Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

Alibaba Plans To Invest in Swiss Duty-Free Retailer Dufry On October 5, 2020, Swiss duty-free retailer Dufry announced that it will raise up to $763 million from investors, including Alibaba and private equity firm Advent International. Alibaba plans to acquire a stake of up to 9.99% in the travel retail firm. The global travel retail industry has slumped due to the sharp decline in international travel. Dufry reported a 61% decline in sales in the first half of 2020, and its French rival Lagardère announced that revenue was down 55% in the same period. Dufry said in June that it will reduce personnel expenses by 20–35% to save costs. While international duty-free sales have slumped, the domestic duty-free market in China is growing. Domestic duty-free business includes downtown duty-free stores and Hainan province’s off-shore duty-free shops. Alibaba and Dufry have also agreed to form a joint venture in China, with Alibaba owning a 51% share and Dufry owning the remaining 49%. Dufry will leverage Alibaba’s digital expertise, such as experiential online shopping technologies, such as Tmall Flagship Store 2.0, to help brands better reach and engage with consumers. Retailers who adopted the Tmall Flagship 2.0 feature saw value generated by each unique visitor increase by 15%. In addition, Alibaba will draw on Dufry’s supply chain expertise. With this new joint venture, Alibaba may be set to disrupt the travel retail market in China. Looking at the wider context, the Chinese government plans to ease control of the duty-free market and develop more duty-free stores to attract consumers. With Alibaba’s prominent position in China, the company is likely to get a license from the government to run a duty-free business—though it might take some time to realize the plan. Coresight Research insight: Alibaba’s investment in Dufry indicates the e-commerce giant’s ambition to capture sales from the growing Chinese duty-free market. The domestic duty-free market is expected to grow at a 28.5% CAGR from 2019 to 2025, reaching $8.25 billion in 2025, according to Morgan Stanley. As this estimate was made in June, it factors in the impact of the pandemic. The domestic duty-free consumption data during the country’s National Day holiday once again confirm a booming duty-free market in China. The number of consumers that made purchases in four selected duty-free stores in Hainan grew by 64% year over year during October 1–7. Retail sales in these duty-free stores increased by 167% year over year to ¥1.03 billion ($152.9 million) during the same period, according to the Ministry of Commerce. Pinduoduo Livestreams Dairy Giant Yili’s Production Line On September 22, 2020, Pinduoduo launched a livestreaming session at Yili’s formula factory in Hohhot, Inner Mongolia. It showcased the grazing grounds, milking facility, storage tanks and production line to consumers. More than 600,000 Pinduoduo users watched the live broadcast, and this helped Yili Gold Crown milk powder achieve sales of nearly triple those from the previous day. In July, Pinduoduo had launched the “Mom and Baby Product Traceability” campaign, allowing consumers to take a virtual tour of factories producing major mom-and-baby brand products through livestreaming. For instance, consumers can see the production process of diapers and milk powder sold on the Pinduoduo platform. Pinduoduo aims to help consumers feel more at ease when buying these products—consumers want reassurance of the high quality and safety of such products. These concerns are top priorities for consumers in the mom and baby category, particularly following the melamine milk scandal in 2008. [caption id="attachment_118356" align="aligncenter" width="580"] Poster of Pinduoduo’s livestreaming at Yili’s formula factory

