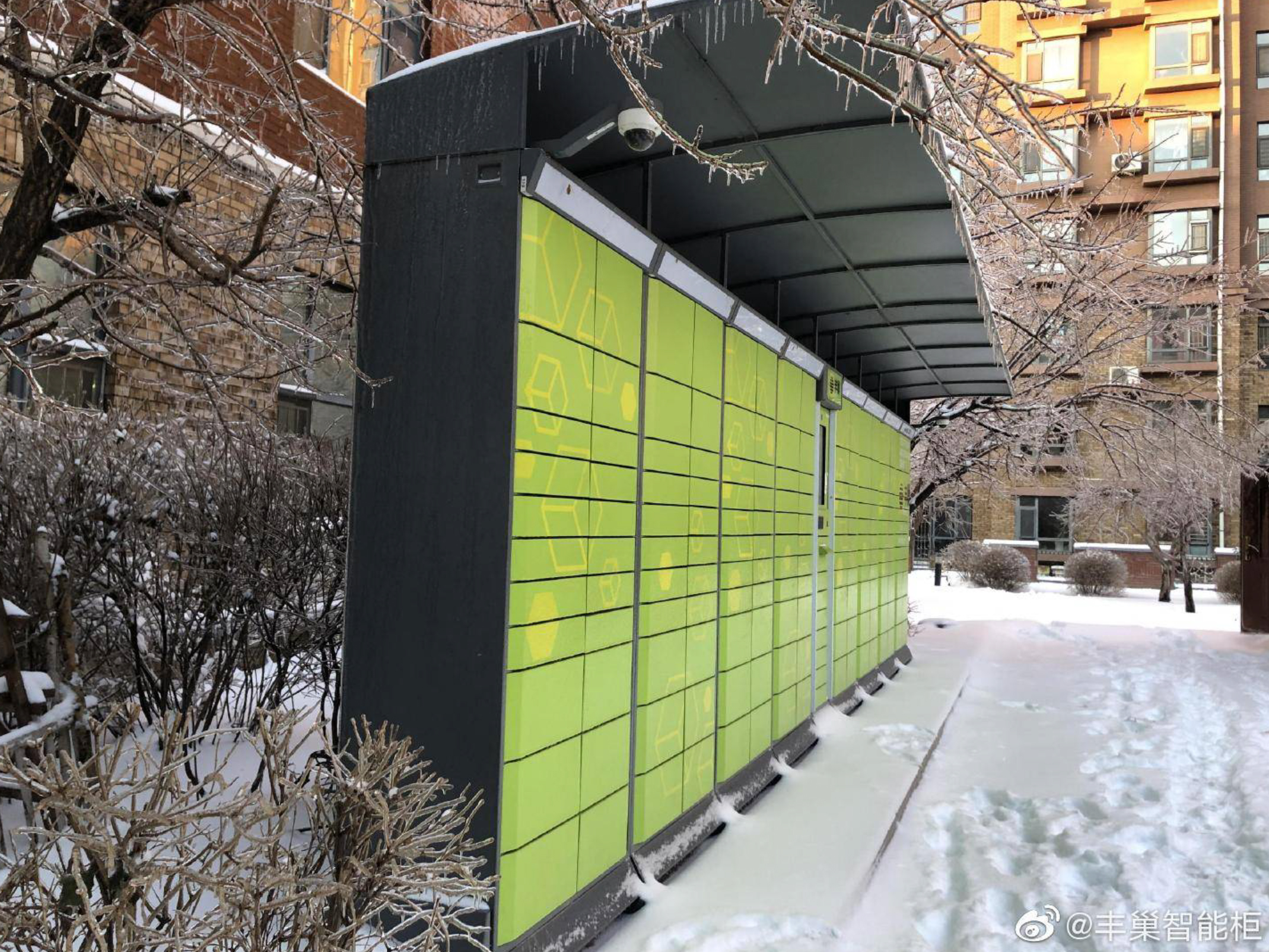

The opening of JD Worldwide’s duty-free store in Sanya, Hainan province Source: JD.com [/caption] Coresight Research insight: In July 2020, Hainan province increased its annual duty-free shopping quota from ¥30,000 ($4,600) to ¥100,000 ($15,400) per person and expanded the permitted range of duty-free goods from 38 categories to 45. In 2020, actual sales by duty-free shops in Hainan exceeded ¥32 billion ($4.9 billion), representing year-over-year growth of 127%. Following the duty-free policy change, from July 1 to December 31, 2020, average duty-free sales each day in Hainan surpassed ¥120 million ($18.5 million), double the amount compared to the same period in 2019. China’s domestic duty-free sales are expected to grow at a CAGR of 28.5% CAGR from 2019 to 2025—reaching $8.25 billion in 2025—according to Morgan Stanley’s estimate made in June 2020. In October 2020, Alibaba announced plans to invest in Swiss duty-free retailer Dufry Swiss duty-free retailer Dufryto tap into China’s domestic duty-free market—the two have agreed on a joint sales venture in China. We also saw changes to Hainan’s duty-free stores, with the expanded category range and increase in duty-free allowances, in order to encourage domestic duty-free spending after the Covid-19 outbreak in China. As global travel is unlikely to return to normal in the short term, there are still opportunities for growth in the duty-free market in Hainan. Delivery Locker Investments Increase with Growth of Last-Mile Delivery Market On January 7, Chinese delivery locker manufacturer Yidahuazhan completed a ¥35 million ($5 million) funding round, with JD.com, Pinduoduo and Suning.com as investors. On the same day, SF Express, one of China’s largest delivery services and logistics companies, announced that delivery locker operator Hive Box, in which SF Express has a majority share, would raise $400 million by issuing an additional 484 ordinary shares. The company plans to use the funding to roll out more delivery lockers across a wider range of cities. In 2020, the total revenue of delivery services in China reached ¥879.5 billion ($135.7 billion), representing 17.3% year-over-year growth, according to China’s State Post Bureau. With the rapid growth of the delivery market in China, delivery lockers have attracted attention as a solution for last-mile delivery problems. According to data technology service company Tianyancha, as of January 11, 2021, there are more than 800 companies engaged in delivery locker services in China, of which 280 companies were newly established in 2020. [caption id="attachment_122520" align="aligncenter" width="725"]

A set of Hive Box delivery lockers

A set of Hive Box delivery lockers Source: Hive Box [/caption] Coresight Research insight: According to research firm Essence Securities, in 2019, 10% of delivery packages that were sent by businesses to consumers were stored in lockers and that figure is expected to increase to 30% in 2023. The research firm also anticipates that the number of delivery lockers in China will exceed two million sets (as shown in the picture above) and expects the market size to surpass ¥50 billion ($8 billion) by 2023. Companies use delivery lockers as last-mile delivery solutions to send goods to consumers, with the usage now expanding to include consumer returns. The general public can also send goods using these lockers—consumers who want to send goods to others can place an order on related logistics apps and then deposit the package in the locker to be collected and delivered to the recipient. Appendix: New Retail Developments New Retail developments in China are listed in Appendix Figure 1.

Appendix Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=725]

Source: Company reports/Coresight Research Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies, and even brick-and-mortar stores. See selected transactions in the following tables.

Appendix Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=726]

Source: Company reports/Coresight Research

Appendix Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=727]

Source: Company reports/Coresight Research

Appendix Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=728]

Source: Company reports/Coresight Research