Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China. This month, we have seen retail firsts on Alibaba’s e-commerce platform Tmall and the forging of more retail partnerships—both of which are moves influenced by the coronavirus pandemic, as the retail sector looks to boost sales during China’s recovery.What’s New in New Retail

Shanghai Fashion Week Goes Online Via Tmall Shanghai Fashion Week, held on March 24–30, 2020, became the world’s first fashion-week event to livestream its shows. The event was initially postponed due to the coronavirus pandemic, but organizers then decided to partner with Tmall instead, to move Shanghai Fashion Week online. The event comprised more than 150 designers and brands presenting over 1,000 products of their autumn-winter collections via livestreaming. Its “see now, buy now” format allowed consumers to purchase or pre-order products they saw on the runway directly from their smart devices while watching the livestreaming sessions. According to Tmall, the entire event drew over 11 million views and generated more than ¥20 million ($2.82 million) in gross merchandise volume. Chinese luxury brand Icicle attracted over 238,000 views during its two-hour livestream show, and sales through its Tmall store increased by 100%. The e-commerce platform also invited some designers to share their brand stories and inspirations online, as well as engage with viewers. [caption id="attachment_108384" align="aligncenter" width="580"] Source: Alizila[/caption]

Coresight Research insight: Retailers and brands turned to livestreaming amid the coronavirus crisis to boost their online presence and continue operations. As Shanghai Fashion Week demonstrated, events can also capitalize on the livestreaming trend, which is particularly popular among young Chinese consumers. Tmall is the preferred destination for livestreaming, as it has more than 800 million monthly active users. This massive user base provides exposure for emerging and independent designers, as well as larger brands, which positively impacts sales. While traditional fashion weeks are unlikely to be replaced, this innovative online model may accelerate the combination of digital and physical in future retail events.

Huda Beauty Launches on Tmall Global

Cosmetics brand Huda Beauty opened its flagship store on Tmall Global, Alibaba’s cross-border e-commerce platform, on March 25, 2020, marking the brand’s entry into China’s lucrative beauty market. Founded in 2013, the Dubai-based brand has accumulated an enormous following on social media in the West in recent years. Its best-selling products include eyeshadow palettes, liquid lipsticks, foundation and false lashes. The brand has currently unveiled 15 products on Tmall Global and ultimately plans to bring its full product line to the platform.

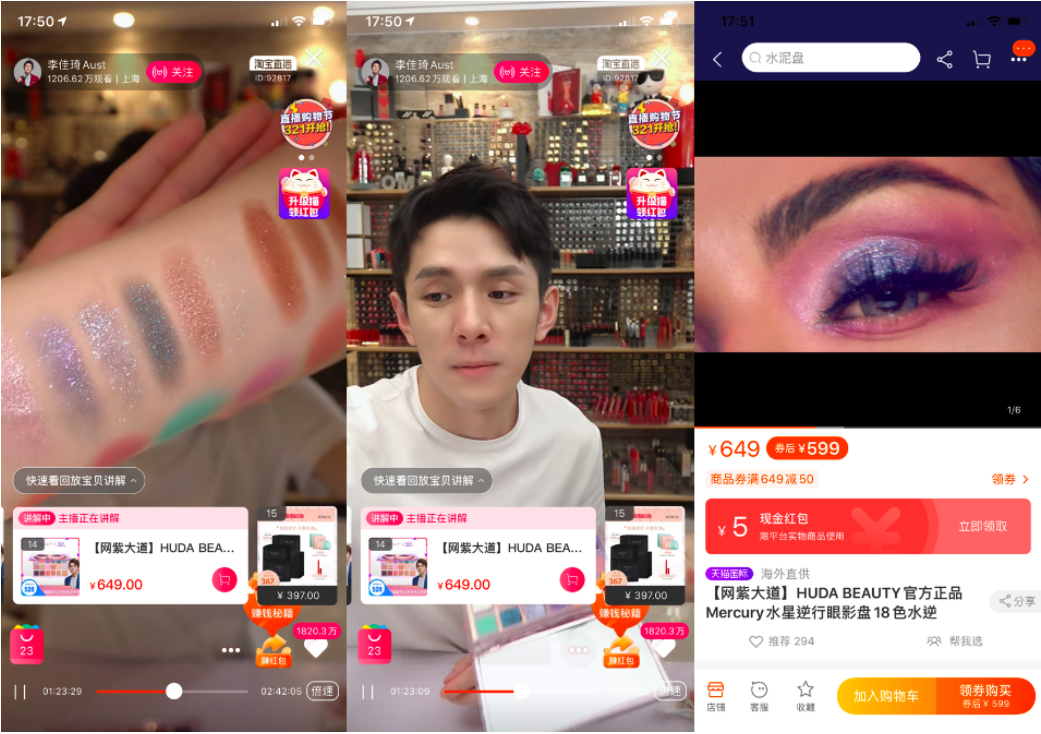

According to Tmall Global, 300,000 people visited Huda Beauty’s flagship store on its opening day. To celebrate the launch, the brand partnered with top influencers Austin Li and Becky Li to initiate a spring makeup-look challenge on social media platform Weibo, where both used Huda Beauty’s new “Mercury Retrograde” eyeshadow palette to create different looks. Austin Li also featured the palette during a livestreaming session, which received over 12 million views.

