DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.

What’s New in New Retail?

WeChat and Alipay Go on a Health Kick

China’s Internet companies are eyeing the healthcare sector.

Tencent is trialling medical services, including online doctor consultations, hospital appointments (in China, most people would visit a hospital to see a doctor) and sales of medicine on its WeChat mini program named Tencent Health. The new function was launched in March and is currently open to certain WeChat users based in Shenzhen, with plans to roll it out to other cities.

Users can order a range of medicines supplied by Nepstar Drugstore, one of the largest pharmacy chains in China, with home delivery as fast as one hour. Users can also pay for services through WeChat’s electronic social security card, launched in January 2018, that links to the social security card that is part of China’s nationwide welfare system that covers pensions, medical care, unemployment, maternity and workplace injury.

Tencent’s Cloud and Smart Industries business group launched the e-health services, a new business unit formed since a major company restructuring last September designed to shift its focus to industrial Internet — offering digital solutions to traditional industries.

In the meantime, Alibaba’s mobile payment app Alipay is aiming to achieve 300 million users for its Xiang Hu Bao (meaning mutual protection) health plan in the next two years. Launched last October, Xiang Hu Bao is an online platform within the Alipay mobile app that offers a basic health plan to protect against 100 critical illnesses. The platform currently has over 50 million users.

Xiang Hu Bao is not a health-insurance product and is classified as a mutual-aid platform by Alipay — all participants in the platform share the risk of the covered illnesses and bear the expenses collectively. It is easy to join the health plan on Alipay: Participants do not need to make any and anyone between 30 days and 59 years old who meet basic health and risk criteria can participate. The service primarily targets low-income groups who cannot afford more expensive health insurance.

Coresight Research insight: Chinese Internet companies have been looking for new expansion opportunities and local services are a focal point. The healthcare sector is ripe for disruption as Internet companies look to digitalize a range of industries and bring more transactions to their apps to make them one-stop platforms.

Korean Eyewear Brand Gentle Monster Lands on Tmall and Luxury Pavilion

Korea’s eyewear brand Gentle Monster has expanded its online presence in China by opening a flagship store on Alibaba’s Tmall and a storefront on Tmall Luxury Pavilion, Alibaba’s dedicated site for luxury and premium brands.

Launched in 2017, Tmall Luxury Pavilion is Alibaba’s effort to increase market power in China’s luxury market. With Gentle Monster, the platform now has more than 100 premium brands. Those who were born 1990 or later are the key target audience, representing over 50% of buyers, according to Tmall Luxury Pavilion.

Coresight Research insight: China’s consumers have become major buyers of global luxury goods and China’s luxury consumer base increasingly represented by young consumers. Adding trendy, fun brands such as Gentle Monster to Tmall will resonate with young consumers. Brands often launch exclusive items, coupled with celebrity endorsements, on Tmall or Tmall Luxury Pavilion as their strategy to differentiate the experience from other sales channels.

[caption id="attachment_84769" align="aligncenter" width="720"] Chinese celebrity Li Yifeng, the brand ambassador of Gentle Monster

