DIpil Das

Introduction: The Plus-Size Apparel Market Is Growing

Inclusivity is the zeitgeist of the 21st century, spanning ethnicities, sexuality and sizing, to name a few topics. Technology has empowered diverse consumers around the world to obtain products once unavailable and, at the same time, consumer shopping behavior towards plus-size clothing has changed.

Larger women, once marginalized, are now courted by designers, retailers and brands. A growing supply of inclusive apparel is addressing new consumer expectations – but this shopper is far from sated in terms of fashion apparel.

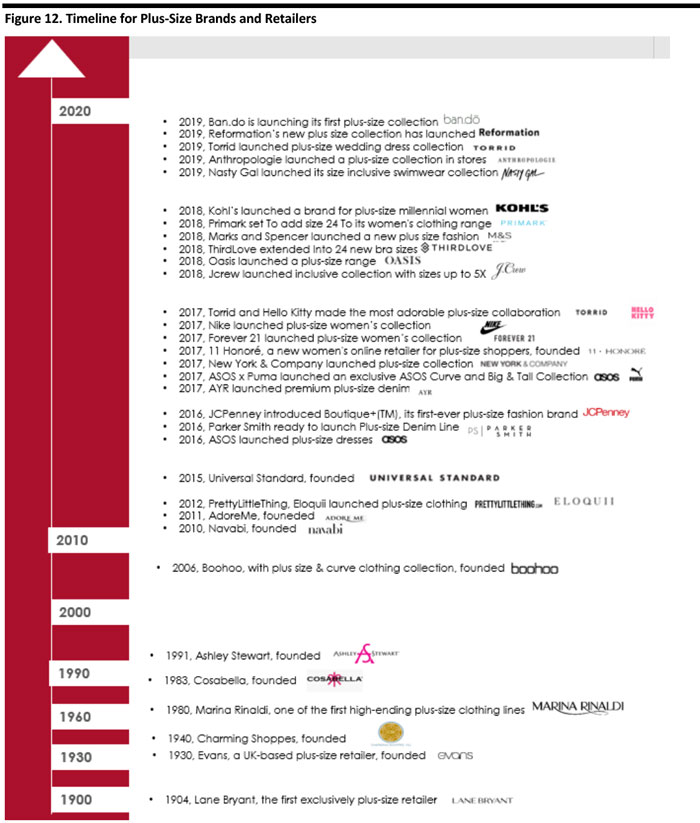

Brands and retailers have expanded plus-size offerings to better serve this growing market segment and take advantage of the opportunity it presents. Sportswear, intimates and bridal dresses are popular segments for plus-size business expansion in 2019. On its June 5th earnings call, American Eagle announced it would extend sizing, with women's jean sizes spanning 00 to 24 and men's waist sizes up to 48 in all stores and online.

In addition to the unmet needs of the plus-size apparel and fashion shopper, fashion rental and social commerce/community will drive industry growth.

Women’s Inclusive Sizing Market in the US

To gauge the potential size of the inclusive or plus-size apparel market, we looked at population, obesity and average apparel spend among US women.

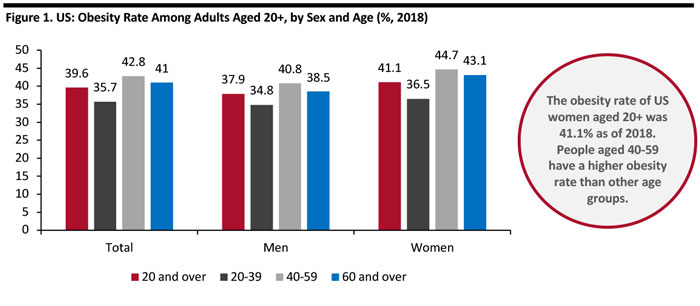

Obesity

The increasing prevalence of obesity is fueling the inclusive-size market in the US. According to the Behavioral Risk Factor Surveillance System at the Center for Disease Control and Prevention (CDC), the rate of obesity among women in the US is approximately 41.1% - approximately 53 million women.

