Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China. This month, we have seen initiatives from JD.com and Alibaba in response to the coronavirus outbreak.What’s New in New Retail

JD.com Uses Drone and Robots To Deliver Orders during the Coronavirus Outbreak On February 7, JD.com conducted its first delivery via drone to Liuzhuang village in Hebei province, China. Usually, residents would have parcels transported across Baiyang Lake by boat,but the water route was closed due to the coronavirus outbreak. Since the only alternative was a 100-kilometer detour around the water, JD.com identified an opportunity to use robots to carry goods the two kilometers across the lake. The drones drop parcels—such as snacks, electronics and daily necessities—to a fixed point in the village for customers to collect, removing the need for human-to-human contact. [caption id="attachment_104080" align="aligncenter" width="700"] JD.com’s drone crossed over the Baiyang Lake on February 7, 2020.

JD.com’s drone crossed over the Baiyang Lake on February 7, 2020.Source: Company website[/caption] On February 6, JD.com also used level 4 (fully autonomous in a controlled area) self-driving delivery robots to transport goods from its Renhe delivery station to a hospital in Wuhan. The robot carried large products, such as daily necessities and medical supplies donated by the public. As part of this delivery system, the robot sends a collection code to the customer’s phone upon arrival. The customer can then input this code into the robot to release their package. According to JD.com, this method of fulfilling orders will reduce human-to-human contact and therefore help to prevent the spread of the coronavirus. [caption id="attachment_104083" align="aligncenter" width="700"]

JD.com’s self-driving delivery robot (left) and customers collecting parcel from the robot (right)

JD.com’s self-driving delivery robot (left) and customers collecting parcel from the robot (right)Source: Company website[/caption] Coresight Research insight: In the midst of the coronavirus outbreak, many stores closed and shoppers turned to e-commerce to buy groceries and daily necessities. MissFresh, a Chinese online grocery retailer, saw the number of online orders for fresh food increase 136% year over year on the first day of Lunar New Year (January 25) in Northern China. While experiencing rising demand for grocery products, online retail firms have faced challenges in delivering to isolated or quarantined shoppers—the use of drones for delivery is just one of the innovative retail and food-service trends in China that are being driven by the coronavirus outbreak. Ultimately, the boost in online grocery shopping and these new services could prompt a step-up in shoppers’ expectations even once the outbreak subsides—consumers may purchase groceries online more frequently, and some of them may expect enhanced services. [caption id="attachment_104086" align="alignleft" width="200"]

Taobao’s initiative to help farmers sell fresh goods online

Taobao’s initiative to help farmers sell fresh goods onlineSource: Company website[/caption] Alibaba Helps Farmers To Sell Fresh Produce in the Midst of the Coronavirus Outbreak The coronavirus outbreak has impacted agricultural retail: Many farmers are not able to sell their fresh goods because trade centers of agricultural products have closed. Alibaba’s domestic e-commerce platform Taobao has therefore launched an initiative on February 6 to help farmers to sell their produce online. Taobao will source fresh goods directly from farmers—rather than going through intermediaries/trade centers—and then sell these products at a lower price to customers. The initiative currently covers fresh goods produced in Liaoning, Shandong, Sichuan and Zhejiang provinces. One farmer, Li Qiulan from Shandong province, said that under the Taobao initiative she and other farmers in the village altogether received up to 5,000 orders of asparagus on a day. Kenzo Opens Flagship Store on Tmall Luxury Pavilion On January 17, LVMH’s luxury fashion brand Kenzo opened a flagship store on Tmall Luxury Pavilion. This is the brand’s first partnership with e-commerce providers in China. It also makes Kenzo the first brand in the LVMH family to launch a standalone store on Tmall Luxury Pavilion. Kenzo’s store offers apparel, footwear, bags and accessories. [caption id="attachment_104090" align="aligncenter" width="700"]

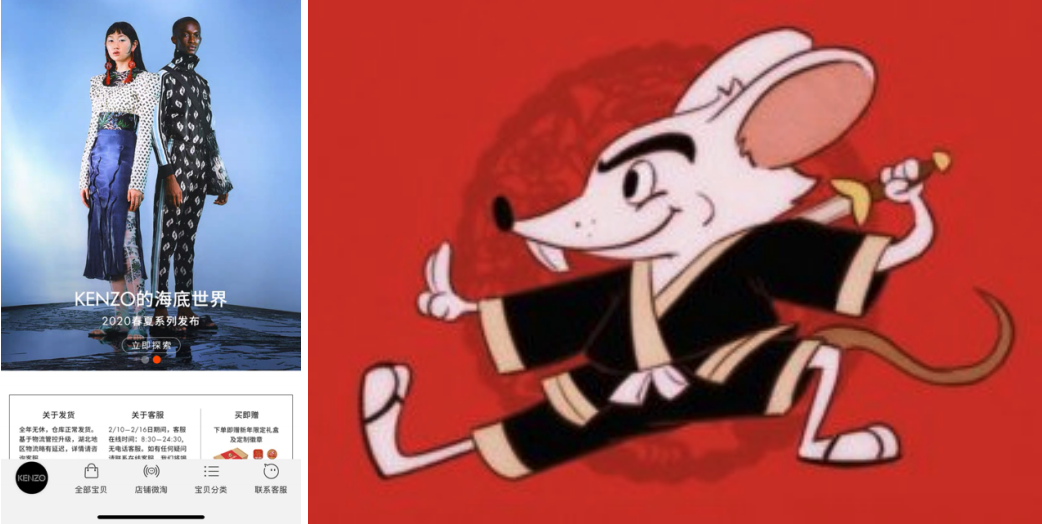

Kenzo’s flagship store on Tmall Luxury Pavilion (left) and Kung Fu Rat character (right)

Kenzo’s flagship store on Tmall Luxury Pavilion (left) and Kung Fu Rat character (right)Source: Tmall/Alizila[/caption] The brand also launched a Chinese New Year-themed special collection in honor of the Year of the Rat. The collection includes T-shirts, jumpers, backpacks and trainers, all featuring Kenzo’s Kung Fu Rat character. The store launched an interactive racing game centered around Kung Fu Rat and its zodiac companions, through which consumers are given the chance to win gifts. Coresight Research insight: Tmall is a preferred platform among luxury brands that are seeking to reach Chinese consumers. Alibaba launched Tmall Luxury Pavilion in 2017 to sell luxury and branded products. It now features over 150 brands, selling products ranging from apparel and beauty to watches and luxury cars. According to research firm Bain, consumers in China will continue to spend more on luxury goods than any other region over the next five years, accounting for an estimated 46% of total worldwide sales of personal luxury goods in 2025—a rise of 11 percentage points from 35% of worldwide sales in 2019. In 2019, Chinese consumers spent around €98.35 billion (around $106.3) on personal luxury goods. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=57]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=58]

Source: Company reports/Coresight Research

Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=59]

Source: Company reports/Coresight Research

Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months

[wpdatatable id=60]

Source: Company reports/Coresight Research