[caption id="attachment_108385" align="aligncenter" width="580"]

Source: Alizila[/caption]

Coresight Research insight: Retailers and brands turned to livestreaming amid the coronavirus crisis to boost their online presence and continue operations. As Shanghai Fashion Week demonstrated, events can also capitalize on the livestreaming trend, which is particularly popular among young Chinese consumers. Tmall is the preferred destination for livestreaming, as it has more than 800 million monthly active users. This massive user base provides exposure for emerging and independent designers, as well as larger brands, which positively impacts sales. While traditional fashion weeks are unlikely to be replaced, this innovative online model may accelerate the combination of digital and physical in future retail events.

Huda Beauty Launches on Tmall Global

Cosmetics brand Huda Beauty opened its flagship store on Tmall Global, Alibaba’s cross-border e-commerce platform, on March 25, 2020, marking the brand’s entry into China’s lucrative beauty market. Founded in 2013, the Dubai-based brand has accumulated an enormous following on social media in the West in recent years. Its best-selling products include eyeshadow palettes, liquid lipsticks, foundation and false lashes. The brand has currently unveiled 15 products on Tmall Global and ultimately plans to bring its full product line to the platform.

According to Tmall Global, 300,000 people visited Huda Beauty’s flagship store on its opening day. To celebrate the launch, the brand partnered with top influencers Austin Li and Becky Li to initiate a spring makeup-look challenge on social media platform Weibo, where both used Huda Beauty’s new “Mercury Retrograde” eyeshadow palette to create different looks. Austin Li also featured the palette during a livestreaming session, which received over 12 million views.

[caption id="attachment_108385" align="aligncenter" width="580"] Top influencer Austin Li recommends Huda Beauty’s eyeshadow palette during a livestreaming session

Top influencer Austin Li recommends Huda Beauty’s eyeshadow palette during a livestreaming session Source: Alizila[/caption] Coresight Research insight: International brands continue to launch on Tmall and Tmall Global during the coronavirus crisis. In March, streetwear brand Bape, sneaker and apparel brand Undefeated and luxury brands Prada and Miu Miu all made their debuts on Alibaba’s e-commerce platforms. Huda Beauty’s store launch has been timed well, as eye-makeup products in China are gaining popularity and trending on social media, with many beauty influencers sharing tutorials and recommendations. Eyeshadow sales on Tmall increased 40% year over year from January to March 2020, according to the platform. Data provider ECdataway reported that sales of cosmetic and skincare products on Tmall jumped 89.5% during the International Women’s Day (March 8) promotion period. Beauty therefore seems to be a more resilient discretionary product category, and sales are likely to quickly rebound in China as the nation recovers from the coronavirus outbreak. Meituan Starts Delivering Smartphones and Cosmetics on Its Platform Chinese food-delivery platform Meituan has expanded its physical goods delivery to tens of thousands of items, by forging partnerships with more retailers. As of April 9, 2020, the platform now offers delivery of various products such as smartphones and beauty items: Consumers can now purchase smartphones from Huawei in three Chinese cities and beauty products from Sephora in 16 cities. Meiutan provides 30- to 60-minute delivery services on nonfood items, depending on location. These offerings build on Meituan’s existing services in the physical goods category: The platform has operated delivery services for clothes from Hailan Home, a Chinese menswear brand, since 2018. In March 2020, the company partnered with 72 physical bookstores in Beijing to sell their products, waiving admission fees and reducing service fees to alleviate the burden on bookstores amid the coronavirus pandemic. Meituan’s move to incorporate new types of products aims to boost sales, as its business was negatively affected by the coronavirus crisis. The company warned of negative sales growth and operating loss for its first quarter of 2020 due to challenges in both supply and demand. Meituan also puts itself in competition with e-commerce giants such as Tmall and JD.com. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=136]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=137]

Source: Company reports/Coresight Research

Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=138]

Source: Company reports/Coresight Research

Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=139]

Source: Company reports/Coresight Research