DIpil Das

New Retail Briefings

“New Retail” is a model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. The term was introduced by Alibaba Group, although many other companies in China and elsewhere are implementing various elements of the model. In this biweekly series, we review the latest trends in New Retail, with a focus on major digital platforms and multichannel retail companies in China.What’s New in New Retail?

Alibaba Starts “Local to Global” Strategy Alibaba has begun scaling up its global expansion initiatives. AliExpress, Alibaba’s international e-commerce platform that lets Chinese brands sell overseas, is now open to small and medium-sized merchants in Russia, Turkey, Italy and Spain. Companies can register and sell to all countries AliExpress serves. The move is part of Alibaba’s broader globalization strategy to become an international company with global offerings. Meanwhile, in May, Alibaba launched The New Chinese Goods Project, which seeks to help Chinese brands expand into overseas markets. The company has set a goal of signing up 700,000 Chinese brands to sell globally through Tmall Global, Lazada and AliExpress. Earlier, in March, AliExpress announced it would partner with 1,000 Chinese beauty brands to transform them from trade-oriented to brand-oriented companies. Coresight Research Insight: China’s National Bureau of Statistics reported that retail sales growth in China slowed to 7.2% in April, the slowest pace in 16 years. Expanding overseas allows Alibaba to find new space to fuel its growth. This could also drive an improvement in the overall quality of Chinese goods as they seek to compete more effectively in international markets. This may in turn inspire Chinese consumers to embrace local brands. [caption id="attachment_88713" align="aligncenter" width="720"] AliExpress’s homepage

AliExpress’s homepage Source: AliExpress [/caption] Meituan Closes Five Ella Fresh Food Supermarkets Local services company Meituan has closed all five stores in its fresh food supermarket chain Ella in Jiangsu province, cutting its total store count from seven to two. The first Ella supermarket opened in May 2018, featuring a range of fresh local and international produce, and promising to deliver to consumers in 30 minutes within a distance of three kilometers (just under two miles). The company remains confident the fresh food business is key to its long-term business strategy, according to Chinese technology news media Technode. Coresight Research Insight: Fresh food e-commerce is an emerging space in New Retail and convenience, and the wide product selection it offers has attracted Chinese consumers. However, an online-to-offline fresh food business is expensive to operate due to the costs associated with handling and transporting perishable fresh foods. Chinese fresh food supermarkets have begun reviewing store opening strategies: Apart from Ella, Alibaba’s Freshippo and JD.com’s 7Fresh have also recently slowed expansion. [caption id="attachment_88714" align="aligncenter" width="720"]

Ella Supermarket

Ella Supermarket Source: Meituan [/caption] Intersport Partners with Suning to Enhance its Presence in China Sports retailer Intersport has signed a franchise agreement with Suning, a major e-commerce operator and retailer in China known for electronic and digital products to enhance its presence in China. Under the partnership, Suning will open more Intersport stores in its malls, expanding Intersport’s reach and enhancing Suning’s product portfolio by expanding into the sports category. Suning is eyeing the market for sports products in response to a growing fitness and healthy lifestyle trend in China, according to the company’s Vice President Gary Gong. [caption id="attachment_88715" align="aligncenter" width="720"]

