DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

Alibaba Acquires Controlling Stake of Sun Art Retail Group On October 19, Alibaba announced that it took control of domestic hypermarket chain Sun Art Retail from its French owner, Auchan Retail. Alibaba invested HK$28 billion ($3.6 billion) to become the controlling shareholder in Sun Art Retail. After this transaction, Alibaba’s stake in Sun Art Retail Group increased to 72%. Sun Art Retail is one of China’s largest offline hypermarket operators, with two banners: “Auchan” and “RT-Mart.” As of December 31, 2019, it had 486 stores with a total gross store space of approximately 13 million square meters (around 139.9 million square feet), across 232 cities in China. Alibaba’s investment in Sun Art Retail started in 2017 when it acquired a 36.168% stake in Sun Art Retail from the hypermarket operator’s Taiwanese partner Ruentex Group, whose business mainly covers construction, education, medical services and textile garment retail. Since then, Sun Art Retail has started to apply Alibaba’s New Retail strategies to its stores, including online and offline integration, and logistics upgrades. As of November 2020, all of Sun Art Retail’s stores in China have been integrated to Alibaba’s online platforms—store inventory from Sun Art Retail is available for shoppers who purchase from delivery arm Ele.me, fresh food-delivery platform Taoxianda and Tmall Supermarket. All Sun Art Retail stores can provide one-hour delivery within a five-kilometer store radius, and 180 stores can support half-day delivery within 20 kilometers. [caption id="attachment_119831" align="aligncenter" width="700"] Sun Art Retail’s website features digitalization

Sun Art Retail’s website features digitalization Source: Sur Art Retail [/caption] Coresight Research insight: Alibaba’s recent move indicates the e-commerce giant’s ambition to capture more sales in the grocery market, which grew tremendously during the coronavirus pandemic. Fresh food e-commerce also surged, and the country’s booming fresh food e-commerce market is expected to grow by 44.7% to ¥404.7 billion (around $59.3 billion) in 2020, from ¥204.5 billion (around $30.0 billion) in 2018, according to data from Coresight Research and research firm iResearch. This estimate was made after the Covid-19 outbreak. Alibaba can use its New Retail initiative to enhance its supply chain and meet the growing demand. Auchan's retreat from China came after exits from other European hypermarket and supermarket operators, such as Carrefour, Metro and Tesco. JD.com Partners with Kuaishou To Host a 200-Hour Livestream for Singles’ Day JD.com teamed up with video-sharing platform Kuaishou, to host a 200-hour uninterrupted livestream session, covering from November 1 to 9. Kuaishou users were able to access coupon codes via the livestream, which could be used toward purchases on JD.com. Key opinion leaders (KOLs) on Kuaishou took turns to promote products to users. Shoppers could click product links to be directed to JD.com’s stores on KuaishouL If the product was sold through JD.com’s first-party retail business, shoppers could complete the purchase directly on Kuaishou; and if the product was from JD.com’s third-party retail business, consumers would be directed to JD.com’s app to finish the transaction. JD.com and Kuaishou’s partnership began in May this year. Since then, Kuaishou users have been able to purchase products from JD.com’s s first-party retail business directly on Kuaishou and enjoy delivery and after-sales services provided by JD.com. [caption id="attachment_119832" align="aligncenter" width="700"]

JD.com and Kuaishou’s livestreaming session

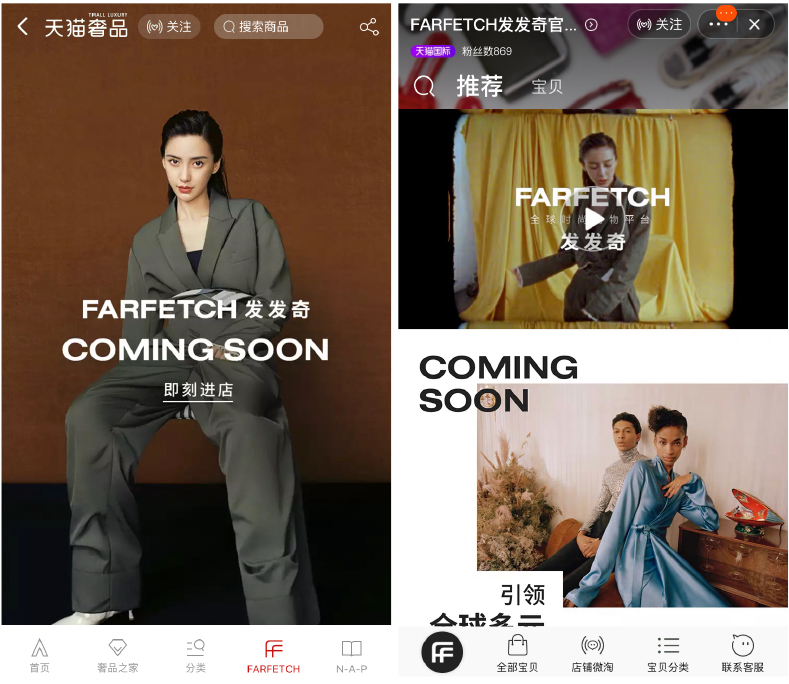

JD.com and Kuaishou’s livestreaming session Source: Kuaishou [/caption] Coresight Research insight: JD.com and Kuaishou’s 200-hour livestream indicates the companies’ ambition to capture more sales through this channel. Livestreaming is becoming a go-to option for Chinese consumers seeking new products and promotions. It is one of the most popular and effective channels for brands and retailers to boost sales and engage with consumers. In just 10 minutes on the first day of the Singles’ Day pre-sale this year (October 21), GMV on Taobao Live, Alibaba’s designated livestreaming platform, exceeded the amount generated on the entire first day of the pre-sale in 2019. Alibaba and Richemont Invest in Farfetch On November 5, Alibaba announced its plans with luxury goods holding company Richemont to each invest $300 million into online luxury fashion retail platform Farfetch via private convertible notes. The two companies will also each invest $250 million in a new joint venture, Farfetch China, which will operate Farfetch’s online business in the China market. As part of the co-operation, Farfetch will open its online stores on Tmall Luxury Pavilion, off-price luxury platform Luxury Soho and cross-border e-commerce platform Tmall Global. It is worth nothing that Alibaba’s two rivals, JD.com and Tencent, have also invested in Farfetch. In June 2017, JD.com invested $397 in the luxury platform to purchase a 16.5% stake in the company. In January 2020, Tencent purchased Farfetch’s convertible corporate bonds for $125 million. [caption id="attachment_119833" align="aligncenter" width="700"]

Farfetch’s store on Tmall Luxury Pavilion

Farfetch’s store on Tmall Luxury Pavilion Source: Tmall [/caption] Coresight Research insight: China’s consumers have become major buyers of global luxury goods. Amid a slump in international travel in 2020 and likely into 2021, we expect a substantial redirection of luxury shopping from overseas to domestic, including via online platforms. In spring 2020 (amid the pandemic), Bain estimated that Chinese shoppers will account for around 50% of the global luxury market by 2025, reaching €320–330 billion (around $375.9–387.6 billion). Appendix: New Retail Developments New Retail developments in China are listed in Appendix Figure 1.

Appendix Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=573 table_view=regular]

Source: Company reports/Coresight Research Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies, and even brick-and-mortar stores. See selected transactions in the following tables.

Appendix Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=574 table_view=regular]

Source: Company reports/Coresight Research

Appendix Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=575 table_view=regular]

Source: Company reports/Coresight Research

Appendix Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=576 table_view=regular]

Source: Company reports/Coresight Research