Nitheesh NH

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.

What’s New in New Retail?

Wet Markets Going Digital Via Ele.me

Alibaba’s on-demand food-delivery platform Ele.me is taking China’s traditional wet markets online. Vendors at these wet markets typically sell fresh produce, meat and seafood. Through Ele.me, shoppers can order products from market vendors, with agents from Ele.me delivering orders in as little as an hour. Customers can also order products and choose when they want to have the products delivered.

Alibaba says many Chinese consumers still prefer to shop for fresh food at wet markets, a traditional, low-tech format. Collaborating with Ele.me, vendors in these markets will be able to blend online and offline retailing.

[caption id="attachment_83238" align="aligncenter" width="720"] Ele.me deliveryman at the wet market

Ele.me deliveryman at the wet market

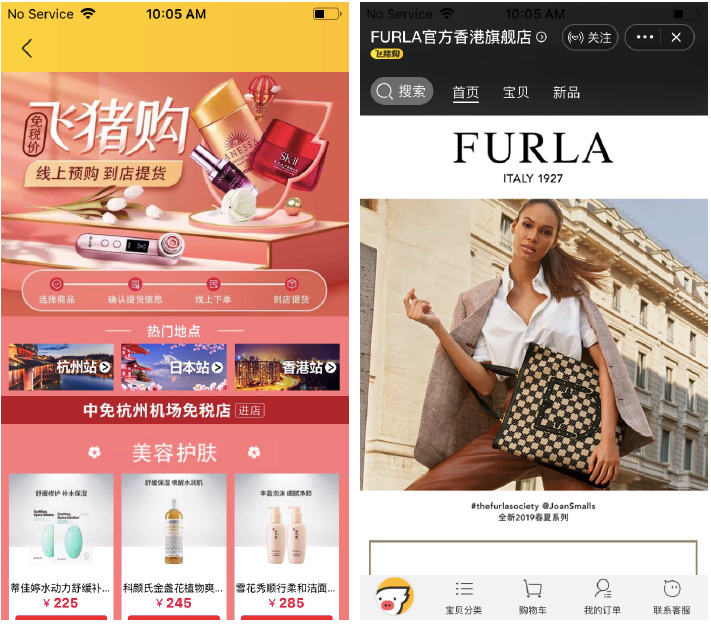

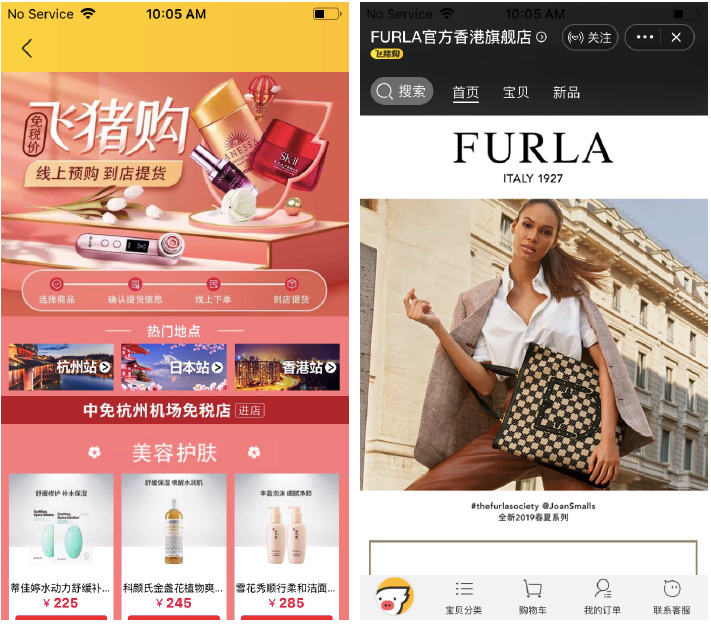

Source: Alizila.com [/caption] Fliggy Provides Pre-Order Services for Chinese Tourists Alibaba’s online travel platform Fliggy is launching a Fliggy Buy service that enables customers to order products online at duty-free and tax-free stores in their travel destinations before they start their trips. Fliggy Buy offers a wide range of products, including cosmetics, luggage, bags and alcohol, which are provided by third-party merchants. To date, bags and accessories retailer Furla Hong Kong and Japanese duty-free retailer Laox are selling on the platform. Roman Zhu, Head of Fliggy Buy, said Fliggy Buy will invite more brands and merchants to sell on the platform, ranging from high-end luxury brands and electronics retailers to pharmacy stores. [caption id="attachment_83239" align="aligncenter" width="720"] Fliggy Buy Platform

