Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

Alipay Now Available to Visitors Ant Financial’s Alipay launched an international version of its widely used payment app that visitors to China can use, called Tour Pass. Visitors to China are finding it increasingly difficult to pay with cash as digital payment platforms have become so popular, but local digital payment platforms have (up till now) required the user to have a bank account in China to connect to the payment app. Now, visitors can sign up for a “temporary” version: To use it, visitors need an overseas phone number, a valid visa allowing them to be in China and an international ATM or credit card to sign up the service. There are some differences between the local and visitor versions: The local version links directly to a credit card, but the visitor version works as a prepaid card service, provided by the Bank of Shanghai. That means visitors have to top up the account, and can have a maximum balance of ¥2,000 ($285) in the account In addition to using the app to pay, visitors can also use it to call a taxi, purchase train tickets and book a hotel in the Tour Pass mini app. An account is valid for three months, after which Alipay automatically refunds any remaining money. The number of visitors to China increases every year: A total of 30.5 million visited in 2018, up 4.7% year over year, according to government data. Making Alipay available to visitors will not only make life easier for visitors but could create a whole new market for the payment platform, potentially positioning it for international expansion as visitors get familiar with the app then return home. The next day, Alipay’s competitor WeChat Pay announced the acceptance of international credit cards for overseas visitors. Supported credit card network operators include Visa, Mastercard and JCB and card issuers American Express. However, the function is limited to only a few online services now such as car-hailing service Didi, JD.com, travel service Ctrip and the official train ticket booking provider 12306. [caption id="attachment_99429" align="aligncenter" width="700"] Source: Alizia[/caption]

Meituan Launches Mini Programs in Its App

Meituan-Dianping, a local consumer products and retail service provider, has introduced a feature that allows any company to launch a mini app that runs within the Meituan master app. Meituan-Dianping offers a wide range of services, such as restaurant reviews, food delivery, tickets and group buying. Mini apps run within another app, allowing users to access the other app’s features without having to leave Meituan-Dianping, or to download and update a separate app. The program is still in early stages, with only a few mini apps such as weather service Moji Weather available.

All of Meituan-Dianping’s apps already have their own mini apps embedded in Tencent-owned WeChat: Meituan’s move is relatively late compared to tech giants such as Tencent, Baidu and Alibaba. As of June 30, 2019, the Meituan app had 422 million users and 59 million merchants. The launch may help Meituan-Dianping keep users on its platform and gives merchants another channel to reach consumers.

[caption id="attachment_99448" align="aligncenter" width="700"]

Source: Alizia[/caption]

Meituan Launches Mini Programs in Its App

Meituan-Dianping, a local consumer products and retail service provider, has introduced a feature that allows any company to launch a mini app that runs within the Meituan master app. Meituan-Dianping offers a wide range of services, such as restaurant reviews, food delivery, tickets and group buying. Mini apps run within another app, allowing users to access the other app’s features without having to leave Meituan-Dianping, or to download and update a separate app. The program is still in early stages, with only a few mini apps such as weather service Moji Weather available.

All of Meituan-Dianping’s apps already have their own mini apps embedded in Tencent-owned WeChat: Meituan’s move is relatively late compared to tech giants such as Tencent, Baidu and Alibaba. As of June 30, 2019, the Meituan app had 422 million users and 59 million merchants. The launch may help Meituan-Dianping keep users on its platform and gives merchants another channel to reach consumers.

[caption id="attachment_99448" align="aligncenter" width="700"] Meituan’s main app page does not display any mini programs (left); Moji Weather mini program in Meituan app (right)

