DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

ByteDance’s News Platform Jinritoutiao Adds New Coronavirus-Inspired Function Jinritoutiao, a news platform owned by ByteDance (which also owns TikTok), launched a new coronavirus-inspired “Play at Home” function that includes a wide range of functionality for people staying at home. They include tools for people doing more cooking at home (users can find recipes and watch cooking tutorials), for people exercising at home, taking classes at home, and ordering groceries and medicine for delivery. ByteDance said some of the functions have been there for some time, but the company has enhanced functionality and improved the interface to make it more directly targeted at home-bound consumers. [caption id="attachment_106039" align="aligncenter" width="427"] Jinritoutiao’s new “Play at Home” function

Jinritoutiao’s new “Play at Home” function Source: Company website [/caption] With the grocery delivery function, consumers can shop grocery products via two third-party vendors—Meicai and Carrefour—although users need to create separate accounts to order from each as the merchants have not integrated their systems with Jinritoutiao. [caption id="attachment_106040" align="aligncenter" width="700"]

Meicai page on Jinritoutiao (left) and Meicai (right)

Meicai page on Jinritoutiao (left) and Meicai (right) Source: Company website [/caption] Coresight Research insight: ByteDance has been responsive to the coronavirus situation in China, apart from launching the “Play at Home” function. Its short-video platform TikTok premiered the film Lost in Russia, which had been designated for release during the Chinese New Year holiday when Chinese consumers usually shop, dine out and go to cinemas. But with cinemas closed, ByteDance paid ¥630 million (around US$91 million) for the rights and premiered the movie on TikTok. The company said the film was viewed 180 million times in the first three days. Alibaba Helps Cinemas to Sell Snacks With cinemas closed for weeks, most found themselves with large inventories of unsold snacks and beverages. To clear that inventory, Alibaba’s food delivery arm Ele.me teamed up with its film-making unit Alibaba Pictures, along with around 20 cinema companies to sell these products online. Snacks and beverages are a huge revenue source for cinemas, and normally in-cinema prices are considerably higher than average. So, to clear the inventory the companies had to dramatically cut prices. For example, a bag of fruit and nut mix sells for just ¥12 (around US$1.70) on cinema operator Wanda’s Ele.me store—compared to ¥40 (around US$5.7) on Taobao. Alibaba said this initiative would cover 1,000 cinemas and by the end of February, these cinemas will sell their snacks and beverages on Ele.me. [caption id="attachment_106041" align="aligncenter" width="452"]