Fliggy Buy Platform

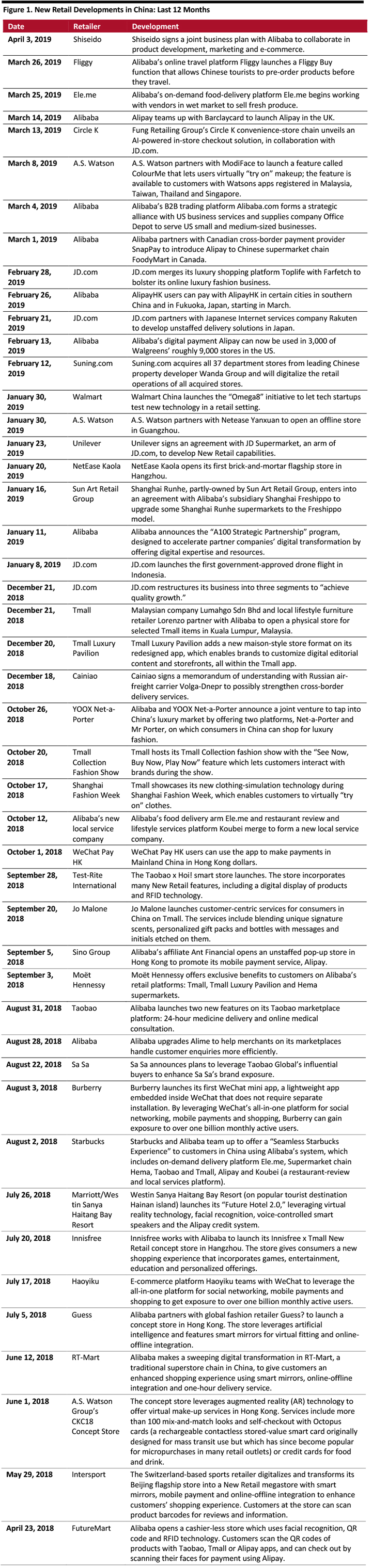

Source: Fliggy[/caption] Customers can view detailed product information and product reviews in Chinese, and they can pick up their orders once they reach their destinations. This “pre-shopping” will give Chinese tourists more time to spend on non-shopping activities such as sightseeing and experiencing local culture. Shiseido Partners with Alibaba for Product Development On April 1, Japanese cosmetics brand Shiseido signed a joint business plan with Alibaba. The two companies will work together on product development, marketing, e-commerce and customer relationship management. To implement the business plan, Shiseido has established a strategic development office in Hangzhou, which will work with Alibaba to co-create products tailored for Chinese consumers. This partnership will help Shiseido to use Alibaba’s big data and consumer insights to develop new products based on what consumers are looking for on Tmall. The first of the two co-developed products under this initiative—a shampoo and an oil for split ends—will launch exclusively on Tmall in September. Coresight Research Insight: Shiseido sees the potential of China’s lucrative market and plans to leverage Alibaba’s capacity in big data gleaned from its 700 million users to fuel growth. According to Shiseido, its China business was the fastest growth segment in 2018, with sales growth of 32.3% year over year to US$1.73 billion. New product development based on consumer data will help the brand to better cater to customers’ needs and demands. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_83260" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

