Neiman Marcus Considering Strategic Alternatives

Neiman Marcus Group is exploring the option to sell itself or undergo capital restructuring, amid a swelling debt profile and a disappointing sales performance. The company currently has $4.9 billion in debt and over $1.2 billion in deferred income tax. It also recorded an impairment charge of$153 million in 2Q of fiscal year 2017, primarily related to the Neiman Marcus brand name. The company has warned investors of the risk of future impairment, if the economic and operating conditions continue to worsen.

Hudson’s Bay Co., an acquisitive Canadian retail group, is reported to be in advanced talks to acquire Neiman Marcus. One of the major obstacles, however, will be the amount of debt that Neiman Marcus currently owes. The interest from Hudson’s Bay seemingly comes from its failure to acquire Macy’s recently.

Disappointing Financial Performance

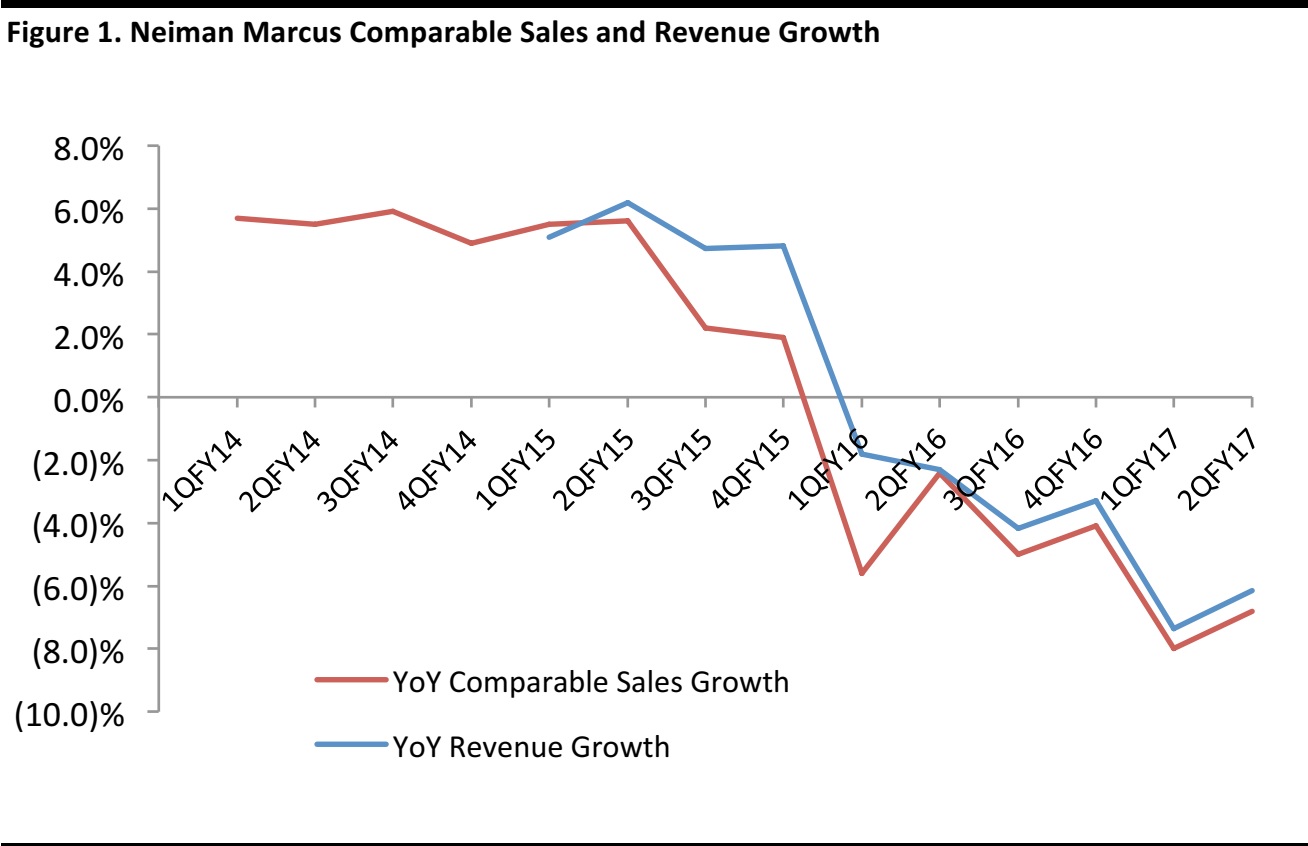

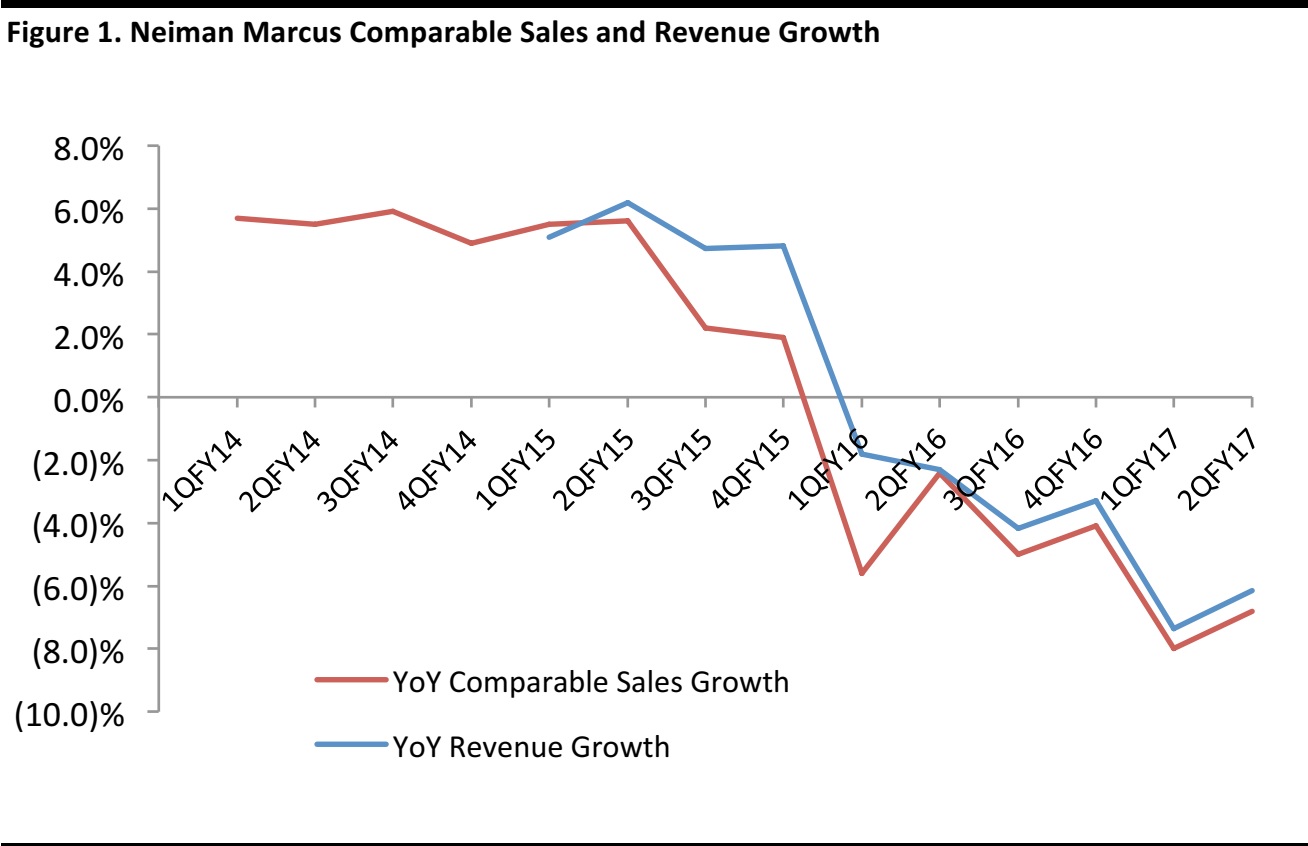

Neiman Marcus reported 2QFY17 revenue of $1.4 billion, down 6% year over year, and a net loss of $117 million. Comparable sales growth is down 6.8% this quarter, and, although picking up slightly from 1QFY17, has been in negative territory for six consecutive quarters since August 2015. The company credits the decline in topline performance primarily to: 1) the strong US dollar, which has dented tourist sales; and 2) the plunge in oil prices, which has curbed affluent Texas consumer spending.

