albert Chan

New Retail Briefings

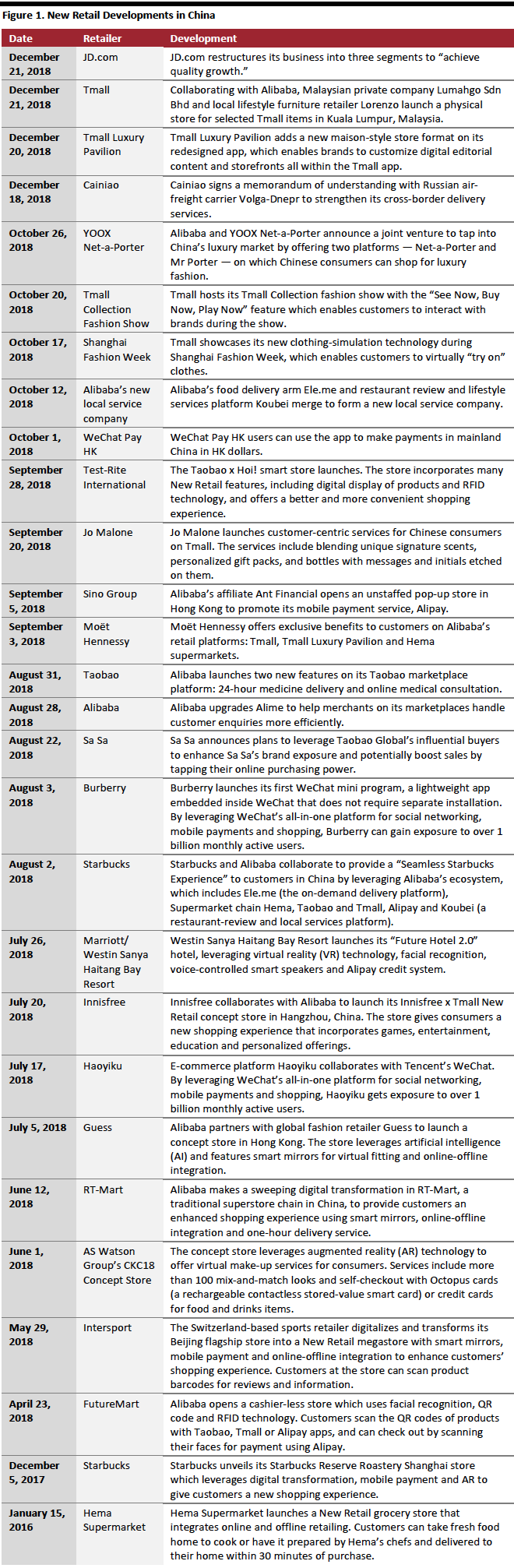

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by the Alibaba Group, although elements of the model are now being implemented by various firms in China and further afield. In this fortnightly series, we review the latest trends in New Retail in China, with a focus on major digital platforms and multichannel retail companies.What’s New in New Retail?

Alibaba Launches A100 Strategic Partnership Program Alibaba launched the “A100 Strategic Partnership” program in January 2019 to help partner brands digitalize by giving them access to resources within its ecosystem so participating brands can access Alibaba services in 11 areas to enhance online-offline business integration. Alibaba will also assign a dedicated team to serve each participating brand. Companies that have participated so far include Starbucks, Nestlé, L'Oréal, P&G, Haier, and Easyhome. Nestlé has moved beyond Alibaba’s e-commerce platforms to work with its logistics arm Cainiao Network to sort inventory based on customers’ preferences in specific regions of China, while P&G has worked with Alibaba’s retail innovation arm Tmall Innovation Center to co-create a shampoo series with a fragrance tailored for the China market. By enabling brands to further tap into its capabilities, Alibaba is trying to achieve greater synergies among brands and its business units. [caption id="attachment_68294" align="aligncenter" width="636"] Alibaba CEO Daniel Zhang introduces the “A100 Strategic Partnership” program

Alibaba CEO Daniel Zhang introduces the “A100 Strategic Partnership” programSource: Alizila.com[/caption] NetEase Kaola Opens First Offline Flagship Store In January, NetEase Kaola, which operates one of the largest cross-border e-commerce platforms in China, opened its first brick-and-mortar flagship store, in Hangzhou, south of Shanghai. The store features over 3,000 stock-keeping units of imported goods ranging from cosmetics, skincare, mom and baby to electronics and apparel. The company will update its product listings regularly based on big data analytics. NetEase Kaola aims to establish 15 physical stores in 2019 to offer consumers the convenience of buying a wide range of imported products offline. This follows moves by both Tmall Global, Alibaba’s cross-border e-commerce site, and JD Worldwide, JD.com’s online marketplace selling imported products, to opening of the first cross-border e-commerce offline stores in 2018. E-commerce giants in China have upped their game in selling imported goods offline as the country’s new e-commerce law favors cross-border e-commerce trade. [caption id="attachment_68295" align="aligncenter" width="630"]

NetEase Kaola’s first brick-and-mortar flagship store in Hangzhou

NetEase Kaola’s first brick-and-mortar flagship store in HangzhouSource: NetEase Kaola[/caption] Sun Art Retail Group to Upgrade Stores with Alibaba’s Freshippo Business Model Shanghai Runhe, partly-owned by Sun Art Retail Group, entered into agreements with Alibaba subsidiary Shanghai Freshippo to upgrade Shanghai Runhe hypermarkets and supermarkets to use the Freshippo model in Hainan province (an island province in the south of China) and in the northeastern region. Freshippo, formerly known as Hema, is Alibaba’s tech-driven fresh-food grocery chain that allows consumers to shop, eat in-store or order groceries for home delivery. Under the partnership, Shanghai Runhe will incorporate the technology supplied by Shanghai Freshippo and offer delivery services for products sold through the Freshippo app. JD.com Launches First Drone Flight in Indonesia JD.com successfully launched the first government-approved drone flight in Indonesia on January 8, turning a new page for the drone delivery business in Southeast Asia. The pilot flight occurred in West Java, from Jagabita village, Parung Panjang, to MIS Nurul Falah Leles Elementary School to deliver backpacks and books to students, part of a JD.com donation program. Drone deliveries are particularly helpful in Indonesia where many people live in remote areas. JD.com and its joint venture partner in Indonesia JD.ID have set a goal to deliver 85% of orders same- or next-day by using drones and other logistics services. [caption id="attachment_68306" align="aligncenter" width="674"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies and even brick-and-mortar stores. These are some highlights:

[caption id="attachment_68309" align="aligncenter" width="674"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies and even brick-and-mortar stores. These are some highlights:

[caption id="attachment_68309" align="aligncenter" width="674"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_68308" align="aligncenter" width="670"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_68308" align="aligncenter" width="670"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_68307" align="aligncenter" width="676"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_68307" align="aligncenter" width="676"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]