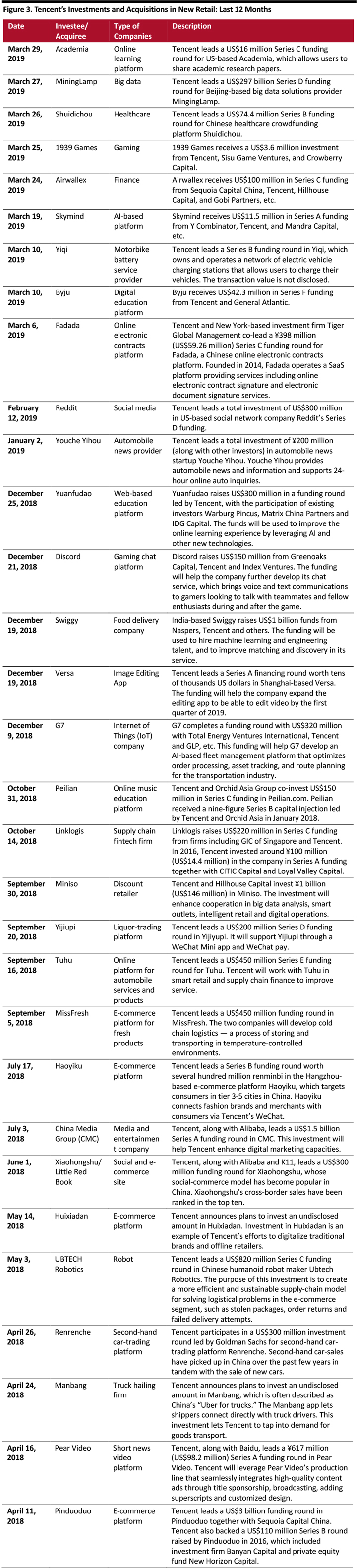

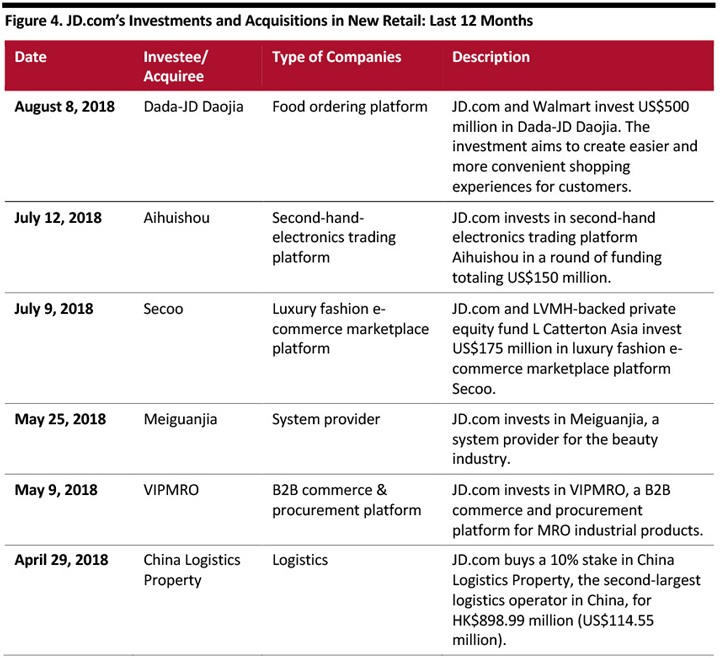

Investments and Acquisitions in New Retail

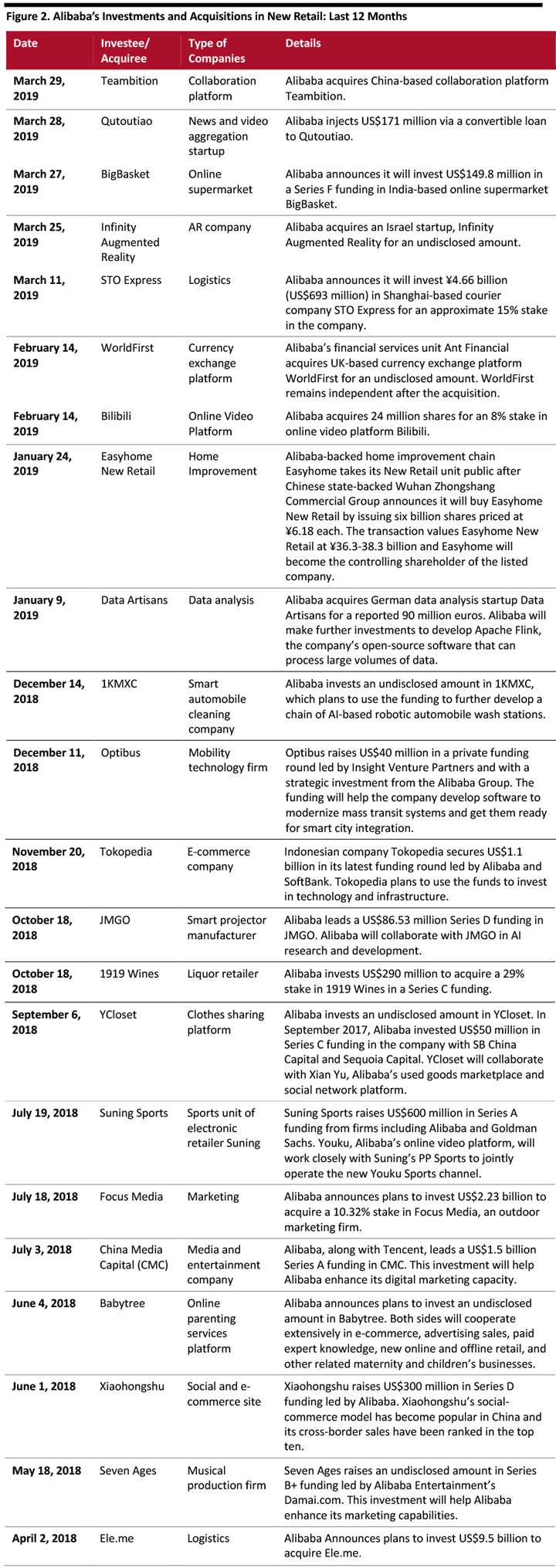

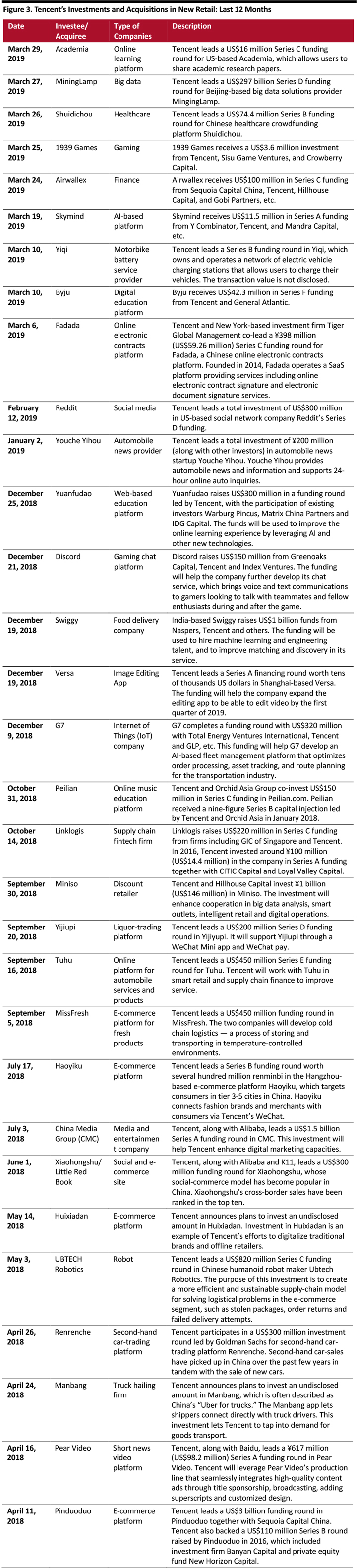

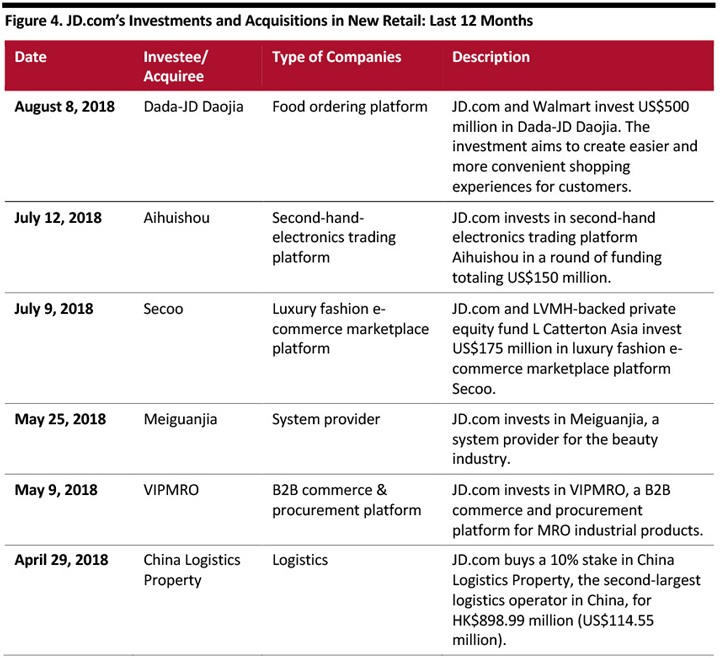

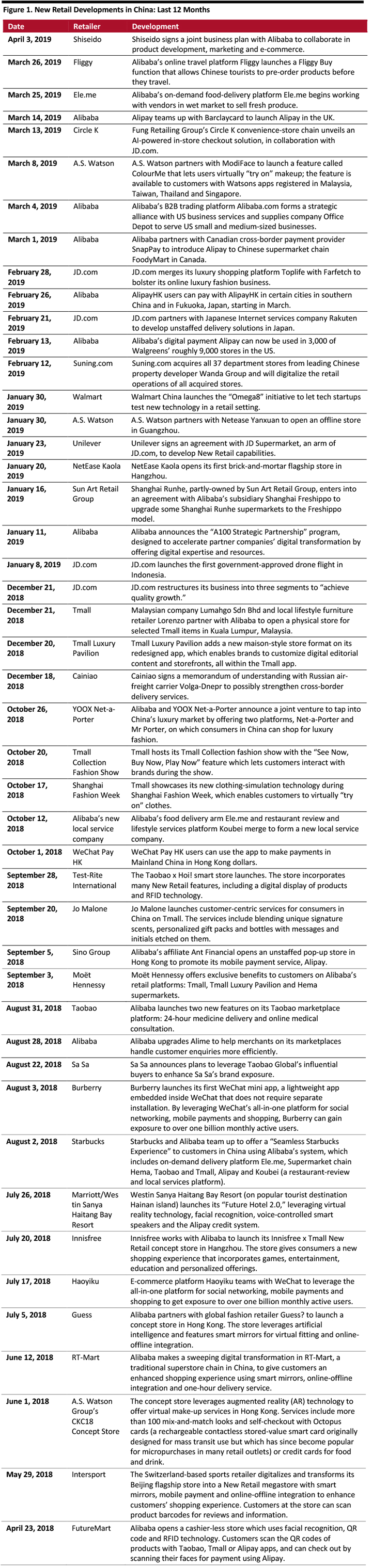

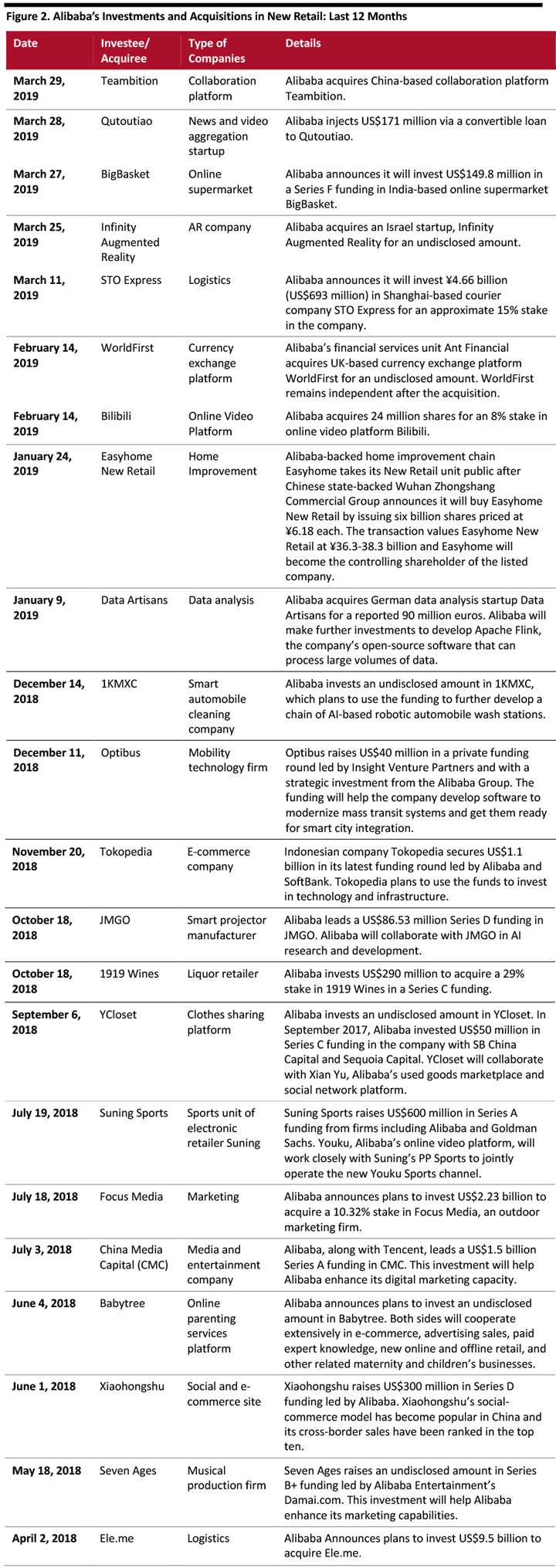

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. We note selected transactions in the following tables.

[caption id="attachment_83264" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. We note selected transactions in the following tables.

[caption id="attachment_83264" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83262" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83262" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83265" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83265" align="aligncenter" width="720"] Source: Company reports/Coresight Research [/caption]

Source: Company reports/Coresight Research [/caption]

Ele.me deliveryman at the wet market

