DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was coined by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail?

Taobao Launch Multi-Label Store to Bring Online Clothing Brands Offline Alibaba’s e-commerce platform Taobao launched a multi-label store called Taostyle in the Hangzhou Kerry Centre shopping mall to help bring the independent clothing brands that sale via its online platform, offline. The store rotates inventory and refreshes the brands selling there at least twice a month. Using consumer insights from Alibaba’s e-commerce platforms, the Taostyle team can determine which brands and products to feature regularly in the store. The store also features in-store technology to assist shoppers, for example, scanning a QR code on the clothing tag to get detailed product information and customer reviews. There is also a booth inside the store offering livestreaming functionality so anyone can get online and promote their products in real time. Currently, the Taostyle store offers around 350 items from a rotating batch of over 20 brands. Coresight Research Insight: The Taostyle clothing store represents a natural progression of the New Retail model: E-commerce platforms are building showroom-style physical stores for small- to medium-sized online brands that may not have the resources to build out an offline presence. For consumers, the store’s rotating brands and products offer newness that should drive repeat visits. [caption id="attachment_86440" align="aligncenter" width="720"] Taostyle store

Taostyle store Source: Alizila.com [/caption] Freshippo Fresh Food Supermarket Close a Store for the First Time Alibaba’s new retail venture Freshippo fresh food supermarket (formerly known as Hema) closed its store in Kunshan (near Shanghai) – the chain’s first store closure since it opened in 2016. Alibaba has expanded the Freshippo network rapidly. Freshippo has opened 139 stores in three years, according to its official store list. Since Freshippo stores serve both as shops and warehouses, they soak up a lot of capital investment to open and run, which lengthens the time needed to begin generating positive returns. In an interview with Chinese media site linkshop.com in April, Freshippo CEO Hou Yi said he believes a large number of Freshippo stores will become profitable and the overall financial health of the company will improve in one to two years. The first store closure in Kunshan suggests that Freshippo has been optimizing its store opening strategy to ensure a healthy expansion and operations of all its Freshippo fresh food supermarkets. JD.com Step Up Fresh Food E-Commerce Partnerships in Southeast Asia JD.com’s fresh food supermarket chain 7Fresh and Yonghui Superstores, one of the largest supermarket chains in China and in which JD.com has invested, will jointly invest ¥5 billion (around $750 million) in Thailand to build a direct sourcing and distribution line for tropical fruit. 7Fresh also signed a memorandum of understanding with Thai agricultural brands to import ¥1.5 billion (around $223 million) worth of Thai fruit in the next three years. Another Southeast Asian country, Brunei, has opened an online store on JD.com called Brunei National Pavilion. The store will sell food to China, starting with the country’s well-known blue shrimp. Earlier in April, JD.com made agreements with two fishery companies in Brunei to supply seafood from their fish farms, adding a new overseas direct sourcing channel to the e-commerce platform. Coresight Research Insight: More Chinese consumers shop for fresh food online, particularly imported products, which many believe are of higher quality. China is undergoing a “consumption upgrade” in which a rising middle class population is demanding more premium and quality products. Sourcing from Southeast Asia fits with JD.com’s logistics model due to closer geographical proximity, as JD.com aims to deliver imported fresh products within 48 hours. [caption id="attachment_86441" align="aligncenter" width="720"]

7Fresh Supermarket

7Fresh Supermarket Source: Corporate.jd.com [/caption] Apple Open Weibo Account to Engage with Chinese Customers In April, Apple opened an official account on Weibo, China’s social media site akin to Twitter, to provide customer support and tips for using its products. This is Apple’s second venture into a major Chinese social media platform following its launch of an official WeChat public account last year. Companies increasingly turn to social media sites to engage with customers, and this is particularly important for Apple as sales in China slow. Weibo boasts 462 million monthly active users (as of December 2018) – and so represents a major opportunity to interact with Chinese customers. [caption id="attachment_86442" align="aligncenter" width="720"]