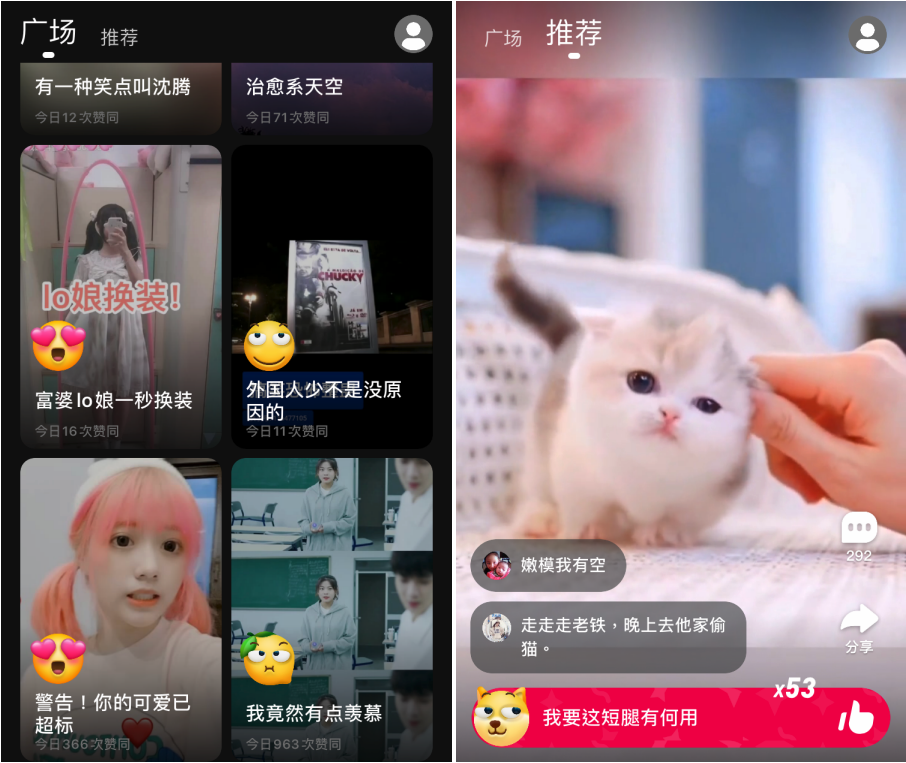

Meituan’s main app page does not display any mini programs (left); Moji Weather mini program in Meituan app (right)Source: Meituan app[/caption] Coresight Research insight: Mini apps become a must have to provide a better user experience, as well as to support cross-platform collaboration. WeChat first introduced mini apps in 2017, and now offers over 2.3 million across 300 industries. The Baidu app, which has more than 100,000 mini apps, partnered with e-commerce platform Youzan in July to support a feature that lets users search for and buy products within the app. Alipay had over 200,000 mini apps on its microblogging platform Sina Weibo as of September 2019. Kuaishou Unveils A New Short Video App Taizan to Compete with Bytedance’s Douyin Kuaishou, China’s second largest short video app, introduced a new app called Taizan in October. Taizan aggregates popular short video clips from Kuaishou and categorize them based on trendy topics. Users can browse the most popular videos of the day using tabs such as “recommended” or “attitude.” Currently, only functions such as “like” and “comment” are available. Kuaishou is adding more features, such as uploading user-generated video and direct messaging. Kuaishou has been actively developing its content and social ecosystem to attract new users and compete with Bytedance. Almost half of Douyin and Kuaishou users in China overlap: They use both apps. Kuaishou has launched more than ten platforms since 2017, including video editor app Kuaiying, photo-editing app Yitian Camera and social game app Kuaishou Dianwan, but few have generated much traffic. The Kuaishou app had an average daily active user base of over 200 million in October, roughly flat from the number in May. Meanwhile, major competitor Douyin claims to have 320 million daily active users in June. [caption id="attachment_99449" align="aligncenter" width="700"]

Source: Taizan app[/caption]

Appendix: New Retail Developments

New Retail developments in China are listed in Figure 1.

Figure 1. New Retail Developments in China: Last 12 Months

[wpdatatable id=31]

Source: Taizan app[/caption]

Appendix: New Retail Developments

New Retail developments in China are listed in Figure 1.

Figure 1. New Retail Developments in China: Last 12 Months

[wpdatatable id=31]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables: Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=33]Source: Company reports/Coresight Research

Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=34]Source: Company reports/Coresight Research

Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=35]Source: Company reports/Coresight Research