Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.

What’s New in New Retail?

JD.com Launches a Gifting WeChat Mini Program “JD Gift”

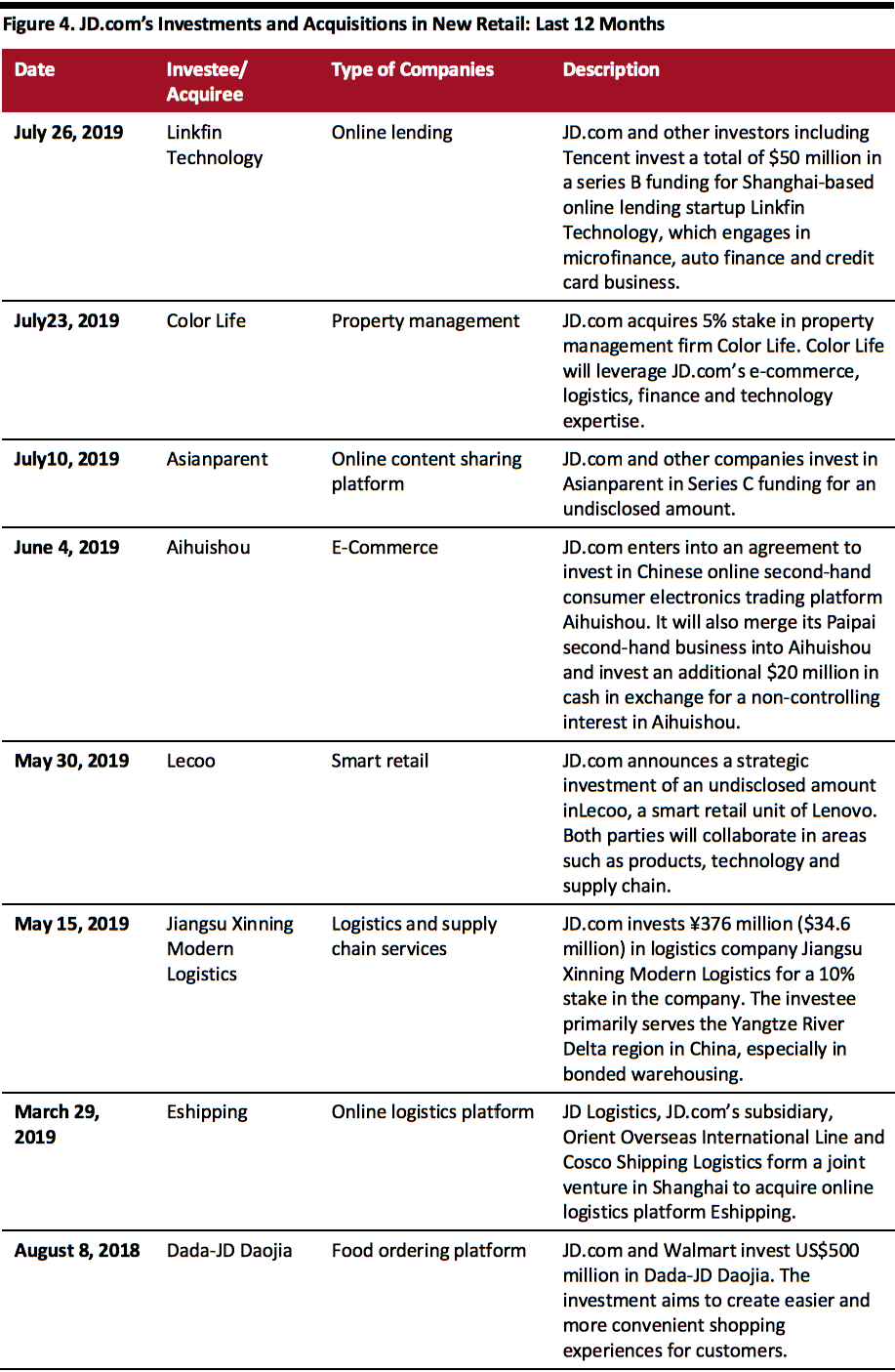

JD.com has launched a gifting mini program “JD Gift” on China’s major social app WeChat to facilitate online gifting. According to JD.com, the initiative aims to make it easy for busy urban dwellers to send gifts and to help them potentially avoid awkwardness when they need to ask for the recipient’s address.