[caption id="attachment_92476" align="aligncenter" width="700"] Source: CDC[/caption]

Source: CDC[/caption]

Percentage of American Women Who Intend to Shop for Plus-Size Clothing

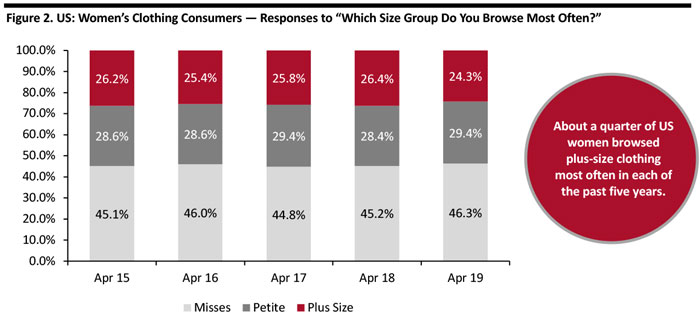

To better grasp how many American women intend to buy plus-size apparel, we reviewed consumer survey data from Prosper Insights & Analytics. Prosper asks respondents which size group of women’s clothing they browse most often.

According to the survey results, about a quarter of US women most often browse plus-size clothing, and that percentage has remained fairly flat year to year. In 2019, 24.3% of US women say they have browsed plus-size clothing, which translates to approximately 31 million women.

[caption id="attachment_92477" align="aligncenter" width="700"] Base: 7,321 US Internet users aged 18+, surveyed in April 2019

Base: 7,321 US Internet users aged 18+, surveyed in April 2019 Source: Prosper Insights & Analytics [/caption]

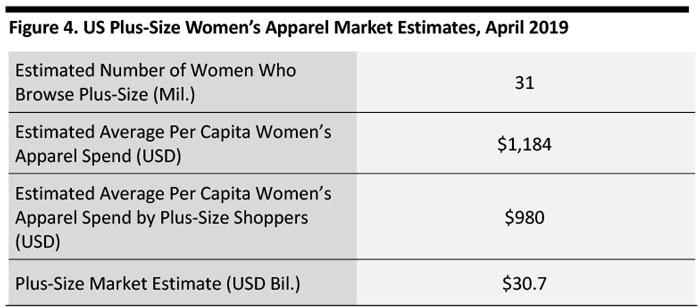

Market Estimates

We estimate the US women’s plus size clothing market will be worth $30.7 billion in 2019, growing around 4% to reach approximately $31.9 billion in 2020, and growing at a CAGR of just under 3% to $36.3 billion by 2025.

[caption id="attachment_92478" align="aligncenter" width="700"] Source: BEA/CDC/US Census Bureau/Prosper Insights & Analytics/Coresight Research[/caption]

Our market size estimates factor in the proportion of women that browse plus-size clothing, estimated per capita spend and the apparel market’s trajectory. Our market size estimates reflect apparel spending by those who most often shop the plus-size size group.

Source: BEA/CDC/US Census Bureau/Prosper Insights & Analytics/Coresight Research[/caption]

Our market size estimates factor in the proportion of women that browse plus-size clothing, estimated per capita spend and the apparel market’s trajectory. Our market size estimates reflect apparel spending by those who most often shop the plus-size size group.

- As shown earlier, Prosper survey data show 24% of US women browse the plus-size size group “most often.” This equates to an estimated 31 million plus-size shoppers.

- Survey data from Prosper show that per-person spend is lower among plus-size shoppers: For every $1 spent on clothing by the average woman, plus-size shoppers typically spend only 82.8 cents.

- We forecast total clothing sales growth to maintain the 2.6% CAGR exhibited in the 2014-2018 period.

Source: BEA/Prosper Insights & Analytics/Coresight Research [/caption]

Source: BEA/Prosper Insights & Analytics/Coresight Research [/caption]

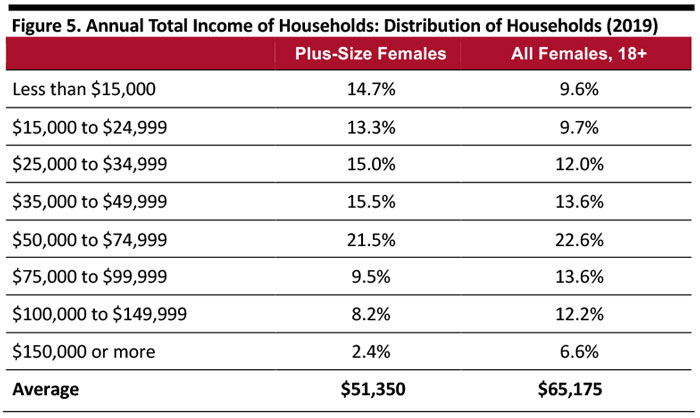

Household Income

According to data from Prosper Insights & Analytics, plus-size female consumers have an average annual household income of $51,350, 21.1% less than the $65,175 average annual household income for all females aged 18 and above. And more than half (58.5%) of plus-size women live in households with annual income less than $50,000, versus 44.9% of all females 18 and above.

