albert Chan

New Retail in China

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In our New Retail in China series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.

What’s New in New Retail

Alibaba Plans To Open 10 More Membership-Only Wholesale Stores

On April 24, 2021, Hou Yi, CEO of Alibaba’s Freshippo grocery retail chain, announced the company’s plan to open 10 more of the chain’s membership-only wholesale Freshippo X stores in 2021. The first Freshippo X store opened in October 2020 in Shanghai and achieved profitability in two months, according to Alibaba. It now carries more than 3,000 SKUs, of which nearly 30% are exclusive products available only to members. There are 100 buyers in the sourcing team, working with more than 500 suppliers around the world.

Alibaba intends to make Freshippo X stores the first choice for family leisure shopping and is expanding the format’s services and offerings into the fashion, fitness and pet sectors, among others. In April 2020, it opened its first ophthalmic center at its Shanghai store, offering free cleaning, adjustment and maintenance of members’ spectacles, as well as free eye tests.

A Freshippo X store in Beijing will open in June 2021, and a branch is set to open in Chengdu later in the year. Further locations have yet to be announced.

[caption id="attachment_127984" align="aligncenter" width="700"] The first Freshippo X store opening in Shanghai in October 2020

The first Freshippo X store opening in Shanghai in October 2020Source: Freshippo official Weibo account[/caption]

Coresight Research insight: The membership-only store market in China has great growth opportunities, and the main players are currently executing expansion plans. As of April 2020 (the latest available data), Sam’s Club has 31 stores in China, covering 22 cities and serving more than 3 million members. The company plans to have 40–45 stores open or under construction in China by the end of 2022. Costco opened its first store in mainland China in August 2019 and has three further stores under construction.

JD.com and Louis Vuitton Jointly Launch a New Model for Shoppers

On April 15, 2021, JD.com and luxury fashion house Louis Vuitton launched a new joint shopping model. Consumers can now access Louis Vuitton’s official WeChat shopping mini-program through the JD.com app by typing “LV” into the search bar. Under the new partnership, Louis Vuitton will not sell its products through JD.com’s app but will gain access to the platform’s traffic. In 2020, JD.com had 471.9 million annual active customers, an increase of 30.3% from 2019. WeChat owner Tencent has a 17.1% stake in JD.com and is a key ally.

In order to stay competitive in China’s online luxury market, JD.com has offered several incentives to attract luxury brand partners. The platform has provided livestreaming and social e-commerce support since the outbreak of the Covid-19 pandemic. For instance, it helped Canadian luxury brand Ports host a nine-hour livestreamed fashion show last year, leading to sales of more than ¥10 million ($1.5 million) in a single day, according to JD.com.

JD.com reported that during last year’s Singles’ Day sales, the number of consumers that made their first luxury purchase on its platform increased by 279% year over year.

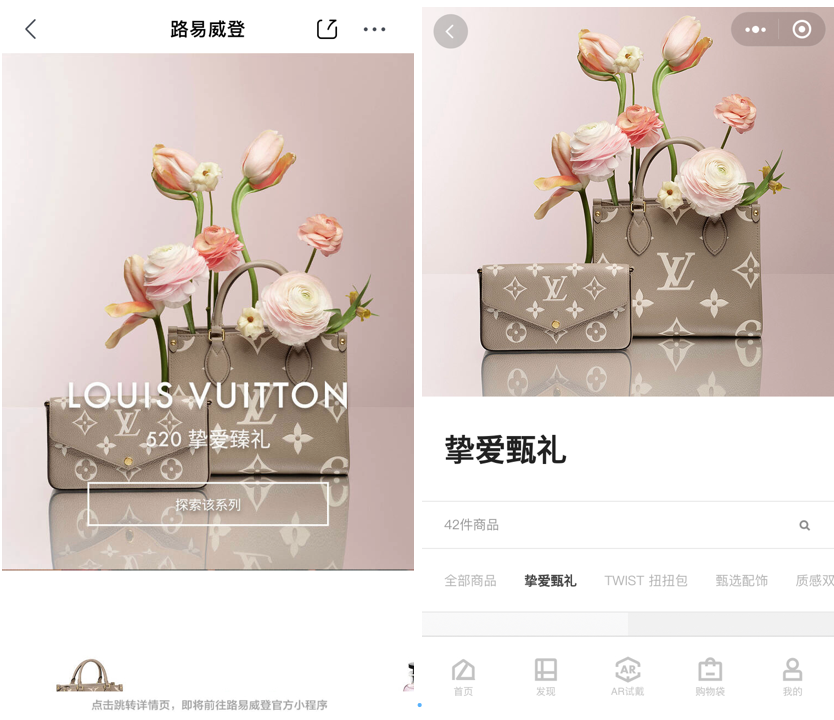

[caption id="attachment_127985" align="aligncenter" width="550"] The search result of “LV” on JD.com’s app (left) through which users can access Louis Vuitton’s WeChat mini-program (right)

The search result of “LV” on JD.com’s app (left) through which users can access Louis Vuitton’s WeChat mini-program (right)Source: JD.com/Louis Vuitton[/caption]

Coresight Research insight: China’s e-commerce luxury market is set to grow from ¥93 billion ($14 billion) in 2020 to ¥147 billion ($22 billion) in 2025, according to consulting firm McKinsey. Currently, the preferred platform for most luxury brands’ online flagships is Tmall Luxury Pavilion, owned by Alibaba. More than 200 luxury brands have opened stores on the platform, which reported that sales jumped 159% year over year in the first quarter of 2021.

Japanese Cosmetics Company Premier Anti-Aging and Tencent Cloud Form a Partnership

Japanese cosmetics company Premier Anti-Aging has signed an MoU with Tencent Cloud. Announced on April 26, 2021, the MoU aims to strengthen the brand’s New Retail strategy and drive sales in China. The partnership gives the brand access to a WeChat official account and mini-program, and more importantly the powerful data analytics to better understand and target Chinese consumers.

Since its establishment in December 2009, Premier Anti-Aging has been promoting its products at an affordable price under the direct-to-consumer (D2C) model. In February 2021, the company founded a local subsidiary in China, focused on selling its products Duo, Canadel, Immune and Sitrana, and upcoming new brands in the market.

Japan is one of the major players in China’s imported beauty market. According to the Japan Cosmetic Industry Association, Japan’s beauty exports to China have seen record highs for six consecutive years, accounting for more than 70% of sales.

[caption id="attachment_127986" align="aligncenter" width="550"] Premier Anti-Aging’s mobile application

Premier Anti-Aging’s mobile applicationSource: Premier Anti-Aging[/caption]

Appendix: New Retail Developments

New Retail developments in China over the past 12 months are listed in Appendix Figure 1.

Appendix Figure 1. New Retail Developments in China: Last 12 Months

[wpdatatable id=991 table_view=regular]Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables.

Appendix Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=992 table_view=regular]Source: Company reports/Coresight Research

Appendix Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=993 table_view=regular]

Source: Company reports/Coresight Research Appendix Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=994 table_view=regular]

Source: Company reports/Coresight Research