Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this monthly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail

Alibaba Increases Stake in Logistics Firm YTO Express On September 1, 2020, Alibaba invested ¥1 billion (around $146.2 million) in logistics firm YTO Express to increase its stake in the company from 12% to 22.5%. Founded in 2000, YTO Express is one of the largest logistics services providers in China. Its business saw booming growth during Covid-19, with net profit growth of 40.6% year over year in the second quarter of 2020. Alibaba’s latest investment in YTO marks its effort to hold a greater share of China’s booming express delivery industry. According to the State Post Bureau, express delivery companies delivered 63 billion parcels in 2019, up 24% year over year. The revenue for this sector increased by 23% to ¥745 billion (around $109 billion) in 2019. [caption id="attachment_116301" align="aligncenter" width="700"] YTO Delivery

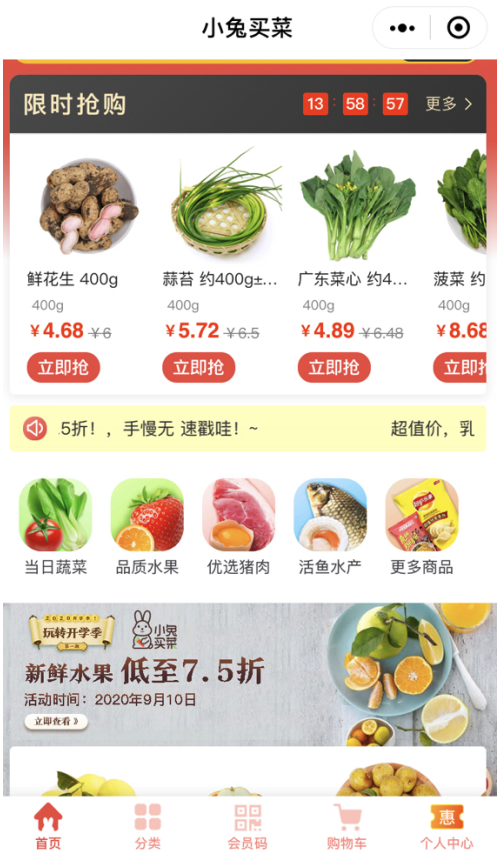

YTO DeliverySource: Weibo[/caption] Coresight Research insight: Alibaba does not have its own dispatch fleet to serve sellers and buyers on its massive marketplace. However, the company has shares in top express delivery firms to ensure that delivery services meet demands—for instance, YTO will cooperate with Alibaba through its logistics arm Cainiao to use data to forecast demand and supply. This move will also help Alibaba to better compete with other e-commerce giants, such as JD.com, which has its own logistics network. Alibaba has stakes in four other large express delivery companies—Best (33% stake), STO Express (14.65% stake), Yunda (2% stake) and ZTO Express (8.7% stake). Grocery Retailer Bunnymaicai Raises New Fund for Digital Development Grocery retailer Bunnymaicai, which was founded in 2019, raised $10 million in a Series A funding round on August 31. Investors include Country Garden Venture Capital, Joy Capital and ZWC Partners. Bunnymaicai, which currently operates in Wuxi, Jiangsu, allows consumers to buy fresh food from around 100 physical stores or on its WeChat mini-program and app. The grocer purchases most of its products directly from farmers and can delivers online orders to shoppers within 30 minutes. The retailer will use the newly raised funds to improve its online operation and provide consumers with a more convenient shopping experience. Bunnymaicai also plans to further leverage big data algorithms to forecast sales. It aims to achieve “clearance of meat and vegetable products daily” by matching the supply and demand of daily orders. The grocer will accelerate its adoption of community group buying—an increasingly popular selling model in China that is aimed at groups of residents living in the same housing development. The community group buying market is expected to reach $12.72 billion ($89 billion) in China in 2020, according to Kantar China. The company will also enhance delivery services, such as in-store pickup and home delivery from the store, to facilitate a smooth and fast shopping experience. [caption id="attachment_116302" align="aligncenter" width="300"]

Bunnymaicai WeChat mini program

Bunnymaicai WeChat mini programSource: WeChat[/caption] Coresight Research insight: Bunnymaicai’s recent funding is in the context of a growing fresh food e-commerce market. The market is expected to grow 59.5% to ¥200 billion (around $29.2 billion) in 2020 from ¥125.4 billion (around $18.3 billion) in 2018, according to research firm Qianzhan. This estimate was made before the Covid-19 outbreak. JD.com Teams Up with Cooking Brand Fulinmen On September 7, 2020, JD.com and Chinese cooking-oil brand Fulinmen signed an agreement to facilitate product innovation, marketing promotion and logistics services cooperation. Fulinmen will adopt a consumer-to-manufacturer (C2M) model using artificial intelligence (AI), big data and cloud technologies from JD.com; leveraging real-time analytics will enable the brand to better understand consumer needs. C2M products are gaining popularity among Chinese consumers. During the 6.18 shopping festival from June 1 to 14, 2020, sales of C2M products on JD.com spiked 622% year over year. The brand also intends to learn from JD.com’s insights into data-driven marketing to increase brand influence and sales performance—for instance, by promoting products to consumers based on their browsing and searching preferences. Fulinmen will also leverage JD.com’s logistics expertise to reduce supply chain costs and improve distribution efficiency. JD Logistics—the smart supply-chain solutions division of JD.com—operates an innovative program that matches online orders with the nearest offline supply source in real time and arranges a courier for timely delivery. Its automated warehouses integrate technologies such as AI, deep learning and image recognition to fulfill orders efficiently across China. To address last-mile delivery needs, JD.com also uses autonomous vehicles and drones for faster and safer delivery. [caption id="attachment_116303" align="aligncenter" width="700"]

Fulinmen’s store on JD.com

Fulinmen’s store on JD.comSource: JD.com[/caption] Coresight Research insight: Fulinmen’s recent collaboration indicates the cooking-oil brand’s ambition to capture more sales on JD.com. From January to June 2020, JD.com’s online supermarket, JD Super, reported 100% year-over-year growth for sales of over 10,000 fast-moving consumer goods brands. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. Figure 1. New Retail Developments in China: Last 12 Months [wpdatatable id=455]

Source: Company reports/Coresight Research

Investments and Acquisitions in New Retail To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies, and even brick-and-mortar stores. See selected transactions in the following tables. Figure 2. Alibaba New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=456]Source: Company reports/Coresight Research

Figure 3. Tencent New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=457]Source: Company reports/Coresight Research

Figure 4. JD.com New Retail Investments and Acquisitions: Last 12 Months [wpdatatable id=458]Source: Company reports/Coresight Research