The income disparity is one of the reasons plus-size females spend less on clothing than the overall female population — along with fewer apparel and fashion offerings in their size.

[caption id="attachment_92480" align="aligncenter" width="700"] Base: 7,321 US Internet users aged 18+, surveyed April 2019

Base: 7,321 US Internet users aged 18+, surveyed April 2019 Source: Prosper Insights & Analytics [/caption]

Offline Specialty Retail

Based on the latest available data (2018) from IBIS World, specialty plus-size apparel retailers — offline or instore — have racked up revenues of $10.1 billion. (The industry does not include online sales or plus-size clothing sales from stores with multiple departments.)

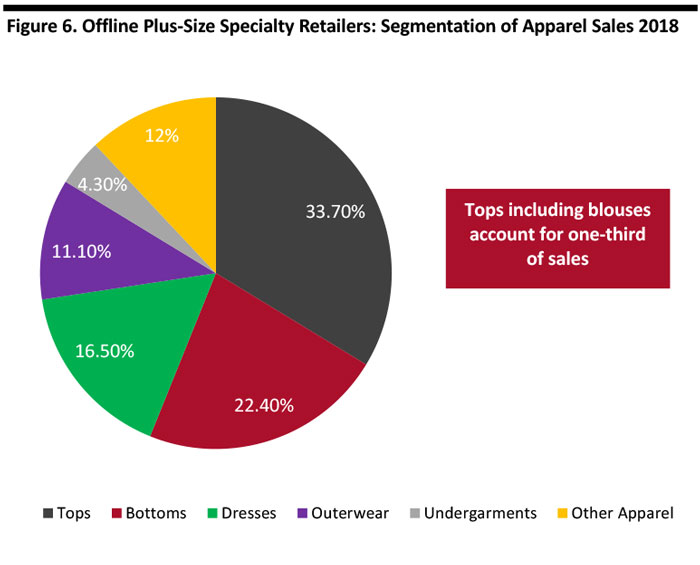

Plus-size women’s clothing stores sell similar products as general women’s clothing stores and they normally carry merchandise sized 14 and up. From the segmentation in figure 6, we can see tops and blouses represent the largest category of offline industry revenue at an estimated 33.7%. Bottoms generate the second largest share at 22.4% and dresses account for 16.5%.

[caption id="attachment_92481" align="aligncenter" width="700"] Source: IBIS[/caption]

Source: IBIS[/caption]

Shopping Formats

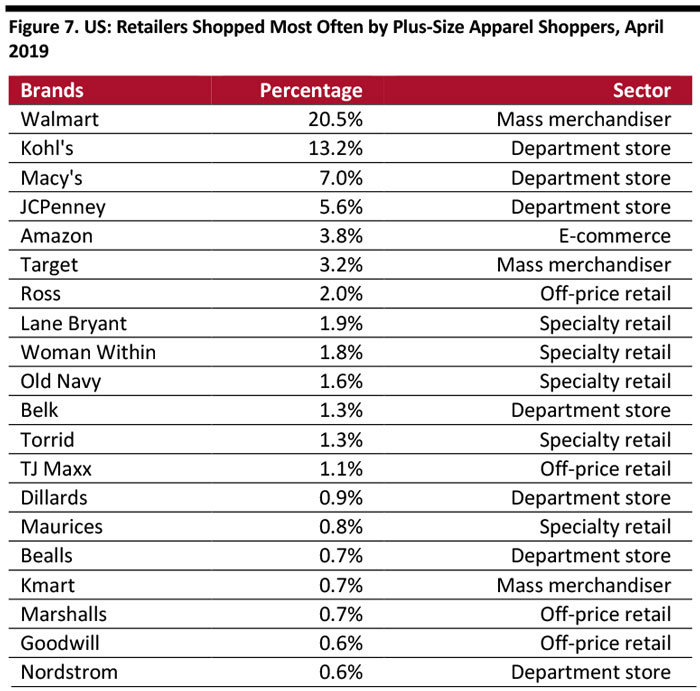

Prosper Insights & Analytics tracks where consumers say they shop most often for plus-size apparel. In April 2019, Walmart was the #1 retailer by this metric, with 20.5% plus-size respondents saying it is where they shop most often. Kohl’s and Macy’s rank second and third place, with 13.2% and 7%, respectively.