Chinese celebrity Li Yifeng, the brand ambassador of Gentle Monster

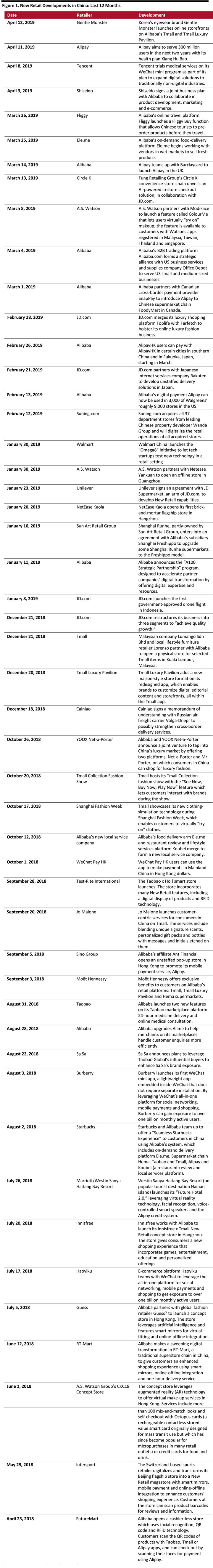

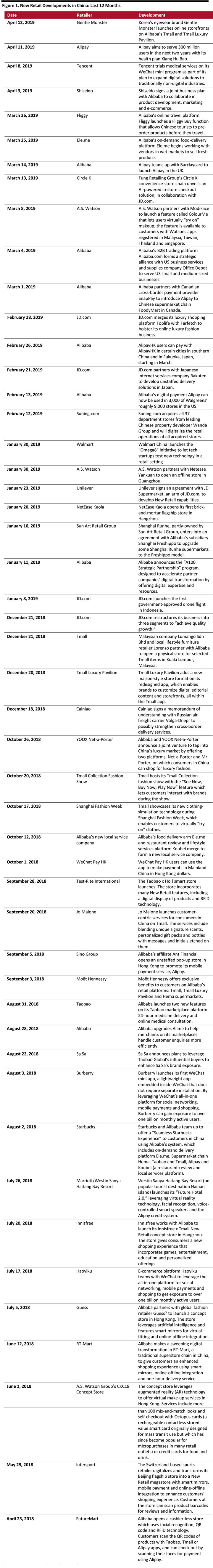

Source: Alizila.com [/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_84770" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