Wanda cinema sells snacks on Ele.me

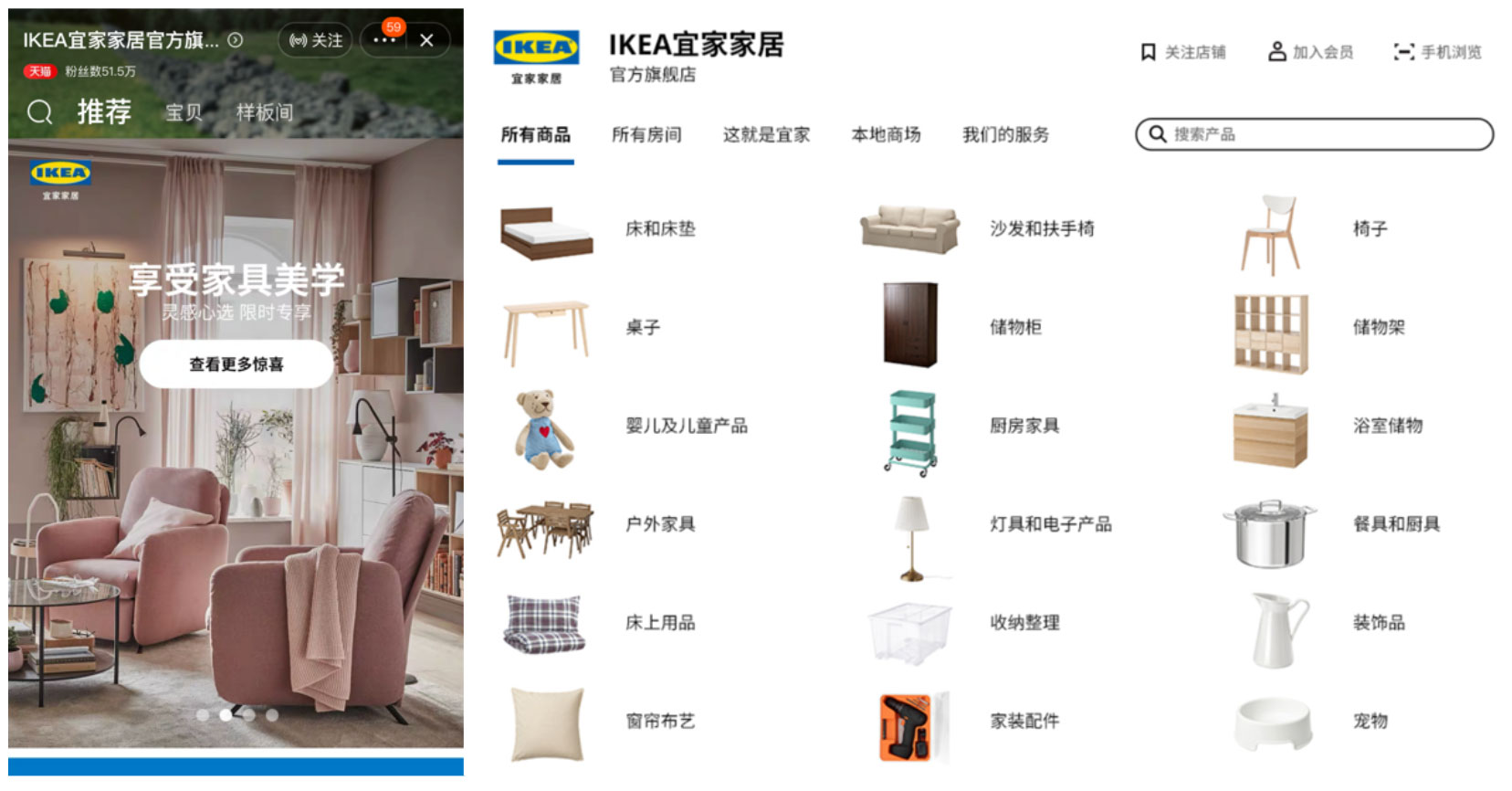

Wanda cinema sells snacks on Ele.me Source: Company website [/caption] IKEA Launches Its First Third-Party Online Store on Tmall On March 10, IKEA opened a flagship store on Tmall, the first time the retailer will sell on a third-party platform. The move was likely prompted by the closure of all 30 of the retailer’s stores in China. The retailer had re-opened 28 of the closed stores as of March 11, but was looking to quickly rebuild its business in China. The online store attracted 515,000 followers within two days of launch. The online flagship store sells around 3,800 of IKEA’s total of 9,500 products available in store. Currently, the online store will deliver only to customers in Anhui, Jiangsu and Zhejiang provinces, plus the Shanghai municipality. [caption id="attachment_106042" align="aligncenter" width="700"]

Ikea’s flagship store on Tmall (left) and Ikea’s product list on Tmall (right)