[caption id="attachment_92482" align="aligncenter" width="700"] Base: Plus-size shoppers among 7,321 US Internet users aged 18+

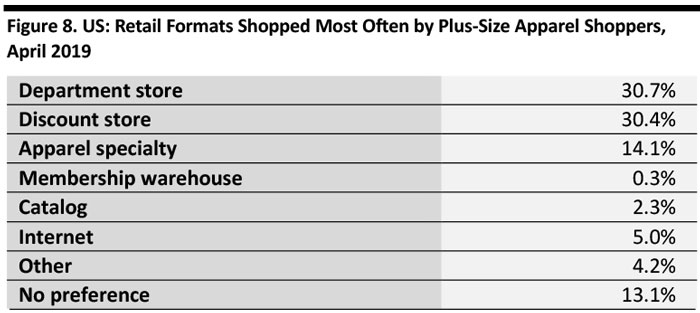

Base: Plus-size shoppers among 7,321 US Internet users aged 18+ Source: Prosper Insights & Analytics [/caption] Similarly, Prosper asks respondents which type of stores (not the specific store) they shop most often for plus-size apparel. Department store and discount stores are the two most popular retail formats for plus-size apparel shopping, garnering 31.6% and 30.5% respectively. Internet retailers are the most-shopped destination for about 5% of respondents, up from 1.6% in April 2015. [caption id="attachment_92483" align="aligncenter" width="700"]

Base: Plus-size shoppers among 7,321 US Internet users ages 18+ surveyed

Base: Plus-size shoppers among 7,321 US Internet users ages 18+ surveyed Source: Prosper Insights & Analytics [/caption]

Intimates Brands and Retailers Are Launching Inclusive Sizing Collections

While tall, thin and sexy Victoria’s Secret models have marketed beautiful lingerie on the catwalks (which are actually now under review as the parent company L Brands no longer sees network televised fashion shows as the right fit), other intimate brands and retailers are launching inclusive sizing lingerie to address the white space.

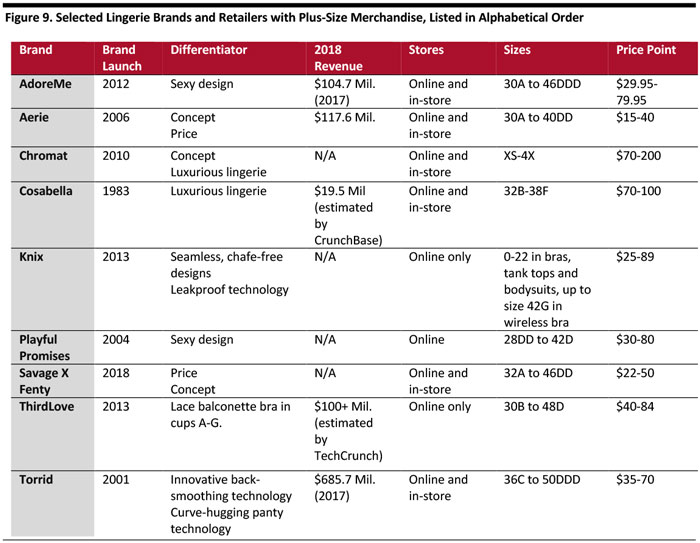

Lingerie is one of the fastest-growing plus-size categories, according to IBISWorld research cited by Bloomberg in September 2017. HanesBrands launched two new plus-size lingerie lines in 2017, and JCPenney, Lane Bryant and PVH Corp have also added to their plus-size intimates offerings. PVH bought e-commerce lingerie startup True & Co in 2017 and, according to Bloomberg, plus sizes account for 56% of True & Co’s sales.

