DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail?

Alibaba Upgrades its Content Tool Weitao Alibaba is upgrading the layout of Weitao, its content tool that lets brands interact with store followers on Taobao and Tmall. When customers visit the brand’s Weitao page, they will see their customer-engagement score with the brand using a thermometer graphic. This scoring system serves as a loyalty program to retain customers and encourage repeat visits through perks and rewards – but also delivers to the merchant better measurements of customer engagement, tapping into a range of metrics, such as browsing the store page, adding items to shopping carts, leaving comments and reviews, and transactions. The new layout will also feature dedicated sections to better promote new products, including features such as notifications sent to store followers on the Taobao app as soon as new products are available. [caption id="attachment_95252" align="aligncenter" width="700"] Customer-engagement scores displayed using a thermometer graphic on Weitao

Customer-engagement scores displayed using a thermometer graphic on Weitao Source: Alizila.com [/caption] Alibaba Expands Membership Benefits for Its Paid Loyalty Program 88VIP Alibaba has enhanced benefits for members of its paid loyalty program 88VIP by expanding the range of brands and services from which its members can enjoy discounts. Now, members get year-round discounts from 388 brands participating in the 88VIP program (just 88 brands joined when the program debuted last August). 88VIP program members also get 5% off when shopping at participating brands’ Tmall or Taobao stores during the 11.11 Global Shopping Festival, also known as Singles’ Day. Apart from the e-commerce platforms, 88VIP members can also enjoy perks from other Alibaba businesses such as online drugstore AliHealth and online travel platform Fliggy—encouraging users to stay longer within Alibaba’s ecosystem. The 88 Membership program was launched in 2017 by combining the Tmall and Taobao loyalty programs into one, and Alibaba now has several levels in its loyalty program. Standard members are called 88 members, more engaged members (those with a loyalty score of 1,000 or more) are awarded Super Member status. The 88VIP loyalty program is a paid membership program launched in August 2018. Super Members pay only RMB88 (about US$13) to join the 88VIP loyalty program, but the standard membership fee is RMB888 (about $130). According to Alibaba, 88VIP members spend double what other shoppers do on average, an annual average of over RMB100,000 ($14,110) as of May 2018, the company said. Coresight Research Insight: Alibaba is leveraging paid memberships to diversify revenue streams and retain users within its ecosystem, offering products and services in many categories of shopping, eating, travel and entertainment. This strategy is forming a more solid base of users that entices brands to embrace or link their own loyalty programs with Alibaba’s, which will further solidify brands’ relationships with Alibaba. JD.com Allows Users to Tailor-Make Clothes on Its Private Label Site Jingzao JD.com has started allowing users to order tailor-made clothes on its private label site Jingzao. JD.com users can provide measurements and preferences for garment details including type of fabric, cuff and pocket designs. Custom-made clothes arrive seven to 10 days later. Customers can also ask for a human tailor to come and take measurements. JD.com is creating further differentiation in China’s crowded e-commerce space by pushing customization available to more consumers. [caption id="attachment_95253" align="aligncenter" width="700"]

Jingzao is JD.com’s private label online marketplace selling home items, kitchenware, apparel, consumer electronics, skincare and food and beverages

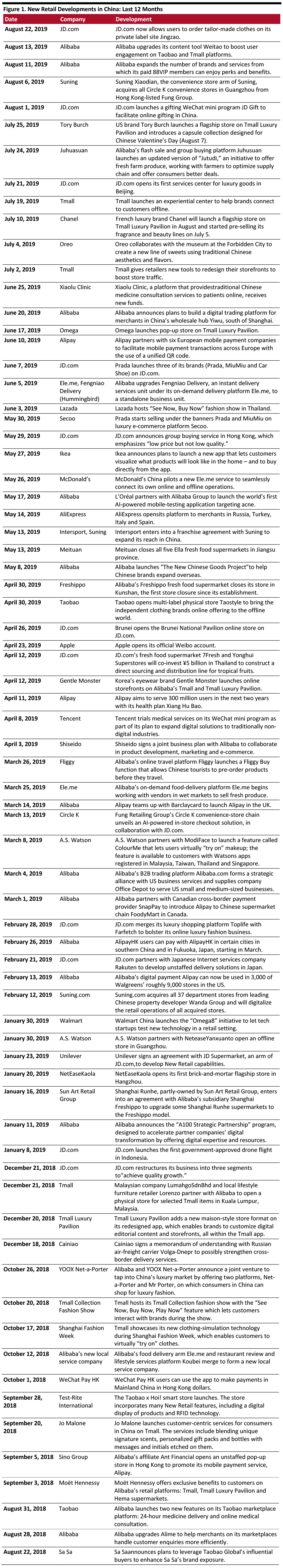

Jingzao is JD.com’s private label online marketplace selling home items, kitchenware, apparel, consumer electronics, skincare and food and beverages Source: Jingzao.jd.com [/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_95271" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