Intersport store

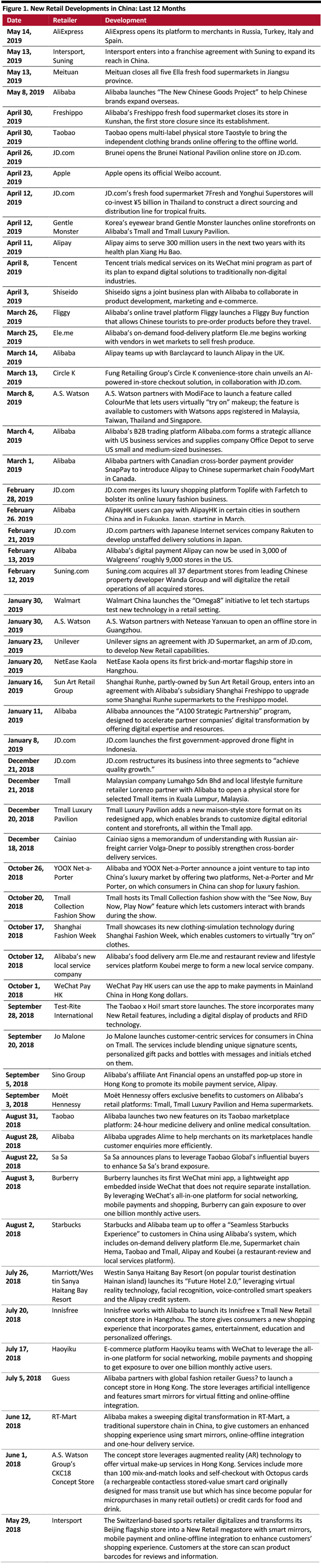

Intersport store Source: Intersport [/caption] Appendix: New Retail Developments New Retail developments in China are listed in Figure 1. [caption id="attachment_88716" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Investments and Acquisitions in New Retail

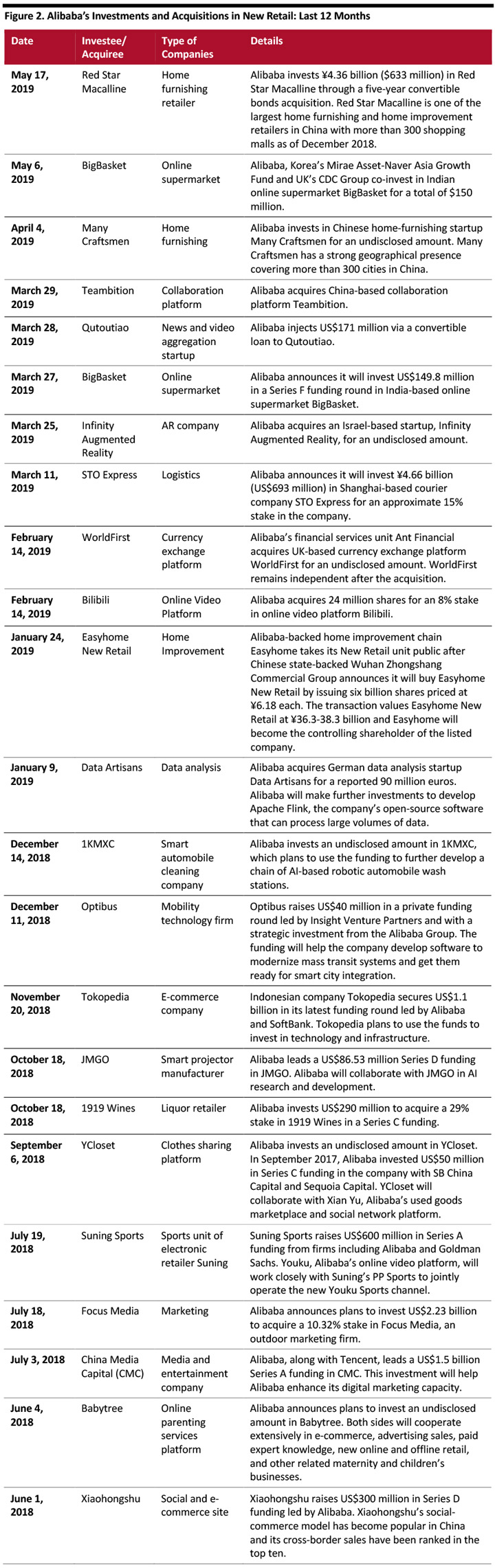

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_88717" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