Below are selected brands in the intimate’s space with a focus on inclusivity and body positivity:

[caption id="attachment_92484" align="aligncenter" width="700"] Source: Company reports and websites/Wall Street Journal/Crain’s New York Business/Coresight Research[/caption]

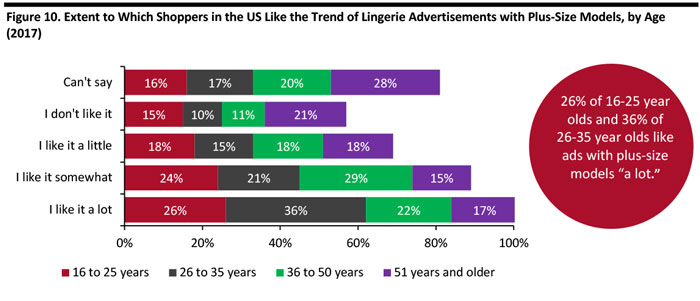

Plus-size models are enjoying higher profiles, such as Gabi Gregg, Kate Wasley and Tara Lynn. From a survey conducted by Statista in 2017 regarding the extent to which shoppers like lingerie ads with plus-size models, we can see that 26% of 16-25 aged and 36% of 26-35 aged respondents like ads with plus-size models a lot, while 29% of 36-50 aged respondents like it somewhat. And respondents aged 51 seem not interested.

Plus-size models used for marketing lingerie send a powerful message about inclusivity and body positivity.

[caption id="attachment_92485" align="aligncenter" width="700"]

Source: Company reports and websites/Wall Street Journal/Crain’s New York Business/Coresight Research[/caption]

Plus-size models are enjoying higher profiles, such as Gabi Gregg, Kate Wasley and Tara Lynn. From a survey conducted by Statista in 2017 regarding the extent to which shoppers like lingerie ads with plus-size models, we can see that 26% of 16-25 aged and 36% of 26-35 aged respondents like ads with plus-size models a lot, while 29% of 36-50 aged respondents like it somewhat. And respondents aged 51 seem not interested.

Plus-size models used for marketing lingerie send a powerful message about inclusivity and body positivity.

[caption id="attachment_92485" align="aligncenter" width="700"] Base: 1,029 US underwear shoppers, surveyed online in March 2017

Base: 1,029 US underwear shoppers, surveyed online in March 2017 Source: Statista [/caption]

Plus-Size Jeans, Activewear, and Even Wedding Dresses: All Leveraging Body Positivity

JCPenney is among the US department stores with strong plus-size offerings, especially in the denim segment. Our research found that JCPenney offered the highest percentage of its women’s jeans in plus sizes of any retailer, with some 37% of jeans sold on its site available in plus sizes.

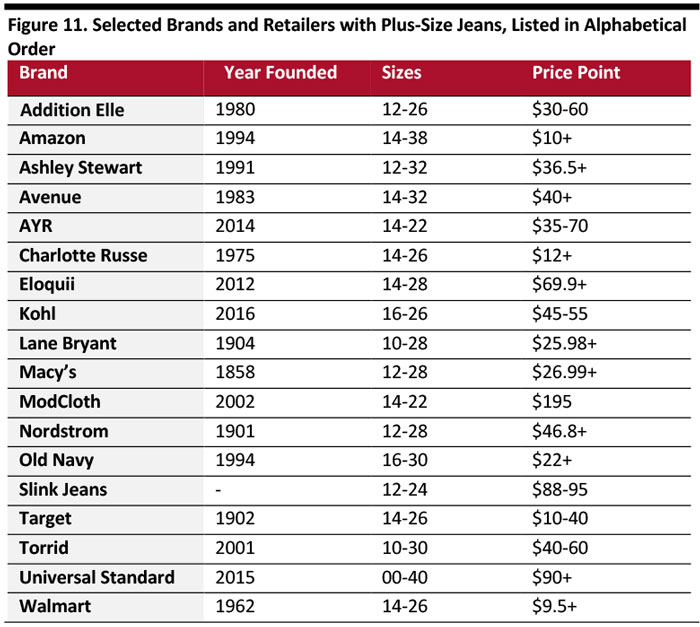

Many retailers have begun to answer the call of plus-size consumers by devoting more resources to this traditionally underserved market, especially in jeans. Figure 11 shows selected brands and retailers with plus-size jeans.

[caption id="attachment_92486" align="aligncenter" width="700"] Source: Company websites/Coresight Research [/caption]

In the plus-size activewear and sportswear segment, Nike launched a plus-size range in March 2017 and plus-size shoppers looking for workout wear, activewear and swimwear can also now shop for those items at retailers spanning Amazon, Old Navy, Nordstrom and Universal Standard. In June 2019, Nike introduced plus-size and para-sport mannequins for its sportswear displays in its redesigned London store. Nike said the aim was to “celebrate the diversity and inclusivity of sport.”