Source: Company reports

Gloomy Retail Landscape

The retail industry, especially companies with a primarily brick-and-mortar presence, has seen strong headwinds brought, in part, by intensifying competition from online retailers. Since the turn of the year, several retailers have announced plans to either rationalize their physical presence by closing stores, or filed for Chapter 11 (i.e. bankruptcy). Major retailers such as BCBG, Gordmans Stores and Wet Seal have all filed for bankruptcy proceedings in 2017, and are seeking, or have already found, a buyer for their assets. They all blamed sluggish mall traffic and shoppers’ shift to internet shopping as the major reasons for their struggles. Other retailers such as JCPenney and Sears, while not having as bleak a performance, have decided to close stores and consolidate their businesses. We believe Neiman Marcus will not be the last to seek a sale or bankruptcy; the trend in the sector is here to stay.

The Company

The company is a luxury onmichannel retailer based in Dallas, Texas, with department stores and online operations under the Neiman Marcus, Bergdorf Goodman, Last Call and My Theresa brand names. It currently operates 42 Neiman Marcus Stores across the US, 27 Last Call clearance centers and two Bergdorf Goodman stores in Manhattan. The company was acquired for $6 billion by Ares Management LP and Canada Pension Plan Investment Board from other private equity firms in a leveraged buyout deal in 2013.