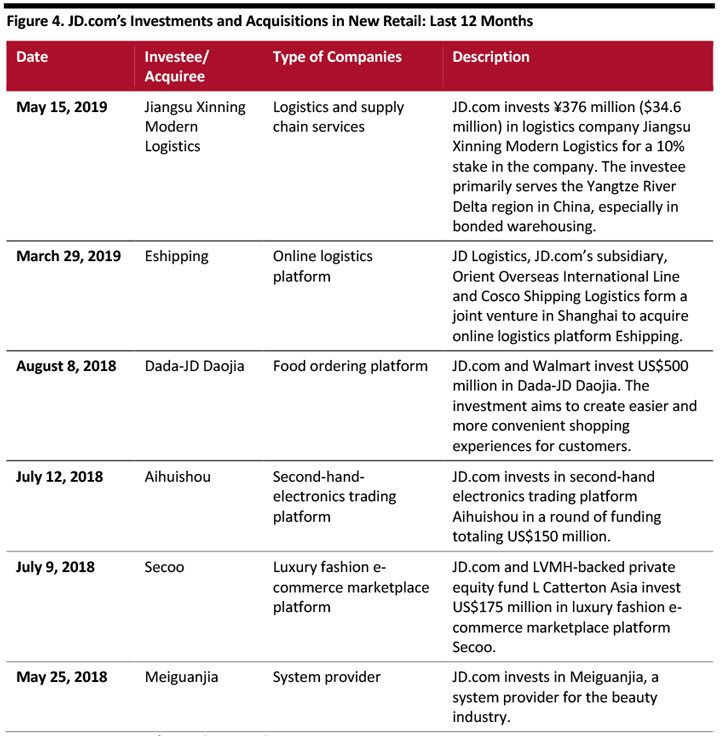

Investments and Acquisitions in New Retail

To expand New Retail abilities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content-creation companies and even brick-and-mortar stores. See selected transactions in the following tables:

[caption id="attachment_88717" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

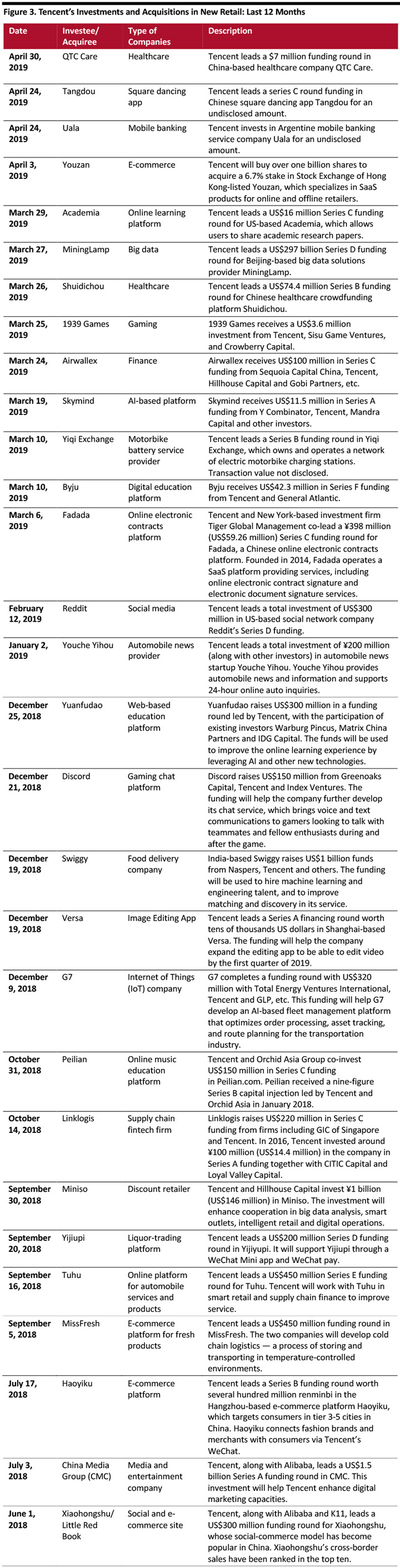

[caption id="attachment_88718" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88718" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88719" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

[caption id="attachment_88719" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]