[caption id="attachment_92487" align="aligncenter" width="700"]

Source: Company websites/Coresight Research [/caption]

In the plus-size activewear and sportswear segment, Nike launched a plus-size range in March 2017 and plus-size shoppers looking for workout wear, activewear and swimwear can also now shop for those items at retailers spanning Amazon, Old Navy, Nordstrom and Universal Standard. In June 2019, Nike introduced plus-size and para-sport mannequins for its sportswear displays in its redesigned London store. Nike said the aim was to “celebrate the diversity and inclusivity of sport.”

[caption id="attachment_92487" align="aligncenter" width="700"] Nike’s plus-size mannequins at its London flagship store

Nike’s plus-size mannequins at its London flagship store Source: Nike [/caption] First launched in 1904, Lane Bryant has been active in the plus-size clothing industry for decades and opened more than 800 stores in US. LiviActive, its plus-size activewear line, caters to sizes 10 to 32 and offers options for all levels of impact. At LiviActive, consumers can shop for activewear by workout activity. Bridalwear is another segment seeing an increase in plus-size offerings. In April 2019, Torrid created a wedding dress collection priced below $200. The collection is designed exclusively for sizes 10 to 30 and includes all wedding day essentials: Not just for the bride, but also bridesmaid and guest dresses, as well as accessories and lingerie, and of course, bridal gowns. [caption id="attachment_92488" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Plus-Size Business Models: Fashion Rental and Social Commerce Community

New business models such as fashion rental, led by Gwynnie Bee in the plus-size segment, and personal styling subscription services, such as Stitch Fix, are also offering fashion-conscious plus-size shoppers greater fashion choice online.

Gwynnie Bee offers women’s plus-size fashion rentals by online subscription, targeting professional women aged 28-45. Subscribers can rent items sized 10-32 from more than 190 brands. Since 2012, Gwynnie Bee has increased sales 10-15% annually, according to an October 2016 article in Fast Company, becoming one of the largest purchasers of plus-size fashion.

Plus-size e-commerce platform Part & Parcel launched a new social commerce community for plus-size women in May 2019. This innovative social commerce community offers the opportunity for plus size women to sell a range of affordable and versatile wardrobe essentials to fellow plus size women, customer to customer. Additionally, with its SS19 collection, Part & Parcel is the first brand to create Dimensional Sizing™ which offers extended options designed to allow women to purchase their true size while experiencing the comfort of extra room in various areas such as bust, bicep, waist and calf. Dimensional sizing will be offered in a wide-range of clothing options from blouses and blazers to shoes and pants so customers can customize fit depending on where they need it to feel most comfortable.

Part & Parcel’s social commerce model powers economic mobility for the plus-size community through its partner program, which allows plus-size women to connect over an engaging shopping experience, in-person or online, and earn commission when consumers purchase merchandise through them.

Ashley Stewart was founded in 1991, originally as a lifestyle brand for the African-American plus-size woman, but since its beginnings, it has developed into a movement for inclusivity and the universality of the Ashley Stewart woman, including a college tour that gives away $5,000 scholarships. To apply, students submit a 250-word essay describing how they demonstrate strong leadership skills at the university and stewardship in the community. Whoopi Goldberg also introduced Dugbee by Whoopi, exclusively at Ashley Stewart, in sizes 1X-3X at selected stores and online.

Key Insights

- Continued demand for plus-size clothing will be met by a growing supply of inclusive apparel to address elevated consumer expectations that are likely to support market expansion for many years.

- Many retailers and brands are serving plus-size shoppers more proactively, offering more fashionable choices in stores, online and through other options such as rental and subscription services. And, retailers and brands are extending sizing and offerings to meet these demands.

- We predict the plus-size market and lingerie categories will continue to see positive disruption from new market entrants. And, we expect specialty retailers to further explore marketplace partnerships and collaborations, and to look for opportunities to expand in the US.

- Coresight Research estimates the woman’s plus size clothing market in the US is approximately $30.7 billion in 2019 and will grow to $36.3 billion by 2025, reflecting the approximate one-quarter of women who shop plus-size brands most often.