Apple’s official Weibo account

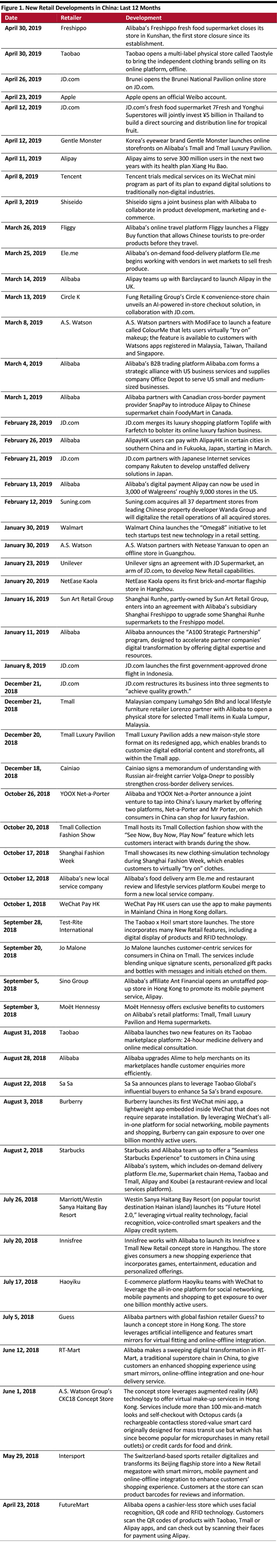

Apple’s official Weibo account Source: Weibo.com [/caption] Appendix: New Retail Developments [caption id="attachment_86443" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