After users select a gift and pay for it on the mini program, they send the gift to a WeChat contact with a message included. Once the recipient clicks the message box to receive the gift, he or she can then input shipping information. JD Logistics, JD.com’s logistics affiliate, will arrange the shipment accordingly.

[caption id="attachment_94583" align="aligncenter" width="700"] Steps for using the JD Gift WeChat mini program

Steps for using the JD Gift WeChat mini program

Source: JD Corporate Blog[/caption] According to Statista, there were around 673.5 million social media users in China and around 30% of mobile Internet time was spent on WeChat in 2018. With such a high usage rate, WeChat has long been the go-to tool for many brands and retailers to reach out to their customers and to implement brand campaigns. Coresight Research Insight: Brands such as Starbucks have already attempted to use the WeChat gifting feature for social e-commerce, which is heating up in China’s e-commerce market in 2019. The strategic partnership between JD.com and Tencent, WeChat’s parent company, allows the former to favorably tap the mainstream social app to drive social e-commerce as a new revenue stream. JD.com Opens a Luxury Goods Services Center JD.com opened its first services center for luxury goods in a downtown location in Beijing in late July. The store will offer services ranging from cleaning, repairing, maintenance and recycling to trading for high-end products including jewelry, clothes and watches. Customers can place an order on JD.com’s mobile app in advance to book the services. The service center has a size of 1,300 square feet and includes a display section of secondhand suitcases and bags for sale. JD.com will continue to launch more such service centers during the rest of the year and is open to a franchise model if the business becomes sophisticated. Coresight Research Insight: The after-sale service market for high-end products is becoming competitive as a number of online platforms are launching maintenance and repair services centers offline. This includes Alibaba’s Tmall Wuyougo Service Center and luxury-focused e-commerce platform Secoo’s after-sale service centers. These platforms are building the corresponding infrastructure to strive for closer cooperation with luxury brands, especially when luxury brands have been launching on various Chinese e-commerce platforms besides building their own Chinese websites in recent years. Suning Acquires Circle K Stores in Guangzhou from Fung Group Suning Xiaodian, the convenience store unit of major Chinese retail group Suning, announced that it has acquired Hong Kong-listed Fung Group’s entire Circle K convenience store network in Guangzhou, a tier-one city in southern China. Alibaba-invested Suning operates its own e-commerce platform, Suning.com, and a variety of physical stores including supermarkets, convenience stores and consumer electronics specialty stores. The company has been expanding offline since the beginning of this year by first acquiring 37 department stores from Chinese property developer Wanda and then taking over French hypermarket Carrefour’s business in China in July. Suning then proceeded to digitalize the acquired retail space to prompt online-to-offline retail integration in the New Retail trend. [caption id="attachment_94584" align="aligncenter" width="700"] Suning Xiaodian, the convenience store business of Suning

Suning Xiaodian, the convenience store business of Suning

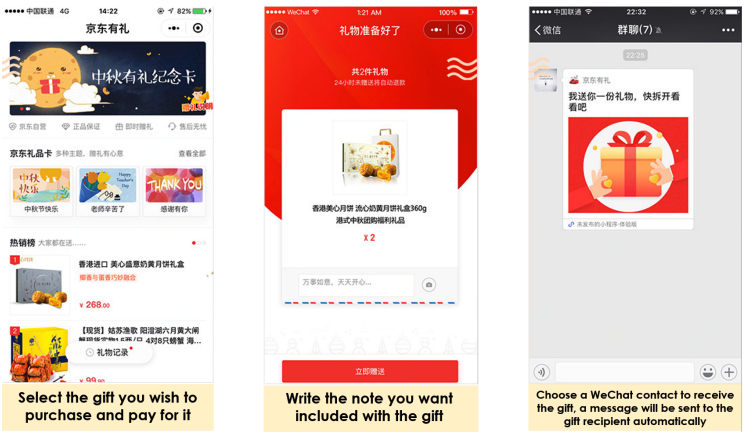

Source: Suning.cn[/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_94585" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