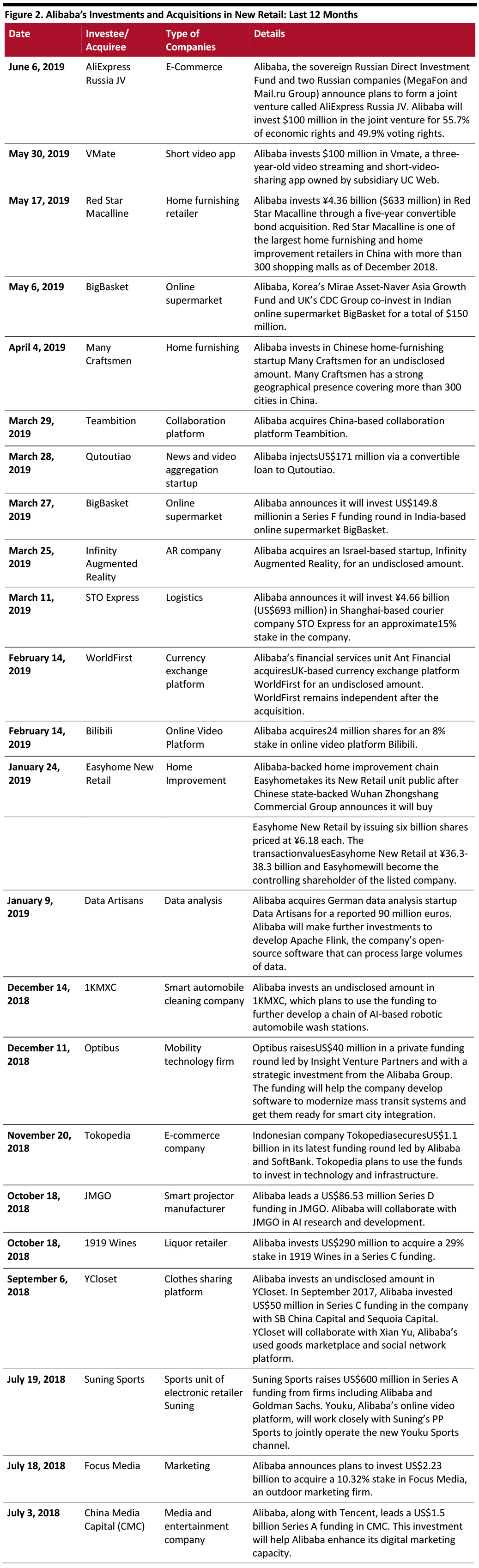

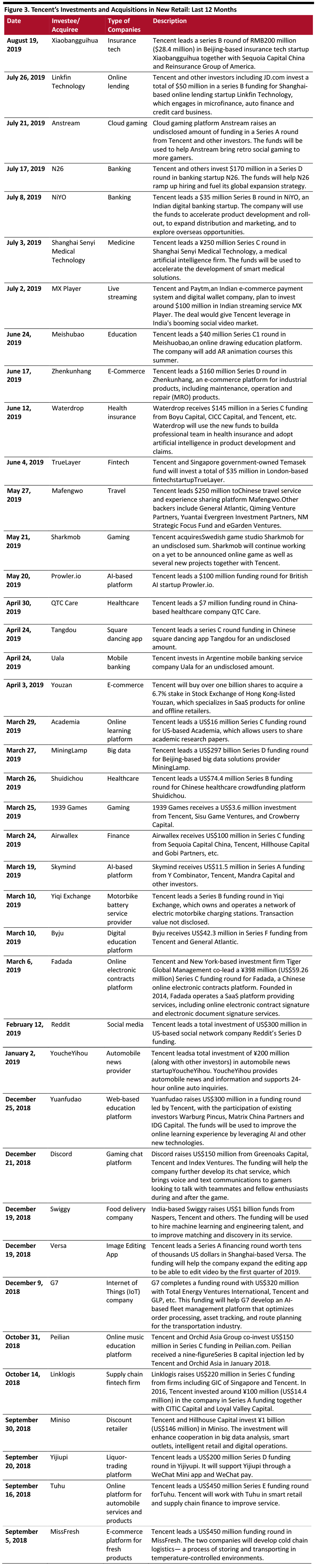

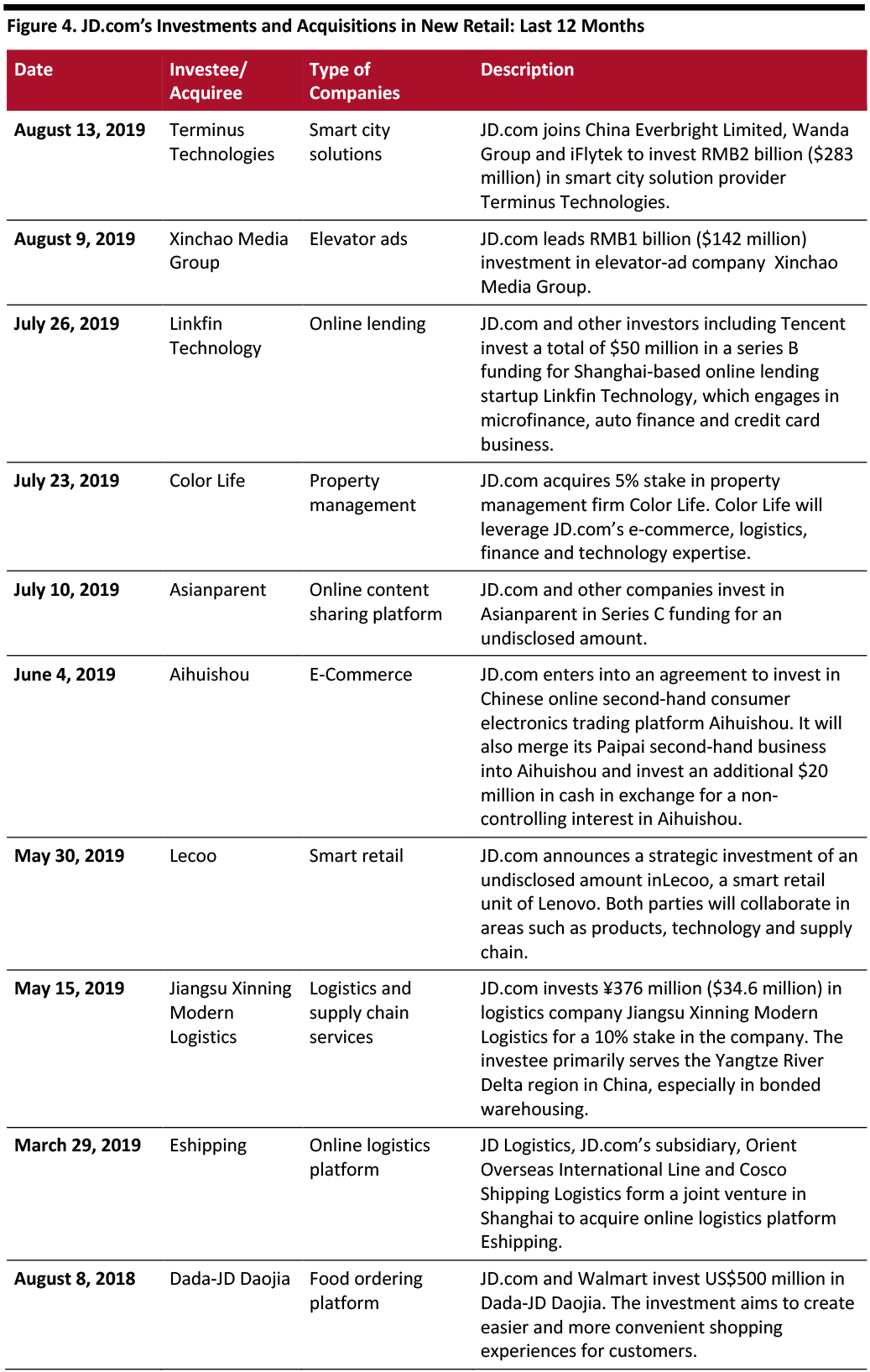

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_95272" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_95272" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_95273" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_95273" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_95274" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_95274" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]