DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail?

Prada Sells on Secoo and JD.com Prada has hastened its expansion in China’s e-commerce space by selling on third-party e-commerce platforms. In May, the Italian fashion brand formed a partnership with Secoo, China’s luxury-focused e-commerce platform that enjoys a good reputation for genuine products, and began selling Prada and Miu Miu products on the platform. The company went on to launch three of its brands: Prada, Miu Miu and Car Shoe on JD.com, China’s second largest B2C e-commerce platform, in June. JD.com is among Secoo’s investors and provides logistics services to the company. The partnerships will see closer relationships among Prada, Secoo and JD.com. Compared to competitors such as Gucci and Louis Vuitton, Prada was relatively late in establishing an online presence in China: The company launched its first online store on its Chinese official site in late 2017. Coresight Research Insight: Prada has adjusted its strategies in China and given more attention to the online space over offline store expansion. It comes as no surprise: Luxury brands have to up their digital games if they want to target the millennials who are digitally active and now represent 28% of China’s luxury consumers, according to Mckinsey’s China Luxury Report 2019. Moreover, the data captured in online commerce helps luxury brands analyze shopper behavior in greater detail. [caption id="attachment_91198" align="aligncenter" width="700"] Prada’s official website in Chinese

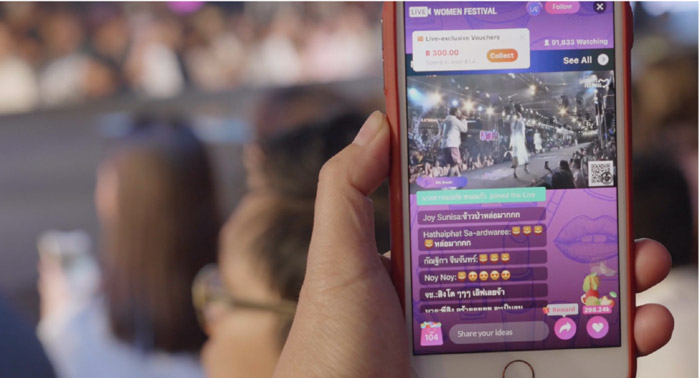

Prada’s official website in Chinese Source: Prada [/caption] Lazada Launches “See Now, Buy Now” Fashion Show in Thailand Alibaba-owned Southeast Asian e-commerce platform Lazada launched a “See Now, Buy Now” fashion show in Thailand during its month-long “Women’s Festival” in May to honor women shoppers across Southeast Asia. The “See Now, Buy Now” event lets viewers buy the items they see in the fashion show directly from the app they’re using to watch the show. This is Lazada’s third “See Now, Buy Now” fashion show in Southeast Asia, following similar events in the Philippines and Malaysia. Over 120,000 viewers in Thailand watched the fashion show, which showcased both international brands and local sellers, on mobile phones in real time through livestreaming. Viewers could purchase the items they saw on the runway immediately on the Lazada app. Shoppers could also interact with sellers on the app to learn more about the brands and products. The fashion show was an infusion of shopping and entertainment as Thai celebrities and pop singers were invited to perform on the show. Alibaba first trialed the “See Now, Buy Now” concept in China for its Tmall Fashion Show and later used the approach in Southeast Asia. [caption id="attachment_91199" align="aligncenter" width="700"]

Lazada app users watch the “See Now, Buy Now” fashion show in real time via livestreaming

Lazada app users watch the “See Now, Buy Now” fashion show in real time via livestreaming Source: Alizila.com [/caption] Alipay Partners with Six Mobile Payment Companies in Europe Alibaba’s mobile payment services provider Alipay is partnering with six mobile payment companies in Europe to facilitate mobile payment transactions across Europe. The companies in the partnership include Finland’s ePassi and Pivo, Norway’s Vipps, Spain’s MOMO, Portugal’s Pagaqui and Austria’s Bluecode. The six mobile payment companies boast a total of five million users and around 190,000 merchants in Europe have joined their networks. Shoppers can use any one of the six partner payment solutions at any merchant that supports any one of the partner mobile payment solutions in 10 European countries. This is because the six companies will adopt a unified QR code provided by Alipay to settle transactions. Chinese tourists will also be able to pay with Alipay at merchants that accept the European payment apps. [caption id="attachment_91200" align="aligncenter" width="700"]