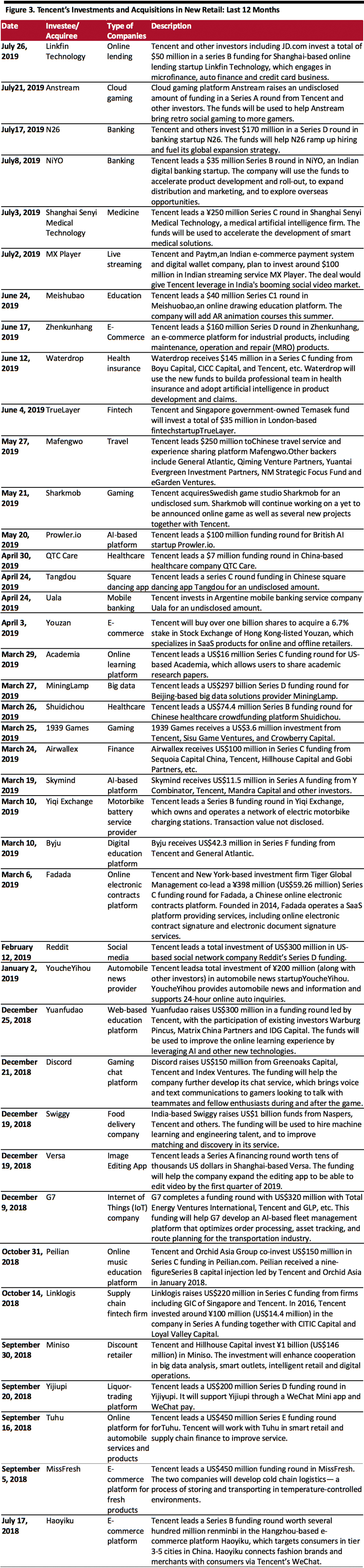

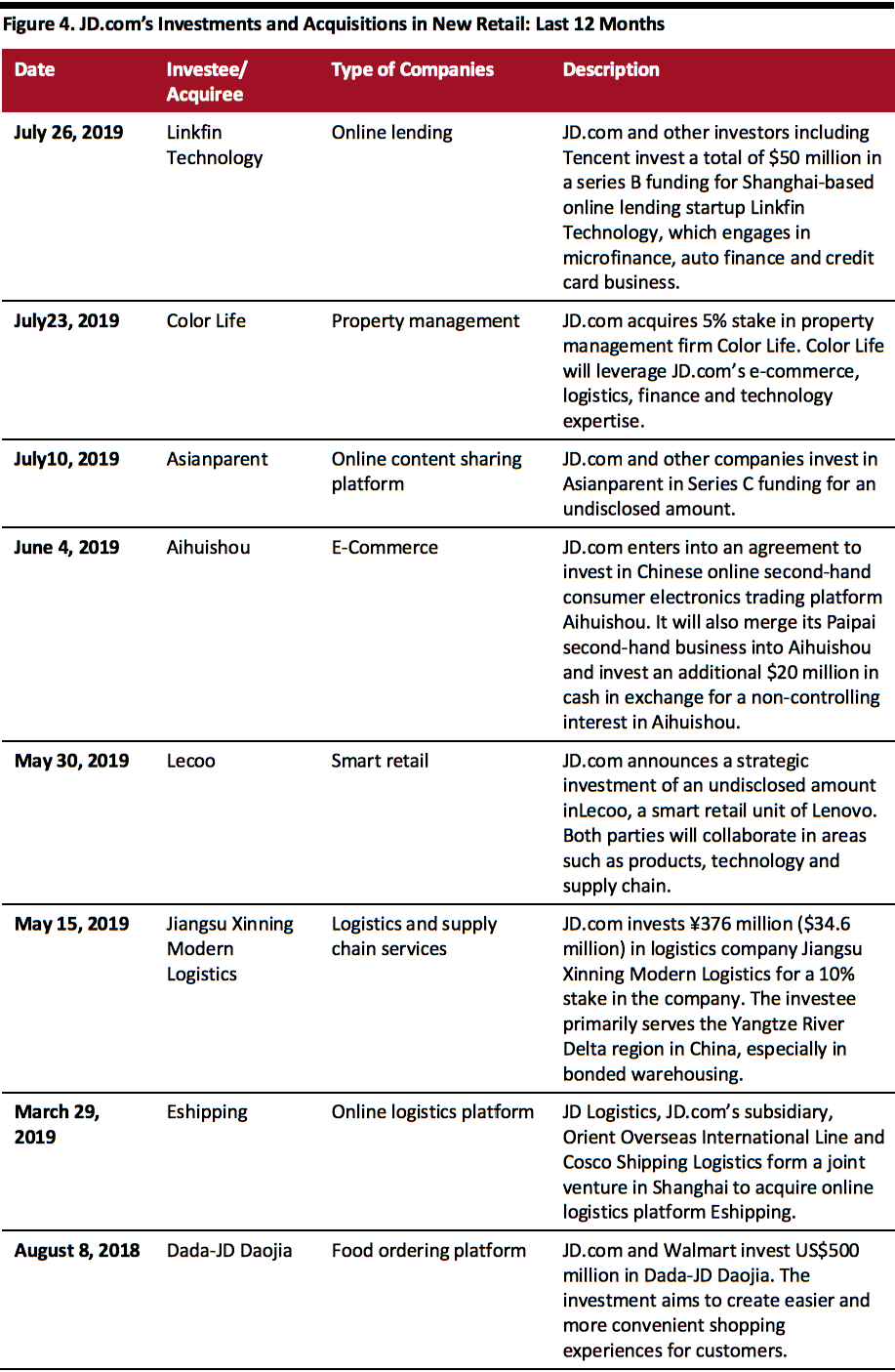

Investments and Acquisitions in New Retail

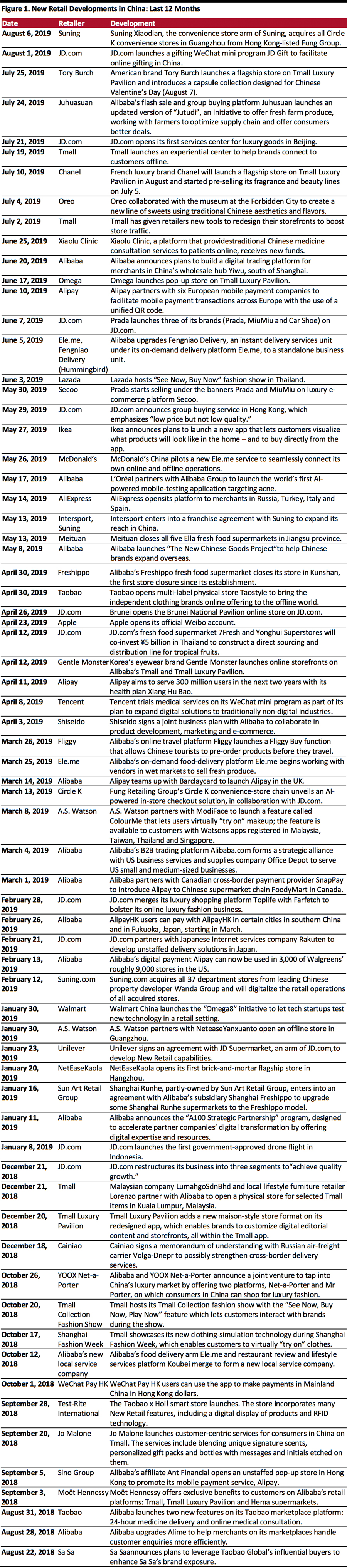

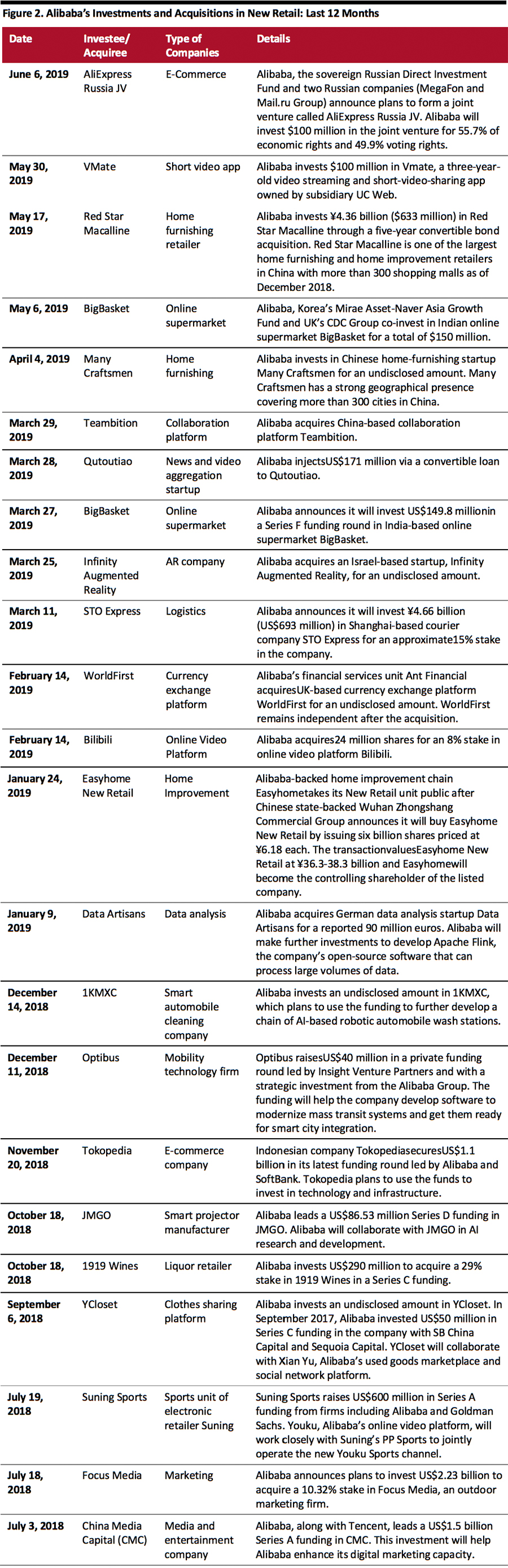

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_94586" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_94586" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94587" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94587" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94588" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94588" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Steps for using the JD Gift WeChat mini program

Steps for using the JD Gift WeChat mini programSource: JD Corporate Blog[/caption] According to Statista, there were around 673.5 million social media users in China and around 30% of mobile Internet time was spent on WeChat in 2018. With such a high usage rate, WeChat has long been the go-to tool for many brands and retailers to reach out to their customers and to implement brand campaigns. Coresight Research Insight: Brands such as Starbucks have already attempted to use the WeChat gifting feature for social e-commerce, which is heating up in China’s e-commerce market in 2019. The strategic partnership between JD.com and Tencent, WeChat’s parent company, allows the former to favorably tap the mainstream social app to drive social