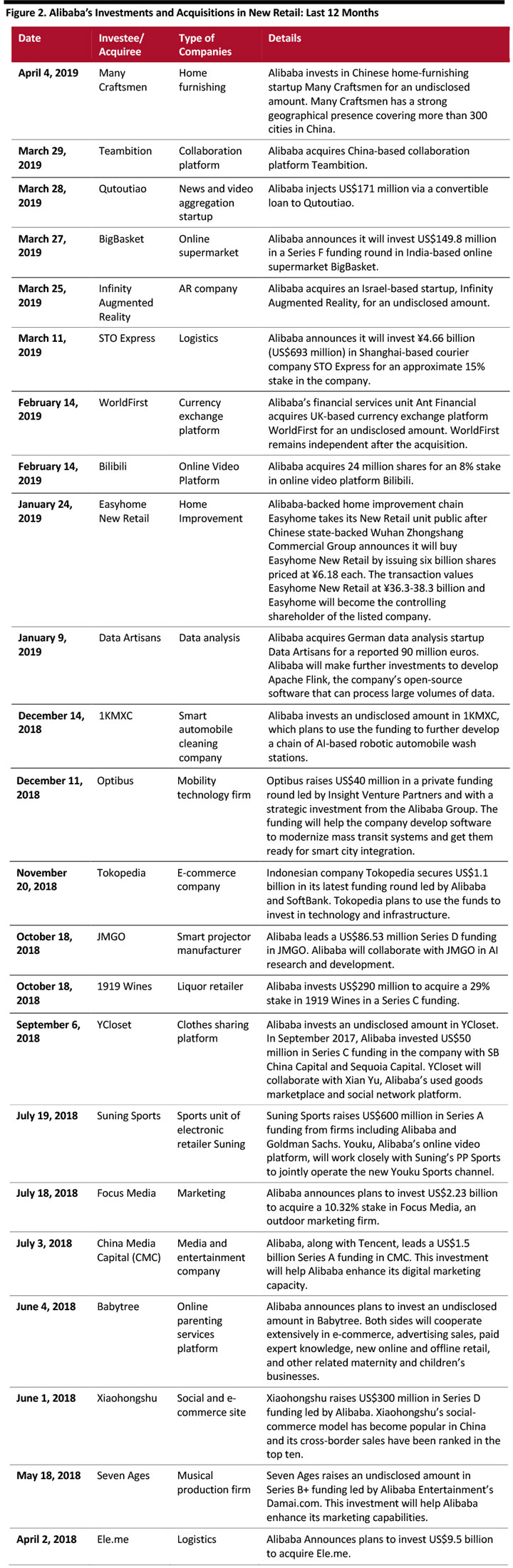

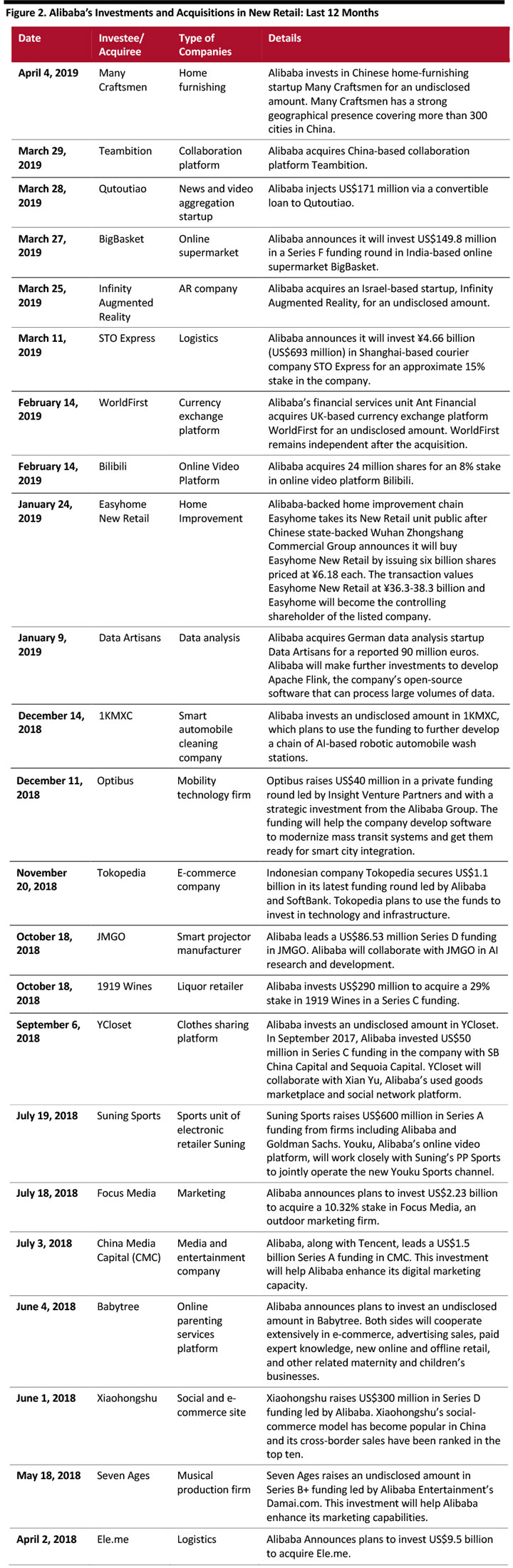

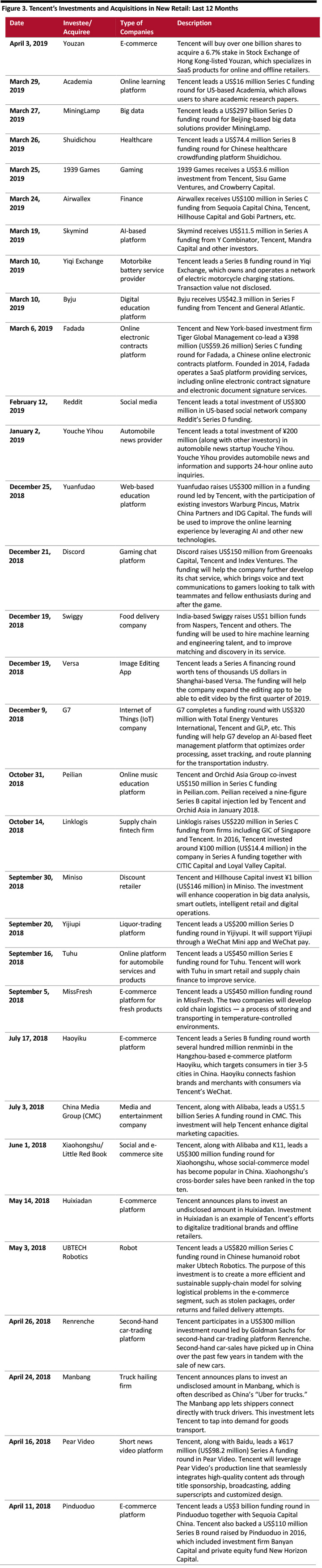

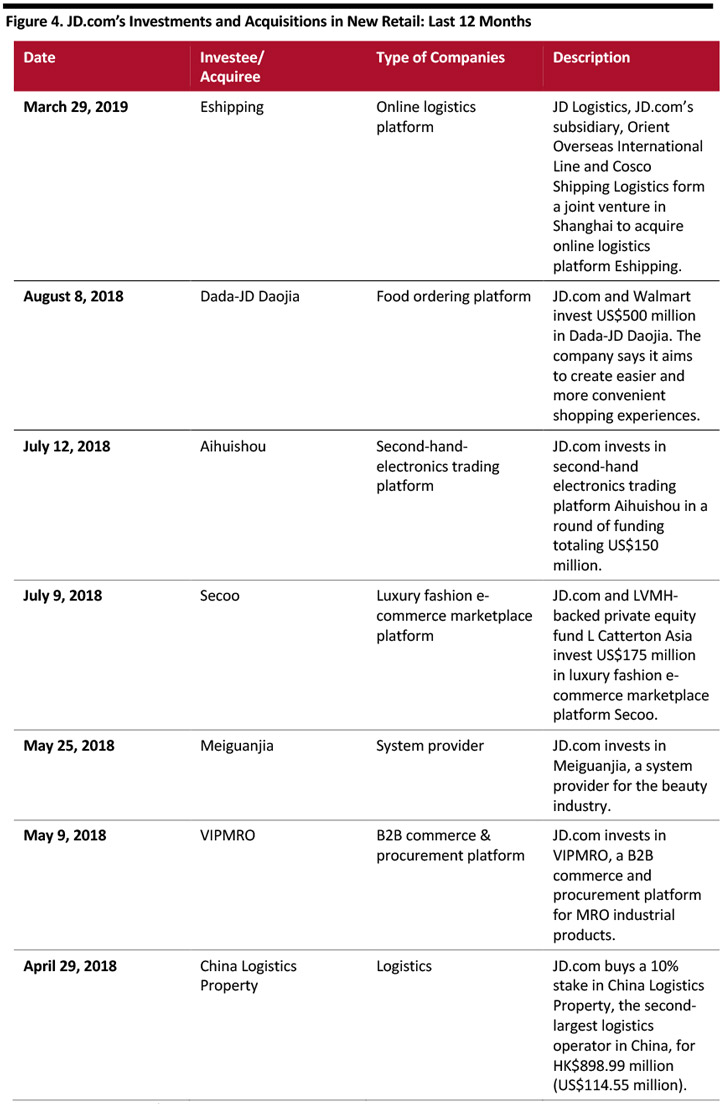

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_84771" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_84771" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

