DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China. This month, we have seen e-commerce platforms introduce new initiatives and brands launch specific marketing campaigns to increase sales. These developments have been influenced by the coronavirus pandemic, from which China is slowly recovery—with the retail sector looking to boost sales post lockdowns.What’s New in New Retail

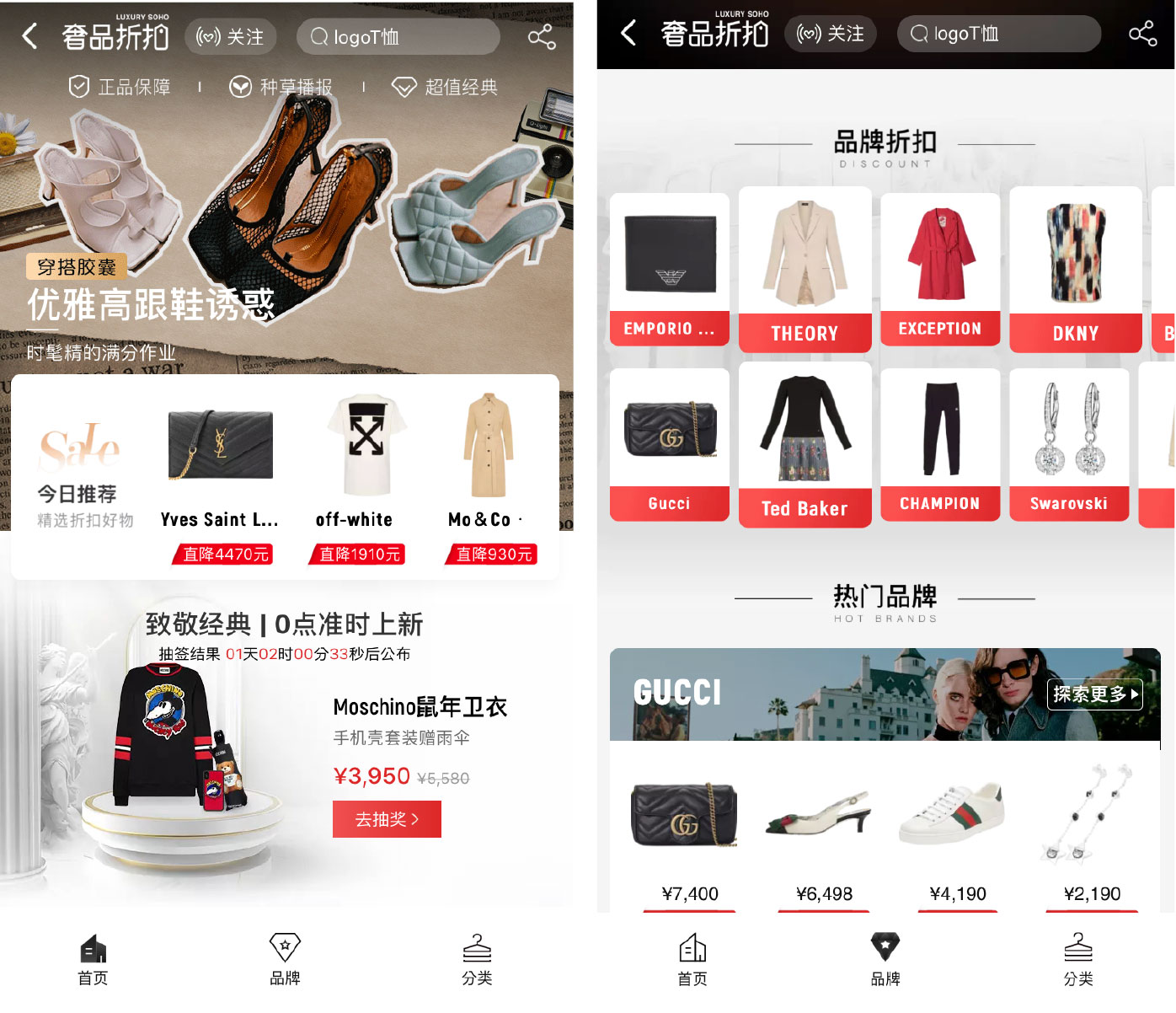

Alibaba Debuts a New Luxury Outlet Channel: Luxury Soho On April 20, 2020, Alibaba launched a luxury discount channel, Luxury Soho, on its Tmall e-commerce platform. The new channel runs alongside the company’s existing Luxury Pavilion, which focuses on a more affluent group of consumers and sells branded products at full price. Luxury Soho, on the other hand, will sell products from high-end brands at discount prices, just like a physical outlet. The new channel targets younger luxury consumers who are price-sensitive but at the same time value premium experiences and craftmanship. According to Tmall data, a rapidly increasing number of younger consumers (born after 1995) are using Luxury Soho. [caption id="attachment_110189" align="aligncenter" width="700"] Alibaba’s Luxury Soho discount channel

