albert Chan

New Retail Briefings

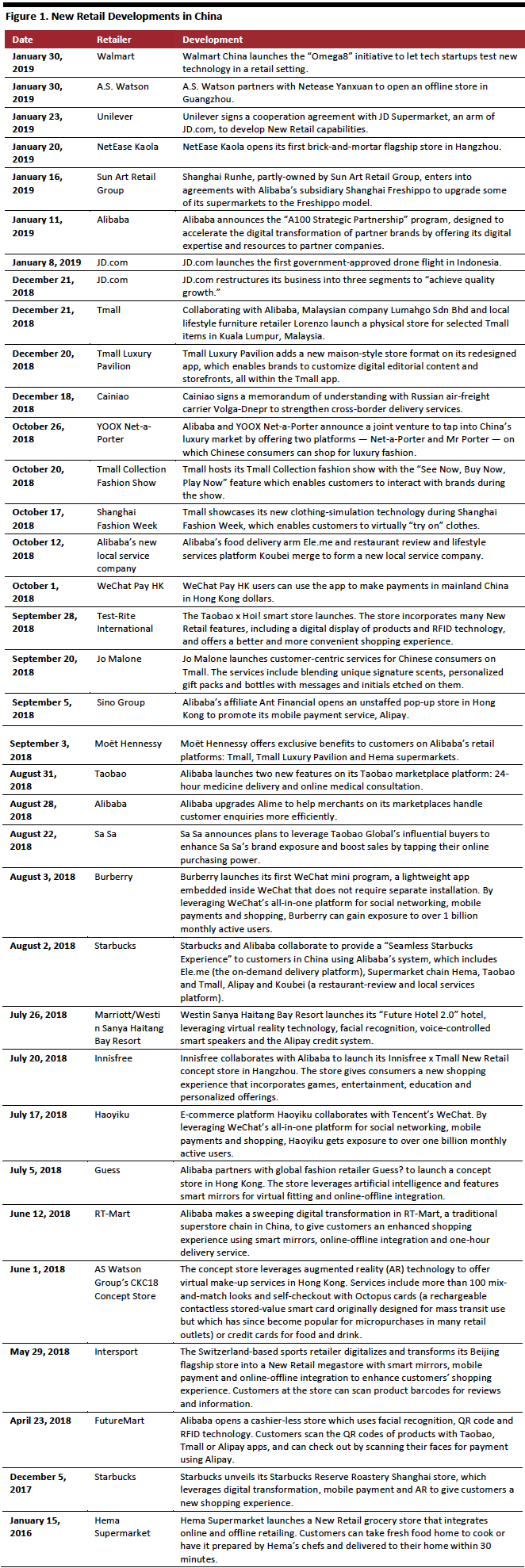

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by the Alibaba Group, although elements of the model are now being implemented by various firms in China and further afield. In this biweekly series, we review the latest trends in New Retail in China, with a focus on major digital platforms and multichannel retail companies.What’s New in New Retail?

Walmart China Sets Up Omega8 Initiative for Retail Innovation Walmart China launched the Omega8 initiative in January 2019 to serve as a proof of concept (POC) platform that lets tech startups test newly designed technology applications in a real retail environment. Walmart reported over 50 startups signed up for the initiative. Walmart will train these companies in a variety of retail operation skills. Walmart said its existing 400 offline stores in China will act as testing grounds for startup technology before rolling out to mass market. This Omega8 initiative shows Walmart’s ambition of leveraging tech startups for its own digital innovation, and understanding of the Chinese market. Ben Hassing, Senior Vice President of Walmart China said, “Walmart has worked with many technology startups not only to propel our business in China, but also to understand the Chinese market and China in greater depth.” [caption id="attachment_75060" align="aligncenter" width="654"] Walmart China

Walmart ChinaSource: Walmart[/caption] A.S. Watson Partners with Netease Yanxuan in Opening an Offline Store In January, health and beauty retailer A.S. Watson opened a lifestyle store “Watsons + NetEase Yanxuan” in Guangzhou, in collaboration with NetEase Yanxuan, which sells private label products through its e-commerce website and offline stores. The 250-square-feet store features a variety of products, including skincare and health products, travel accessories and household supplies. This partnership will potentially benefit both parties:

- Yanxuan will possibly leverage A.S. Watson’s network of over 3,000 Watsons stores in China, while Yanxuan’s product offering complements Watsons’.