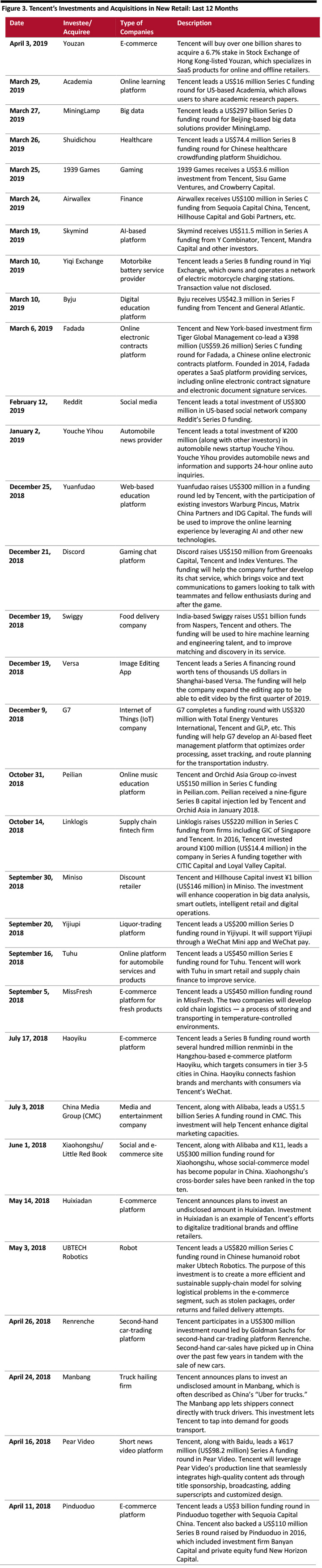

[caption id="attachment_84788" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84788" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

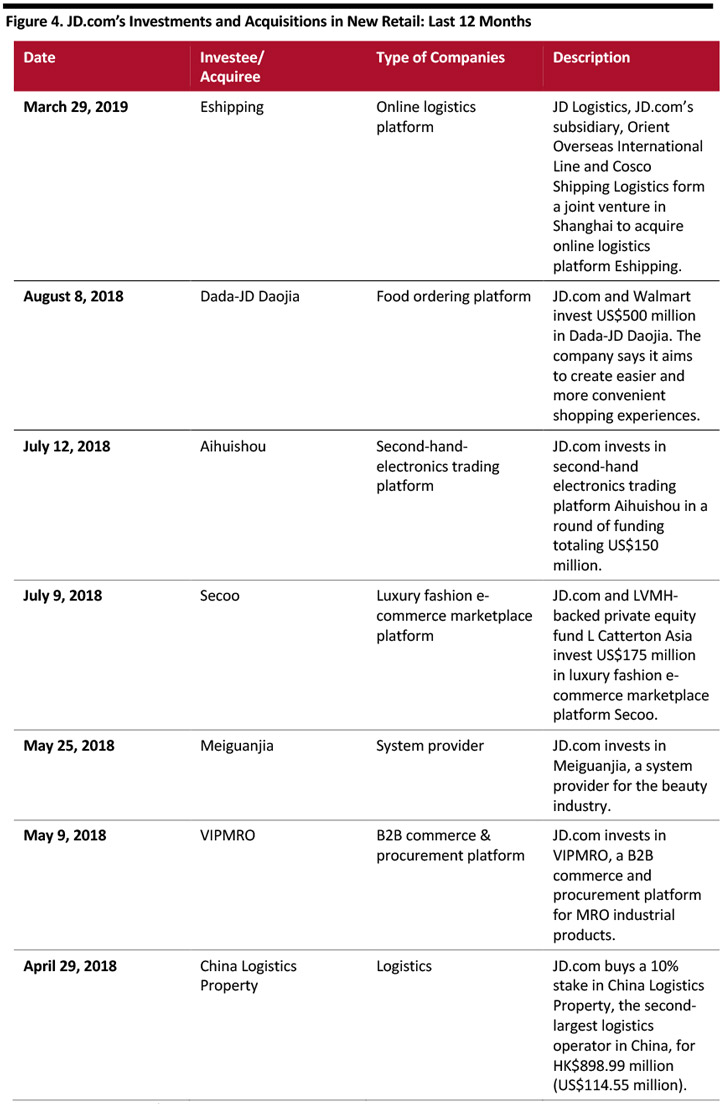

[caption id="attachment_84789" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84789" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Chinese celebrity Li Yifeng, the brand ambassador of Gentle Monster

Chinese celebrity Li Yifeng, the brand ambassador of Gentle Monster Source: Alizila.com [/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_84770" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_84771" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_84771" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84788" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84788" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84789" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_84789" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]