Ele.me deliveryman at the wet market Source: Alizila.com [/caption] Fliggy Provides Pre-Order Services for Chinese Tourists Alibaba’s online travel platform Fliggy is launching a Fliggy Buy service that enables customers to order products online at duty-free and tax-free stores in their travel destinations before they start their trips. Fliggy Buy offers a wide range of products, including cosmetics, luggage, bags and alcohol, which are provided by third-party merchants. To date, bags and accessories retailer Furla Hong Kong and Japanese duty-free retailer Laox are selling on the platform. Roman Zhu, Head of Fliggy Buy, said Fliggy Buy will invite more brands and merchants to sell on the platform, ranging from high-end luxury brands and electronics retailers to pharmacy stores. [caption id="attachment_83239" align="aligncenter" width="720"]

Fliggy Buy Platform

Fliggy Buy PlatformSource: Fliggy[/caption] Customers can view detailed product information and product reviews in Chinese, and they can pick up their orders once they reach their destinations. This “pre-shopping” will give Chinese tourists more time to spend on non-shopping activities such as sightseeing and experiencing local culture. Shiseido Partners with Alibaba for Product Development On April 1, Japanese cosmetics brand Shiseido signed a joint business plan with Alibaba. The two companies will work together on product development, marketing, e-commerce and customer relationship management. To implement the business plan, Shiseido has established a strategic development office in Hangzhou, which will work with Alibaba to co-create products tailored for Chinese consumers. This partnership will help Shiseido to use Alibaba’s big data and consumer insights to develop new products based on what consumers are looking for on Tmall. The first of the two co-developed products under this initiative—a shampoo and an oil for split ends—will launch exclusively on Tmall in September. Coresight Research Insight: Shiseido sees the potential of China’s lucrative market and plans to leverage Alibaba’s capacity in big data gleaned from its 700 million users to fuel growth. According to Shiseido, its China business was the fastest growth segment in 2018, with sales growth of 32.3% year over year to US$1.73 billion. New product development based on consumer data will help the brand to better cater to customers’ needs and demands. Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_83260" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. We note selected transactions in the following tables.

[caption id="attachment_83264" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. We note selected transactions in the following tables.

[caption id="attachment_83264" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83262" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83262" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83265" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_83265" align="aligncenter" width="720"] Source: Company reports/Coresight Research [/caption]

Source: Company reports/Coresight Research [/caption]