- Watsons focuses on skincare and health care products, while Yanxuan’s strength is in household products.

- Watsons will potentially leverage Yanxuan’s consumer data and Yanxuan’s product line.

Watsons + NetEase Yanxuan store in Guangzhou

Watsons + NetEase Yanxuan store in GuangzhouSource: Watsons China[/caption] Unilever Collaborates with JD Supermarket for New Retail Development Unilever and JD Supermarket, an arm of JD.com, signed a cooperation agreement for 2019 under which the companies will collaborate in a variety of areas, including category expansion, technology development and New Retail. Under the agreement, Unilever will draw on JD Supermarket’s product development capabilities to develop new products based on consumer behavior data, and then Unilever will sell these new products on JD Supermarket. Unilever said it will create product lines that are exclusive to JD Supermarket, and start a joint warehouse project with JD.com in the first half of 2019 to enhance warehousing capacity and delivery services. [caption id="attachment_75062" align="aligncenter" width="662"]

Source: Company reports/Coresight Research[/caption]

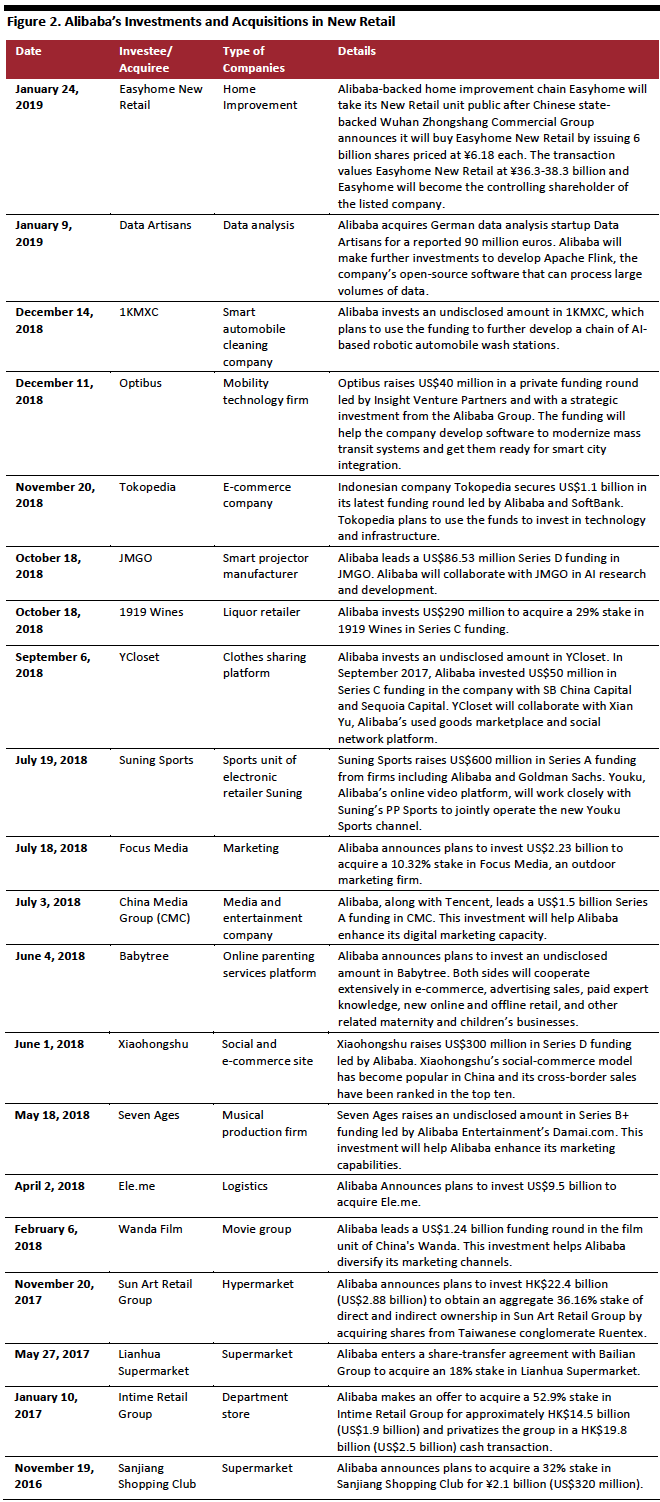

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies and even brick-and-mortar stores. These are some highlights:

[caption id="attachment_75065" align="aligncenter" width="660"]

Source: Company reports/Coresight Research[/caption]

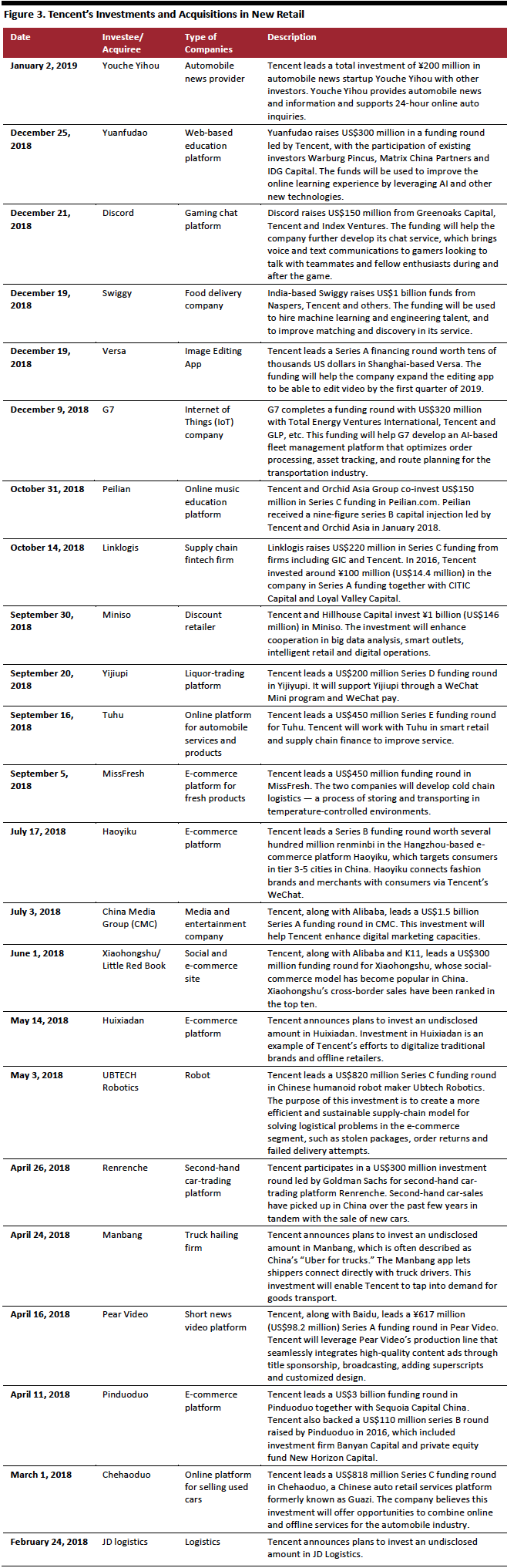

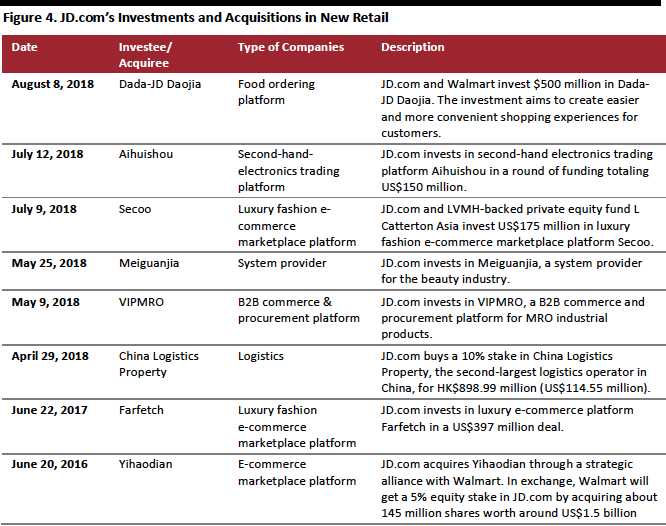

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies and even brick-and-mortar stores. These are some highlights:

[caption id="attachment_75065" align="aligncenter" width="660"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_75064" align="aligncenter" width="658"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_75064" align="aligncenter" width="658"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_75063" align="aligncenter" width="666"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_75063" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]