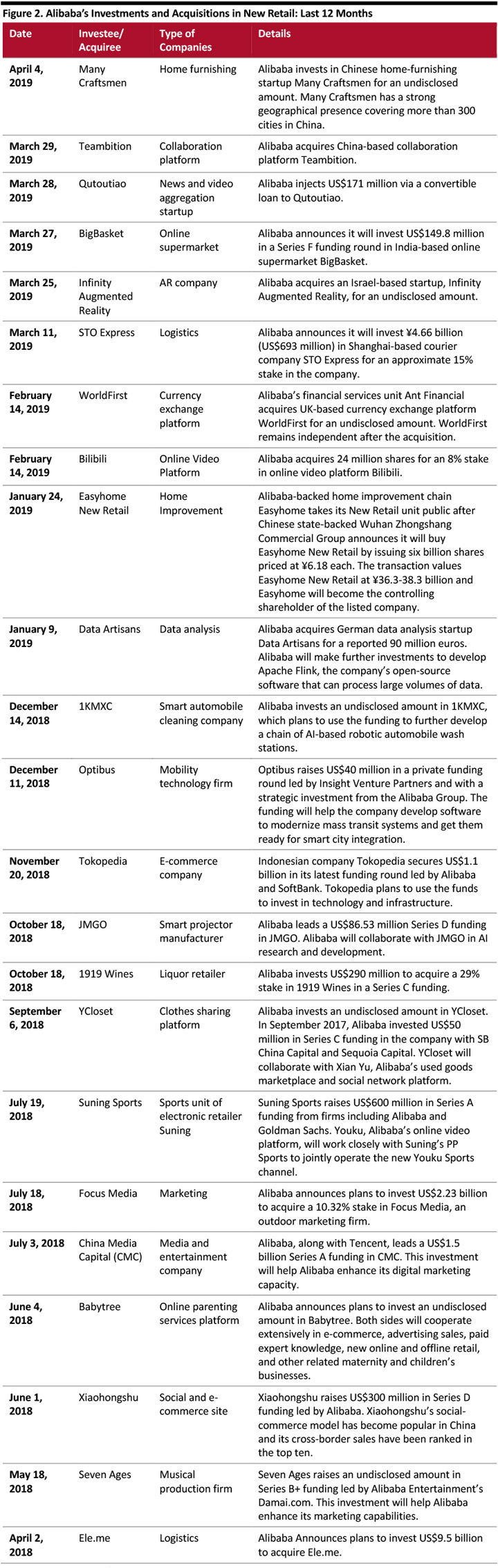

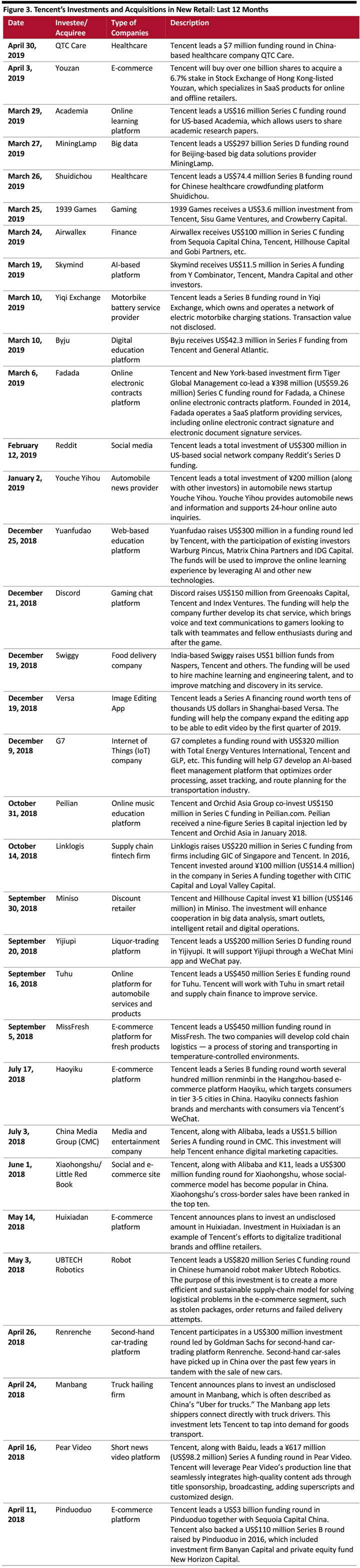

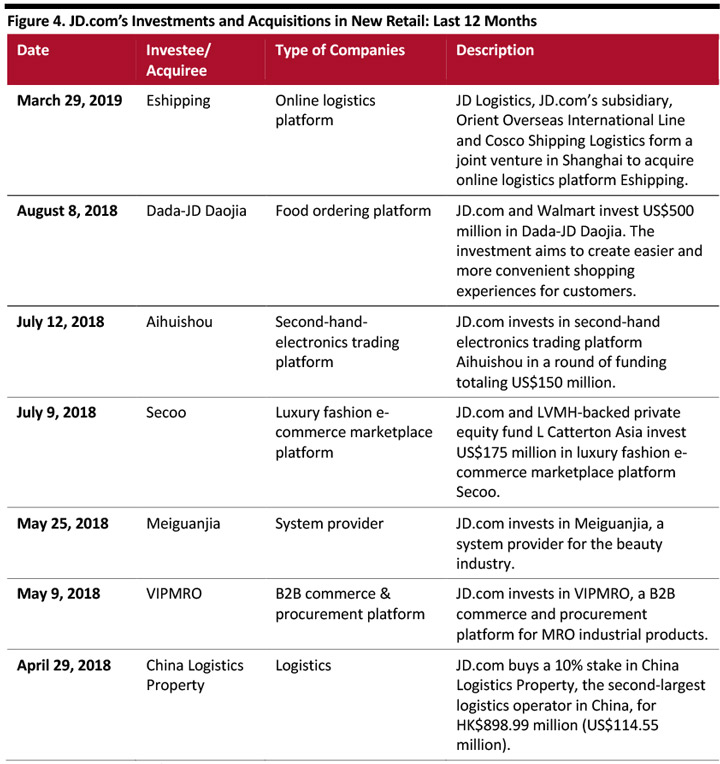

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_86444" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_86444" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86446" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86446" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86447" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_86447" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]