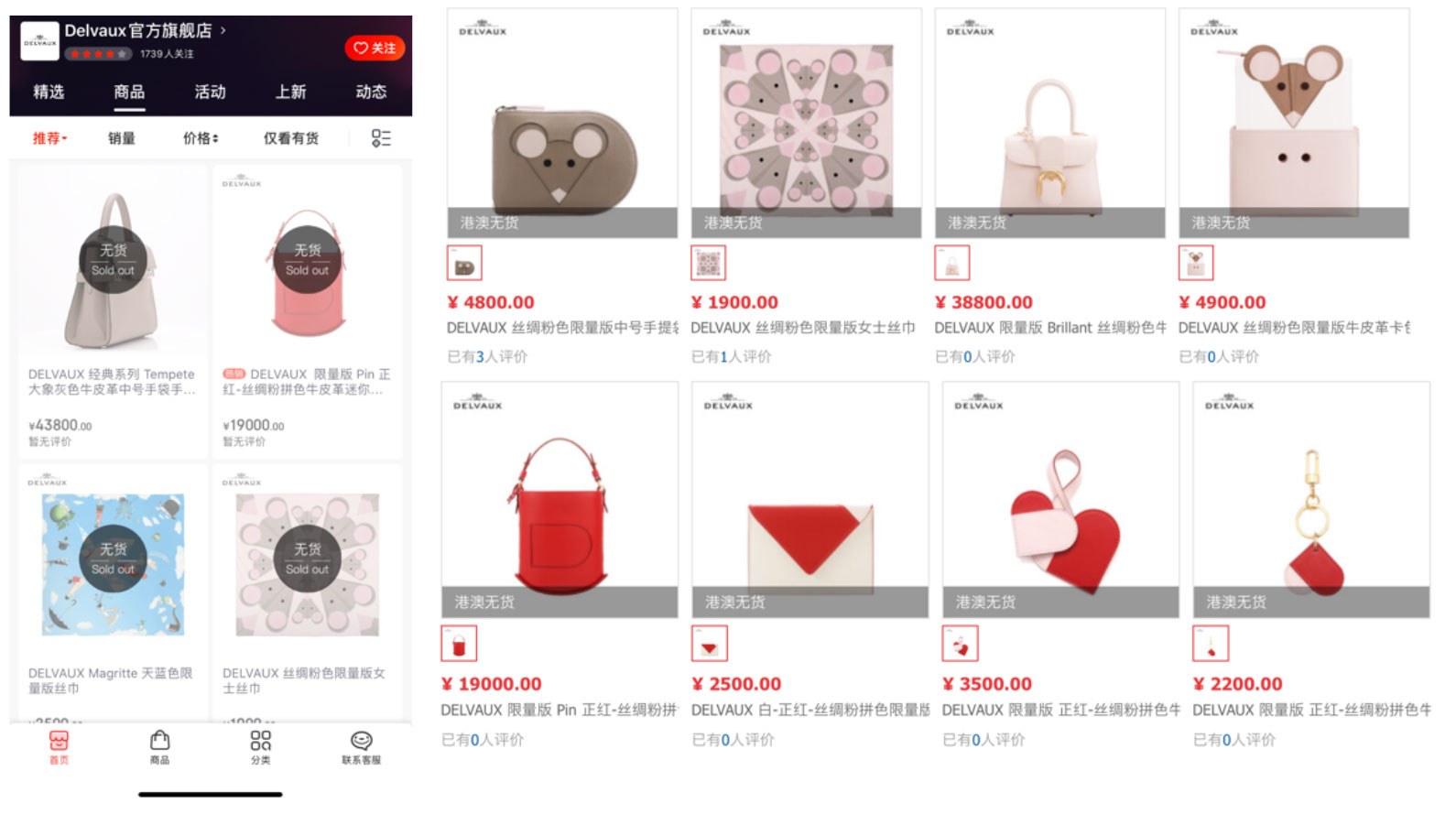

Ikea’s flagship store on Tmall (left) and Ikea’s product list on Tmall (right) Source: Company website [/caption] Coresight Research insight: Apart from launching a flagship store on Tmall, in January 2020, IKEA released its first mobile app in China, which sells 9,300 products and furnishing services—twice what it offers on Tmall. The mobile app also serves consumers in over 200 cities. Despite its own store fleet, and its own dedicated shopping app, IKEA sees value in a Tmall presence as it reaches a huge pool of existing online shoppers. Delvaux Opens Flagship Store on JD.com On March 5, Belgian luxury brand Delvaux launched a flagship store on JD.com, the brand’s first collaboration with an e-commerce platform in China. The store sells bags for both men and women. There is currently only one collection of bags in the men’s category, and ten collections for women, including special collections for the year of the rat and Valentines’ Day. [caption id="attachment_106043" align="aligncenter" width="700"]

Delvaux’s flagship store on JD.com (left) and special collections for Chinese New Year and Valentines’ Day (right)

Delvaux’s flagship store on JD.com (left) and special collections for Chinese New Year and Valentines’ Day (right) Source: Company website [/caption] JD.com will use its premium JD Luxury Express to deliver Delvaux products, featuring delivery staff in suits and white gloves to give consumers a sense of luxury and formality. [caption id="attachment_106045" align="aligncenter" width="700"]

JD Luxury Express: suited, white-gloved deliverymen

JD Luxury Express: suited, white-gloved deliverymen Source: Company website [/caption] Coresight Research insight: Delvaux had a physical presence in China before going online with a physical store in Beijing in 2013. It later on opened stores in Shanghai, Hong Kong, Hangzhou and Chengdu, but the total number of stores remains under 10. However, luxury brands temporarily closed stores in China, making this an opportune time for Delvaux to go online. Company CEO Marco Probst said the brand is embracing the opportunities of e-commerce in China, while PwC and Goldman Sacks estimate the e-commerce penetration rate in China’s luxury sector will grow from 10% in 2019 to 13% in 2021. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=90] Source: Company reports/Coresight Research Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables: Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=91] Source: Company reports/Coresight Research Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=92] Source: Company reports/Coresight Research Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=93]