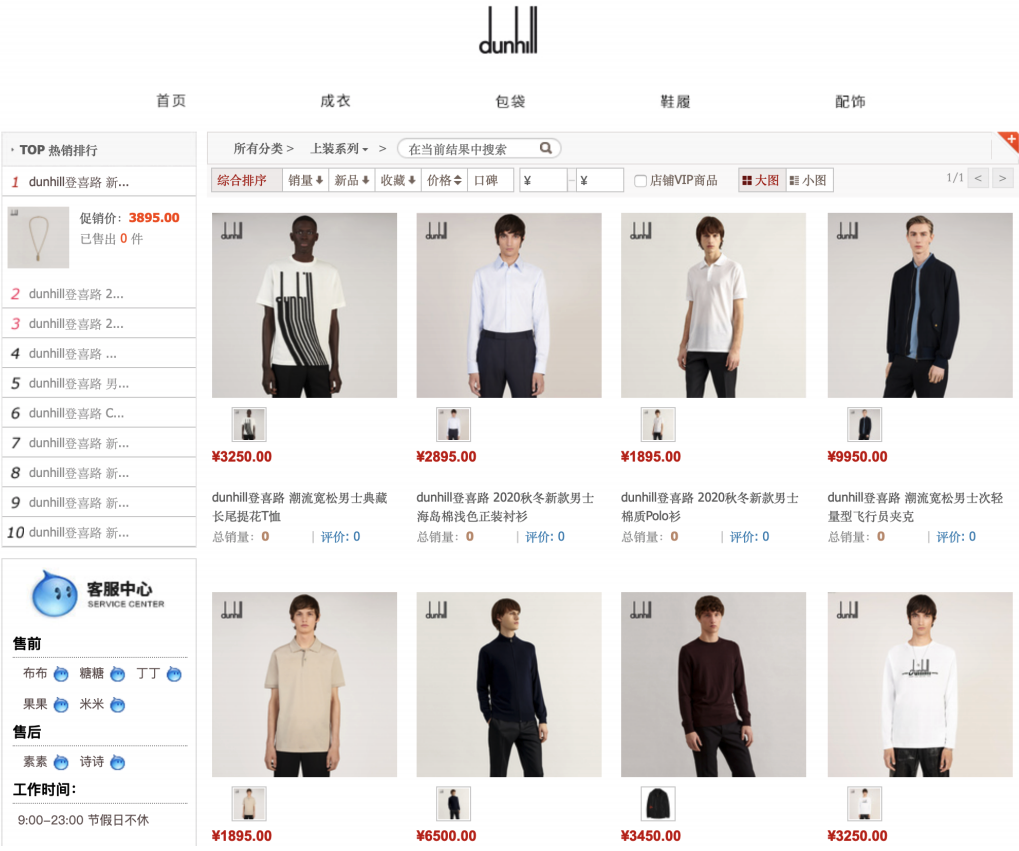

Poster of Pinduoduo’s livestreaming at Yili’s formula factorySource: Weibo[/caption] Dunhill Sets Up a Flagship Store on Tmall Luxury Pavilion On September 26, British luxury brand Dunhill—owned by Richemont—opened a flagship store on Tmall Luxury Pavilion, Alibaba’s dedicated site for luxury and premium brands. The brand will sell a range of products on the platform, including Dunhill’s ready-to-wear items, leather goods and footwear. Dunhill is the ninth Richemont brand to launch a digital store on Tmall Luxury Pavilion. Figure 1. Digital Stores by Richemont-Owned Brands on Tmall Luxury Pavilion [wpdatatable id=522]

Source: Alizila/Coresight Research

This move also demonstrates Richemont’s continuous efforts to reach Chinese consumers in a way that is aligning with their shopping habits—Chinese consumers are often digital-savvy and like to shop online. Around 749.4 million Chinese shoppers purchased products online in the first half of 2020, up by 17.3% from the same period in 2019, according to Statista. [caption id="attachment_118358" align="aligncenter" width="700"] Dunhill’s store on Tmall

Dunhill’s store on TmallSource: Tmall[/caption] Coresight Research insight: China’s consumers have become major buyers of global luxury goods. It is estimated that Chinese shoppers will account for around 50% of the global luxury market by 2025, reaching €320–330 billion (around $375.9–387.6 billion), according to Bain. The estimate was made in spring during the pandemic, and the data was released in May. Fashion Label Ports Launches Exclusive Benefits for JD Plus Members On October 8, 2020, JD.com’s membership day for its Plus members, JD.com teamed up with Canadian fashion group Ports to launch a special promotion for its JD Plus members. Consumers who visited Ports’ online store on JD.com could win coupons, such as ¥200 (around $29.70) discounts on orders above ¥1,999 (around $296.90). In its offline stores in Beijing, Shanghai and Shenzhen, shoppers could also access discounts of up to 95% on products from the brand’s newly launched autumn and winter lines. To better engage with its JD Plus members, JD.com held a “membership day” on the eighth day of each month since January this year—this was previously an annual event. The premium membership system covers the entire shopping process, from price concessions to after-sales service, and aims to speed up the customer-acquisition process for brands as well as retain the loyalty of high-end customers. [caption id="attachment_118359" align="aligncenter" width="700"]

Special promotion held by JD.com and Ports

Special promotion held by JD.com and PortsSource: Weibo[/caption] Appendix: New Retail Developments New Retail developments in China are listed in Appendix Figure 1. Appendix Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=523]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies, and even brick-and-mortar stores. See selected transactions in the following tables. Appendix Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=524]Source: Company reports/Coresight Research

Appendix Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=525]Source: Company reports/Coresight Research

Appendix Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=526]Source: Company reports/Coresight Research