Alipay QR code payment

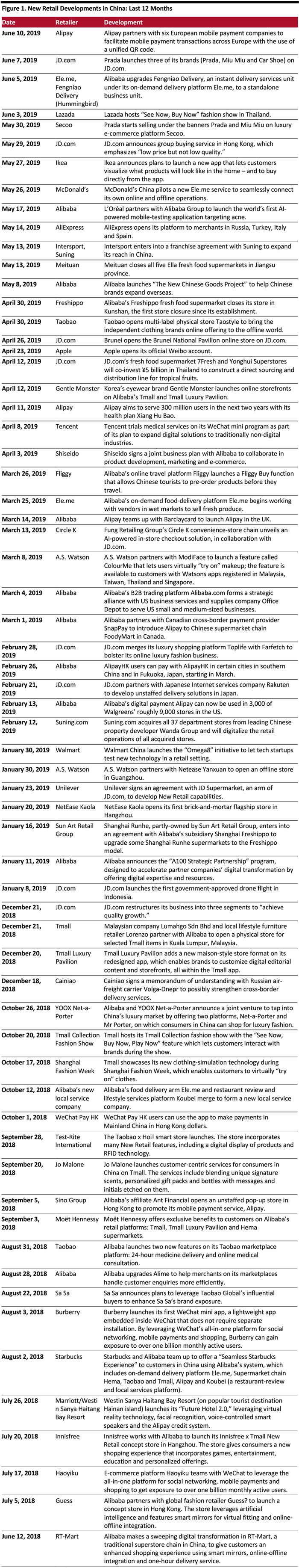

Alipay QR code payment Source: Alizila.com [/caption] Alibaba Makes Ele.me’s Logistics Arm a Standalone Unit Alibaba has made Fengniao Delivery (or Hummingbird), the logistics arm of its on-demand delivery platform Ele.me, a standalone unit to better serve Alibaba’s ecosystem and the instant delivery needs of merchants operating local services. Fengniao is one of the chief players in China’s instant delivery service, an emerging category that helps merchants deliver in 30–45 minutes. Fengniao data shows it fulfilled in an average delivery time of less than 30 minutes and served over 3.5 million merchants in 2018. Beginning as an on-demand food delivery platform, Ele.me and Fengniao have gradually expanded service categories to include medicine, fresh food and grocery items at convenience stores and supermarkets. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_91201" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