e-commerce as a new revenue stream. JD.com Opens a Luxury Goods Services Center JD.com opened its first services center for luxury goods in a downtown location in Beijing in late July. The store will offer services ranging from cleaning, repairing, maintenance and recycling to trading for high-end products including jewelry, clothes and watches. Customers can place an order on JD.com’s mobile app in advance to book the services. The service center has a size of 1,300 square feet and includes a display section of secondhand suitcases and bags for sale. JD.com will continue to launch more such service centers during the rest of the year and is open to a franchise model if the business becomes sophisticated. Coresight Research Insight: The after-sale service market for high-end products is becoming competitive as a number of online platforms are launching maintenance and repair services centers offline. This includes Alibaba’s Tmall Wuyougo Service Center and luxury-focused e-commerce platform Secoo’s after-sale service centers. These platforms are building the corresponding infrastructure to strive for closer cooperation with luxury brands, especially when luxury brands have been launching on various Chinese e-commerce platforms besides building their own Chinese websites in recent years. Suning Acquires Circle K Stores in Guangzhou from Fung Group Suning Xiaodian, the convenience store unit of major Chinese retail group Suning, announced that it has acquired Hong Kong-listed Fung Group’s entire Circle K convenience store network in Guangzhou, a tier-one city in southern China. Alibaba-invested Suning operates its own e-commerce platform, Suning.com, and a variety of physical stores including supermarkets, convenience stores and consumer electronics specialty stores. The company has been expanding offline since the beginning of this year by first acquiring 37 department stores from Chinese property developer Wanda and then taking over French hypermarket Carrefour’s business in China in July. Suning then proceeded to digitalize the acquired retail space to prompt online-to-offline retail integration in the New Retail trend. [caption id="attachment_94584" align="aligncenter" width="700"]

Suning Xiaodian, the convenience store business of Suning

Suning Xiaodian, the convenience store business of SuningSource: Suning.cn[/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_94585" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_94586" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_94586" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94587" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94587" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94588" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_94588" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]