Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

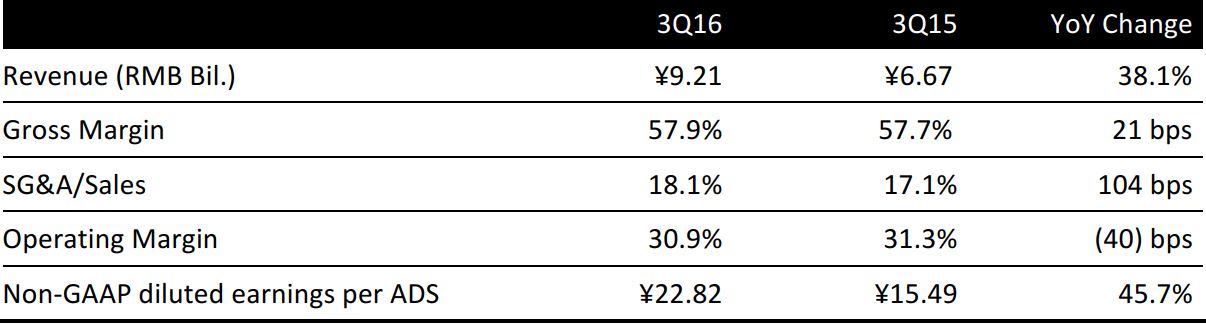

NetEase reported 3Q16 revenue of ¥9.21 billion (US$1.38 billion), a 38.1% increase over the corresponding period in 2015. Although strong, the growth missed market expectations, which had projected revenue of US$1.43 billion. The shortfall was due to slighter weaker mobile game revenue, which fell ¥0.2 billion over the previous quarter. The company posted non-GAAP earnings per ADS of ¥22.82 (or US$3.42), up 45.7% year over year, and beating the consensus estimate of US$3.20.

COSTS AND MARGINS

Online games: Gross profit margin for the online games business for 3Q16 was 65%, down 2.9% year over year. The squeeze in profit margin was driven by increased revenue contributions from mobile games and licensed games, which have relatively lower gross profit margins.

Advertising services: Gross profit margin for the advertising services business was 65.3%, down 2.3% year over year, mainly due to higher staff-related costs and content purchase costs.

E-mail, e-commerce and others: The margin for the e-mail, e-commerce and others business was 33.5%, a big jump from last year’s corresponding period of 0.1%, which was dragged down by the development of NetEase’s e-commerce businesses.

SEGMENT OPERATIONS

Source: Company reports/Fung Global Retail & Technology

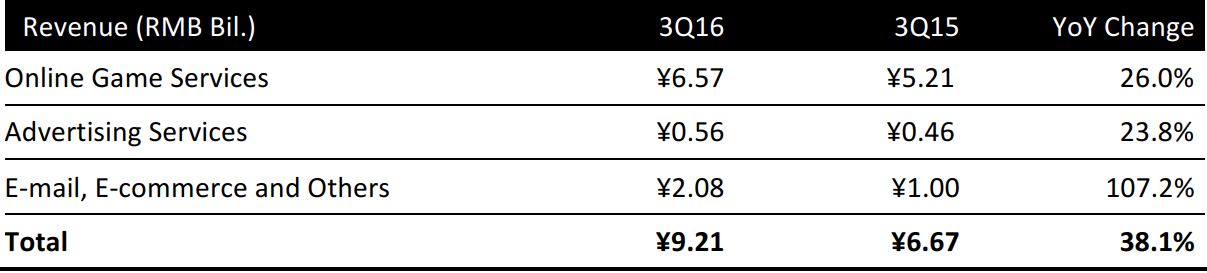

- Online Game Services: Revenue grew 26.0% year over year to ¥6.57 billion, and accounted for 71.3% of total revenue. Certain new game launches such as Onmyoji, a 3D mobile game based on a globally popular Japanese novel series, were launched toward the end of September, and so the full impact of their contributions were not apparent in the 3Q results.

- Email, e-commerce and others: Revenue was ¥2.08 billion, accounting for 22.6% of total revenue, and was up 107.2% year over year. Its e-commerce platform, Kaola.com registered a healthy pace of growth. The company will focus on direct merchandise sales and look to maximize the values of complementary services that extend the reach of the platform.

- Advertising: Revenue was ¥0.56 billion, up 23.8% year over year, and represented 6.1% of total revenue. Advertising revenue growth was driven by demand from the auto, internet services and telecom sectors.

GUIDANCE

During the earnings conference call, management guided for the following future growth areas for the company:

- Maintain growth by continuing to focus on providing first-rate games and products to the expanding online market.

- Look to explore overseas market such as Japan, Australia and New Zealand for certain games with globally popular content such as Onmyoji.

- Introduce virtual and augmented reality interfaces to enhance interactive communications for mobile users that further improves players’ experiences and grows the user base.

- Focus on bringing premium Internet products and services that capture the imaginations of users as progressive developments in the Internet services marketplace take place.

Consensus estimates for 2016 are for revenues of US$5.61 billion, up 60.3%, and non-GAAP earnings per ADS of US$13.34, up 54.0%.