Alibaba’s Luxury Soho discount channel Source: Tmall [/caption] The Luxury Soho platform provides tools to support brands in running their own stores, and brands have full control over pricing, product selection and how their store looks. They can use technologies such as livestreaming and augmented reality to innovatively communicate with consumers. Luxury labels such as Bulgari, Burberry, Fendi, Gucci, Hermes, Michael Kors and Sisley have started to sell products on the platform. Michael Kors offers discounts as deep as 78%. For instance, its Peyton shoulder bag is marked down from ¥5,000 (around $705) to ¥1,099 ($155). Coresight Research insight: Given the temporary store closures and depressed demand in Western markets, selling through outlet platforms in non-Western markets could help retailers and brands to mitigate the impact of the coronavirus pandemic. Companies selling discretionary goods could seek to clear some of their inventories—providing products still have relevance and stocks are cleared in a way that maintains brand integrity. Indeed, French luxury group Kering said in its first-quarter 2020 earnings call that it will sell seasonal products at discounted prices to boost sales later this year. Decathlon Sees Uptick in Sales of Outdoor Products on Tmall Sports retailer Decathlon launched its Super Brand Day campaign on Tmall on April 24, 2020, selling protective sports gear, skateboards and roller blades, outdoor apparel and tents. The Super Brand Day marketing program was introduced in 2015 by Tmall to showcase selected brands to Chinese consumers. Each participating brand has a 24-hour period in which they are promoted by the platform—being given top placement on Tmall’s homepage and marketing campaigns—and can provide consumers with special offers and unique shopping experiences. Decathlon saw sales of its outdoor products rise considerably on its Super Brand Day, and the company sold around 10,000 trampolines in just 10 minutes before running out of stock. [caption id="attachment_110190" align="aligncenter" width="404"]

Decathlon’s Tmall store

Decathlon’s Tmall store Source: Alizila [/caption] Part of Decathlon’s success on the day came from its marketing strategy and upgraded delivery services. The brand designed a mobile game for its Super Brand Day, which consumers could play while shopping. The retailer also offered an in-store pickup service across 150 offline stores, as well as launching a two-hour home delivery service for addresses in close proximity to its stores. Coresight Research insight: With China returning to normalcy following coronavirus lockdowns, people are beginning to go outside more and take part in more outdoor activities. In addition to Decathlon on Tmall, we have seen sales of outdoor products increase on other e-commerce platforms. For instance, Pinduoduo reported that sales of barbeque equipment and picnic mats increased 250% year over year from April 1 to April 19, 2020. On Suning’s e-commerce platform Suning.com, sales of tents and picnic mats grew 121.2% and 116.7% month over month, respectively, between April 29 and May 4, 2020. Tencent Launches Group-Buying Mini Program Xiao’e Pinpin On April 29, 2020, Tencent launched a mini program called Xiao’e Pinpin, which allows users to purchase products at lower prices by forming groups. In essence, the mini-program is a group-buying platform, similar to Pinduoduo. The mini program displays products in a content feed, comprising products from multiple merchants. Currently, items on sale include electronics, apparel, grocery and cosmetics, but products are not categorized, just shown in the format of news feed. This makes it difficult for consumers to locate specific products they want to purchase, particularly as there is no search functionality. [caption id="attachment_110191" align="aligncenter" width="329"]

Xiao’e Pinpin

Xiao’e Pinpin Source: WeChat [/caption] Coresight Research insight: With the economy experiencing a big hit from the coronavirus pandemic, Tencent is expanding into group buying to tap into lower-tier markets as an opportunity for growth. Online retail sales of physical goods in lower-tier markets will account for an estimated 45% of total online retail sales in China, worth some ¥8.1 trillion (around $1.25 trillion), in 2025. This would represent a CAGR of 18.3% from 2018 to 2025 (although these estimates were made before the disruption of the coronavirus outbreak). The group-buying shopping model is attractive for shoppers with a limited budget, especially those in lower-tier cities, as they can join together to take advantage of lower prices. Major e-commerce players have also launched group-buying platforms to tap into this shopper demographic. For example, JD.com started its group-buying mini program on WeChat in June 2018 and launched group-buying app Jingxi in April 2019. Suning.com established its own group-buying app in July 2018. Shanghai Launches Two-Month-Long Shopping Festival To Reboot Economy On May 4, Shanghai kicked off a new, two-month-long “55 (Double Five) Shopping Festival” to revive the economy post coronavirus lockdowns. The omnichannel shopping season is being driven by the Shanghai Municipal People's Government and places emphasis on “shopping and tourism”. To learn more about the new festival and its promotions,read our detailed report here. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1.

Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=192 table_view=regular] Source: Company reports/Coresight Research Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables.

Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=197 table_view=regular] Source: Company reports/Coresight Research

Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=195 table_view=regular] Source: Company reports/Coresight Research

Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=196 table_view=regular] Source: Company reports/Coresight Research