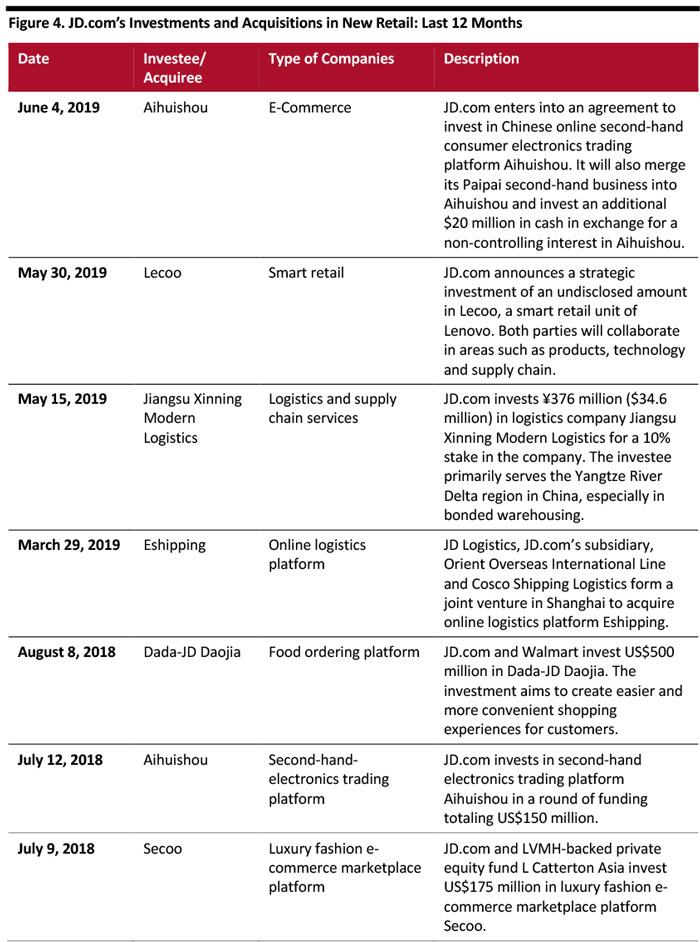

Investments and Acquisitions in New Retail

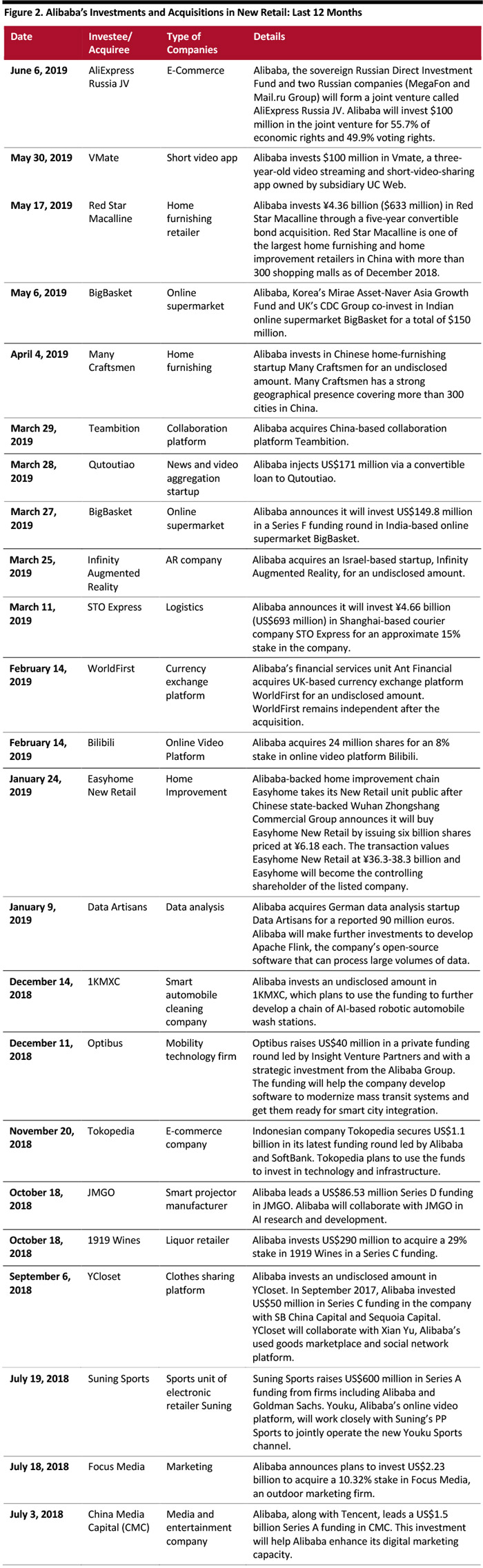

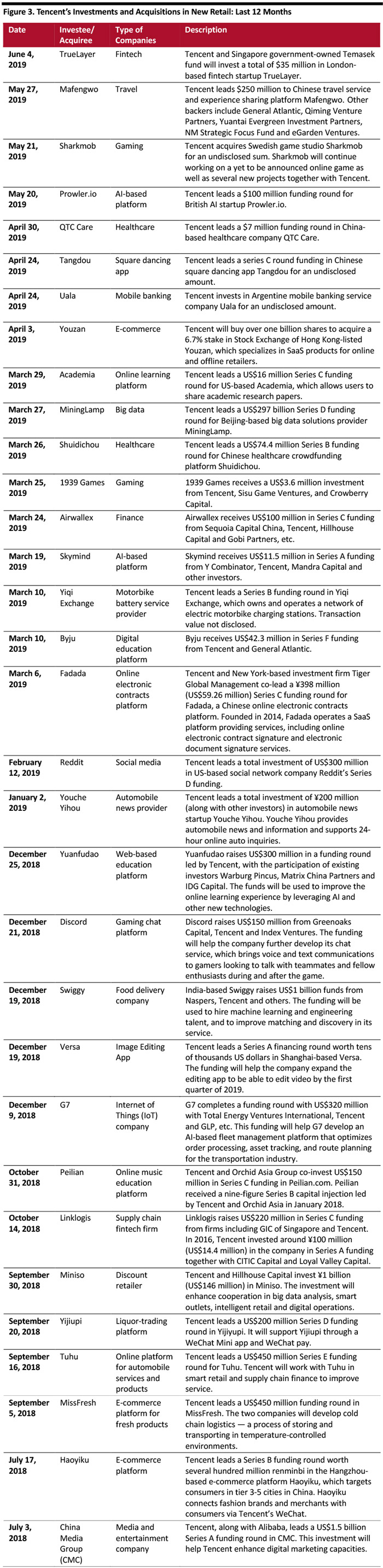

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_91202" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_91202" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_91203" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_91203" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_91204" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_91204" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]